- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

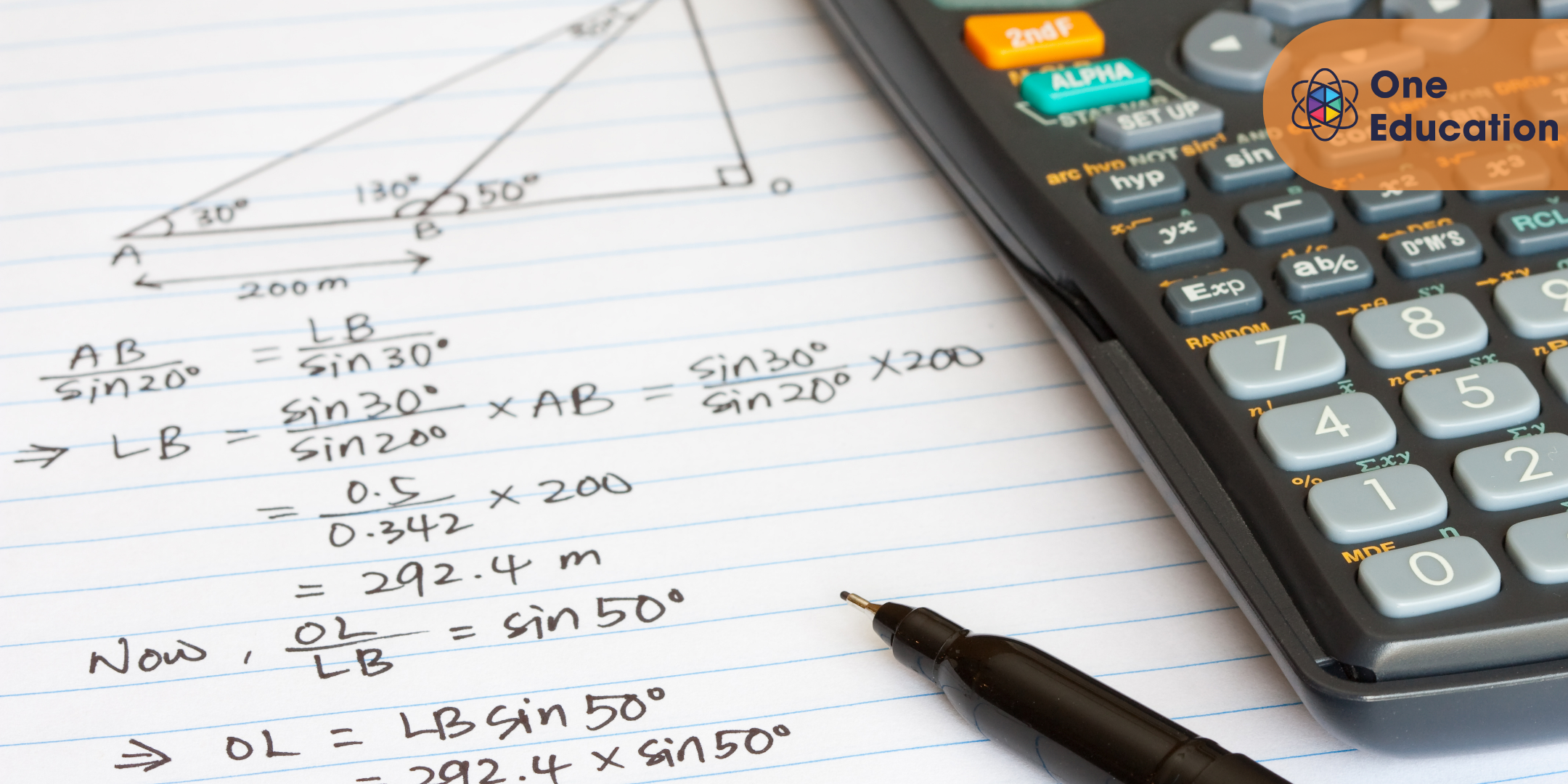

Mathematics Fundamentals - Percentages Course

By One Education

Percentages play a silent yet powerful role in our everyday decisions—whether it’s sorting out discounts, understanding interest rates, or figuring out proportions. The Mathematics Fundamentals - Percentages Course is tailored to help learners grasp the core principles of percentages without any complicated jargon or overwhelming equations. Clear, engaging, and neatly structured, this course takes the mystery out of percentage calculations and turns confusion into confidence. Designed for learners of all levels, this course breaks down the essentials into bite-sized, logical steps—making each concept stick with ease. Whether you're brushing up for exams, sharpening your skills for work, or just trying to finally make sense of supermarket sales, you’ll find this course refreshingly clear. From calculating increase and decrease to working through percentage change and reverse percentages, everything you need is right here—well explained and easy to follow. Learning Outcomes: Develop a foundational understanding of percentages and their applications in math Learn how to calculate percentages of numbers, increase or decrease numbers by percentages, and calculate compound interest Gain confidence in solving percentage problems and applying mathematical concepts Expand your understanding of practical applications of percentages in real-world scenarios Prepare for more advanced math courses or exams that involve percentages The Mathematics Fundamentals - Percentages course is designed to provide learners with a comprehensive understanding of percentages and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve percentage problems. Upon completing this course, learners will have a solid foundation in percentages and be prepared for more advanced math courses or exams. With a focus on developing practical skills in calculating percentages, increasing or decreasing numbers by percentages, and calculating compound interest, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Percentages Course Curriculum Introduction Introduction Percentages Lesson 1 - Finding 10% by dividing by 10 Lesson 2 - Dividing by 10 with numbers that don't end in a zero Lesson 3 - Dividing decimals by 10 Lesson 4 - Dividing by 10 with decimals less than 10 Lesson 5 - Dividing by 10 with whole numbers less than 10 Lesson 6 - Dividing pennies by 10 Lesson 7 - Finding 20% of a number Lesson 8 - Practise finding 20% of a number Lesson 9 - Finding 5% of a number Lesson 10 - Practise finding 5% of a number Lesson 11 - Finding 1% of a number Lesson 12 - Practise finding 1% of a number Lesson 13 - Finding 2% of a number Lesson 14 - Finding 50% of a number Lesson 15 - Practise finding 50% of a number Lesson 16 - Finding 25% of a number Lesson 17 - Finding any percentage of any number Lesson 18 - Ways to find different percentages Lesson 19 - Practise finding any percentage of any number Lesson 20 - Practise finding any percentage of any number Lesson 21 - Using a calculator Lesson 22 - Practise using a calculator to find percentages of numbers Lesson 23 - Let's practise Lesson 24 - Let's practise Lesson 25 - Let's practise Lesson 26 - Let's practise Lesson 27 - Let's practise Lesson 28 - Let's practise Lesson 29 - Let's practise Lesson 30 - Let's practise Lesson 31 - Let's practise Lesson 32 - Let's practise Lesson 33 - Increasing a number by a percentage Lesson 34 - Increasing a number by a percentage Lesson 35 - Increasing a number by a percentage Lesson 36 - Increasing a number by a percentage on a calculator Lesson 37 - Increasing a number by a percentage on a calculator Lesson 38 - Increasing a number by a percentage on a calculator Lesson 39 - Decreasing a number by a percentage Lesson 40 - Decreasing a number by a percentage Lesson 41 - Decreasing a number by a percentage Lesson 42 - Decreasing a number by a percentage on a calculator