- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Keep your drivers informed, compliant, and confident behind the wheel. This subscription is designed to improve driver knowledge, reduce risks, and support ongoing transport compliance. Each course tackles real-world challenges with clear, practical guidance drivers can apply immediately. 📲 24/7 online access for 12 months – start anytime, on any device!

Stock Trading Strategies & Analysis

By Imperial Academy

Level 2 & 4 Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 5 CPD Courses | Lifetime Access

This VAT & Tax Accounting course provides you with the scientific information you need to understand and apply VAT and tax accounting principles in the UK. The course covers all aspects of VAT, from understanding the basics to complying with the latest regulations. Students will also learn about tax accounting, including how to prepare tax returns and manage tax liabilities. Learning Outcomes Understand the basics of VAT Calculate VAT Identify VAT-taxable persons Register for VAT Apply VAT rates Invoice and keep records Apply VAT to goods, services, and vehicles Understand the concept of supply Complete a VAT return Comply with VAT regulations Identify VAT exemptions and zero-rated VAT Understand miscellaneous VAT issues and penalties Learn about Making Tax Digital This Bundle Consists of the following Premium courses: Course 01: Introduction to VAT Course 02: Level 3 Tax Accounting Course 03: Commercial Law 2021 Course 04: UK Tax Reforms and HMRC Legislation Course 05: Self-Assessment Tax Return Filing UK Course 06: Companies House Filing UK Course 07: Debt Management - Online Course Course 08: Improve your Financial Intelligence Course 09: Financial Wellness: Managing Personal Cash Flow Course 10: Financial Analysis: Finance Reports Course 11: Banking and Finance Accounting Statements Financial Analysis Course 12: Budgeting and Forecasting Course 13: Financial Analysis Course 14: Fraud Management & Anti Money Laundering Awareness Complete Diploma Enrol now to advance your career, and use the premium study materials from Apex Learning. How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your expertise and essential knowledge, which will assist you in reaching your goal. Curriculum of Bundle Course 01: Introduction to VAT Understanding VAT Terminology and Calculation Taxable Persons Registration Rates Invoicing and Records Application in Goods, Services and Vehicles Supply The VAT Return Tips on VAT Compliance Exemptions and Zero-Rated VAT Miscellaneous VAT Issues and Penalties Making Tax Digital If you are interested in learning more about VAT & Tax Accounting, I encourage you to enroll in this course today. You will gain the knowledge and skills you need to succeed in this field. CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This VAT & Tax Accounting course is perfect for: Business owners who want to understand VAT and how it affects their business Accountants who want to learn more about VAT and tax accounting Students who are interested in a career in VAT and tax accounting Anyone who wants to learn more about VAT and tax accounting Requirements Our VAT & Tax Accounting course is fully compatible with PCs, Macs, laptops, tablets and Smartphone devices. Career path There are many different career paths that you can pursue after completing this course. Here are a few examples: VAT consultant Tax accountant Financial controller Treasury manager Internal auditor Tax lawyer The salary range for these positions varies depending on your experience and qualifications. However, you can expect to earn a good salary in any of these roles. Certificates Certificate of completion Digital certificate - Included You will get the PDF Certificate for the title course (Introduction to VAT) absolutely Free! Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Introduction to VAT) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

