- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

5626 Courses delivered On Demand

Advanced Professional Certificate in International Financial Crimes

4.9(261)By Metropolitan School of Business & Management UK

Advanced Professional Certificate Courses These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD). Advanced Professional Certificate in International Financial Crimes This Advanced professional certificate course explores the concept and evolution of financial crimes, including fraud, corruption, and money laundering principal and secondary offences. The course provides insight into relevant cases involving financial crimes, focusing on the regulatory landscape of insider dealing and market abuse. The course presents an in-depth and detailed analysis of white-collar crimes' concepts, characteristics, and effects and reflects on various white-collar crimes' civil remedies. In addition, the course explains the concept and evolution of money laundering and Identifies the three stages of money laundering, all while explaining the aim and techniques of each stage. The course provides insight into different methods used in money laundering, including trade schemes, insurance policies, and cryptocurrencies. Also, the course presents an analysis of the impact of money laundering on economic growth and financial stability. Finally, the course is designed to cover the framework of international cooperation in the fight against financial crimes. The course provides insight into various international platforms involved in this global effort, including the European Union, the United Nations, and the FATF. From this perspective, the course covers multiple topics, including market abuse and market manipulation, corruption, and money laundering. Also, the course presents an analysis of various global financial crime risk management challenges. Course Details After the successful completion of this lecture, you will be able to; Understand the concept of financial crimes. Understand the concept and the regulatory landscape of corporate fraud. Understand the concept and the regulatory landscape of bribery and corruption. Reflect on various cases involving financial crimes. Understand the concept and the regulatory landscape of insider dealing and market abuse. Reflect on money Laundering Principal offences. Understand the concept, characteristics, and effects of white-collar crimes. Reflect on various white-collar crimes civil remedies. Understand the concept and evolution of money laundering. Identify the three stages of money laundering. Understand different methods used in money laundering. Measure the impact of money laundering on economic growth. Understand the framework of international cooperation in the fight against financial crimes. Understand the European Union anti-money laundering regulatory landscape. Understand the United Nations anti-money laundering regulatory landscape. Reflect on the EU market abuse regulation. Understand the intergovernmental anti-money laundering regulatory landscape. Reflect on various global financial crime risk management challenges. Accreditation The content of this course has been independently certified as conforming to universally accepted Continuous Professional Development (CPD) guidelines. Entry Requirements There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and gets updated on current ideas in their respective field. We recommend this certificate for the following audience. Legal advisors. Compliance specialists Compliance officers Financial advisors and managers Banking professionals Accountants Real estate agents Insurance professionals Legal advisors. Law practitioners. Contract specialists. Legal officers. Contract managers. Business developers. Law lecturers. Business lecturers. Legal and business researchers.

Online Food Safety Level 2 Course - CPD Accredited

By Shout Out Safety

Watch a film, don't read a powerpoint! Our Food Safety Level 2 course is an interactive and engaging online learning experience. Developed by industry experts, it is designed to meet the needs of individuals who work with food or handle food-related activities. The online course is delivered through video-based training modules, making it easy to follow and comprehend the content.

Rigging Safety for Construction and Industry

By Compliance Central

This Construction Safety course is developed by industry experts and is packed with several insightful modules to give you a proper understanding of Construction Safety and allow you to accelerate your career. Rigging is the act of preparing equipment to be lifted by cranes, hoists, or other material-handling machinery. This Rigging Construction Safety and Industry course is designed to provide learners with updated knowledge of the safety practice while working with cranes and hoist systems. The loads that cranes lift come in all shapes and sizes. If mishandled, they can cause serious problems. Loads that have been improperly rigged can be dumped on the ground, start to spin, or swing out of control which can be hazardous for anyone near them. The rigging safety course reviews the hazards associated with rigging and moving loads, discusses the equipment and safe work practices that employees should use to avoid tragic consequences. Learning Outcome of Rigging Safety for Construction and Industry: By the end of the course learners will be able to demonstrate that they can: Introduce yourself with the method of Rigging Identify the hazards involved while lifting with a crane Familiarize the method of choosing the right sling for the load Explore the Types of hitches and how to use them. Learn about the Standard hand signals Expand your knowledge on Lifting, moving, and lowering loads safely Rigging Safety for Construction and Industry Course Curriculum: Module 01 - Rigging and crane safety. Module 02 - Choosing the right sling for the load. Module 03 - Types of hitches and how to use them. Module 04 - Standard hand signals. Module 05 - Lifting, moving and lowering a load safely. Rigging Safety for Construction and Industry Course Assessment & Certification: To claim your certificate from Compliance Central, you need to complete the assessment of this course successfully. After that, you will have to order the digital certificate for £3.99. And for the hard copy, the charge will be £8.99, without any shipping charge inside the UK. However, the additional shipping charge will be £9.99 for international delivery. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This comprehensive Construction course is ideal for individuals associated with the sectors such as: Construction workers Safety professionals Anyone who needs the relevant knowledge of crane and hoist instruments Requirements This Rigging Safety for Construction and Industry course has no requirements. Career path The Rigging Safety for Construction and Industry course will enable you to get hired in Rigging Safety for Construction and Industry-related jobs. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

