- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

PRINCE2 Foundation: Virtual In-House Training

By IIL Europe Ltd

PRINCE2® Foundation: Virtual In-House Training Projects fail for a variety of reasons including poor planning, lack of defined quality criteria, poor understanding of the business drivers, inadequate control, and lack of senior management involvement in other words, lack of a structured best practice approach to project delivery. PRINCE2® (6th Edition is the current version) is a structured, process-based approach to project management providing a methodology which can be easily tailored and scaled to suit all types of projects. It is the de facto standard for project management in the UK Government and is used extensively in more than 150 countries worldwide with in excess of 20,000 organizations already benefiting from its powerful approach. It can be used easily in combination with PMI®'s PMBOK® Guideto provide a robust project management methodology, or to augment an existing PMBOK®-based methodology with additional rigor around areas such as Quality, Organization, and Benefits Realization. The goals of this course are to provide participants with a thorough grounding in PRINCE2® and its benefits and to prepare them to sit the Foundation exam. What you will Learn You'll learn how to: Identify the benefits and principles underlying a structured approach to project management Define the PRINCE2® method in depth, including the principles, themes, and processes Prepare and practice for the Foundation exam Getting Started Introductions Course structure Course goals and objectives Overview of the PRINCE2® Foundation exam PRINCE2® Introduction Introducing PRINCE2® The structure of PRINCE2® What PRINCE2® does not provide What makes a project a 'PRINCE2® project'? Project Management with PRINCE2® Defining a project Managing a project Controlling the variables The Project Manager's work PRINCE2 Principles PRINCE2® Principles The Seven Principles Tailoring and Adopting PRINCE2® Defining tailoring Defining embedding What can be tailored? Who is responsible for tailoring? Introduction to the PRINCE2® Themes What is a PRINCE2® Theme? What are the PRINCE2® Themes? Tailoring the themes Format of the theme chapters Business Case Need for a business case Elements of a business case How a business case is developed Managing Benefits Organization Need for a special type of organization PRINCE2® organization structure Roles in a PRINCE2® project Combining roles Quality Relevance of quality to project work Quality, quality control, and quality assurance Quality management approach and the quality register Who is responsible for quality? Plans Need for plans and their hierarchy Approach to planning Content of a PRINCE2® plan Product-based planning Risk The need to manage risks What is a risk? Risk and continued business justification A risk management option Change Change is inevitable Different types of change Baselines and configuration management Issue and change control in PRINCE2® Progress Controlling a PRINCE2® project The application of tolerance Types of control Raising exceptions Introduction to Processes Processes and the project lifecycle The PRINCE2® journey Structure of the process chapters Tailoring the processes Starting up a Project Appointing people to the PRINCE2® roles Establishing some baselines Should we go further with this work? Planning for initiation Directing a Project Should we start / continue the project? Responding to internal / external influences Should we close this project? Initiating a Project Establishing the project's approaches Creating the project plan Refining the business case Assembling the PID Controlling a Stage Authorizing and reviewing work Monitoring and reporting Handling non-planned situations Triggering the next process Managing Product Delivery Accepting work from the Project Manager Getting the work done by the team Routine and non-routine reporting Handing back the completed work Managing a Stage Boundary Taking stock of what we have done Updating the PID Consider the options for continuing / stopping Producing exception plans Closing a Project PRINCE2® at the end of a project Transition of product to operational use How well did we do? Tying up all the loose ends

