- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Charity Accounting

By Compete High

ð Unlock the Secrets of Effective Charity Accounting! ð Are you passionate about making a difference in the world through charitable work? Do you want to ensure that every dollar donated to your cause is maximized for impact? Look no further! Our Charity Accounting course is designed to equip you with the essential skills and knowledge to navigate the intricate world of financial management within the non-profit sector. ð What You'll Learn: In this comprehensive course, you'll delve into the fundamentals of charity accounting, gaining insights into budgeting, financial reporting, compliance with regulatory standards, and more. We provide a holistic overview of accounting principles tailored specifically to the unique needs and challenges faced by charitable organizations. From understanding the nuances of fund accounting to mastering donor stewardship, we cover it all! ð¡ Benefits of Taking the Course: Optimized Financial Management: Learn how to effectively manage finances within a charitable organization, ensuring transparency and accountability. Maximized Impact: Gain the skills to maximize the impact of every donation by efficiently allocating resources and minimizing overhead costs. Compliance Confidence: Navigate the complex regulatory landscape with confidence, ensuring your organization remains in compliance with legal and financial requirements. Enhanced Donor Relations: Understand the importance of financial transparency in building trust with donors, fostering long-term relationships, and attracting new supporters. Career Advancement: Stand out in the competitive non-profit sector with specialized skills and knowledge in charity accounting, opening up new opportunities for career growth and advancement. ð Who is This For? This course is perfect for: Non-profit Professionals: Whether you're a finance manager, executive director, or program coordinator within a charitable organization, this course will empower you to excel in your role. Aspiring Accountants: If you're considering a career in accounting and have a passion for making a difference, this course provides a valuable introduction to the unique challenges and opportunities within the non-profit sector. Volunteers and Board Members: Gain a deeper understanding of financial management to better fulfill your duties and responsibilities within the board of directors or as a volunteer for a charitable organization. ð Career Path: Upon completing the Charity Accounting course, you'll be equipped with the skills and knowledge to pursue various rewarding career paths within the non-profit sector, including: Financial Manager: Oversee the financial operations of a charitable organization, ensuring fiscal responsibility and transparency. Grant Writer: Utilize your understanding of charity accounting to effectively communicate financial information in grant proposals, securing funding for important projects and initiatives. Fundraising Manager: Develop strategic fundraising campaigns informed by your expertise in financial management, maximizing donor contributions and impact. Non-profit Consultant: Offer your specialized knowledge in charity accounting to advise and support a diverse range of non-profit organizations in optimizing their financial practices. Don't miss out on this opportunity to elevate your skills and make a meaningful impact in the world of charitable accounting! Enroll today and take the first step towards unlocking your full potential in the non-profit sector. ð FAQ (Frequently Asked Questions) - Charity Accounting Q1: What is Charity Accounting? Charity accounting refers to the specialized financial reporting and management practices used by charitable organizations to track and report their financial activities. It involves maintaining accurate records of income, expenses, assets, and liabilities, adhering to regulatory requirements, and ensuring transparency in financial reporting. Charity accounting aims to provide stakeholders, including donors, beneficiaries, and regulatory bodies, with a clear understanding of how funds are raised, managed, and utilized to support the organization's charitable objectives. Q2: Why is Charity Accounting Important? Charity accounting is essential for several reasons. Firstly, it helps ensure accountability and transparency, which are critical for maintaining the trust of donors and the public. Accurate financial reporting also enables charitable organizations to demonstrate their impact and effectiveness in achieving their mission and objectives. Moreover, complying with accounting standards and regulatory requirements ensures legal compliance and helps prevent financial mismanagement or fraud. Q3: What are the Key Differences Between Charity Accounting and Regular Accounting? While charity accounting shares many similarities with regular accounting practices, there are some key differences. One significant distinction is the emphasis on accountability to donors and the public in charity accounting. Charitable organizations often face stricter reporting requirements and scrutiny due to their tax-exempt status and reliance on public trust. Additionally, charity accounting may involve tracking donations, grants, and restricted funds separately to ensure proper allocation and compliance with donor intentions. Q4: What are the Challenges Associated with Charity Accounting? Charity accounting can present various challenges, including managing complex funding streams, complying with evolving regulatory frameworks, and accurately valuing non-cash donations or volunteer services. Additionally, charitable organizations may struggle with limited financial resources and expertise, making it challenging to implement robust accounting systems and practices. Furthermore, maintaining transparency while protecting sensitive donor information can be a delicate balance for charities. Q5: How Can Charities Improve Their Accounting Practices? Charities can improve their accounting practices by investing in staff training, implementing robust financial management systems, and seeking professional advice when needed. It's essential to stay informed about changes in accounting standards and regulatory requirements and to conduct regular audits to ensure compliance and identify areas for improvement. Collaborating with other charities or seeking mentorship from experienced financial professionals can also provide valuable insights and support in enhancing accounting practices. Ultimately, prioritizing transparency, accuracy, and accountability is key to effective charity accounting. Course Curriculum Module 1- The Charity Accounting Concept The Charity Accounting Concept 00:00 Module 2 Accounting Principles Standards Policies and Concepts Accounting Principles Standards Policies and Concepts 00:00 Module 3- Fund Accounting Fund Accounting 00:00 Module 4- Reporting and Accounts for Charities Reporting and Accounts for Charities 00:00