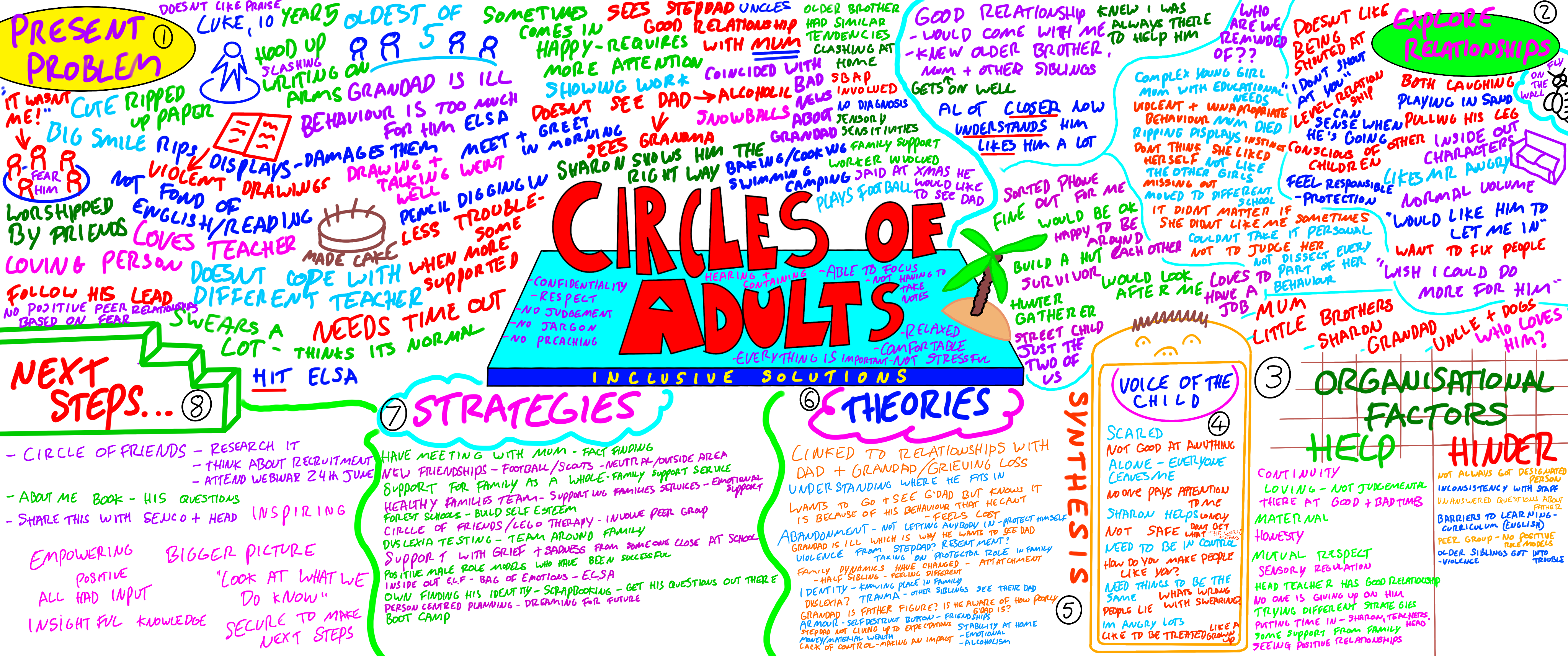

Problem solving in depth - the Circle of Adults process

By Inclusive Solutions

Getting underneath behaviour - and the dangerous long term implications of not processing feelings.

Animal Psychology, Diet and Nutrition & Animal Science

By Imperial Academy

In the UK, over 50% of households have at least one pet, and the pet industry is worth over £7 billion. Up for it?

FinTech : Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses Bundle!

