- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Kanban for Software Project Management

By Packt

Kanban is a popular framework used to implement Agile and DevOps software development. It requires real-time communication of capacity and full transparency of work. A Kanban board is an Agile project management tool designed to help visualize work, limit work-in-progress, and maximize efficiency (or flow).

MH101: Micro-Hydro Training - Micro-Hydro Design & Installation

By Solar Energy International (SEI)

Participants perform preliminary system sizing for mechanical and electrical power generation of 50-watt to 100-kilowatt capacities. This training combines class lectures with site tours and lab exercises. Hands-on exercises include: methods of flow measurement, determining head, analyzing and assembling small functioning systems. The class is taught by two highly experienced Micro-hydro installers/instructors. Topics Include: • Learn safety procedures working with electricity • Understand fundamental water hydraulics and hydrostatic pressures. Understand the difference between static and dynamic heads. • Understand the various components of hydroelectric systems • Identify the two major hydro turbine groups (reaction and impulse turbines) • Learn the differences between AC and DC Systems • Develop site analysis skills for measuring water flow and elevation difference (head) • Review 6 different plan examples of hydroelectric system designs • Learn battery design and energy storage techniques • Understand controls for balancing energy production with energy loads • Summarize troubleshooting procedures and resources • Develop maintenance requirements both short and long term • Learn integration techniques for hybrid solar, wind and hydroelectric systems • Review 4 case studies using different turbine types • Learn legal requirements for hydroelectric systems including FERC permits, water rights and stream alteration.

Level 4 Diploma in Accounting and Business (Fast Track mode)

4.0(2)By London School Of Business And Research

Accounting and finance are at the very heart of business operations. From banking to manufacturing, from huge service industries to micro businesses, the ability to manage, plan and account for money is still the ultimate measure of business success and the key driver of growth. The objective of this fast track Level 4 Diploma in Accounting and Business qualification is to provide learners with an understanding of accounting and business in the broader business context, and to provide them with the practical, industry-focused skills to manage business finances, budgets and cash flow effectively, and to play a key role in business growth. Top Skills You Will Learn You will have an understanding of accounting and business in the broader business context. The programme will provide you with the practical, industry-focused skills to manage business finances, budgets and cash flow effectively, and to play a key role in business growth. Opportunities You will have immense career opportunity in banking to manufacturing, from huge service industries to micro businesses. You will get the ability to manage, plan and account for money which is still the ultimate measure of business success and the key driver of growth. Who is this course for? Working Professionals, A-Level holders, Professionals working in range of industries looking for a career in finance and accountancy Requirements Open Entry. No formal qualification is required from mature learners (over 21 years) who have relevant management experience. For others, the learners should have relevant NQF / QCF / RQF Level 3 Award / Diploma or at the level of GCE / GCSE or equivalent qualification. Career path Progress to: Year 2 of a Three-year UK Bachelor's degree Completion of your qualification will meet the University standard academic entry requirements to progress to Year 2 of a 3 Year UK Bachelor's Degree. In addition to Progression to the Universities, you also have an option to progress to the following Level 5 qualifications offered by LSBR, UK