Charity Accounting and Financial Management Mini Bundle

By Compete High

Learn charity-focused accounting, finance, and problem-solving to strengthen your management and analysis skills online. Charity finance is a delicate balance of stewardship, accuracy, and calm problem-solving under pressure. This mini bundle brings together essential topics—accounting, financial analysis, business analysis, business management, and structured problem solving—all focused on the not-for-profit context. Whether you're overseeing budgets or handling funding reports, this bundle supports your role with clarity and purpose. It's ideal for those involved in running, supporting, or reporting within charitable organisations. From planning costs to responding to financial puzzles with a level head, this is where spreadsheet meets strategy—without any need for complicated jargon or beige PowerPoint slides. Learning Outcomes: Understand accounting principles for charity-related finance roles. Analyse financial data to support planning and decision-making. Evaluate charity business activities through structured analysis. Interpret financial reports in a management-led context. Identify and respond to financial and operational issues. Apply structured approaches to charity-focused problem solving. Who Is This Course For: Charity finance officers handling budgeting and expenditure. Admin staff supporting financial reporting within charities. Charity managers overseeing funding and financial planning. Support workers assisting with operational decision-making. Grant officers reviewing costs and funding allocations. Entry-level accountants within charitable organisations. Trustees or board members reviewing charity performance. Fund programme staff handling budgeting-related queries. Career Path (UK Average Salaries): Charity Accountant – £36,000 per year Financial Analyst (Charity) – £37,000 per year Business Analyst (Non-profit) – £38,000 per year Budget Officer – £32,000 per year Operations Coordinator (Charity) – £30,500 per year Programme Finance Officer – £34,000 per year

