- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Our excellent value long-term support option for RICS APC candidates, covering all RICS APC routes, pathways and world regions. This is one of our most popular packages providing you with your own personal APC support team. This can include a Counsellor sign-off, subject to separate agreement between you and Property Elite. This includes: Submission Review APC Question Pack E-mock Interview 2 hours of 1-2-1 or small group online/telephone mentoring per month with a current RICS APC assessor. If you wish, this can be saved up to use at any time during your sign-up period with Property Elite. Full suite of online revision quizzes Full revision guide package Our minimum sign up period is 4 months - minimum £350 + VAT per month over 4 months = total of £1,400 + VAT. You will need to sign up at least 1 month before you submit your final assessment documents to ensure you are able to take full advantage of this package.

APM Project Fundamentals Qualification (PFQ): In-House Training

By IIL Europe Ltd

APM Project Fundamentals Qualification (PFQ): In-House Training This practical course gives Participants a solid introduction to the fundamentals of project management and to prepare them for the one-hour, multiple-choice exam held at the end of the course. The APM Project Fundamentals Qualification (PFQ) is an entry-level qualification suitable for those who are new to project management and working in a project team, and who wish to understand the standard terminology. The goal of this course is to prepare you to successfully pass the exam. What you will Learn You'll learn how to: Identify project management terminology and context Identify project management processes Identify the roles involved in project management Describe project success criteria and benefits Prepare project documentation Acquire the level of understanding needed to pass the APM PFQ examination Getting Started Introductions Course structure Course goals and objective Project Context Project characteristics Project management processes Business and project context Organizational roles Project Lifecycle Programme and portfolio management Project Concept Phase Stakeholder management Project success and benefits management Business case Benefits People in Projects Leadership and teamwork Communication Project Definition Phase Project management plan Quality management Risk management Scope management Scheduling Resource management Estimating Procurement Project Implementation Phase Change control and configuration management Issue management Information management Project Hand-over and Close-out Phase Hand-over and close-out Post-project review Revision and Exam Revision and practice questions APM PFQ examination

APM Project Fundamentals Qualification (PFQ): Virtual In-House Training

By IIL Europe Ltd

APM Project Fundamentals Qualification (PFQ): Virtual In-House Training This practical course gives Participants a solid introduction to the fundamentals of project management and to prepare them for the one-hour, multiple-choice exam held at the end of the course. The APM Project Fundamentals Qualification (PFQ) is an entry-level qualification suitable for those who are new to project management and working in a project team, and who wish to understand the standard terminology. The goal of this course is to prepare you to successfully pass the exam. What you will Learn You'll learn how to: Identify project management terminology and context Identify project management processes Identify the roles involved in project management Describe project success criteria and benefits Prepare project documentation Acquire the level of understanding needed to pass the APM PFQ examination Getting Started Introductions Course structure Course goals and objective Project Context Project characteristics Project management processes Business and project context Organizational roles Project Lifecycle Programme and portfolio management Project Concept Phase Stakeholder management Project success and benefits management Business case Benefits People in Projects Leadership and teamwork Communication Project Definition Phase Project management plan Quality management Risk management Scope management Scheduling Resource management Estimating Procurement Project Implementation Phase Change control and configuration management Issue management Information management Project Hand-over and Close-out Phase Hand-over and close-out Post-project review Revision and Exam Revision and practice questions APM PFQ examination