By Compliance Central

Feeling Stuck in Your Career? The FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses Bundle is Your Skill-Building Solution. This exceptional collection of 20 premium courses is designed to encourage growth and improve your career opportunities. Suited to meet different interests and goals, FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle provides an engaging learning experience, helping you learn skills across various disciplines. With The FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses Bundle, you'll have a personalised journey that aligns with your career goals and interests. This comprehensive package helps you confidently tackle new challenges, whether entering a new field or enhancing your existing knowledge. FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle is your gateway to expanding your career options, increasing job demand, and enhancing your skill set. By enrolling in this bundle, you'll receive complimentary PDF certificates for all courses, adding value to your resume at no extra cost. Develop key skills and achieve important progress in your career and personal development. Start your journey today and experience the transformative impact of FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses bundle on your job life and career growth! This FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses Bundle Comprises the Following CPD Accredited Courses: Course 01: Corporate Finance: Working Capital Management Course 02: Financial Analysis Course 03: Financial Modelling for Decision Making and Business plan Course 04: Capital Budgeting & Investment Decision Rules Course 05: Learn the Fundamentals of Financial Accounting Course 06: Financial Consultant Training Course 07: Banking and Finance Accounting Statements Financial Analysis Course 08: UK Tax Accounting Course 09: Finance: Financial Risk Management Course 10: Anti Money Laundering & Countering of Terrorist Financing Course 11: Data Analysis In Excel Course 12: GDPR Course 13: Secure Your Finance by Creating a Robust Financial Plan Course 14: Time Management Course 15: Career Development Plan Fundamentals Course 16: CV Writing and Job Searching Course 17: Learn to Level Up Your Leadership Course 18: Networking Skills for Personal Success Course 19: Ace Your Presentations: Public Speaking Masterclass Course 20: Learn to Make a Fresh Start in Your Life What will make you stand out? Upon completion of this online The FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses Bundle, you will gain the following: CPD QS Accredited Proficiency with this FinTech: Financial Technology, Capital Budgeting & Tax Accounting Bundle After successfully completing FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle, you will receive a FREE PDF Certificate from REED as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials of this FinTech: Financial Technology, Capital Budgeting & Tax Accounting Bundle The online test with immediate results You can study and complete FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle at your own pace. Study for FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle using any internet-connected device, such as a computer, tablet, or mobile device. The FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses bundle is a premier learning resource, with each course module holding respected CPD accreditation, symbolising exceptional quality. The content is packed with knowledge and is regularly updated to ensure it remains relevant. This bundle offers not just education but a constantly improving learning experience designed to enrich both your personal and professional development. Advance the future of learning with the FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle, a comprehensive, complete collection of 20 courses. Each course in FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle has been handpicked by our experts to provide a broad range of learning opportunities. Together, these modules form an important and well-rounded learning experience. Our mission is to deliver high-quality, accessible education for everyone. Whether you are starting your career, switching industries, or enhancing your professional skills, the FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle offers the flexibility and convenience to learn at your own pace. Make the FinTech: Financial Technology, Capital Budgeting & Tax Accounting package your trusted partner in your lifelong learning journey. CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The FinTech: Financial Technology, Capital Budgeting & Tax Accounting - 20 Courses is perfect for: Expand your knowledge and skillset for a fulfilling career with FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle. Become a more valuable professional by earning CPD certification and mastering in-demand skills with FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle. Discover your passion or explore new career options with the diverse learning opportunities in FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle. Learn on your schedule, in the comfort of your home - FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle offers ultimate flexibility for busy individuals. Requirements You are warmly invited to register for this bundle. Please be aware that no formal entry requirements or qualifications are necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path Gain a wide range of skills across various fields, improve your problem-solving capabilities, and keep current with industry trends. Perfect for those aiming for career advancement, exploring a new professional direction, or pursuing personal growth. Begin your journey with FinTech: Financial Technology, Capital Budgeting & Tax Accounting bundle. Certificates CPD Certificates Digital certificate - Included

GCSE Chemistry Online Course (IGCSE)