AML, KYC, UK Compliance, CRM, Employment Law Training

By Compliance Central

In today's business environment, where regulatory compliance, effective customer relationship management, and adherence to employment laws are critical, our comprehensive training bundle is designed to empower professionals to excel in these crucial areas. This suite of courses includes a Diploma in Anti-Money Laundering (AML), training in Know Your Customer (KYC) protocols, UK-specific compliance, Customer Relationship Management (CRM), and Employment Law, providing a robust foundation for those looking to enhance their organisational integrity and operational efficiency. Stand out in the job market by completing the AML Training course. Get an accredited certificate and add it to your resume to impress your employers. 05 CPD Accredited Courses are: Course 01: Diploma in Anti-Money Laundering (AML) Course 02: KYC Course 03: Compliance UK Course 04: CRM - Customer Relationship Management Course 05: Employment Law Our AML, KYC, UK Compliance, CRM, and Employment Law Training course starts with the basics of AML Training and gradually progresses towards advanced topics. Therefore, each lesson of this AML Training is intuitive and easy to understand. Key Highlights of the AML Course: Lifetime Access to all AML Learning Resources An Interactive, Online AML Course Created By Experts in the AML Field Self-Paced and 24/7 Learning Support Free Certificate After AML Course Completion Diploma in Anti-Money Laundering (AML): The Diploma in Anti-Money Laundering (AML) equips professionals with essential skills to detect and prevent financial crimes, ensure compliance with regulations, and safeguard organizational integrity. KYC (Know Your Customer): The KYC (Know Your Customer) course enhances customer verification processes, mitigating fraud risks and building trust with clients, which are vital for regulatory compliance and protecting businesses from penalties. Compliance UK: Compliance UK provides an overview of regulatory standards, ensuring businesses operate within legal boundaries to avoid penalties and maintain regulatory compliance. CRM - Customer Relationship Management: CRM focuses on enhancing customer interactions and loyalty, driving business growth through personalised experiences and effective relationship management strategies. Employment Law: The Employment Law course covers essential legal aspects of managing a workforce, ensuring businesses create a fair and compliant work environment, and mitigating legal risks. ***AML - Anti Money Laundering Course Curriculum***: Module 01: Introduction to AML Module 02: Proceeds of Crime Act 2002 Module 03: Development of AML Regulation Module 04: Responsibility of the AML Reporting Officer Module 05: AML Risk-based Approach Module 06: Customer Due Diligence Module 07: AML Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: AML Awareness and Training Quality Licence Scheme Endorsed Certificate of Achievement: Upon completing the AML course, you can order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Diploma in Anti Money Laundering (AML) at QLS Level 5'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £109 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The AML course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in AML. It is also great for professionals who are already working in AML and want to get promoted at work. Money Laundering Reporting Officer AML Analysts AML Officer Risk & Compliance Analyst Compliance Manager Requirements To enrol in this AML course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this AML training course, you may explore trendy and in-demand jobs related to this course. Such as: Compliance Officer - £30,000-£50,000/year. Risk Manager - £35,000-£60,000/year. Financial Investigator - £35,000-£60,000/year. Fraud Investigator - £30,000-£50,000/year. Corporate Finance Analyst - £40,000-£70,000/year. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - £9.99 Each hardcopy Certificate is available for £9.99. P.S. For each hardcopy certificate the delivery charge inside the UK is £3.99 and for international students it is £9.99.

Sage 50 Accounting

By IOMH - Institute of Mental Health

Overview of Sage 50 Accounting Sage 50 Accounting is the perfect course for anyone looking to master the art of bookkeeping and accounting. With over 6.1 million users globally, it's no secret that Sage 50 is a market leader. In fact, 96% of Sage 50 Accounts users have reported increased productivity and accuracy in their financial records. This comprehensive course covers everything you need to know about bookkeeping, from creating invoices and managing bank accounts to preparing financial reports and analysing business performance. With step-by-step tutorials and expertly designed Sage 50 Accounting course materials, you'll develop the skills you need to succeed in your financial career. So if you're looking to take your career to the next level, don't wait any longer. Enrol in Sage 50 Accounting course today and start building your financial expertise! With our 100% satisfaction guarantee, you have nothing to lose and everything to gain. Start your journey toward financial success today. Enrol right now! Get a quick look at the course content: This Sage 50 Accounting Course will help you to learn: Master bookkeeping concepts and techniques Gain experience with Sage 50 Accounting software Learn to manage invoices, bank accounts, and financial reports Develop skills in analysing business performance Learn how to prepare accurate financial records Increase productivity and accuracy in financial tasks Enhance career opportunities in the financial industry. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Sage 50 Accounting. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Sage 50 Accounting course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Sage 50 Accounting is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. The course is ideal for: Entrepreneurs and small business owners Bookkeepers and accountants Aspiring financial professionals Individuals seeking to improve their financial skills Employees in finance and accounting departments Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Sage 50 Accounting course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career path The Sage 50 Accounts course can prepare individuals for a variety of job titles, including: Bookkeeper Accountant Financial Manager Financial Analyst Business Accountant Financial Advisor Tax Specialist Payroll Manager These career opportunities can provide you with a salary ranging from £20,000 to £65,000 in the UK. Course Curriculum Sage 50 Accounts Sage 50 Bookkeeper - Coursebook 00:00:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:11:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:31:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:14:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:09:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00

