- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1051 Courses delivered On Demand

Description The use of accounting is very significant regardless of the size of the company since it helps to provide a methodological procedure for detailing the activities of the business. The Finance and Accounting Level 1 and 2 course teaches you the ins and outs of finance and accounting in a fun and comprehensive guide to the mind. Through the course, you'll learn the fundamental measures of finance and accounting to manage the accounts of your business. You'll also understand the necessary accounting terms and concepts and learn to prepare reports on financial information about the performance, financial position, and cash flows of a business. Here's what the course includes: Planning and preparation for accurate Financial Statements for your business The importance of Balance Sheet and the contrast within presenting a Balance Sheet style in the US and UK Maintain adequate and systematic records of business transactions Alternatives for raising extra capital and company budgeting Once you've completed this course, you can successfully contribute to the overall stability and progress of the business. Assessment: This course does not involve any MCQ test. Students need to answer assignment questions to complete the course, the answers will be in the form of written work in pdf or word. Students can write the answers in their own time. Once the answers are submitted, the instructor will check and assess the work. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Finance and Accounting Level 1 and 2 is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Finance and Accounting Level 1 and 2 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Module : 01 Chris Moore - Accounting for Beginners Promo FREE 00:01:00 Chris Moore - 1. Introduction 00:03:00 Chris Moore - 2. First Transactions 00:05:00 Chris Moore - 3. T Accounts introduction 00:03:00 Chris Moore - 4. T-Accounts conclusion 00:03:00 Chris Moore - 5. Trial Balance 00:02:00 Chris Moore - 6. Income Statement 00:03:00 Chris Moore - 7. Balance Sheet 00:03:00 Module : 02 Chris Moore - 8. Balance Sheet Variations 00:03:00 Chris Moore - 9. Accounts in practise 00:05:00 Chris Moore - 10. Balance Sheets what are they 00:05:00 Chris Moore - 11. Balance Sheet Level 2 00:03:00 Chris Moore - 12. Income Statement Introduction 00:06:00 Chris Moore - 13. Are they Expenses, or Assets 00:03:00 Chris Moore - 14. Accounting Jargon 00:02:00 Module : 03 Chris Moore - 15. Accruals Accounting is Fundemental 00:03:00 Chris Moore - 16. Trial Balance 3 days ago More 00:04:00 Chris Moore - 17. Fixed Assets and how it is shown in the Income Statement 00:03:00 Chris Moore - 18. Stock movements and how this affects the financials 00:03:00 Chris Moore - 19. Accounts Receivable 00:03:00 Chris Moore - 20. How to calculate the Return on Capital Employed 00:05:00 Chris Moore - 21. Transfer Pricing - International Rules 00:02:00 Handout - Finance and Accounting Handout - Finance and Accounting 00:00:00 Assessment Assignment - Finance and Accounting Level 1 and 2 00:00:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Accounting, Business Performance Management, Data Analysis, and Marketing - 4 Courses in 1 Bundle

By Lead Academy

Whether you are self-taught and you want to fill in the gaps for better efficiency and productivity, this Accounting, Business Performance Management, Data Analysis, and Marketing - 4 in 1 course will set you up with a solid foundation to become a confident accountant and finance assistant and develop more advanced skills. Lead Academy Scholarship Programme | Enrol Today & Save £347 This comprehensive Accounting, Business Performance Management, Data Analysis, and Marketing - 4 in 1 course is the perfect way to kickstart your career in the field of accounting & finance. This course will give you a competitive advantage in your career, making you stand out from all other applicants and employees. As one of the leading course providers and most renowned e-learning specialists online, we're dedicated to giving you the best educational experience possible. This course is crafted by industry expert, to enable you to learn quickly and efficiently, and at your own pace and convenience. How Will I Benefit? Boost your career in accounting & finance Deepen your knowledge and skills in your chosen field just in hours not years! Study a course that is easy to follow. Save money and time by studying at your convenient time Have access to a tutor whenever you are in need So, what are you thinking about! Start getting the benefits by enrolling today! Why Choose Lead Academy: Lifetime Access High-quality e-learning study materials Learn the most in-demand skills Self-paced, no fixed schedules 24/7 customer support through email Available to students anywhere in the world No hidden fee Study in a user-friendly, advanced online learning platform Who is this course for? This comprehensive Accounting, Business Performance Management, Data Analysis, and Marketing - 4 in 1 course is suitable for anyone looking to improve their job prospects or aspiring to accelerate their career in this sector and want to gain in-depth knowledge of accounting & finance. Entry Requirement There are no academic entry requirements for this Business Accounting and Finance course, and it is open to students of all academic backgrounds. As long as you are aged seventeen or over and have a basic grasp of English, numeracy and ICT, you will be eligible to enrol. Career path This Business Finance course opens a brand new door for you to enter the relevant job market and also provides you with the chance to accumulate in-depth knowledge at the side of needed skills to become flourishing in no time. You will also be able to add your new skills to your CV, enhance your career and become more competitive in your chosen industry. Course Curriculum Business Accounting and Finance What is Business finance. What is Business finance. Why Businesses Fail Why Businesses Fail The Principles of Business Finance Part 1 The Principles of Business Finance Part 1 The Principles of Business Finance Part 2 The Principles of Business Finance Part 2 The Balance Sheet The Balance Sheet The Income Statement The Income Statement The Cashflow Statement The Cashflow Statement A Business Finance Exercise A Business Finance Exercise Financial Performance Indicators Financial Performance Indicators Investment Analysis Investment Analysis Investment Analysis Exercise Investment Analysis Exercise Key Learning Points in Business Finance Key Learning Points in Business Finance Business Performance Management Assessment Social Media Marketing Masterclass 2019 Introduction General Tips & Tricks Series SEO (Search Engine Optimization) YouTube Google Analytics Email Marketing Linkedln Facebook Instagram Mobile App

