- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

144 Courses delivered On Demand

Discover compassionate and effective communication within leadership roles. This involves utilizing communication strategies that prioritize empathy, transparency, and active listening to build trust and understanding among team members. By prioritizing kindness in interactions, acknowledging diverse perspectives, and providing clear and respectful feedback, the goal is to cultivate strong relationships, enhance collaboration, and inspire a shared sense of purpose among team members. Learning Objectives The following are some of the key outcomes in this course: Understand the elements that make effective communication work Identify the top three communication skills for leading with kindness Develop listening skills for kind leaders Practice effective feedback skills Prepare to speak with impact Target Audience Managers, Team Leaders, Young Professionals

In the dynamic realm of business, the power of governance and risk management remains pivotal in steering companies towards excellence. 'Governance and Risk Management: Navigating Corporate Strategies' offers a comprehensive exploration into the fabric of corporate governance, unearthing its structures, mechanisms, and ethical obligations. Delve deeper into the significance of governance in ESG (Environmental, Social, and Governance) and master the intricate art of risk management, grasping its types and the processes involved, all while gaining insights into the realms of compliance and its auditing. Learning Outcomes Understand the foundational concepts of corporate governance and its pivotal role in businesses. Recognise the diverse governance structures and mechanisms at play within organisations. Gain insights into the importance of transparency, disclosure, and the role of ethics. Acquire knowledge about governance's role within ESG contexts. Develop a thorough understanding of risk, its varied types, and its management processes. Why buy this Governance and Risk Management: Navigating Corporate Strategies? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Governance and Risk Management: Navigating Corporate Strategies for? Business leaders aiming to strengthen their governance strategies. Compliance officers seeking to expand their knowledge on corporate ethics and audit processes. Strategy consultants looking to deepen their understanding of risk management. Students of business or corporate law aiming to grasp governance nuances. Professionals keen on incorporating governance and risk strategies into their toolkit. Career path Business Strategy Analyst: £35,000 - £55,000 Compliance Officer: £30,000 - £50,000 Corporate Governance Consultant: £40,000 - £60,000 Risk Management Specialist: £45,000 - £70,000 Compliance Audit Manager: £50,000 - £80,000 Governance and Risk Analyst: £40,000 - £60,000 Prerequisites This Governance and Risk Management: Navigating Corporate Strategies does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Governance and Risk Management: Navigating Corporate Strategies was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 1: Introduction to Corporate Governance Introduction to Corporate Governance 00:20:00 Module 2: Governance Structures and Mechanisms Governance Structures and Mechanisms 00:16:00 Module 3: Transparency, Disclosure, and Ethics Transparency, Disclosure and Ethics 00:16:00 Module 4: Corporate Governance in ESG Corporate Governance in ESG 00:12:00 Module 5: Introduction to Risk Management Introduction to Risk Management 00:10:00 Module 6: Risk and Types of Risk Risk and Types of Risk 00:09:00 Module 7: Risk Management Process Risk Management Process 00:07:00 Module 8: Compliance and Ethics Compliance and Ethics 00:12:00 Module 9: Compliance Audit Compliance Audit 00:13:00

ICA Advanced Certificate in Managing Sanctions Risk

By International Compliance Association

ICA Advanced Certificate in Managing Sanctions Risk Sanctions are a key tool in the armoury of the global fight against financial crime. Understanding sanctions remains a complex yet fascinating topic and is crucial for the development of well-rounded strategy in combating financial crime. The ICA Advanced Certificate in Managing Sanctions Risk explores the intricacies and challenges of meeting sanctions obligations. You will learn about the latest sanctions challenges and best practice and you will review case studies so you understand the risks sanctions present to firms and the frameworks used to manage these risks. The course will also investigate key areas of sanctions controls such as sanctions screening, managing alerts and sanctions evasion typologies. This course will enable you to: Understand latest sanctions challenges Learn sanctions best practice Review case studies, so you understand the risks sanctions present to firms and the frameworks used to manage these risks Investigate key areas of sanctions controls such as sanctions screening, managing alerts and sanctions evasion typologies. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate This course is awarded in association with Alliance Manchester Business School, the University of Manchester. Students who successfully complete the assessment criteria for this course will be awarded the ICA Advanced Certificate in Managing Sanctions Risk and will be able to use designation - (Adv.Cert(Sanctions). What will you learn? Global sanctions architecture - Political, Legal and Implementation context The international context Transparency, control and ownership Developing the control framework Sanctions lifting and roll back Identifying higher risk jurisdictions and activities