AML : Anti Money Laundering Course

By Training Tale

***AML : Anti Money Laundering Course*** Every year, billions of dollars are laundered, making compliance more important than ever. Even with advancement of technology, financial infrastructures are not totally safe from fraud and cybercriminals. The huge amount of illegal money floating 'below the surface' and disrupting the economic balance is the main reason for the implementation of anti-money laundering policies. Anti-money laundering (AML) regulations and procedures require financial institutions to monitor and prevent their customers from engaging in money laundering activities. AML seeks to deter criminals from transferring illegal funds into the financial system while also protecting your organisation. With this Course, you will learn about AML policies and gain a thorough understanding of financial crime. Through this AML: Anti Money Laundering Course you will learn what money laundering is and how AML plays a role in preventing money laundering. This course will teach you how criminals use a variety of methods to launder money and convert black money into white money. This course covers a wide range of essential topics, including the evolution of AML regulations, a risk-based approach, customer due diligence, suspicious activity/transactions, record keeping, and much more. By the end of this AML: Anti Money Laundering Course, you will have a clear understanding of the responsibilities of a money laundering reporting officer as well as the skills required to make your mark in the financial world. Learning Outcomes After completing this Course, learner will be able to: Gain a thorough understanding of Money Laundering Gain in-depth knowledge about proceeds of crime act 2002 Understand the development of anti money laundering regulation Understand responsibility of the money laundering reporting officer Understand risk-based Approach Understand customer due diligence Gain a solid understanding of record keeping Understand the importance of staff awareness and training Why Choose this Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the Course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the Anti-Money Laundering (AML) Training course] [ AML: Anti Money Laundering Course] course curriculum Module 01: A Quick Overview of Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Evolution of Anti Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Officer Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Employees and Agents Awareness and Training Assessment Method After completing each module of the Anti-Money Laundering (AML) Training Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Anti-Money Laundering (AML) Training course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? This Course is suitable for anyone interested in learning about AML legislation and how terrorist financing works in order to protect their business and customers. Ethics & Compliance Professionals AML Analysts Accountants & Bookkeepers Bankers Money Laundering Reporting Officer AML Officer Risk & Compliance Analyst Compliance Manager Requirements There are no specific requirements for this Course because it does not require any advanced knowledge or skills. Career path This Course may lead you to a variety of career opportunities. Such as: AML Analyst Compliance Manager Money Laundering Reporting Officer Lawyer In the UK, the average annual salary for these job opportunities ranges from £15,000 to £75,000 per year. Certificates Certificate of completion Digital certificate - Included

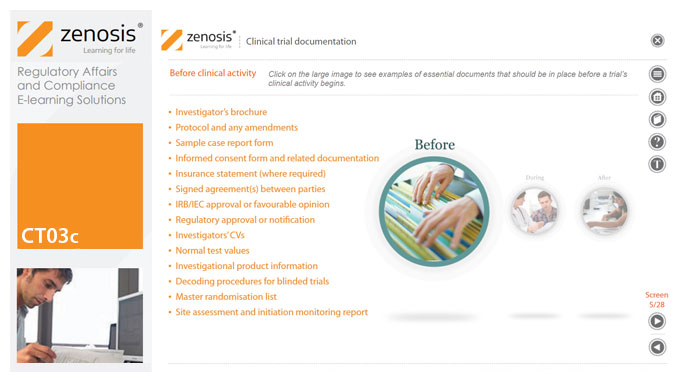

CT03c - Clinical trial documentation

By Zenosis

Regulatory authorities tend to abide by the maxim that ‘If it isn’t documented, it didn’t happen’. Rigorous documentation of all aspects of a clinical trial is necessary to provide evidence of GCP and compliance with regulatory requirements, as well as enabling effective management of the trial. In this short course we describe important examples of the documents designated by ICH GCP as essential to the conduct of a clinical trial.