Overview Developing a stronghold of partnership accounting can lead to promising career opportunities in the fields of business, finance and accounting. You can get top-notch training on partnership accounting and build the core skills needed to flourish in this area with our Partnership Accounting Course. Through the comprehensive course you will get the chance to establish a solid understanding of partnership accounting. The course will deliver lessons on partnership agreements and formation. Then, the course will help you learn the key skills for managing capital accounts, income allocation and financial statement management. The course will also focus on the dissolution and liquidation of partnerships. At the end of the course, you will receive a certificate of achievement. This certificate will demonstrate your expertise in this area and help you pursue a promising career. Join now! Course Preview Learning Outcomes Grasp the main principles of partnership accounting Enhance your knowledge of partnership agreements and formation Know how to manage capital accounts Learn the methods of income allocation Develop the ability to manage financial statements Deepen your understanding of dissolution and liquidation of partnership Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Engaging tutorial videos, materials from the industry-leading experts Opportunity to study in a user-friendly, advanced online learning platform Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email. What Skills Will You Learn from This Course? Partnership Accounting Capital Accounts Management Income Allocation Financial Statement Management Who Should Take This Partnership Accounting Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Partnership Accounting Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ This exclusive Partnership Accounting Course will equip you with effective skills and abilities and help you explore career paths such as Financial Controller Financial Analyst Fund Accountant Financial Planner Module 01: Introduction to Partnership Accounting Introduction to Partnership Accounting 00:13:00 Module 02: Partnership Agreement and Formation Partnership Agreement and Formation 00:16:00 Module 03: Partnership Capital Accounts Partnership Capital Accounts 00:12:00 Module 04: Partnership Income Allocation Partnership Income Allocation 00:10:00 Module 05: Partnership Financial Statements Partnership Financial Statements 00:13:00 Module 06: Changes in Partnership Changes in Partnership 00:10:00 Module 07: Dissolution and Liquidation of Partnership Dissolution and Liquidation of Partnership 00:18:00 Module 08: Partnership Taxation Basics Partnership Taxation Basics 00:15:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Financial Statements Fraud Detection Training

By The Teachers Training

Overview Financial Statements Fraud Detection Training Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Financial Statements Fraud Detection Training Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Financial Statements Fraud Detection Training Introduction To The Course 00:03:00 Meaning Of Financial Fraud 00:05:00 Definition Of Financial Statement Fraud 00:07:00 Who Commits Financial Fraud? 00:11:00 Conceptual Framework Of Financial Statement 00:11:00 Qualitative Characteristics Of Financial Statements 00:02:00 Methods Of Committing Financial Statement Fraud 00:02:00 Method 1 Of Financial Fraud: False Revenue Part 1 00:15:00 Method 1 Of Financial Fraud: False Revenue Part 2 00:02:00 Method 2 Timing Differences 00:10:00 Method 3 Concealment Of Liabilities 00:06:00 Method 4 Improper Disclosure 00:09:00 Additional Red Flags For Method 4 00:02:00 Method 5 Improper Asset Valuation 00:12:00 Deterrence Of Financial Fraud 00:08:00 Understanding Revenue Falsification 00:08:00 Catching Falsification Of Expenses 00:08:00 Financial Frauds In Assets 00:11:00 Resource Resource - Financial Statements Fraud Detection Training 00:00:00

