- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML - 20 Courses Bundle

By NextGen Learning

Get ready for an exceptional online learning experience with the Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML bundle! This carefully curated collection of 20 premium courses is designed to cater to a variety of interests and disciplines. Dive into a sea of knowledge and skills, tailoring your learning journey to suit your unique aspirations. The Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML is a dynamic package, blending the expertise of industry professionals with the flexibility of digital learning. It offers the perfect balance of foundational understanding and advanced insights. Whether you're looking to break into a new field or deepen your existing knowledge, the Money & Banking package has something for everyone. As part of the Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML package, you will receive complimentary PDF certificates for all courses in this bundle at no extra cost. Equip yourself with the Money & Banking bundle to confidently navigate your career path or personal development journey. Enrol today and start your career growth! This Bundle Comprises the Following CPD Accredited Courses: Central Banking Monetary Policy Digital Banking Bank Teller Raise Money and Valuation for Business Banking and Finance Accounting Statements Financial Analysis UK Tax Accounting Introduction to VAT Applied Economics Anti Money Laundering & Countering of Terrorist Financing Introduction to Accounting Capital Budgeting & Investment Decision Rules Debt Management - Online Course Hacked Credit and Debit Card Recovery Course Finance Principles Financial Reporting Career Development Plan Fundamentals CV Writing and Job Searching Learn to Level Up Your Leadership Networking Skills for Personal Success Ace Your Presentations: Public Speaking Masterclass Learning Outcome: Gain comprehensive insights into multiple fields. Foster critical thinking and problem-solving skills across various disciplines. Understand industry trends and best practices through the Money & Banking Bundle. Develop practical skills applicable to real-world situations. Enhance personal and professional growth with Money & Banking Bundle. Build a strong knowledge base in your chosen course via Money & Banking Bundle. Benefit from the flexibility and convenience of online learning. With the Money & Banking package, validate your learning with a CPD certificate. Each course in this bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Embrace the future of learning with the Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML, a rich anthology of 15 diverse courses. Each course in the Money & Banking bundle is handpicked by our experts to ensure a wide spectrum of learning opportunities. ThisMoney, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML bundle will take you on a unique and enriching educational journey. The bundle encapsulates our mission to provide quality, accessible education for all. Whether you are just starting your career, looking to switch industries, or hoping to enhance your professional skill set, the Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML bundle offers you the flexibility and convenience to learn at your own pace. Make the Money & Banking package your trusted companion in your lifelong learning journey. CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML bundle is perfect for: Lifelong learners looking to expand their knowledge and skills. Professionals seeking to enhance their career with CPD certification. Individuals wanting to explore new fields and disciplines. Anyone who values flexible, self-paced learning from the comfort of home. Career path Unleash your potential with the Money, Banking, Monetary Policy, TAX, Accounting, Economics, Finance, Investment & AML bundle. Acquire versatile skills across multiple fields, foster problem-solving abilities, and stay ahead of industry trends. Ideal for those seeking career advancement, a new professional path, or personal growth. Embrace the journey with the Money & Banking bundle package. Certificates Certificate Of Completion Digital certificate - Included Certificate Of Completion Hard copy certificate - Included You will get a complimentary Hard Copy Certificate.