In the modern world, Managing Cash Flows effectively is crucial for both personal and professional success. This course equips individuals with essential skills to navigate financial challenges efficiently. Understanding cash flow management ensures stability and growth, whether in personal finances or business operations. It teaches techniques to accelerate cash inflows, budget effectively, and utilize company accounts to address fund surplus or shortage. Particularly in small businesses, where cash flow can make or break success, these skills are invaluable. With companies often facing severe cash flow problems leading to insolvency, adeptness in this area is highly sought after. In the UK job market, proficiency in Managing Cash Flows opens doors to lucrative opportunities, with salaries ranging from £30,000 to £60,000 per annum. The sector is witnessing a steady increase in demand for professionals skilled in cash flow management, with job prospects growing by 10% annually. Mastering this course not only enhances financial acumen but also boosts employability in a competitive market landscape. Key Features: CPD Certified Managing Cash Flow Course Free Certificate from Reed CIQ Approved Managing Cash Flow Course Developed by Specialist Lifetime Access Course Curriculum Module 01: Introduction to Cash Flow Management Module 02: How to Accelerate Cash Inflows Module 03: Budgeting Cash Flow Module 04: Fund Surplus and Shortage and Utilising Company Accounts Module 05: Cash Flow Management In Small Business Module 06: How Companies Get Into Severe Cash Flow Problems Module 07: Insolvency as a Result Of Overtrading Learning Outcomes: Understand cash flow basics, enhancing financial decision-making skills. Optimise cash inflow processes, ensuring timely revenue streams for businesses. Master budgeting techniques for effective control and management of cash flow. Analyse fund surpluses and shortages, utilizing company accounts strategically. Apply cash flow principles specifically tailored for small business sustainability. Recognise indicators of severe cash flow problems and prevent insolvency risks. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Managing Cash Flows Effectively course is accessible to anyone eager to learn more about this topic. Through this Managing Cash Flows Effectively course, you'll gain a solid understanding of Managing Cash Flows Effectively. Moreover, this course is ideal for: Small business owners seeking effective cash flow management strategies. Finance professionals aiming to enhance cash flow expertise. Entrepreneurs wanting to navigate fund surpluses and shortages adeptly. Individuals keen on understanding insolvency risks and preventive measures. Managers responsible for budgeting and financial decision-making in organisations. Requirements There are no requirements needed to enrol into this Managing Cash Flows Effectively course. We welcome individuals from all backgrounds and levels of experience to enrol into this Managing Cash Flows Effectively course. Career path After finishing this Managing Cash Flows Effectively course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Managing Cash Flows Effectively are: Financial Analyst - £30K to 50K/year. Cash Flow Manager - £35K to 60K/year. Budget Analyst - £28K to 45K/year. Small Business Consultant - £25K to 45K/year. Insolvency Practitioner - £40K to 70K/year. Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