By CloudLearn

Our Online GCSE Chemistry Course is the international version. This Course provides basic knowledge and understanding of the unifying patterns and themes of chemistry. You will also learn scientific methods which will allow you to form hypotheses and design experiments to test them. The course aims to develop an understanding of the principles of chemistry and then builds on this knowledge looking at the chemistry of the elements, organic chemistry, physical chemistry and chemistry in industry. The same International GCSE qualification you'd get in school or college Unlimited 1:1 support from your Chemistry tutor Fast-track - get the qualification when you need it Study 24/7, 365 on your phone, tablet or laptop You don't need any previous qualifications to study this International GCSE course. This course will teach you the Edexcel International GCSE Chemistry syllabus (4CH1). You'll study 5 units: Principles of Chemistry Chemistry of the elements Organic chemistry Physical chemistry Chemistry in industry For a full breakdown of course content, download the IGCSE Chemistry Brochure. All of your lessons and assessments are available on CloudPort - our Moodle-based learning environment (Moodle VLEs are used by most colleges and universities in the UK). Start with lesson 1 and work through the course in a linear pathway or choose to jump to the section that you need. Your learning is completely flexible and allows you to set your programme of learning around the skills you need. Submit assessments as you work through the course. Get instant results and feedback on activities to track your progress. Use these assessments as learning launchpads, allowing you to focus your time on the topics you need to brush up on. You will have access to all course materials, assessments and tutor support for 12 months from the day of enrolment. Extensions are available for students who wish to study over a longer period. You are not alone! You will be assigned a personal 1:1 tutor on your day of enrolment. Your tutor will remain by your side, throughout your learning journey until you get qualified. All tutors are qualified teachers and subject matter specialists who will ensure you have the correct guidance and support when you need it. As a CloudLearn student you will have unlimited access to tutor support. CloudLearn GCSEs and A-Levels are structured around formative assessments allowing you to test your knowledge as you work towards qualification. Before taking your exam you will submit a mock exam to give you the practise you need before the big day. When ready we arrange your exam. We have agreements with exam centres all over the UK. Our students also take advantage of preferential pricing due to the volume of students we channel to exam centres. As part of your enrolment service package we will make all the arrangements for your final exam. This includes locating a centre and booking the relevant exam/s. Exam fees are additional. Exam fees can be bundled using the Exam Bundles drop down when adding to basket. Have a look on our Exams Page for a detailed explanation of this service. The Edexcel IGCSE Chemistry exam is available in May/June and Oct/Nov each year. It is assessed over 2 exam papers: Paper 1 4CH1/1C - 2 hour exam Paper 2 4CH1/2C - 1 hour exam We generally ask that you book written exams at least 6 months in advance. Booking your exam after the booking deadline will incur late fees (available for one month after deadline) and high late fees (available up until exam entry closure). Some students will study for the exam over a period of months or years, as they dictate their own study schedule. We do however have students who will study intensively and prepare in a matter of weeks. You are only constrained by the exam diet. GCSE exams are available in May/June of each year, with core subjects also assessed in January. We are so confident in the CloudLearn model of study that we guarantee you will pass your exam. As long as you do what we recommend, we offer a full money-back guarantee. The UK's only GCSE and A-Level specialist Study at your pace, where and when you want Study interactively on any device We guarantee your exam pass We arrange your exams Our flexible study, unlimited support, and interest-free payment plans allow you to fit learning around your busy schedule That's why we support thousands of students every year, to get the GCSEs they need to prosper. Choose to pay in full or spread the cost over our 6 months interest-free payment plans. We offer longer payment plans of 12, 24, 36 or 48 months. These extended plans are subject to interest. For more details contact our student advisors on 0330 111 4006 or visit our payment plan page. By joining our Online GCSE Chemistry Course, you will gain invaluable skills that can be applied in any field or occupation. Once you have acquired an understanding of chemical facts, concepts and principles, we will test your critical thinking, problem solving and analytical skills. Additionally, you will develop your experimental and investigative skills through an appreciation of the practical nature of chemistry, whilst learning to be a conscientious and responsible worker by implementing correct and safe laboratory techniques. You will also learn about the significance of open-mindedness and social responsibility in the workplace by understanding the widespread importance of chemistry and how materials are used in the world. Furthermore, you will bolster your organisational and communication skills as you will be tasked with selecting, preparing and presenting information clearly and logically, using appropriate scientific terms and conventions. We also hope to show you the benefits of continuous learning and intellectual curiosity by inspiring a sustained enjoyment of, and interest in, the scientific world. Therefore, the skills that you will acquire during the CloudLearn GCSE Chemistry Course can set you apart from your peers and put you on a path toward further learning or a successful career in a wide-range of professions.