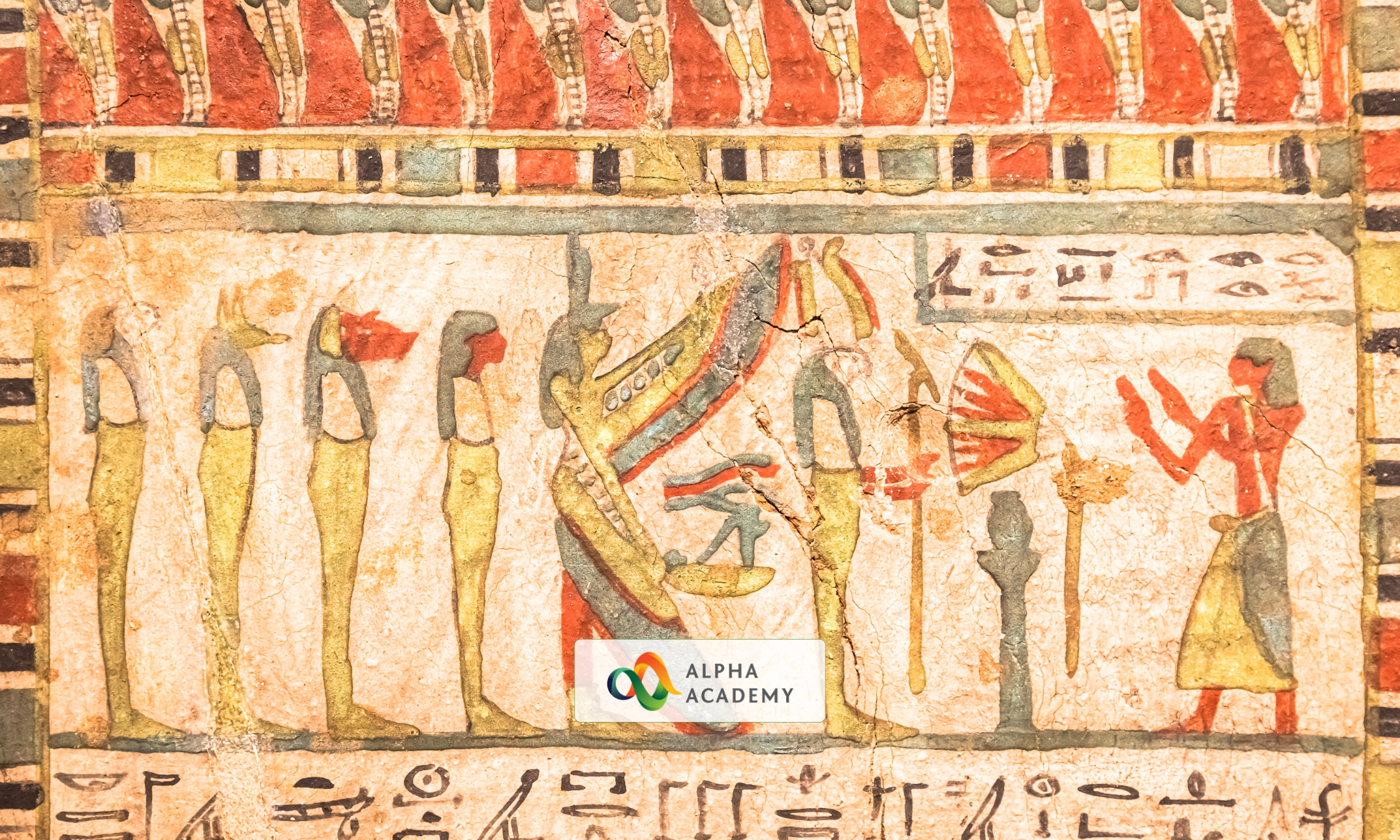

Course Overview Egypt is a country rich with mystery and exciting historical events. Enrich your knowledge about this fascinating country through the Egyptology course. You will get a tour of Egypt without even stepping out of the house. In this Egyptology course, you will receive detailed lessons on different areas of Ancient Egypt. The informative modules will educate you on the Egyptian dynasty, government, society and much more. You will learn about the art and architecture of Ancient Egypt. In addition. You will get introduced to the fundamentals of the trading system, military forces, writings and language used in Ancient Egypt. Through this course, you will not only learn about this historical nation but also receive a certificate of achievement. So enrol now and start learning! Learning Outcomes Learn about the different dynasties of Egypt Enrich your knowledge of Egyptian gods and goddesses Understand the system of Egyptian government and society Explore the fundamentals of Egyptian art and architecture Discover the principles of trade and military force of Ancient Egypt Gain in-depth knowledge of the language, writing and numeral system of Ancient Egypt Assessment and Certification At the end of the Egyptology course, you will be required to sit for an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39. Career Path This Egyptology course will provide you with an in-depth understanding of the subject. On successful completion, you will have the skills, confidence and practical knowledge to fast-track a successful career in relevant sectors. Professions in this field include: History Teacher Historian

Investment

By NextGen Learning

Course Overview: This Investment course offers learners a comprehensive understanding of investment strategies and financial markets. The course covers a range of essential topics, including different investment types, portfolio management, and risk assessment. Learners will gain valuable insights into bond and stock markets, enabling them to make informed decisions in diverse investment environments. The course is designed for those looking to enhance their investment knowledge, regardless of their current financial expertise, providing a solid foundation in the principles of investing. Course Description: In this course, learners will explore various investment methods, from bonds to stocks, and gain an understanding of core financial concepts such as portfolio diversification and risk management. The course delves into investment theory, focusing on how markets function, the evaluation of potential returns, and the identification of risk factors. With an emphasis on building a structured investment strategy, learners will also gain an understanding of how to manage and optimise their portfolios. By the end, learners will have the tools and knowledge to evaluate different investment opportunities, supporting their financial growth and decision-making processes. Course Modules: Module 01: Introduction to Investment Overview of investment basics The role of investments in personal finance Understanding risk and return Module 02: Types and Techniques of Investment Stock market, bonds, and real estate investments Active vs passive investing Introduction to alternative investments Module 03: Key Concepts in Investment Compound interest and time value of money Diversification and asset allocation Financial instruments overview Module 04: Understanding the Finance Basics of financial statements Financial ratios and metrics Introduction to valuation techniques Module 05: Investing in Bond Market Types of bonds and their characteristics Bond pricing and yields Understanding interest rates and bond durations Module 06: Investing in Stock Market Stock market indices and trading Analysis of stock performance Fundamentals of stock picking Module 07: Risk and Portfolio Management Measuring and managing investment risk Portfolio construction and diversification strategies Evaluating portfolio performance (See full curriculum) Who is this course for? Individuals seeking to develop investment skills for personal financial growth. Professionals aiming to enhance their understanding of financial markets. Beginners with an interest in investing and financial markets. Anyone interested in building a solid foundation in investment strategies. Career Path: Investment Analyst Financial Planner Portfolio Manager Stock Broker Risk Manager Wealth Manager Financial Consultant