Professional Certificate in Understanding Potential Investment Decisions and Global Strategies in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The course explores investment decision prerequisites in a globalised economy. The learner will be equipped to make sound investment decisions based on the tools and strategies discussed in this course. After the successful completion of this lecture, you will be able to understand the following: Understanding investment & motives of investment. Understanding the money market, its functions, and its instruments. Understanding investment appraisal and techniques. Understanding global financial management and its objectives. The concept of capital investment, types, and impact of investment appraisal on global financing. Global business activities. Global financial investment strategies. Aspects of global strategy development. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Understanding Potential Investment Decisions & Global Strategies Quiz: Understanding Potential Investment Decisions & Global Strategies Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the knowledge of the learner in the field. This certificate is for everyone eager to know more and gets updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Finance Manager Investment Manager Financial Analyst Stock Broker Operations Manager Team Lead Average Completion Time 2 Weeks Accreditation 1 CPD Hour Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Description Carbon Finance Diploma Introducing the Carbon Finance Diploma, a comprehensive online course designed for those keen to master the intricacies of carbon finance and its growing significance in today's world. This diploma not only familiarises you with the foundational knowledge in carbon finance but also offers insight into its application and implications in various sectors. The Carbon Finance Diploma kicks off with a module dedicated to 'Understanding Carbon Finance'. This serves as a foundation, giving learners a solid grounding on the basic principles and the core concepts. As the world becomes more environmentally conscious, carbon finance has become a pivotal aspect of global economics and business strategies. This course ensures that students gain a holistic understanding of the subject. A key component of the diploma is 'The Economics of Carbon'. Here, learners will gain insight into the economic factors and drivers that influence carbon pricing and its broader economic impacts. With the pressing need to combat climate change, understanding the economic nuances of carbon is essential for both policymakers and business leaders. Trading is a significant part of carbon finance. Hence, the course offers a dedicated section on 'Carbon Markets and Trading'. This module unravels the dynamics of carbon markets, including the buying, selling, and trading of carbon credits. It provides learners with the tools to navigate these markets effectively. No study of carbon finance would be complete without exploring the 'Financial Instruments in Carbon Finance'. This section delves into the various instruments available in the market, from carbon credits to bonds and other financial tools. It's a deep exploration of how finance professionals can harness these instruments for both profitability and sustainability. The Carbon Finance Diploma also stresses the 'Role of Governments and Policies'. Governments worldwide play a crucial role in shaping the carbon finance landscape through regulations, incentives, and policies. By understanding governmental roles, one can anticipate shifts in the carbon market and strategise accordingly. Corporate involvement in carbon finance is growing exponentially. Therefore, the module on 'Carbon Finance in the Corporate World' is integral to this diploma. It outlines how corporations are adapting and integrating carbon finance strategies, ensuring their operations are both profitable and sustainable. In a rapidly evolving field like carbon finance, staying updated with 'Innovative Solutions and Technologies' is crucial. This segment of the course introduces learners to the latest technological advancements and innovative strategies that are shaping the future of carbon finance. Taking a broader look, the 'Global Perspectives on Carbon Finance' section offers students a view of how different nations and regions approach carbon finance. It emphasises the global interconnectedness of carbon markets and the importance of international collaboration. The 'Social Implications of Carbon Finance' is a thought-provoking segment, stressing the broader societal impacts of carbon finance strategies. From community engagements to broader societal shifts, this module paints a picture of the social transformations propelled by carbon finance. Finally, the Carbon Finance Diploma concludes with 'The Road Ahead for Carbon Finance'. This forward-looking module provides insights into the future trajectories of carbon finance, preparing learners to stay ahead of the curve. In summary, the Carbon Finance Diploma is a meticulously crafted online course tailored for both beginners and seasoned professionals. It offers a thorough understanding of the subject, ensuring learners are well-equipped to navigate the complex and ever-evolving world of carbon finance. Enrolling in this course is a step towards becoming a part of the solution to one of the