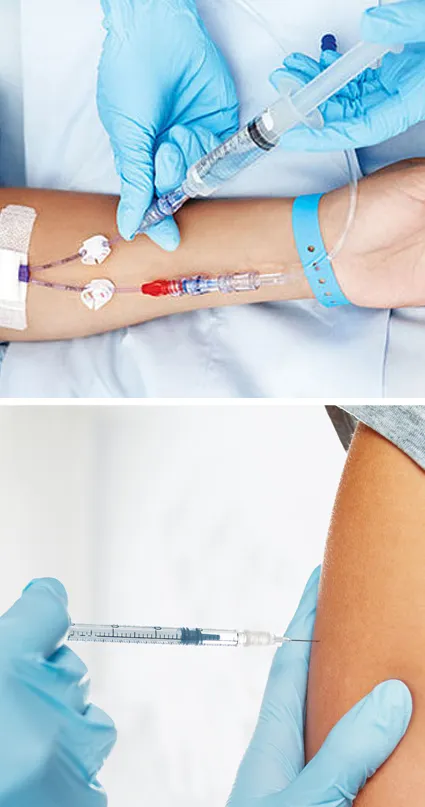

THIS COURSE PACKAGE INCLUDES: 1: PERIPHERAL I.V. CANNULATION - IV THERAPIES COURSE (GPT008) 2: VACCINATION / INJECTION COURSE (GPT601) Learn how to administer injectables and intravenous therapies ... FAST-TRACK YOUR AESTHETICS TRAINING WITH OUR COMPLETE TRAINING PACKAGE 20% Multi-Course Discount Cover all stages from Level 1 through to Level 4 (FDSc) Cover your theory training online Complete your advanced practical training in 1 day Practical training in Classroom or Virtual Classroom Comprehensive Practise@Home training kits for VC Awards 2 accredited qualifications Dual Accreditations for all courses Covers all steps required to safely perform injectables Covers all steps required to safely perform IV therapies Practise IV on artificial arm with fake blood Practise injection techniques on realistic injection pads Learn beginner to advanced skills and techniques Basic understanding of English language required OPEN TO ALL APPLICANTS

Dust Off Those Drafts - flash fiction

By Flash Cabin

Four weeks of revision exercises, study stories and feedback exchange for flash fiction authors.

Medical Terminology Training Courses - Level 3

By Mediterm Training

This course leads to the Mediterm Advanced Certificate in Medical Terminology (Level 3), the highest qualification in Medical Terminology, and can be studied flexibly over 20 weeks

Medical Terminology Training Courses - Level 2

By Mediterm Training

This course leads to the Mediterm Intermediate Award in Medical Terminology (Level 2), studied over approximately 12 weeks (taking more or less time dependent on learner requirements). This course is suitable for those already working in healthcare or those who wish to start a new career in healthcare.

Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Oil & Gas professionals increasingly need to translate complex findings, analysis and recommendations for effective decision-making. If you face challenges in getting your findings into paper, you will benefit from this training course. The Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals course focuses on the unique needs of technical professionals who write for both technical and non-technical readers. This separately bookable training course will demonstrate how technical professionals can use their technical knowledge and logical edge to write in a reader-friendly style, produce grammatically accurate reports and persuasively communicate for buy-in purposes. An ILM Recognised programme. Training Objectives LEARNING OUTCOMES FOR TECHNICAL REPORT WRITING SKILLS By the end of this course, participants will be able to: Write and turn-around accurate technical documents quickly to meet deadlines and productivity goals Understand how technical reports should be structured by applying a systematic approach to the writing task, involving planning, drafting, revision and production Use clear & powerful language to target and persuade readers for positive results Use tried and tested proof reading techniques to check and review documents more effectively Identify and avoid common pitfalls in technical report writing LEARNING OUTCOMES FOR TECHNICAL PRESENTATION SKILLS By the end of this course, participants will be able to: Present and sell your technical presentation more effectively both internally and externally Plan and structure your meetings and presentations for maximum effect Capture your technical and non-technical audience by delivering your presentation with power and authority Handle questions, interruptions and objections with confidence Target Audience This programme has been researched and developed for all Oil & Gas Engineers and Technical Professionals Course Level Basic or Foundation Trainer Your course leader managed the Business Skills Unit of the British Council programmes as well as oversee all training-related matters from 1997. The trainer considers himself a trainer first and specialises predominantly in high-level writing and technical report writing programmes. In addition to conducting training in Technical Writing, the trainer has also been the chief editor for many large writing projects. These include a year-long project editing the entire Start-Up Manual (including the Black Start Manual) for Nippon Oil's Helang Integrated Platform, a 4-month project rewriting the manuals for the Puteri Dulang FSO off Terengganu, and editing the current revision of the PETRONAS Procedures and Guidelines for Upstream Activities (PPGUA). POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Learn how to perform and read an ECG ... Nationally Recognised Qualification OCN Accredited - Level 3 (advanced level) CPD Accredited - The CPD Certification Service Introduces you to the fundamentals of setting up and operating an ECG machine Includes patient preparation Produce a valid (error free) ECG Learn and understand ECG traces Recognise recordings that require urgent attention Basic understanding of English language required OPEN TO ALL APPLICANTS VIRTUAL CLASSROOM OPTION INCLUDES COMPREHENSIVE PRACTISE@HOME ECG TRAINING KIT Final interpretation of all ECG recordings is the responsibility of a medical professional.