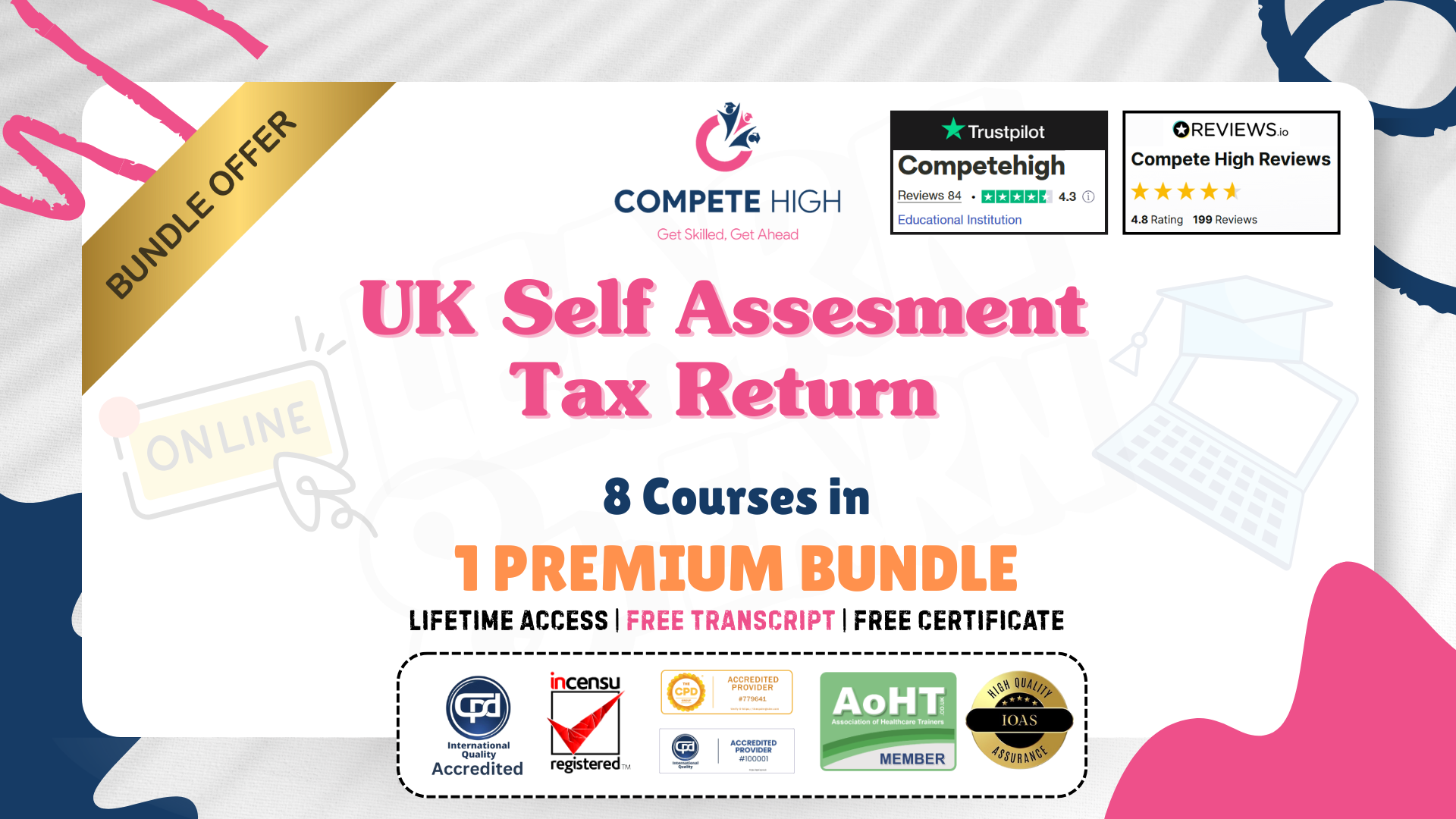

UK Self Assessment Tax Return: 8-in-1 Premium Online Courses Bundle

By Compete High

Make taxes your superpower. The UK Self Assessment Tax Return: 8-in-1 Premium Online Courses Bundle is perfect for anyone seeking roles in tax, finance, freelancing, or accounting support. 💼📊 🧾 Description Featuring high-demand topics like Sage, Xero, Power BI, Excel, data analysis, and tax, this bundle is tailored for work in accountancy, tax return filing, self-employed finance, and data entry. 🧾 Job tracks include: Self-Assessment Assistant Freelancer Finance Support Bookkeeping Clerk Tax Return Specialist Accounting Assistant 🚨 Filing season waits for no one. Equip yourself today. ⭐ Compete High has 4.8 on 'Reviews.io' and 4.3 on Trustpilot ❓ FAQ Q: Can this help with freelance tax filing? A: Absolutely! It’s designed for both self-employed professionals and admin staff. Q: Do I need experience with Excel or Sage? A: Not at all—you’ll get started from scratch.

Register on the Accounting and Finance today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as proof of your course completion. The Accounting and Finance is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Accounting and Finance Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements The online training is open to all students and has no formal entry requirements. To study the Accounting and Finance, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16.

Overview For those planning for a thriving career in finance, solid skills in depreciation accounting is vital. If you are seeking success in accounting, our Depreciation Accounting Course can be your solution. This course is designed to take your skills to the next level. The course will provide you with the fundamentals of depreciation accounting. From the easy-to-follow modules, you will learn about depreciation models and the strategies to utilise them. In addition, the course will enhance your understanding of reporting and compliance. The course will also cover lessons on depreciation tax shields and depreciation accounting trends and future developments. After the completion of the course, you will receive an accredited certificate of achievement. This certificate will add value to your resume and help you climb the career ladder; enrol now! Course Preview Learning Outcomes Understand the definition and terms of depreciation accounting Learn about depreciation models and how to use them Build your expertise in depreciation reporting and compliance Grasp essential information about depreciation tax shield Get introduced to the trends and future developments of depreciation accounting Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Depreciation Accounting Who Should Take This Depreciation Accounting Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Depreciation Accounting Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ This exclusive Depreciation Accounting Course will equip you with effective skills and abilities and help you explore career paths such as Accountants Financial Analyst Financial Consultant Tax Accountant Module 1: Introduction to Depreciation Accounting Introduction to Depreciation Accounting 00:20:00 Module 2: Accounting for Depreciation Accounting for Depreciation 00:22:00 Module 3: Deep Dive into the Depreciation Model Deep Dive into the Depreciation Model 00:14:00 Module 4: Case Studies and Real-World Applications Case Studies and Real-World Applications 00:11:00 Module 5: Depreciation Reporting and Compliance Depreciation Reporting and Compliance 00:13:00 Module 6: Emerging Trends and Future Developments Emerging Trends and Future Developments 00:18:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Professional Certificate Course in International Investment and Financing in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This Professional Certificate Course in International Investment and Financing provides a comprehensive overview of key financial principles. Participants will gain insights into cash management objectives, exploring motives for holding