Enhance your healthcare expertise with our Bloodborne Pathogens Training course. Navigate regulatory standards, master prevention measures, and develop effective exposure incident responses. Elevate workplace safety through risk assessment, vaccination programs, and meticulous adherence to healthcare policies. Protect yourself and others—empower your professional journey today.

Electrocution Hazards Worksite Safety Training

By Compete High

Stay Shock-Free: Electrocution Hazards Worksite Safety Training Course! ï¸ Are you committed to creating a safer work environment free from electrocution hazards? Enroll in our Electrocution Hazards Worksite Safety Training Course, a comprehensive program meticulously designed to equip you with the knowledge and skills needed to identify, mitigate, and prevent electrical hazards in the workplace. Join us on a journey where safety protocols meet risk assessment, fostering a culture of electrical safety. ð Module 1: Introduction to Electrocution Hazards and Risk Assessment Commence your safety journey with Module 1, providing a thorough introduction to electrocution hazards and the importance of risk assessment. Learn to identify potential hazards, assess risks, and lay the foundation for a proactive approach to electrical safety in the workplace. ð§ Module 2: Electrical Safety Procedures and Establishing a Culture of Safety Master the art of electrical safety procedures in Module 2, focusing on creating and maintaining a culture of safety. Explore best practices for handling electrical equipment, establishing safety protocols, and fostering a workplace environment where safety is a top priority. ð¨ Module 3: Emergency Preparedness and Electrical Safety Inspections Prepare for the unexpected with Module 3, dedicated to emergency preparedness and electrical safety inspections. Develop the skills to respond confidently to electrical emergencies, conduct thorough safety inspections, and implement preventative measures to minimize the risk of incidents. ð Module 4: Electrical Equipment Maintenance for Electrical Hazard Mitigation Optimize your safety measures with Module 4, focusing on electrical equipment maintenance for hazard mitigation. Learn to identify signs of equipment wear and tear, implement preventative maintenance measures, and ensure the longevity and safety of electrical systems. ï¸ Module 5: Specialized Electrical Safety Training for Safety in Contractors Extend your safety practices to contractors in Module 5, where you'll receive specialized electrical safety training. Explore safety considerations for contractors working with electrical systems, fostering collaboration and ensuring a unified approach to electrical safety across the worksite. ð Module 6: Summary and Assessment Cap off your training with Module 6, summarizing key takeaways and assessing your knowledge. Reinforce your understanding of electrocution hazards, safety protocols, and risk assessment strategies, ensuring you are well-equipped to champion electrical safety in your workplace. ð Why Choose Our Electrocution Hazards Worksite Safety Training Course? Expert Guidance: Learn from seasoned professionals and safety experts specializing in electrical safety. Interactive Learning: Engage in practical simulations, real-world scenarios, and assessments to apply theoretical knowledge. Compliance Assurance: Align with industry standards and regulations, ensuring a workplace that prioritizes electrical safety. Customizable Training: Tailor the course to suit your industry-specific needs for maximum relevance. Don't let electrocution hazards compromise safety in your workplace! Enroll now in the Electrocution Hazards Worksite Safety Training Course and empower yourself with the knowledge and skills needed to create a shock-free and secure work environment. Your journey to electrical safety excellence begins here! â¨ð Course Curriculum Module 1 Introduction to Electrocution Hazards and Risk Assessment Introduction to Electrocution Hazards and Risk Assessment 00:00 Module 2 Electrical Safety Procedures and Establishing a Culture of Safety Electrical Safety Procedures and Establishing a Culture of Safety 00:00 Module 3 Emergency Preparedness and Electrical Safety Inspections Emergency Preparedness and Electrical Safety Inspections 00:00 Module 4 Electrical Equipment Maintenance for Electrical Hazard Mitigation Electrical Equipment Maintenance for Electrical Hazard Mitigation 00:00 Module 5 Specialized Electrical Safety Training for Safety in Contractors Specialized Electrical Safety Training for Safety in Contractors 00:00 Module 6 Summary and Assessment Summary and Assessment 00:00