Description Charity Accounting Diploma Navigating the financial landscape of charities requires a unique skill set and a deep understanding of specific regulations. Charities operate under a different set of rules than other businesses, and ensuring their financial management is up to par is critical for their success. This is where the Charity Accounting Diploma comes into play. Tailored exclusively for online learning, this comprehensive course seeks to arm students with the knowledge and tools they need to excel in the world of charity accounting. First and foremost, the course begins with an overview of charity accounting. This foundation ensures that all participants start with a clear understanding of the basics. It's essential to grasp the unique nature of charities and how their financial operations differ from other entities. The course then proceeds to unpack the regulatory landscape for charities. With ever-changing rules and guidelines, it's crucial for charity accountants to remain updated. This section demystifies the regulations governing charities, ensuring that they remain compliant and uphold their reputation. A deep exploration into financial management in charities offers insights into best practices and potential pitfalls. With donations, grants, and various funding methods at play, managing a charity's finances can be intricate. This course ensures that learners can navigate these complexities with ease. One of the significant components of the course is understanding charity funds and reserves. Given that charities function largely on donations and grants, knowing how to manage and report on these funds is imperative. Additionally, the role of trustees in charity accounting is another focal point. Their responsibilities and influence on the financial aspect of charities are crucial for any accountant in this field to understand. No financial course would be complete without discussing auditing and assurance. For charities, these elements offer a layer of credibility and trust. This course provides a comprehensive look into the preparation of charity accounts, offering a step-by-step guide to ensure accuracy and compliance. Transparency and accountability hold a special place in charity accounting. The course delves into the importance of these factors, teaching students how to maintain clarity in their accounts and ensuring stakeholders always have a clear view of the charity's financial health. Gift Aid and VAT have unique implications for charities. With specific rules governing these areas, it's vital for charity accountants to know the ins and outs. This course covers these topics in-depth, providing clarity and guidance on how to manage and report on them accurately. Lastly, given the evolving nature of the sector, the course touches on the future of charity accounting. With technology, regulations, and societal changes always on the horizon, being prepared for what's next is paramount. In conclusion, the Charity Accounting Diploma is not just another online course. It's a journey into the world of charity finance, offering insights, tools, and knowledge that are both comprehensive and relevant. Whether you're a seasoned accountant looking to transition into the charity sector or a newcomer wanting to embark on a meaningful career, this course is the gateway to mastering charity accounting. Register today and elevate your skills in the world of charitable financial management. What you will learn 1:An Overview of Charity Accounting 2:The Regulatory Landscape for Charities 3:Financial Management in Charities 4:Understanding Charity Funds and Reserves 5:The Role of Trustees in Charity Accounting 6:Auditing and Assurance for Charities 7:Preparing Charity Accounts: A Step-by-Step Guide 8:Transparency and Accountability in Charity Accounting 9:Gift Aid and VAT in Charity Accounting 10:The Future of Charity Accounting Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

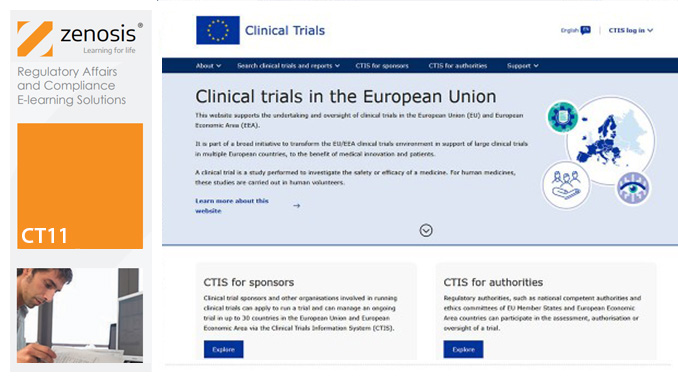

CT11: How to Gain Authorisation for Clinical Research Under the EU Clinical Trials Regulation

By Zenosis

This course sets out the procedures that sponsors need to follow to gain authorisation to conduct clinical trials under the Regulation, and it summarises and links to the extensive guidance available from the European Commission and the European Medicines Agency. Its companion course CT12 sets out the procedures that sponsors need to follow to conduct authorised clinical trials in compliance with the Regulation. The two courses therefore provide an ideal foundation for understanding and complying with the new law.