***24 Hour Limited Time Flash Sale*** Corporate Finance Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Corporate Finance Fundamentals Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Corporate Finance Fundamentals bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Corporate Finance Fundamentals Online Training, you'll receive 25 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Corporate Finance Fundamentals Career Bundle: Course 01: Diploma in Corporate Finance Course 02: Corporate Finance: Working Capital Management Course 03: Financial Modelling for Decision Making and Business Plan Course 04: Financial Management Course 05: Financial Analysis for Finance Reports Course 06: Financial Modeling Using Excel Course 07: Xero Accounting - Complete Training Course 08: Sage 50 Accounts Training Course 09: Learn to Read, Analyse, and Understand Annual Reports Course 10: Online Forex Trading Diploma Course Course 11: Stock Market Day Trading Strategies for Beginners Course 12: Stock Market Investment: Plan for Retirement Course 13: Corporate Finance: Profitability in a Financial Downturn Course 14: Understanding Financial Statements and Analysis Course 15: Financial Statements Fraud Detection Course 16: Finance Assistant Training: Level 1 & 2 Certification Course 17: Making Budget & Forecast Course 18: Anti-Money Laundering (AML) Course 19: Financial Accounting Course 20: Cash Management & Cost Control Course 21: Commercial Law Course 22: Know Your Customer (KYC) Course 23: Diploma in Business Management: Corporate Behaviour Course 24: Corporate Social Responsibility (CSR) Course 25: Corporate Risk And Crisis Management With Corporate Finance Fundamentals, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Corporate Finance Fundamentals today and take the first step towards achieving your goals and dreams. Why buy these Corporate Finance Fundamentals? Free CPD Accredited Certificate upon completion of Corporate Finance Fundamentals Get a free student ID card with Corporate Finance Fundamentals Lifetime access to the Corporate Finance Fundamentals course materials Get instant access to this Corporate Finance Fundamentals course Learn Corporate Finance Fundamentals from anywhere in the world 24/7 tutor support with the Corporate Finance Fundamentals course. Start your learning journey straightaway with our Corporate Finance Fundamentals Training! The corporate Finance Fundamentals premium bundle consists of 25 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Corporate Finance Fundamentals is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Corporate Finance Fundamentals course. After passing the Corporate Finance Fundamentals exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 350 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Corporate Finance Fundamentals course is ideal for: Students seeking mastery in Corporate Finance Fundamentals Professionals seeking to enhance Corporate Finance Fundamentals skills Individuals looking for a Corporate Finance Fundamentals-related career. Anyone passionate about Corporate Finance Fundamentals Requirements This Corporate Finance Fundamentals doesn't require prior experience and is suitable for diverse learners. Career path This Corporate Finance Fundamentals bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