Basic Food Hygiene Certificate (also known as Food Safety Level 2)

By Compliance Central

Are you looking to enhance your Basic Food Hygiene skills? If yes, then you have come to the right place. Our comprehensive course on Basic Food Hygiene will assist you in producing the best possible outcome by mastering the Basic Food Hygiene skills. The Basic Food Hygiene course is for those who want to be successful. In the Basic Food Hygiene Certificate course, you will learn the essential knowledge needed to become well versed in Basic Food Hygiene. Our Basic Food Hygiene Certificate course starts with the basics of Basic Food Hygiene and gradually progresses towards advanced topics. Therefore, each lesson of this Basic Food Hygiene course is intuitive and easy to understand. Why would you choose the Basic Food Hygiene Certificate course from Compliance Central: Lifetime access to Basic Food Hygiene Certificate course materials Full tutor support is available from Monday to Friday with the Basic Food Hygiene Certificate course Learn Basic Food Hygiene Certificate (also known as Food Safety Level 2) skills at your own pace from the comfort of your home Gain a complete understanding of Basic Food Hygiene course Accessible, informative Basic Food Hygiene Certificate learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Basic Food Hygiene Study Basic Food Hygiene in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Basic Food Hygiene Course Improve your chance of gaining in demand skills and better earning potential by completing the Basic Food Hygiene Basic Food Hygiene Curriculum Breakdown of the Basic Food Hygiene Certificate Course Module 01 : Introduction to Food Safety and the Law Module 02 : Bacteria and Microbiological Hazards Module 03 : Physical, Chemical and Allergenic Hazards Module 04 : Food Poisoning and Control Measures Module 05: Food Spoilage and Food Storage Module 06 : Personal Hygiene Module 07 : HACCP and Food Premises Module 08 : Cleaning Module 09 : Reopening and Adapting Your Food Business During COVID-19 CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Basic Food Hygiene course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Basic Food Hygiene. It is also great for professionals who are already working in Basic Food Hygiene and want to get promoted at work. Requirements To enrol in this Basic Food Hygiene course, all you need is a basic understanding of the English Language and an internet connection. Career path The Basic Food Hygiene course will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to Basic Food Hygiene Certificate (also known as Food Safety Level 2). Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Certificate in Anti Money Laundering (AML) Course