Lesson 43 - Decreasing a number by a percentage on a calculator Lesson 44 - Simple interest and compound interest Lesson 45 - Simple interest and compound interest Lesson 46 - Compound interest formula Lesson 47 - Interest questions Lesson 48 - Interest questions Lesson 49 - Reverse percentages Lesson 50 - Reverse percentages Lesson 51 - Reverse percentages How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with percentages in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of percentages and their applications in math Students preparing for math exams or courses that involve percentages Career path Accountant Financial analyst Statistician Data analyst Economist £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

This course aims to prepare individuals for the AWS Certified Solutions Architect Associate exam. It covers essential AWS services, cloud architecture design, deployment strategies, and best practices for managing various AWS components. Learning Outcomes: Understand the fundamental concepts of AWS Cloud Services and their application in real-world scenarios. Design and implement AWS Storage and Virtual Private Cloud (VPC) solutions. Learn how to design, implement, and manage Compute Services effectively. Master Identity and Access Management (IAM) and its best practices for secure access control. Explore Auto Scaling Solutions and Virtual Network Services to optimize AWS infrastructure. Gain proficiency in deploying applications and databases on AWS. Discover additional AWS services and their integration for comprehensive cloud solutions. Develop insights into achieving operational excellence with AWS services. Why buy this AWS Certified Solutions Architect Associate Preparation? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the AWS Certified Solutions Architect Associate Preparation there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This AWS Certified Solutions Architect Associate Preparation course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This AWS Certified Solutions Architect Associate Preparation does not require you to have any prior qualifications or experience. You can just enrol and start learning.This AWS Certified Solutions Architect Associate Preparation was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This AWS Certified Solutions Architect Associate Preparation is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Introduction Introduction 00:03:00 Section 02: Exam Tips and Tricks What is AWS? 00:02:00 Why use AWS? 00:03:00 How to Get Started with AWS 00:04:00 AWS Certifications 00:04:00 Preparation Resources 00:02:00 Benefits of Certification 00:02:00 AWS CSA-A Overview 00:04:00 What's New on the 2020 Updated Exam? 00:03:00 AWS CSA-A Exam Objectives 00:06:00 The Four Key Areas (Compute, Networking, Storage, and Databases) 00:04:00 Master the Knowledge Areas 00:02:00 Use the System 00:05:00 Take Notes 00:03:00 Be Mentally and Physically Prepared 00:04:00 Take the Exam 00:04:00 Section 03: AWS Cloud Services Overview Cloud Computing Defined 00:08:00 Benefits of Cloud Computing 00:10:00 Cloud Computing Models 00:07:00 History 00:07:00 Platform 00:06:00 Services, Part 1 00:10:00 Services, Part 2 00:08:00 Security and Compliance 00:07:00 Regions and Availability 00:06:00 Section 04: AWS Storage Design Storage Services 00:07:00 S3 Storage Class 00:07:00 S3 Terminology 00:09:00 S3 Advanced Features 00:08:00 Creating S3 Buckets Lab 00:08:00 S3 Bucket Properties 00:08:00 S3 Managing Objects Lab 00:11:00 Glacier 00:07:00 Setting up a Glacier Vault Lab 00:08:00 S3 and Tape Gateway 00:06:00 S3 Enhanced Features 00:08:00 Elastic Block Store (EBS) 00:08:00 Creating EBS Volumes Lab 00:07:00 Elastic File System (EFS) 00:07:00 Creating an EFS File System Lab 00:07:00 EFS and PrivateLink 00:03:00 Intro to Amazon FSx 00:06:00 Hands-on with FSx 00:06:00 Integrating on-Premises Storage 00:07:00 Storage Access Security Lab 00:10:00 Storage Performance 00:08:00 Section 05: Virtual Private Cloud (VPC) Virtual Private