TRANSFER PRICING

By Mojitax

The aim of this course is to equip global tax professionals with the necessary skills and knowledge to excel as Transfer Pricing specialists. The curriculum is tailored to align with the Advanced Diploma in International Taxation (ADIT) syllabus, providing support for ADIT candidates in successfully passing their ADIT module 3.03 exam on their first attempt. The course is structured into nine segments, each addressing a specific aspect of the ADIT Transfer Pricing syllabus. Upon completion, students have the option to take either the ADIT professional exam or the MojiTax exam, and our support team remains readily available to address any inquiries or concerns. Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award: MOJITAX certificate of Knowledge, and ADIT Module 3.03 (exam preparation). Author: MojiTax Start date: Self Paced - Anytime Learning Hours: 5 Hours 45 Minutes ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 3.03. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have a solid understanding of transfer pricing principles and confidently pass the ADIT Module 3.03, transfer pricing exam in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our transfer pricing training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam: 01 INTRODUCTION Introduction to MojiTax Transfer Pricing ADIT/CIOT website ADIT Syllabus: Transfer Pricing 02 Part 1: Fundamental sources - 15% Presentation: Fundamental sources Chapter 1: Fundamental sources Quiz 1: Test your knowledge ADIT Revision Questions, Chapter 1 OECD Transfer Pricing Guideline (2022) - Not compulsory OECD BEPS Report 8-10 - Not compulsory United Nations Practical Manual on Transfer Pricing - Not compulsory 03 Part 2: The arm’s length principle (ALP) - 5% Presentation: The arm's length principle (ALP) Chapter 2: The arm's length principle (ALP) Quiz 2: Test your knowledge ADIT Revision Questions, Chapter 2 04 Part 3: Functional Analysis - 10% Presentation: Functional Analysis Chapter 3: Functional Analysis Quiz 3: Test your knowledge 05 Part 4: Transfer pricing methods - 10% Presentation: Transfer Pricing methods Transfer pricing methods ADIT Revision Questions, Chapter 3 & 4. Quiz 4: Test your knowledge 06 Part 5: Comparability - 10% Presentation: Comparability Chapter 5: Comparability ADIT Revision Questions, Chapter 5 Quiz 5: Test your knowledge 07 Part 6: Specific transactions (15%) Presentation: Specific transactions Chapter 6: Specific transactions ADIT Revision Questions, Chapter 6 Quiz 6: Test your knowledge 08 Part 7: Permanent establishments (PEs) - 10% Presentation: Permanent establishments (PEs) Chapter 7: Permanent establishments (PEs) ADIT Revision Questions, Chapter 7 Quiz 7: Test your knowledge 09 Part 8: Compliance issues - 5% Presentation: Compliance issues Chapter 8: Compliance Issues ADIT Revision Questions, Chapter 8 Quiz 8: Test your knowledge 10 Part 9: Avoiding Double Taxation and dispute resolution - 10% Presentation: Avoiding Double Taxation and dispute resolution Chapter 9: Avoiding Double Taxation and dispute resolution ADIT Revision Questions, Chapter 9 Quiz 9: Test your knowledge 11 Part 10: Other issues - 10% Presentation: Other issues Chapter 10: Other issues ADIT Revision Questions, Chapter 10 Quiz 10: Test your knowledge 12 Examination & Certificate Assessment Guidance Assessment & Certificate Portal Module Feedback