By Compliance Central

Are you looking to enhance your Certificate in Anti Money Laundering (AML) skills? If yes, then you have come to the right place. Our comprehensive course on Certificate in Anti Money Laundering (AML) will assist you in producing the best possible outcome by mastering the Certificate in Anti Money Laundering (AML) skills. The Certificate in Anti Money Laundering (AML) course is for those who want to be successful. In the Certificate in Anti Money Laundering (AML) course, you will learn the essential knowledge needed to become well versed in Certificate in Anti Money Laundering (AML). Our Certificate in Anti Money Laundering (AML) course starts with the basics of Certificate in Anti Money Laundering (AML) and gradually progresses towards advanced topics. Therefore, each lesson of this Certificate in Anti Money Laundering (AML) course is intuitive and easy to understand Exclusive Bonus Courses: Course 01: KYC Course Course 02: GDPR Compliance Course 03: Compliance and Risk Management Course 04: Legal Advisor Training Course 05: Financial Investigator/Fraud Investigator Why would you choose the Certificate in Anti Money Laundering (AML) course from Compliance Central: Lifetime access to Certificate in Anti Money Laundering (AML) course materials Full tutor support is available from Monday to Friday with the Certificate in Anti Money Laundering (AML) course Learn Certificate in Anti Money Laundering (AML) skills at your own pace from the comfort of your home Gain a complete understanding of Certificate in Anti Money Laundering (AML) course Accessible, informative Certificate in Anti Money Laundering (AML) learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Certificate in Anti Money Laundering (AML) bundle Study Certificate in Anti Money Laundering (AML) in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Certificate in Anti Money Laundering (AML) Course Improve your chance of gaining in demand skills and better earning potential by completing the Certificate in Anti Money Laundering (AML) Curriculum Breakdown of the Certificate in Anti Money Laundering (AML) Course:- Module 01: Introduction to Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Development of Anti-Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Officer Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Awareness and Training Learning Outcomes for the Certificate in Anti Money Laundering (AML): Understand the concept and processes of money laundering. Demonstrate knowledge of the Proceeds of Crime Act 2002 and its implications. Comprehend the evolution and development of anti-money laundering regulations. Identify the responsibilities of the Money Laundering Reporting Officer. Apply a risk-based approach to detect and prevent money laundering. Implement effective customer due diligence, record keeping, and transaction monitoring. CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Certificate in Anti Money Laundering (AML) course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Certificate in Anti Money Laundering (AML). It is also great for professionals who are already working in Certificate in Anti Money Laundering (AML) and want to get promoted at work. Requirements To enrol in this Certificate in Anti Money Laundering (AML) course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this Certificate in Anti Money Laundering course, you may explore trendy and in-demand jobs. AML Analyst: £30,000-£45,000 per year. Compliance Officer: £35,000-£55,000 per year. Financial Crime Investigator: £40,000-£60,000 per year. Risk Manager: £45,000-£65,000 per year. Fraud Investigator: £35,000-£50,000 per year. AML Consultant: £50,000-£75,000 per year. Certificates CPD Accredited PDF Certificate Digital certificate - Included 6 CPD Accredited PDF Certificates for Free CPD Accredited Hard Copy Certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate for £9.99 each. Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

Investment Banking Level 3 - QLS Endorsed

By Compliance Central

Are you looking to enhance your Investment Banking skills? If yes, then you have come to the right place. Our comprehensive course on Investment Banking will assist you in producing the best possible outcome by mastering the Investment Banking skills. The Investment Banking course is for those who want to be successful. In the Investment Banking course, you will learn the essential knowledge needed to become well versed in Investment Banking. Our Investment Banking course starts with the basics of Investment Banking and gradually progresses towards advanced topics. Therefore, each lesson of this Investment Banking course is intuitive and easy to understand. Why would you choose the Investment Banking course from Compliance Central: Lifetime access to Investment Banking course materials Full tutor support is available from Monday to Friday with the Investment Banking course Learn Investment Banking skills at your own pace from the comfort of your home Gain a complete understanding of Investment Banking course Accessible, informative Investment Banking learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Investment Banking Study Investment Banking in your own time through your computer, tablet or mobile device A 100% learning satisfaction guarantee with your Investment Banking Course Free 5 CPD Course: Course 1: Investment Course 2: Capital Budgeting & Investment Decision Rules Course 3: Financial Advisor Course 4: Business Analysis Level 3 Course 5: Stock Market Investing for Beginners Investment Banking Curriculum Breakdown of the Investment Banking Course Course Outline: Module 1: Introduction to Investment Banking Module 2: Structure and Side of Investment Banking Module 3: Valuation Methods in Investment Banking Module 4: Leveraged Buyout (LBO) Module 5: Initial Public Offering (IPO) Module 6: Merger and Acquisition Module 7: Ethics in Investment Banking Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for Free to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Investment Banking course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Investment Banking. It is also great for professionals who are already working in Investment Banking and want to get promoted at work. Requirements To enrol in this Investment Banking course, all you need is a basic understanding of the English Language and an internet connection. Career path Investment Analyst: £40,000 to £70,000 per year Financial Analyst: £35,000 to £60,000 per year Risk Analyst: £35,000 to £65,000 per year Investment Banking Associate: £60,000 to £100,000 per year Portfolio Manager: £50,000 to £100,000 per year Corporate Finance Consultant: £45,000 to £80,000 per year Certificates CPD Accredited Hard Copy Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: £3.99 each Outside of the UK: £9.99 each CPD Accredited PDF Certificate Hard copy certificate - Included CPD Accredited PDF Certificate QLS Endorsed Hard Copy Certificate Hard copy certificate - £10.79 Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each