world's most pressing challenges. What you will learn 1:Understanding Carbon Finance 2:The Economics of Carbon 3:Carbon Markets and Trading 4:Financial Instruments in Carbon Finance 5:The Role of Governments and Policies 6:Carbon Finance in the Corporate World 7:Innovative Solutions and Technologies 8:Global Perspectives on Carbon Finance 9:The Social Implications of Carbon Finance 10:The Road Ahead for Carbon Finance Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Legal Secretary Level 3 Diploma (Paralegal) As the legal industry continues to evolve and expand, the demand for skilled paralegals has never been greater. That's why it's crucial to invest in your professional development and stay up-to-date with the latest trends and regulations. Our Paralegal Training bundle is the perfect solution for anyone looking to enhance their knowledge and skills in this dynamic field. With 15 CPD-certified courses, you'll gain a comprehensive understanding of the legal industry and its many complexities. Each course is designed to equip you with the knowledge and expertise necessary to succeed in the ever-changing legal landscape. From employment law to data protection and document control to financial investigation, this bundle covers all the bases. But it's not just about acquiring theoretical knowledge - it's about putting that knowledge into practice. That's why our courses are designed in such a way that allows you to apply your newfound knowledge to real-life scenarios. Investing in your professional development is not only beneficial for your career but for your personal growth as well. By expanding your skillset and broadening your horizons, you'll become a more well-rounded and knowledgeable individual. Plus, with a hardcopy and PDF certificate, along with a SID worth £180, you'll have tangible proof of your achievements. So why wait? Invest in your future today with our Paralegal Training bundle and take the first step towards becoming a skilled and successful paralegal. Learning Outcomes of Paralegal Diploma (Legal Secretary): Upon completion of the Legal Secretary Level 3 Diploma (Paralegal) bundle, you will be able to: Gain a comprehensive understanding of the legal industry and its complexities Develop expertise in various areas of law, including employment law and data protection Acquire skills in document control, financial investigation, and fraud management Learn about workplace safety and confidentiality Master leadership and management skills Enhance critical thinking and decision-making abilities Gain knowledge of positive psychology and its application in the workplace This Paralegal Courses Bundle Consists of the following Premium courses: Course 01: Paralegal Course 02: Legal Secretary Course 03: Compliance Training Level 2 Course 04: Employment Law Level 3 Course 05: Contract Manager Diploma Course 06: Workplace Confidentiality Course 07: Document Control Course 08: GDPR Data Protection Level 5 Course 09: Financial Investigator Course 10: Fraud Management & Anti Money Laundering Awareness Complete Diploma Course 11: Security Management Advanced Diploma Course 12: Leadership & Management Diploma Course 13: Decision Making and Critical Thinking Course 14: Workplace Safety Course Course 15: Positive Psychology Masterclass Benefits you'll get choosing Apex Learning: One payment, but lifetime access to 14 CPD courses of this Legal Secretary Level 3 Diploma (Paralegal) Bundle Certificates, student ID for the title course included with this Legal Secretary Level 3 Diploma (Paralegal) bundle Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative of Legal Secretary Level 3 Diploma (Paralegal) bundle designed by expert instructors Learn at your ease - anytime, from anywhere Study the course from your computer, tablet or mobile device CPD accredited Legal Secretary Level 3 Diploma (Paralegal) - improve the chance of gaining professional skills Legal Secretary Level 3 Diploma (Paralegal) Curriculum of Legal Secretary Level 3 Diploma (Paralegal) Bundle Course 01: Paralegal Understanding the Concept Key Legal Terminology Effective Communication Skills The Legal Workplace & Professionals Law & Legal Systems Contract & Business Law Property Law Wills, Probate, Estate Law Criminal Law Common Paralegal Legal Matters Human Rights Conflict and Conflict Resolution Professional Conduct and Ethics of Paralegals Mandatory Knowledge Fields and Survival Tips for Paralegals Course 02: Legal Secretary Introduction to Legal Secretary Role of Legal Secretaries General Duties and Day-to-Day Operations of a Legal Secretary Record Keeping Legal Writing Skills & Proofreading Research Skills You Need to Know Transcription, Editing & Correspondence to Judges Legal System of UK UK Court System Meeting Management & Minute Taking Other Secretarial Roles and Responsibilities Customer Service Role Telephone Etiquette Organizing Work Using MS Word Proof Reading CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Legal Secretary Level 3 Diploma (Paralegal) Anyone from any background can enrol in this Legal Secretary Level 3 Diploma (Paralegal) bundle. Requirements Legal Secretary Level 3 Diploma (Paralegal) This Legal Secretary Level 3 Diploma (Paralegal) course has been designed to be fully compatible with tablets and smartphones. Career path Legal Secretary Level 3 Diploma (Paralegal) Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