Cloud (VPC) Overview 00:10:00 Creating a VPC Lab 00:11:00 Configuring DHCP Options Lab 00:04:00 Elastic IP Addresses 00:07:00 Elastic Network Interfaces (ENIs) 00:05:00 Endpoints 00:07:00 VPC Peering 00:08:00 Creating a VPC Peering Connection Lab 00:10:00 Security Groups Overview 00:07:00 Network Address Translation (NAT) 00:11:00 Gateways (VPGs and CGWs) 00:08:00 VPN Configuration Option 00:04:00 Section 06: Compute Services Design EC2 Overview 00:11:00 EC2 Instance Types 00:11:00 EC2 Pricing 00:13:00 EBS and EC2 00:05:00 Section 07: Compute Services Implementation Launching an EC2 Linux Instance Lab 00:13:00 Configuring an EC2 Linux Instance Lab 00:08:00 Setting up an EC2 Windows Instance Lab 00:12:00 Shared Tenancy 00:05:00 Dedicated Hosts 00:08:00 Dedicated Instances 00:06:00 AMI Virtualization 00:12:00 Section 08: Compute Services Management Instance Management 00:09:00 Connecting to Instances Lab 00:09:00 Working with Security Groups 00:10:00 Working with Security Groups Lab 00:10:00 Advanced EC2 Management 00:06:00 AWS Batch 00:06:00 Elastic Container Service (ECS) 00:08:00 Elastic Beanstalk Environment 00:11:00 Section 09: Identity and Access Management (IAM) Identity and Access Management (IAM) Overview 00:07:00 Principals 00:10:00 Root User 00:06:00 Authentication 00:06:00 Authorization Policies 00:13:00 Multi-Factor Authentication 00:08:00 Key Rotation 00:10:00 Multiple Permissions 00:06:00 AWS Compliance Program 00:07:00 AWS Security Hub 00:06:00 Shared Responsibility Models 00:06:00 Section 10: IAM Best Practices User Accounts 00:11:00 Password Policies 00:09:00 Credential Rotation 00:06:00 Principle of Least Privilege 00:05:00 IAM Roles 00:08:00 Policy Conditions 00:08:00 CloudTrail 00:12:00 Section 11: Auto Scaling Solutions Auto Scaling Overview 00:06:00 Auto Scaling Groups 00:04:00 Termination Policies 00:07:00 Auto Scaling Configuration Lab 00:13:00 Launch Methods 00:04:00 Load Balancer Concepts 00:08:00 Elastic Load Balancing (ELB) 00:10:00 Section 12: Virtual Network Services DNS 00:14:00 Configuring DNS Lab 00:07:00 Configuring Route 53 Lab 00:13:00 Configuring ACLs and NACLs Lab 00:09:00 Flow Logs 00:07:00 Section 13: AWS Application Deployment Application and Deployment Services 00:04:00 Lambda 00:06:00 API Gateway 00:09:00 Kinesis 00:06:00 Kinesis Data Streams and Firehose 00:06:00 Kinesis Data Analytics 00:04:00 Reference Architectures 00:06:00 CloudFront 00:10:00 Web Application Firewall (WAF) 00:09:00 Simple Queue Service (SQS) 00:10:00 Simple Notification Service (SNS) 00:08:00 Simple Workflow (SWF) 00:07:00 Step Functions 00:05:00 OpsWorks 00:08:00 Cognito 00:04:00 Elastic MapReduce (EMR) 00:05:00 CloudFormation 00:10:00 CloudFormation Properties 00:03:00 CloudWatch 00:06:00 Trusted Advisor 00:07:00 Organizations 00:09:00 Section 14: AWS Database Design Database Types 00:08:00 Relational Databases 00:08:00 Database Hosting Methods 00:05:00 High Availability Solutions 00:06:00 Scalability Solutions 00:06:00 Database Security 00:08:00 Aurora 00:06:00 Redshift 00:11:00 DynamoDB 00:10:00 Section 15: Database Deployment DynamoDB Tables Lab 00:08:00 MySQL Lab 00:13:00 Configuration Lab 00:13:00 Backups Lab 00:04:00 Restore Lab 00:04:00 Snapshot Lab 00:08:00 Monitoring Lab 00:06:00 Section 16: Additional AWS Services Media Content Delivery 00:13:00 Desktop and Appstreaming 00:06:00 ElastiCache 00:05:00 Security Services Lab 00:12:00 Analytics Engines 00:11:00 Development Operations (DevOps) 00:12:00 AWS Solutions 00:05:00 AWS Transit Gateway 00:03:00 AWS Backup 00:04:00 AWS Cost Explorer 00:04:00 Section 17: Operational Excellence with AWS The Operational Excellence Process 00:08:00 Widget Makers Scenario 00:06:00 Resilient Design 00:08:00 Resilient Design Scenario 00:05:00 Performant Design 00:09:00 Performant Design Scenario 00:06:00 Secure Design 00:08:00 Secure Design Scenario 00:05:00 Cost Optimization 00:07:00 Cost Optimization Scenario 00:05:00 General Best Practices 00:07:00