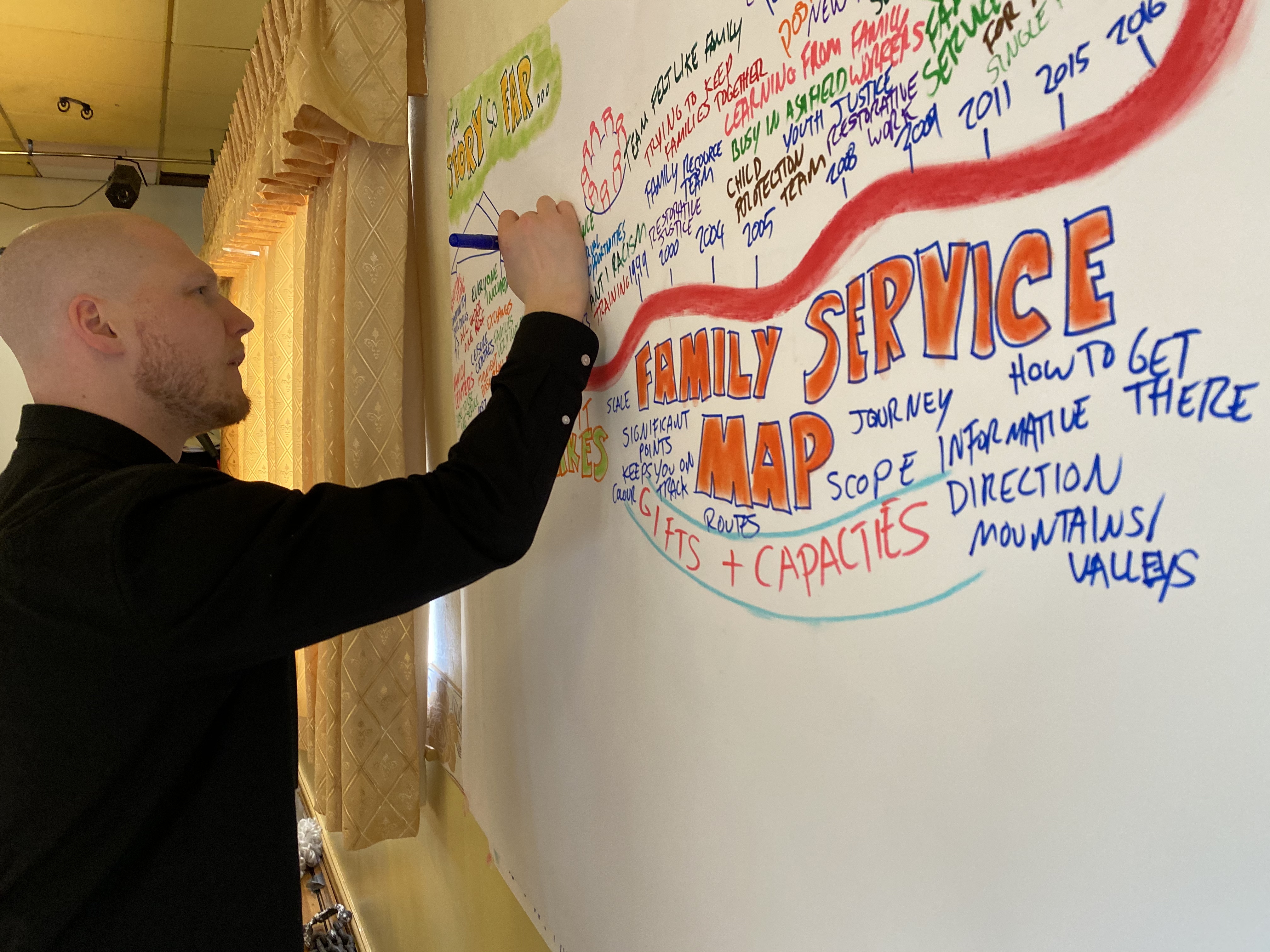

MAP – MAKING AN ACTION PLAN WITH PERSON CENTRED PROCESSES

By Inclusive Solutions

To facilitate a group, family, team or organisation in thinking together around a given challenge or issue here is an opportunity to experience for real the person centred, futures planning tool – MAP (Pearpoint, Forest et. al. 1989). This is a process not a training day. Let us facilitate your planning and refocus your story whilst strengthening you and your group. This tool uses both process and graphic facilitation to help any group develop a shared vision and then to make a start on working out what they will need to do together to move towards that vision. MAPS are great for threshold moments. Is your team stuck? Want to move on, haunted by the past cannot get any useful dialogue about the future? Facing a challenging transition into a new school or setting? Leaving school? Bored with annual reviews, transition plans and review meetings? Want to find a way of making meetings and planning feel more real and engaging? Need an approach, which engages a young person respectfully together with his or her family and friends? Want the ultimate visual record of the process of a meeting, which will help everyone, keep track? Want to problem solve and plan for the future of a small or large group, service or organisation up to the size of an LEA Learning Objectives To create a shared vision To talk through the story so far and reflect upon it To name the worse nightmares that will block progress To strengthen the group by focussing on gifts and capacity To detail needs To specify an Action Plan To create a visual graphic record of the whole event Course Content The MAP process has 6 Steps: The story so far. The group is required to think back over the years to describe their collective experience of changes and events over time within their settings. Stories and events are recorded on the graphic. Building Shared Dreams. The group thinks together about what they would love to see happening for children, families and practitioners in their settings if they could have it all. If there were no constraints on time, money, resources, people or anything else what do they see happening in their imaginations? The various ideas that the group comes up with are then recorded in key words, images and colours on the MAP graphic. The purpose of this Step is to give the group a sense of direction, their North Star, an image of the place they want to work towards. Nightmare. In this Step, the group imagines the worst scenarios. What is the opposite of their dreams? How bad could it get? This is a shorter but powerful process that can give some groups more energy than dreaming together. Gifts and Capacity. In this Step the group is asked to take explicit stock of their capacities and what they already have going for them as they begin working towards the vision. This is a strong reminder for any group of the wealth of knowledge and experience that is already and always in the room. Needs. In this Step the group is invited to begin to name some of the needs they will have if they are to move forward to wards the dream and away from the nightmare. Actions. This is the final Step in the MAP and calls for individuals within the group to name a range of very specific actions (however small) that they will take within a definite time scale. This is not a time for declaring good intentions or suggesting good ideas for someone else to do. The purpose of this Step is to end the MAP process with a range of clearly understood actions that carry this planning process forward into the real world.

Become a GRI Certified Sustainability Professional Bundle

By FBRH Consultants

This GRI, IEMA & CPD course is geared for busy professionals who want to understand how to proceed and create a 1st Class GRI Standards Sustainability Report and have a plan for immediate sustainability action without wasting time.