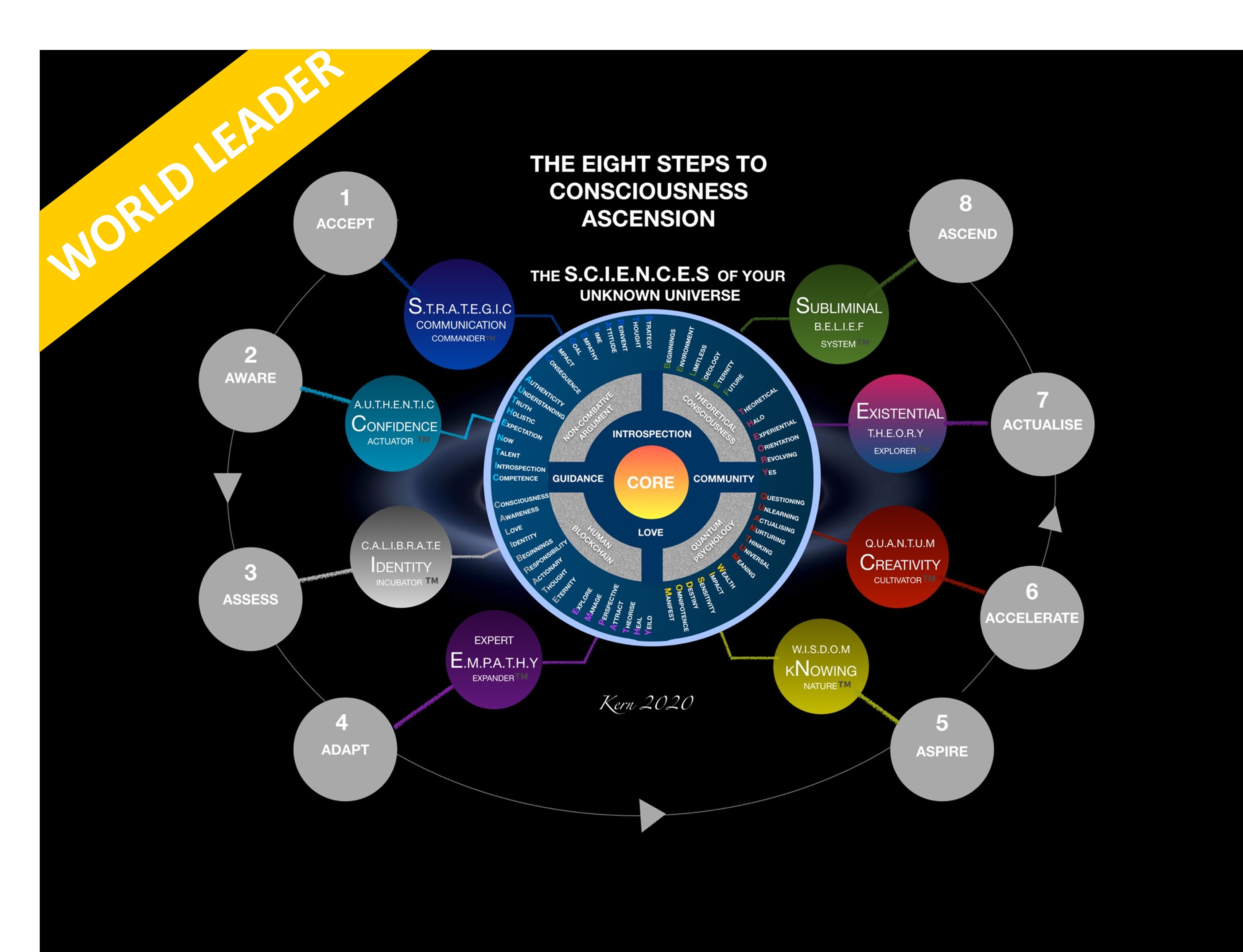

S.C.I.E.N.C.E.S Of Your Unknown Universe - World Leader

By Council For Human Development Swiss Association

The S.C.I.E.N.C.E.S World Leader Program is a 6-month powerful personal development training tool incl. Polymathic Training and Coaching Sessions, based around Neuroplastic Mental Acceleration (NMA): encompassing the eight steps to ascension, spread over 60 x 30 minute training sessions: Accept, Aware, Assess, Adapt, Aspire, Accelerate, Actualise, Ascend. The program is designed to provide mental well-being & acceleration by promoting fluid intelligence (the brain’s ability to learn new skills) though activating neuroplasticity - synaptogenisis & neurogenisis.

Creating a Robust Financial Plan - MasterClass

By Entreprenure Now

Making money is the very reason your business exists – but often, entrepreneurs don’t pay enough attention to the financials that drive the bottom line. Whether due to deep-seated money anxiety, lack of skills or knowledge, or an aversion to long-term planning, business owners often use random guesswork to build the sales and expense projections that should be the foundation of their financial plan. Sound financial planning documents can not only win over investors; they’re valuable tools for monitoring the company’s progress toward profitability. In this learning stream, we’ll examine and counteract common misperceptions about financial planning, learn about different models for revenue and cost projections, and discuss concepts such as the maximum negative cash flow that potential investors will scrutinize. Key expense and revenue models and financial statements will be reviewed one-by-one, with accompanying worksheets and formulas to help you build your own realistic, credible models. A workshop session will focus on finding the happy medium between wildly optimistic projections and overly-conservative, ho-hum estimates, so you can present financial statements that are believable, justifiable, and inspire confidence.