The Corporate Finance course covers essential financial concepts and analysis techniques relevant to businesses. Students will learn about financial analysis, cash forecasting, present value, future value, rate of return, adding debt, risk management, and practical applications of finance in real-world scenarios. Learning Outcomes: Understand the principles of financial analysis and how to assess the financial health of a company. Learn how to forecast cash flows to make informed financial decisions. Gain proficiency in calculating present value and future value to evaluate investment opportunities. Explore the impact of adding debt to a company's capital structure and its effect on overall risk and returns. Develop risk management skills to mitigate financial uncertainties and maximize profitability. Apply corporate finance concepts to real-world situations, making informed financial decisions in practical scenarios. Why buy this Corporate Finance? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Corporate Finance there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Aspiring finance professionals seeking a foundational understanding of corporate finance. Business owners aiming to fortify their financial decision-making prowess. Students of finance and related fields eager to augment their academic knowledge with practical skills. Entrepreneurs needing to navigate the financial aspects of running a business. Individuals keen on a career change towards the finance sector. Prerequisites This Corporate Finance does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Corporate Finance was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Financial Analyst: £30,000 - £50,000 Per Annum Cash Flow Manager: £35,000 - £55,000 Per Annum Investment Advisor: £40,000 - £60,000 Per Annum Risk Management Specialist: £45,000 - £65,000 Per Annum Corporate Finance Consultant: £50,000 - £70,000 Per Annum Chief Financial Officer: £80,000 - £120,000 Per Annum Course Curriculum Corporate Finance Learn More About This Course! 00:06:00 Financial Analysis 00:09:00 Cash Forecast 00:03:00 Present Value 00:13:00 Future Value 00:07:00 Rate of Return and Adding Debt 00:14:00 Risk Management 00:13:00 Finance in Practice 00:07:00 Assignment Assignment - Corporate Finance 00:00:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Corporate Finance: Working Capital Management Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Corporate Finance: Working Capital Management Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Corporate Finance: Working Capital Management Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Corporate Finance: Working Capital Management Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Corporate Finance: Working Capital Management? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Corporate Finance: Working Capital Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Corporate Finance: Working Capital Management course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Corporate Finance: Working Capital Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Corporate Finance: Working Capital Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Corporate Finance: Working Capital Management is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Course Introduction Preview 00:01:00 Section 02: Introduction to Working Capital Management What Is Working Capital and What Are Working Capital Elements 00:05:00 What Are the Benefits and Cost of Various Working Capital Elements 00:07:00 Operating and Cash Conversion Cycle with Practical Example 00:09:00 Cash Conversion Cycle of Different Companies 00:03:00 Working Capital Impact on Company Value 00:04:00 Understanding Working Capital Requirements and Different Approaches in Management 00:05:00 Section 03: Trade Credit and Receivable Management Understand Trade Credits In Business 00:10:00 How Do We Manage Receivables 00:05:00 Understanding How to Change Credit Policies and Evaluate the Impact 00:06:00 Monitoring Receivables 00:05:00 Section 04: Payables Management Payable Management 00:04:00 Section 05: Inventory Management Practices Inventory Management and Pro and Cons of High Inventory 00:05:00 Inventory Management - EOQ, Reorder Levels, Lead Time 00:09:00 ABC System of Managing Inventory 00:04:00 Section 06: Cash Management Practice Cash Management Process 00:06:00 Assignment Assignment - Corporate Finance: Working Capital Management 00:00:00