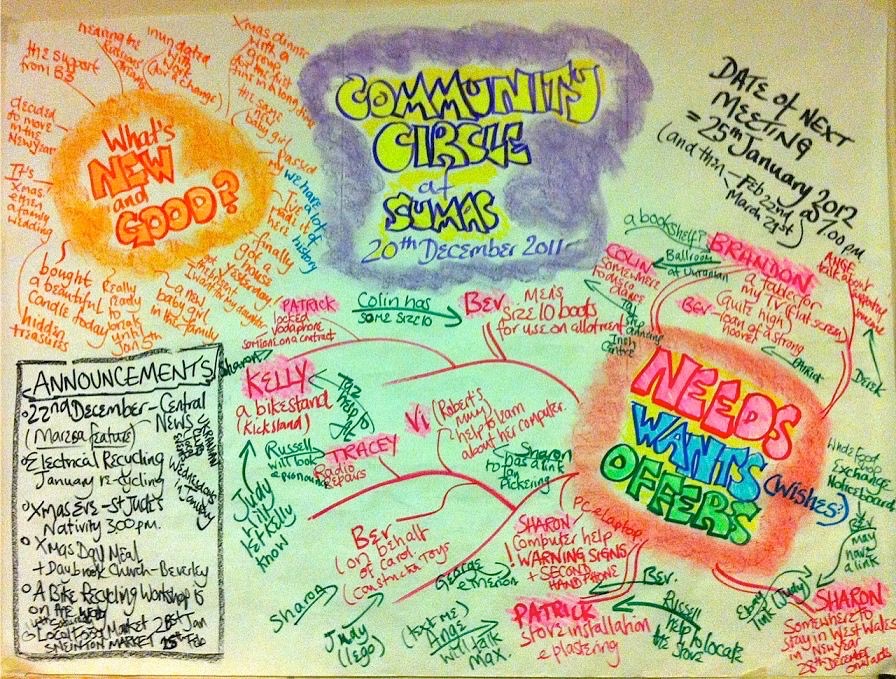

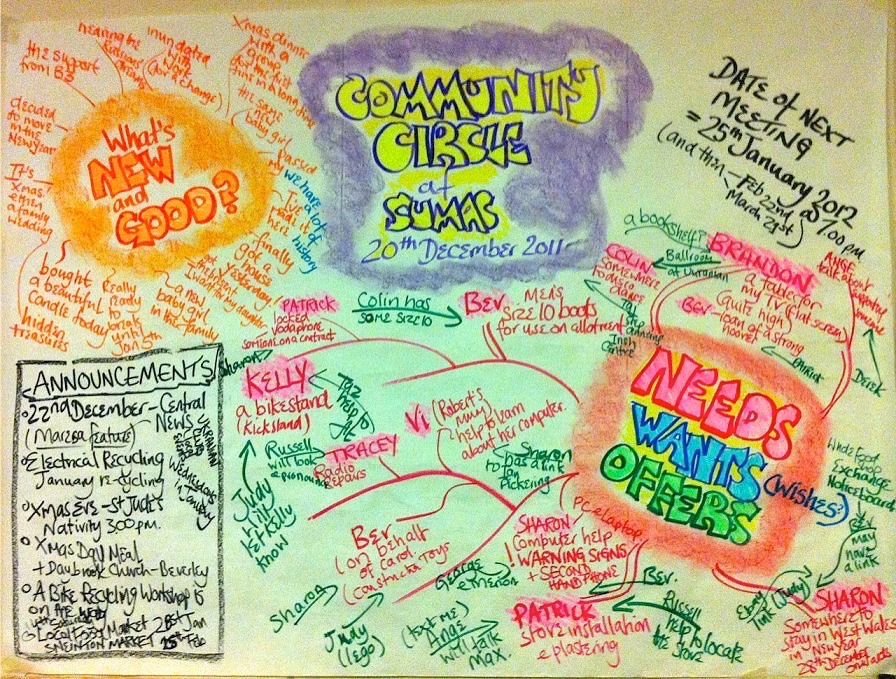

Creating Community Circles - Video training Guide

By Inclusive Solutions

All you need to know to create a Community Circle in 35 minutes!

Creating Community Circles

By Inclusive Solutions

Person Centred Community Building

Family Law and Probate Law

By Imperial Academy

Level 3 & 5 Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 5 CPD Courses | Lifetime Access