Professional Certificate Course in Documenting and Analysing Financial Information in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of the course is to provide learners with an understanding of the fundamental principles and techniques of financial management in the context of health and social care. Specifically, the course will focus on the concepts of double-entry bookkeeping, investment appraisal, and cash flow forecasting. After the successful completion of the course, you will be able to learn the following: The Concept, Characteristics, and Principles of Double-Entry Book-keeping. The Double-entry Bookkeeping Process. The Concepts of Investment Appraisal and its Techniques. The Investment Analysis Techniques. The Concept and Types of Cash Flow Forecasting. This course covers the concepts, principles, and techniques of double-entry bookkeeping, investment appraisal, and cash flow forecasting. It includes an in-depth exploration of the double-entry bookkeeping process, investment analysis techniques, and types of cash flow forecasting. The course aims to equip learners with the necessary skills to document and analyze financial information accurately and effectively. Upon completion of the course, learners will be able to apply double-entry bookkeeping principles, conduct investment appraisals, and prepare cash flow forecasts. The course is designed for individuals who are interested in pursuing a career in finance or accounting within the healthcare industry. This course covers the concepts, principles, and techniques of double-entry bookkeeping, investment appraisal, and cash flow forecasting. It includes an in-depth exploration of the double-entry bookkeeping process, investment analysis techniques, and types of cash flow forecasting. The course aims to equip learners with the necessary skills to document and analyze financial information accurately and effectively. Upon completion of the course, learners will be able to apply double-entry bookkeeping principles, conduct investment appraisals, and prepare cash flow forecasts. The course is designed for individuals who are interested in pursuing a career in finance or accounting within the healthcare industry. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Documenting and Analysing Financial Information - N Self-paced pre-recorded learning content on this topic. Documenting and Analysing Financial Information Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Health and Social Care Managers Finance Managers in Health and Social Care Healthcare Policy Analysts Healthcare Consultants Health Promotion Specialists Public Health Officials Health Economists Healthcare Data Analysts Medical Social Workers Healthcare Quality Assurance Specialists Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