In an unpredictable world, the need for adept security and fraud prevention strategies is paramount. Our 'Security Management and Fraud Prevention Training' serves as a beacon of enlightenment, illuminating the intricate nuances of comprehensive security. Journey through a meticulously crafted curriculum, traversing the landscapes of organisational security, cyber resilience, and insightful risk analysis. Dive into the multifaceted domains of both physical and digital realms, and emerge equipped with strategies to fortify and safeguard businesses from looming threats. Learning Outcomes Understand the foundational principles and nuances of security management. Gain proficiency in organisational security measures and risk reduction methodologies. Develop expertise in implementing physical and information security protection. Grasp the intricacies of business resilience, crisis management, and cyber threat counteraction. Delve into the legal frameworks guiding security protocols and measures. Why choose this Security Management and Fraud Prevention Training? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Security Management and Fraud Prevention Training Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Security Management and Fraud Prevention Training for? Aspiring security consultants looking to solidify their expertise. Business owners keen to enhance their organisation's protection. IT professionals aiming to broaden their horizon into cyber security and fraud prevention. Management personnel responsible for crisis and resilience protocols. Law enthusiasts focusing on security regulations and compliance. Career path Security Consultant: £30,000 - £60,000 Risk Analyst: £35,000 - £70,000 Cyber Security Specialist: £40,000 - £80,000 Fraud Prevention Analyst: £28,000 - £55,000 Crisis Management Expert: £37,000 - £65,000 Compliance Officer: £32,000 - £68,000 Prerequisites This Security Management and Fraud Prevention Training does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Security Management and Fraud Prevention Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Security Management and Fraud Prevention Training Module 01: Introduction to Security Management 00:30:00 Module 02: Organisational Security Management 00:26:00 Module 03: Security Risk Analysis and Risk Reduction 00:23:00 Module 04: Physical and Information Security Protection 00:32:00 Module 05: Business Resilience and Crisis Management 00:17:00 Module 06: Cyber Security and Fraud Prevention 00:25:00 Module 07: Security Investigations and Threat Awareness 00:24:00 Module 08: Laws and Regulations 00:25:00 Mock Exam Mock Exam - Security Management and Fraud Prevention Training 00:20:00 Final Exam Final Exam - Security Management and Fraud Prevention Training 00:20:00

Embark on a Financial Odyssey: Construction Cost Estimation Diploma Welcome to the realm of construction finance, where every brick laid and beam raised holds the potential for a financial masterpiece. The 'Construction Cost Estimation Diploma' is your passport to unraveling the financial intricacies of the construction industry. In Module 1, set sail with an enticing 'Introduction to Construction Management,' laying the foundation for a thrilling expedition into the heart of cost estimation. Module 2 unveils the art and science of 'Cost Estimation,' preparing you for a journey where every pound matters. Explore the dynamic role of a Cost Estimator and discover new dimensions in Module 3. As you progress through the course, understand the myriad 'Elements and Factors Influencing Cost Estimation,' transforming you into a financial architect of