cash and its impact on liquidity management. The course delves into the intricacies of international cash management, addressing factors like currency risk, cross-border transactions, and regulatory requirements. Additionally, it covers risk assessment and mitigation strategies, including hedging and diversification. The program also examines the distinctions between portfolio and foreign direct investment, outlining the benefits and risks. Furthermore, participants will evaluate strategies for sourcing global equity, incorporating tools such as American Depository Receipts (ADRs) and Depositary Receipts. After the successful completion of the course, you will be able to learn about the following: Understand the Objectives of Cash Management and its Importance in Effectively Managing an Organisation's Cash Flows. Explore the Motives Behind Holding Cash and How it Impacts Liquidity Management in Both Domestic and International Contexts. Analyse the Complexities Involved in International Cash Management Including Factors Such as Currency Risk, Cross-border Transactions and Regulatory Requirements. Assess the Risks Associated with International Cash Management and Identify Strategies to Mitigate these Risks Such as Hedging, Diversification and Cash Flow Forecasting. Examine the Concept of Portfolio Investment and its Distinction from Foreign Direct Investment, Highlighting the Benefits and Risks of Engaging in Foreign Portfolio Investment. Evaluate the Benefits and Challenges of Sourcing Equity Globally and Design Strategies for Raising Equity in Foreign Markets Including the Use of American Depository Receipts (ADRS) and Depositary Receipts. This Professional Certificate Course in International Investment and Financing offers a comprehensive understanding of cash management objectives and their pivotal role in organizational cash flow dynamics. Participants delve into motives for holding cash, examining impacts on liquidity management in both domestic and international contexts. The course further analyzes complexities in international cash management, including currency risk, cross-border transactions, and regulatory considerations. Students assess associated risks and explore mitigation strategies such as hedging, diversification, and cash flow forecasting. Additionally, the curriculum covers portfolio investment, distinguishing it from foreign direct investment, and explores the benefits and risks of foreign portfolio investment. The course concludes by evaluating the benefits and challenges of sourcing equity globally, designing strategies for raising equity in foreign markets, and considering instruments like American Depository Receipts (ADRs) and depositary receipts. This Professional Certificate Course in International Investment and Financing provides a comprehensive understanding of cash management objectives and the crucial role it plays in organizational cash flow dynamics. Delve into the motives behind cash holdings, examining their impact on liquidity management both domestically and internationally. The course analyzes the intricacies of international cash management, addressing factors like currency risk and regulatory requirements. Explore risk assessment and mitigation strategies, such as hedging and diversification, and gain insights into portfolio investment distinctions, foreign equity sourcing benefits, and challenges, including the use of American Depository Receipts (ADRs) and Depositary Receipts. Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. International Investment and Financing Self-paced pre-recorded learning content on this topic. International Investment And Financing Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course.The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience,ental Health Specialist Financial Managers and Analysts International Business Executives Treasury and Cash Management Professionals Risk Management Specialists Investment Analysts Corporate Finance Professionals Banking and Finance Graduates Entrepreneurs Expanding Globally Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