PVOL206: Solar Training - Solar Business and Technical Sales - Online

By Solar Energy International (SEI)

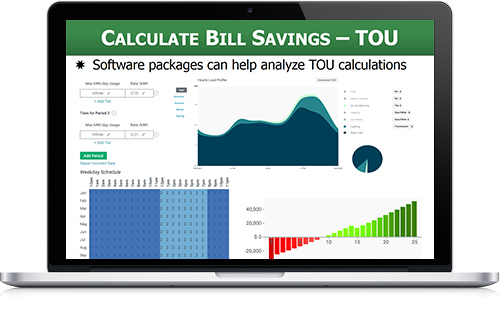

Students who complete PVOL206 will be able to: Discuss the basics of policy and its effect on the solar industry Identify resources to learn more about policy and keep up to date with new developments Describe general sales tips Discuss common objections Identify techniques to close a sale Identify customer motivations and needs Discuss project timeline with customer Manage customer expectations and advise about PV system limitations Discuss manufactures, installation, and roof warranties Explain expected system performance Identify jurisdictional issues (zoning, fire marshal regulations) and city, county, and utility requirements Understand electric bill terminology, key information, and billing procedures Recognize any variations in energy use Determine property type, house orientation, roof tilt/angle, and available area Identify any shading and evaluate obstructions Estimate array size based on customer budget, kWh consumption, and / or available roof area Price array size based on average $/watt Develop price range, savings estimate, and preliminary economic analysis Present (verbal / brief) initial ballpark proposal and benefits, discuss customer's budget limits Identify overall customer considerations and general safety requirements Define the electrical meter and main service panel information required Identify point of interconnection, location for electrical equipment, and location for conduit runs Describe factors to consider with data monitoring Determine maximum PV capacity that can be connected to a specific service and/or electrical panel Create a final array layout Accurately estimate PV system production Define metrics to evaluate labor and material costs Calculate an average residential system cost & identify the major contributing factors Identify the main benefits of reviewing actual build data (job costing) Define property tax exemptions, tax deductions, transfer credits, sales tax exemptions Explain performance based-initiatives Evaluate taxability of credits and other incentives Review net-metering and feed-in tariff laws Identify different utility financial structures and regulated and deregulated markets Describe demand charges & the duck curve Outline financing basics Explore ownership models Calculate annual and cumulative cash flow, determine payback Calculate the environmental benefits of installing solar Identify what to include in a proposal, the proposal process, and what tools are available to generate proposals

ICA Advanced Certificate in Practical Customer Due Diligence (CDD)

By International Compliance Association

ICA Advanced Certificate in Practical Customer Due Diligence (CDD) Course The CDD training course covers best practice in dealing with Customer Due Diligence and working with CDD documentation. Adequate due diligence on new and existing customers has never been so instrumental to protecting a business from reputational, operational, legals and financial risks. Designed for KYC Analysts and professionals working with the CDD process, this course provides a practical qualification in CDD that will help you make clear and informed CDD judgements. In doing so, this course will also improve your ability to identify areas of potential risk for your firm in relation to Customer Due Diligence. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Students who successfully complete the course will be awarded the ICA Advanced Certificate in Practical Customer Due Diligence and will be entitled to use the designation- Adv.Cert(CDD) This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. This three workshop training programme will use CDD documents and hands-on learning to cover the following topics: Outcomes and success criteria of KYC Identification and verification Understanding the customer Understanding the relationship Beneficial ownership Understanding the control structure of the entity Customer screening Risk acceptance Enhanced due diligence How will you be assessed? Three hour examination which comprises multiple choice questions and short form written response questions (including a section where you will be provided with a set of CDD documentation and asked to assess the information/respond to questions based upon them.) Pre-reading/exercises/tasks to be completed in advance of virtual workshops, delivered via the online learning platform. Four compulsory virtual classrooms covering key areas and embedding them through discussions and practical exercises (workshops are compulsory as part of the exam is based on the case study used in the workshops). The innovative workshop exercises that use mock CDD documents, genuinely reflecting the practical issues encountered in the CDD environment.