Overview Get the ideal training and knowledge to kickstart your experience in Financial Trading and a whole new way to earn a living. This course provides you with all tuition needed to take you from being a beginner to becoming a talented Trader on the Stock market. When you enrol in our Forex Trading and Market Structure course, you'll find input and assistance available from some of the most successful financial experts around. No matter what your current skill level is, a variety of educational techniques will turn you into a fiscal genius who will be able to buy and sell all stock with the confidence of a seasoned professional. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Forex Trading and Market Structure. It is available to all students, of all academic backgrounds. Requirements Our Forex Trading and Market Structure is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 2 sections • 10 lectures • 02:20:00 total length •Introduction to Forex Trading: 00:11:00 •Major Currencies and Market Structure: 00:10:00 •Kinds of Foreign Exchange Market: 00:14:00 •Money Management: 00:11:00 •Fundamental Analysis: 00:21:00 •Technical Analysis: 00:32:00 •Pitfalls and Risks: 00:11:00 •Managing Risk: 00:16:00 •Trading Psychology: 00:14:00 •Assignment - Forex Trading and Market Structure: 00:00:00

Overview Learn the basics of currency conversion and the secret to success in Forex trading by enrolling in our Forex Trading Level 3 course.Forex trading has marked a spot as a popular alternative to stock trading. This course is a step-by-step training process that is designed to teach you how to trade on margin by timely buying and selling foreign currencies.After your successful completion, you will have a deep insight into the stock market and its trends, futures trading, exchanged traded funds, opening a trading account, and much more. Make sure you're ready to cope with the challenges of trading. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Forex Trading Level 3. It is available to all students, of all academic backgrounds. Requirements Our Forex Trading Level 3 is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G.There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management , Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 9 sections • 9 lectures • 02:28:00 total length •Introduction to Forex Trading: 00:14:00 •Major Currencies and Market Structure: 00:15:00 •Kinds of Foreign Exchange Market: 00:14:00 •Money Management: 00:11:00 •Fundamental Analysis: 00:21:00 •Technical Analysis: 00:32:00 •Pitfalls and Risks: 00:11:00 •Managing Risk: 00:16:00 •Trading Psychology: 00:14:00

Real Estate Investment, Property Sales & Development - QLS Endorsed Certificate

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | 10 CPD Courses | Lifetime Access | 24/7 Tutor Support