In this competitive job market, you need to have some specific skills and knowledge to start your career and establish your position. This Sage 50 Payroll - Level 5 course will help you understand the current demands, trends and skills in the sector. The course will provide you with the essential skills you need to boost your career growth in no time. The Sage 50 Payroll - Level 5 course will give you clear insight and understanding about your roles and responsibilities, job perspective and future opportunities in this field. You will be familiarised with various actionable techniques, career mindset, regulations and how to work efficiently. This course is designed to provide an introduction to Sage 50 Payroll - Level 5 and offers an excellent way to gain the vital skills and confidence to work toward a successful career. It also provides access to proven educational knowledge about the subject and will support those wanting to attain personal goals in this area. Learning Objectives Learn the fundamental skills you require to be an expert Explore different techniques used by professionals Find out the relevant job skills & knowledge to excel in this profession Get a clear understanding of the job market and current demand Update your skills and fill any knowledge gap to compete in the relevant industry CPD accreditation for proof of acquired skills and knowledge Who is this Course for? Whether you are a beginner or an existing practitioner, our CPD accredited Sage 50 Payroll - Level 5 course is perfect for you to gain extensive knowledge about different aspects of the relevant industry to hone your skill further. It is also great for working professionals who have acquired practical experience but require theoretical knowledge with a credential to support their skill, as we offer CPD accredited certification to boost up your resume and promotion prospects. Entry Requirement Anyone interested in learning more about this subject should take this Sage 50 Payroll - Level 5 course. This course will help you grasp the basic concepts as well as develop a thorough understanding of the subject. The course is open to students from any academic background, as there is no prerequisites to enrol on this course. The course materials are accessible from an internet enabled device at anytime of the day. CPD Certificate from Course Gate At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £4.99 and the hard copy for £9.99. Also, you can order both PDF and hardcopy certificates for £12.99. Career path The Sage 50 Payroll - Level 5 will help you to enhance your knowledge and skill in this sector. After accomplishing this course, you will enrich and improve yourself and brighten up your career in the relevant job market. Course Curriculum Sage 50 Payroll - Level 5 Module 1: The Outline View and Criteria 00:11:00 Module 2: Global Changes 00:07:00 Module 3: Timesheets 00:12:00 Module 4: Departments and Analysis 00:11:00 Module 5: Holiday Schemes 00:10:00 Module 6: Recording Holidays 00:12:00 Module 7: Absence Reasons 00:13:00 Module 8: Statutory Sick Pay 00:16:00 Module 9: Statutory Maternity Pay 00:17:00 Module 10: Student Loans 00:09:00 Module 11: Company Cars 00:13:00 Module 12: Workplace Pensions 00:21:00 Module 13: Holiday Funds 00:13:00 Module 14: Process Payroll (November) 00:11:00 Module 15: Passwords and Access Rights 00:08:00 Module 16: Options and Links 00:10:00 Module 17: Linking Payroll to Accounts 00:08:00 Certificate and Transcript Order Your Certificates or Transcripts 00:00:00