CT12: How to Conduct Clinical Research Under the EU Clinical Trials Regulation

By Zenosis

This course describes the requirements that must be met by, and options available to, the sponsor during the conduct of an authorised clinical trial. It identifies the various interactions with MSCs that occur via the Clinical Trials Information System (CTIS), and it summarises and links to the extensive guidance available from the European Commission and the European Medicines Agency. Its companion course CT11 sets out the European legal and regulatory context for clinical trials and describes how to apply via the CTIS for authorisation to conduct trials. The two courses therefore provide an ideal foundation for understanding and complying with the new law.

Professional Certificate Course in Recent Blockchain Developments and Benefits for Global Trade Finance in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course on Recent Blockchain Developments and Benefits for Global Trade Finance covers essential topics such as the pivotal role of Trade Trust in ensuring secure and transparent trade finance processes, the intricacies of implementing digital standards, the advantages of blockchain technology, the automation potential of smart contracts, and a detailed analysis of consortium-based models and open networks. Participants will also delve into the features, benefits, and impact of groundbreaking initiatives like Marco Polo and Voltron on trade finance while anticipating future trends and opportunities. After the successful completion of the course, you will be able to learn about the following, Role of Trade Trust in ensuring secure and transparent trade finance processes. Implementation Process and Challenges of Digital Standards. Advantages of Blockchain Technology in Trade Finance. Exploring smart contract's role in automating and streamlining contractual agreements for increased efficiency and reduced errors. Analysis of consortium-based models, platform-as-a-service, and open networks; effects on trade finance operations. Examining features, benefits, and impact of initiatives like Marco Polo and Voltron on trade finance; predicting future trends and opportunities. Participants will gain a profound understanding of how Trade Trust contributes to securing and enhancing transparency in trade finance processes. The course explores the implementation processes and challenges associated with digital standards, providing insights into leveraging blockchain technology's advantages in trade finance. The role of smart contracts in automating contractual agreements for increased efficiency and reduced errors will be examined. Explore the forefront of blockchain innovations in global trade finance, from the secure transparency ensured by Trade Trust to the transformative impact of initiatives like Marco Polo and Voltron. Gain practical insights into implementing digital standards, leveraging smart contracts for efficiency, and navigating the evolving landscape of international trade. Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Recent Blockchain Developments and Benefits for Global Trade Finance Self-paced pre-recorded learning content on this topic. Recent Blockchain Developments and Benefits for Global Trade Finance Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Blockchain Solutions Architect for Trade Finance Trade Finance Blockchain Developer Trade Trust Security Analyst Digital Standards Implementation Specialist Blockchain Integration Consultant for Trade Finance Smart Contract Automation Engineer Consortium-Based Models Analyst Platform-as-a-Service (PaaS) Specialist in Trade Finance Open Networks Strategist for Trade Finance Blockchain Trade Finance Trends and Opportunities Analyst Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Are you someone who is part of the marketing industry? Have you ever heard about network marketing? Are interested in becoming one of the experts in network marketing? If so, then this course will help you achieve your dreams in becoming an expert in network marketing! Description: Network marketing has been growing globally because there are lots of emerging markets and the effective use of the internet. In this course, you will be learning about the basics of network marketing and what steps you should do to become knowledgeable in network marketing. You will learn the basic plan mechanics and utilise this knowledge. Then you will be able to know the concept of point value to cash calculation and the payout transparency. There will be a discussion of the buyback policy and breakaway ideas. Who is the course for? Business owners, entrepreneurs or any professionals who want to improve their network marketing skills and learn how to become the best of it. People who have an interest in becoming part of the network marketing industry Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Diploma in Network Marketing is a useful qualification to possess, and would be beneficial for the following careers: Account Executive Data Marketing Specialist Digital Marketing Manager Marketing Specialist Sales Executive Social Media Manager. Diploma in Network Marketing If You Fail to Plan,You Plan to Fail 00:30:00 Terminology and Jargon You Can't Live Without 00:30:00 Clearing Up Common Misconceptions 01:00:00 Recognizing Basic Plan Mechanics 00:15:00 How Do You Calculate Value On Cash And Point 00:15:00 Payout Transparency 00:15:00 Buy Back Policy 00:30:00 Breakaway 01:00:00 Infinity Bonuses & Blocking 00:30:00 Summary and Closing 00:15:00 Additional Supporting Material Network Marketing 00:00:00 Mock Exam Mock Exam-Diploma in Network Marketing 00:20:00 Final Exam Final Exam-Diploma in Network Marketing 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00