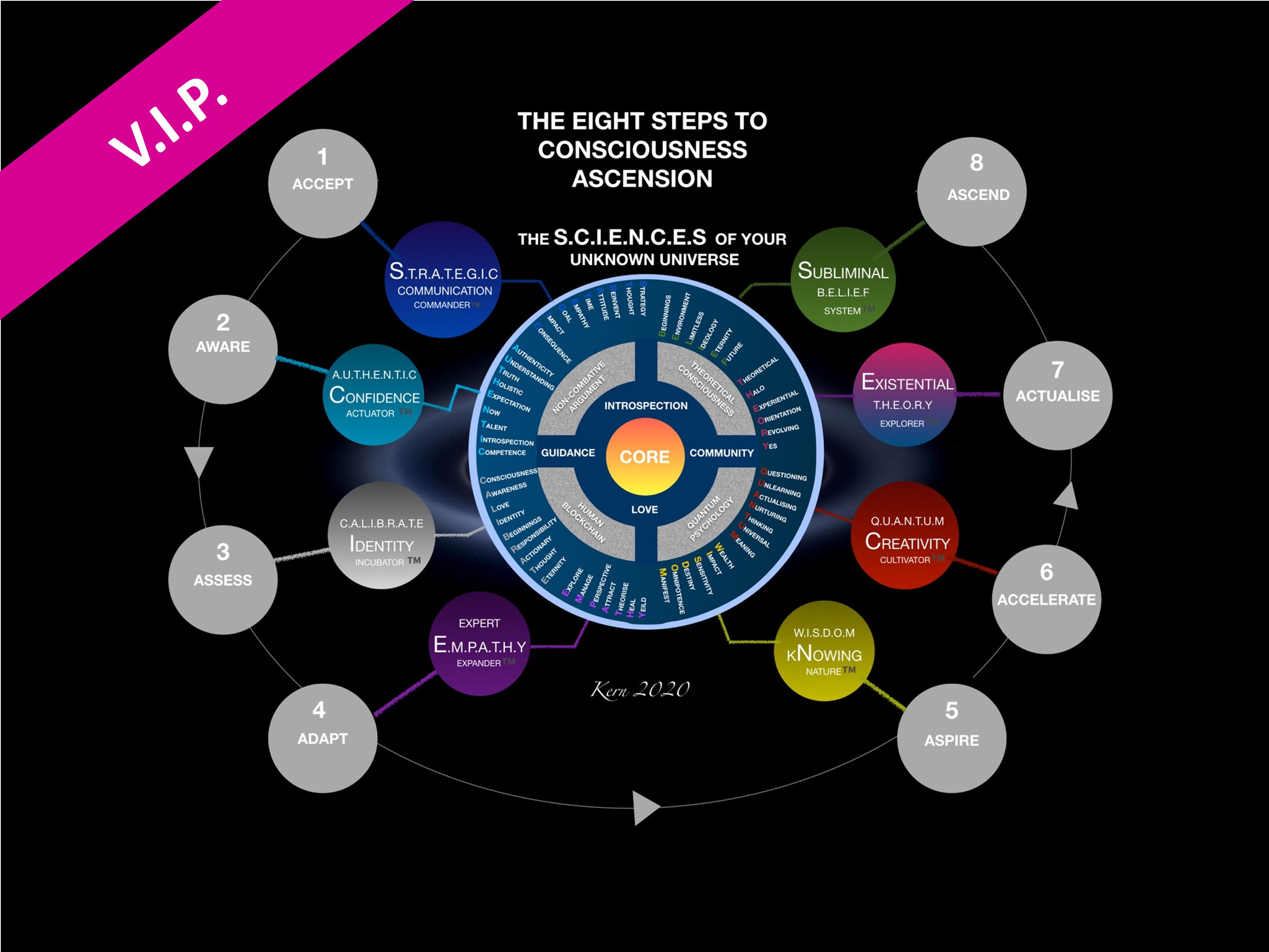

S.C.I.E.N.C.E.S Of Your Unknown Universe - VIP

By Council For Human Development Swiss Association

The S.C.I.E.N.C.E.S VIP Program is a 3-month powerful personal development training tool, based around Neuroplastic Mental Acceleration (NMA): encompassing the eight steps to ascension, spread over 60 x 30 minute training sessions: Accept, Aware, Assess, Adapt, Aspire, Accelerate, Actualise, Ascend. The program is designed to provide mental well-being & acceleration by promoting fluid intelligence (the brain’s ability to learn new skills) though activating neuroplasticity - synaptogenisis & neurogenisis.

Cashflow Management and Forecasting

By iStudy UK

The Cashflow Management and Forecasting course teaches you how to manage personal finances better. Throughout the course, you will learn to create a sales forecast, and able to maintain your own personal flow. The course also shows you how to reduce debt to improve your flow. The course explains two things: Sales forecasting and Cashflow management. You will learn about cash flow and know in which cash flows into you, improvements to the cash flow, and the common cash flow problems. The course is best for the people who are currently working in the accounts or finance department or want to obtain the career of an accountant. Upon completion, you will be able to create cash flow forecasts and report back to the owners of the firm. In short, the course teaches you to forecast and manage the cash flow. What Will I Learn? By the end of the course, you will be able to forecast and manage the cash flow Manage personal finances better Requirements You'll need to be prepared to dig out your own bank statements (last 3 months min) so that you can fill in the template No previous accounting or finance knowledge required or assumed Module 01 Introduction FREE 00:03:00 What is Cashflow? 00:08:00 Forecasting FREE 00:10:00 Planning and Management 00:08:00 Planning Part 2 00:12:00 Module 02 Where it can go Wrong 00:09:00 Personal Cashflow Analysis 00:05:00 Personal Cashflow Analysis my Numbers Story 00:06:00 Debt 00:10:00 Conclusion 00:04:00