Banking: Bank Teller and Digital Banking

By Compliance Central

Feeling Stuck in Your Career? The Banking: Bank Teller and Digital Banking Bundle is Your Skill-Building Solution. This exceptional collection of 40 premium courses is designed to encourage growth and improve your career opportunities. Suited to meet different interests and goals, the Banking, Bank Teller and Digital Banking bundle provides an engaging learning experience, helping you learn skills across various disciplines. With Banking: Bank Teller and Digital Banking Bundle, you'll have a personalised journey that aligns with your career goals and interests. This comprehensive package helps you confidently tackle new challenges, whether entering a new field or enhancing your existing knowledge. The Banking, Bank Teller and Digital Banking bundle is your gateway to expanding your career options, increasing job demand, and enhancing your skill set. By enrolling in this bundle, you'll receive complimentary PDF certificates for all courses, adding value to your resume at no extra cost. Develop key skills and achieve important progress in your career and personal development. Start your journey today and experience the transformative impact of the Banking: Bank Teller and Digital Banking bundle on your job life and career growth! This Banking: Bank Teller and Digital Banking Bundle Comprises the Following CPD Accredited Courses: Course 01: Bank Teller Course 02: Introduction to Banking Course 03: Central Banking Monetary Policy Course 04: Digital Banking Course 05: Investment Banking Course 06: Banking and Finance Accounting Statements Financial Analysis Course 07: Insurance Agent Training Course 08: Key Account Management Course Course 09: Anti-Money Laundering (AML) Training Course 10: Finance Principles Course 11: Financial Analysis : Finance Reports Course 12: Financial Statements Fraud Detection Training Course 13: Credit Analyst Course 14: Overcome Payment Fraud and Risks Course 15: Debt Management - Online Course Course 16: Hacked Credit and Debit Card Recovery Course Course 17: Internal Audit Skills Diploma Course 18: Compliance & Business Risk Management Course 19: Advanced Tax Accounting Course 20: Introduction to Accounting Course 21: Xero Accounting and Bookkeeping Online Course 22: Sage 50 Accounts Course 23: Introduction to VAT Course 24: Capital Budgeting & Investment Decision Rules Course 25: Customer Relationship Management (CRM) Course 26: Know Your Customer (KYC) Course 27: Raise Money and Valuation for Business Course 28: Stock Market Investment Course 29: Stock Trading & Investing Course 30: Document Control Course 31: Excel for Bookkeeping Course 32: Data Analysis and Forecasting in Excel Course 33: Career Development Plan Fundamentals Course 34: CV Writing and Job Searching Course 35: Learn to Level Up Your Leadership Course 36: Networking Skills for Personal Success Course 37: Ace Your Presentations: Public Speaking Masterclass Course 38: Learn to Make a Fresh Start in Your Life Course 39: Motivation - Motivating Yourself & Others Course 40: Excel: Top 50 Microsoft Excel Formulas in 50 Minutes! What will make you stand out? Upon completion of this online Banking: Bank Teller and Digital Banking Bundle, you will gain the following: CPD QS Accredited Proficiency with this Banking, Bank Teller and Digital Banking Bundle After successfully completing the Banking, Bank Teller and Digital Banking bundle, you will receive a FREE PDF Certificate from REED as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials of this Banking, Bank Teller and Digital Banking Bundle The online test with immediate results You can study and complete the Banking, Bank Teller and Digital Banking bundle at your own pace. Study for the Banking, Bank Teller and Digital Banking bundle using any internet-connected device, such as a computer, tablet, or mobile device. The Banking: Bank Teller and Digital Banking bundle is a premier learning resource, with each course module holding respected CPD accreditation, symbolising exceptional quality. The content is packed with knowledge and is regularly updated to ensure it remains relevant. This bundle offers not just education but a constantly improving learning experience designed to enrich both your personal and professional development. Advance the future of learning with the Banking, Bank Teller and Digital Banking bundle, a comprehensive, complete collection of 40 courses. Each course in the Banking, Bank Teller and Digital Banking bundle has been handpicked by our experts to provide a broad range of learning opportunities. Together, these modules form an important and well-rounded learning experience. Our mission is to deliver high-quality, accessible education for everyone. Whether you are starting your career, switching industries, or enhancing your professional skills, the Banking, Bank Teller and Digital Banking bundle offers the flexibility and convenience to learn at your own pace. Make the Banking, Bank Teller and Digital Banking package your trusted partner in your lifelong learning journey. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Banking: Bank Teller and Digital Banking is perfect for: Expand your knowledge and skillset for a fulfilling career with the Banking, Bank Teller and Digital Banking bundle. Become a more valuable professional by earning CPD certification and mastering in-demand skills with the Banking, Bank Teller and Digital Banking bundle. Discover your passion or explore new career options with the diverse learning opportunities in the Banking, Bank Teller and Digital Banking bundle. Learn on your schedule, in the comfort of your home - the Banking, Bank Teller and Digital Banking bundle offers ultimate flexibility for busy individuals. Requirements You are warmly invited to register for this bundle. Please be aware that no formal entry requirements or qualifications are necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path Gain a wide range of skills across various fields, improve your problem-solving capabilities, and keep current with industry trends. Perfect for those aiming for career advancement, exploring a new professional direction, or pursuing personal growth. Begin your journey with the Banking, Bank Teller and Digital Banking bundle. Certificates CPD Certificates Digital certificate - Included

SCM230 SAP Supply Network Planning (APO-SNP)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for This course is intended for project team members and other key users (persons from special departments) responsible for creating and optimizing a cross location supply plan including production, procurement and distribution plans. In this course, students gain an understanding of how to create cross-location production plans, distribution resource plans, and procurement plans taking into account work center capacities, supplier capacities, and transportation capacities in SAP APO. Course Outline Overview of Supply Chain Planning in SAP SCM (APO), Integration with Demand Planning (DP) and Production Planning (PP/DS) Overview of exchanging master and transaction data with SAP ECC Master data for supply network planning, interchangeability and shelf live Configuring Supply Network Planning and interactive planning using planning books and macros Introduction to the Planner Home Page (EhP 3) Collaborative Supply Planning (supplier and manufacturer exchange data over the Internet) Integrated exception management in the alert monitor Discussions about the different planning methods: Heuristic including capacity leveling, optimization, capable-to-match, and VMI. Standard and advanced Cross-location safety stock planning Deployment: Implementing stock transport requisitions into manageable stock transport orders. Calculating and optimizing short-term replenishment plans for distribution centers and customers Transport Load Builder (TLB): Grouping stock transfers by threshold values for volumes, weight and pallets. Additional course details: Nexus Humans SCM230 SAP Supply Network Planning (APO-SNP) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the SCM230 SAP Supply Network Planning (APO-SNP) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.