Financial Engineering Courses - 8 Courses Bundle

By NextGen Learning

Course Overview The Financial Engineering Courses – 8 Courses Bundle is a comprehensive training package designed to equip learners with a robust understanding of the mathematical, statistical, and analytical foundations of modern finance. This bundle merges core financial theories with quantitative models to support strategic financial decision-making. Learners will explore concepts ranging from derivatives pricing and risk modelling to portfolio optimisation and stochastic processes, gaining a solid foundation in the methodologies used in financial institutions and investment firms. By the end of the course, participants will be able to interpret financial models, assess risk frameworks, and contribute effectively to quantitative analysis roles. This course is particularly valuable for those aiming to strengthen their understanding of finance through an analytical lens, aligning with roles in investment banking, financial consultancy, or quantitative research. Course Description This course bundle offers eight interconnected modules covering a wide array of financial engineering topics. Learners will be introduced to financial mathematics, stochastic calculus, fixed income securities, options pricing, quantitative risk management, and algorithmic trading strategies. The programme provides an in-depth look into the mechanics of financial markets and the computational tools that underpin asset valuation and portfolio structuring. Through clear instruction and structured content, learners will build confidence in applying quantitative techniques and economic theory to real-world financial challenges. Emphasis is placed on theoretical rigour, analytical accuracy, and strategic application. Ideal for learners with a background or interest in finance, mathematics, or economics, this course supports a deeper understanding of financial markets and prepares participants for roles that require data-driven financial modelling and risk assessment skills. Course Modules Module 01: Introduction to Financial Engineering Module 02: Financial Mathematics and Modelling Techniques Module 03: Fixed Income Securities and Yield Curves Module 04: Derivatives and Options Pricing Theory Module 05: Quantitative Risk Management Fundamentals Module 06: Stochastic Processes in Finance Module 07: Portfolio Theory and Investment Analysis Module 08: Algorithmic and Computational Finance (See full curriculum) Bundle Instructions Access all eight courses through a single enrolment. Courses are self-paced and available online 24/7. Learners receive a certificate for each completed module. Support is available throughout the learning journey. Who is this course for? Individuals seeking to build a strong foundation in quantitative finance. Professionals aiming to advance their knowledge in financial modelling and analysis. Beginners with an interest in finance, mathematics, or data-driven investment theory. Graduates or career changers targeting roles in banking, analytics, or asset management. Career Path Quantitative Analyst Financial Risk Manager Investment Banking Analyst Asset or Portfolio Manager Financial Modelling Consultant Data Analyst in Financial Services Derivatives Pricing Specialist Economic Research Associate

Overview Explore trading and hedging applications of barrier options across interest rate, FX, and equity markets. Who the course is for Executives of listed companies who want to enhance their knowledge and skills in ESG and sustainability. Corporate professionals who want to integrate ESG initiatives into their organizations and improve their ESG programs. ESG professionals who want to gain a deep understanding of ESG frameworks, reporting standards, and best practices Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This course covers distressed debt analysis and investing, focusing primarily on corporates but also including financial institutions and sovereign debt as special topics. The programme begins with the foundations of the distressed debt market, causes of and early warning signals, possible outcomes and how to evaluate the probability of outcomes in different scenarios. Restructuring is reviewed in detail, as well as estimation of sustainable debt levels, business valuation and the importance of capital and group structure. Differences between active control and passive non-control investments are highlighted, including stakeholder tactics and due diligence. Case studies cover a variety of companies across sectors and geographies, challenging delegates to make investment decisions on real distressed debt situations. Who the course is for Distressed debt investors, Loan portfolio managers and Private equity investors Hedge fund managers High yield credit analysts and Equity analysts High yield asset managers and Mergers and acquisitions bankers Debt capital markets/leveraged finance bankers Business turnaround/restructuring accountants/corporate finance professionals Lawyers Strategy consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2-day programme covers the latest techniques used for fixed income attribution. This hands-on course enables participants to get a practical working experience of fixed income attribution, from planning to implementation and analysis. After completing the course you will have developed the skills to: Understand how attribution works and the value it adds to the investment process Interpret attribution reports from commercial systems Assess the strengths and weaknesses of commercially available attribution software Make informed decisions about the build vs. buy decision Present results in terms accessible to all parts of the business Who the course is for Performance analysts Fund and portfolio managers Investment officers Fixed Income professionals (marketing/sales) Auditors and compliance Quants and IT developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course to gain real insight into the Solvency 2 balance sheet dynamics, both under standard formula and our illustrative internal model Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now