construction projects. Navigate the seas of 'Cost Management' and master the art of efficiently managing construction materials in Modules 6 and 7. The course concludes with a wealth of knowledge, positioning you as a proficient navigator of construction cost estimation. Learning Outcomes Acquire a comprehensive understanding of construction management principles. Master the techniques and methodologies of accurate cost estimation. Explore the evolving role of a Cost Estimator and stay abreast of industry advancements. Identify and analyze the diverse elements and factors influencing cost estimation. Develop expertise in cost management and material logistics for construction projects. Why choose this Construction Cost Estimation Diploma? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Construction Cost Estimation Diploma for? Individuals aspiring to become construction cost estimators. Construction project managers seeking financial acumen. Students pursuing careers in construction and project management. Professionals aiming to enhance their knowledge of cost estimation. Entrepreneurs venturing into the construction industry. Career path Construction Cost Estimator: £25,000 - £45,000 Project Manager (Construction): £40,000 - £70,000 Construction Financial Analyst: £30,000 - £50,000 Quantity Surveyor: £30,000 - £55,000 Construction Manager: £35,000 - £60,000 Infrastructure Development Consultant: £40,000 - £65,000 Prerequisites This Construction Cost Estimation Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Construction Cost Estimation Diploma was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 1- Introduction to Construction Management Introduction to Construction Management 00:16:00 Module 2- Cost Estimation Cost Estimation 00:34:00 Module 3- Role of Cost Estimator and New Aspects of Cost Estimation Role of Cost Estimator and New Aspects of Cost Estimation 00:10:00 Module 4 - Elements and Factors influencing Cost Estimation Elements and Factors influencing Cost Estimation 00:16:00 Module 5 - Cost Estimation in Construction Industry Cost Estimation in Construction Industry 00:38:00 Module 6 - Cost Management Cost Management 00:19:00 Module 7 - Management of Material for construction Management of Material for construction 00:20:00 Assignment Assignment - Construction Cost Estimation Diploma 00:00:00 Recommended Materials Workbook - Construction Cost Estimation Diploma 03:52:00

The Facilitation Training and Strategic Operations Management Diploma course focuses on the essential skills of facilitation and strategic operations management. Participants will learn about the facilitation process, differentiating between process and content, team development models, building consensus, handling difficult individuals, and intervention techniques. Learning Outcomes: Understand the fundamentals of facilitation and its role in strategic operations management. Distinguish between process and content in facilitating effective group discussions and decision-making. Learn how to lay the groundwork for successful facilitation sessions and team development. Familiarize with the Tuckman and Jensen's Model of Team Development and its application in group dynamics. Develop skills in building consensus among team members and reaching critical decision points. Gain techniques to handle challenging individuals and address group dysfunction during facilitation. Learn about different intervention techniques and their appropriate usage in facilitation scenarios. Why buy this Facilitation Training and Strategic Operations Management Diploma? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Facilitation Training and Strategic Operations Management Diploma you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Facilitation Training and Strategic Operations Management Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning. Prerequisites This Facilitation Training and Strategic Operations Management Diploma was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Facilitation Training and Strategic Operations Management Diploma is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Facilitation Training and Strategic Operations Management Diploma Understanding Facilitation 00:30:00 Process vs. Content 01:00:00 Laying the Groundwork 00:30:00 Tuckman and Jensen's Model of Team Development 01:00:00 Building Consensus 00:30:00 Reaching a Decision Point 01:00:00 Dealing with Difficult People 01:00:00 Addressing Group Dysfunction 01:00:00 About Intervention 00:30:00 Intervention Techniques 00:30:00 Mock Exam Mock Exam- Facilitation Training and Strategic Operations Management Diploma 00:20:00 Final Exam Final Exam- Facilitation Training and Strategic Operations Management Diploma 00:20:00

The 'Finance for Non-finance Managers Certification' course is designed to provide non-finance professionals with essential financial knowledge and skills. Participants will learn the importance of financial information, understand financial statements like balance sheets, profit and loss accounts, and cash flow statements. The course also covers budgeting, cost management, pricing, financing, and methods for measuring an organization's financial performance and managing risks. Learning Outcomes: Recognize the significance of good financial information and its impact on decision-making. Understand the essential financial information required by organizations for effective financial management. Comprehend the basics of balance sheets, profit and loss accounts, and cash flow statements. Gain insights into budgeting and its role in financial planning and control. Learn about pricing strategies and financing options to optimize financial performance. Develop knowledge of cost management techniques to improve profitability. Explore methods for measuring an organization's financial performance and identifying areas for improvement. Understand the concept of risk and risk management in financial decision-making processes. Why buy this Finance for Non-finance Managers Certification? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Finance for Non-finance Managers Certification there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Finance for Non-finance Managers Certification course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Finance for Non-finance Managers Certification does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Finance for Non-finance Managers Certification was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Finance for Non-finance Managers Certification is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Finance for Non-finance Managers Certification Module 01: Importance of Good Financial Information 00:10:00 Module 02: Financial Information Every Organisation Needs 00:05:00 Module 03: The Balance Sheet: Basic Summary of Value and Ownership 00:15:00 Module 04: Profit and Loss Accounts 00:10:00 Module 05: Cash Flow Statement 00:10:00 Module 06: Understanding Budget 00:10:00 Module 07: Pricing and Financing 00:15:00 Module 08: Cost Management 00:30:00 Module 09: Methods for Measuring Your Organisation's Financial Performance 00:10:00 Module 10: Risk and Risk Management 00:30:00 Assignment Assignment - Finance for Non-finance Managers Certification 00:00:00

The Managing Budget: Financial Statements and Money Management course provides comprehensive knowledge of budgeting fundamentals, financial statements, and budget monitoring. Participants will learn to create, manage, and analyze budgets, gaining valuable insights into financial decision-making processes and investment opportunities. Learning Outcomes: Understand the fundamentals of finance and budgeting principles. Identify the components and structure of financial statements. Master the budgeting process, including budget creation and approval. Acquire budgeting tips and tricks for efficient money management. Learn techniques for monitoring and managing budgets effectively. Develop the skills to crunch numbers and analyze financial data. Compare and evaluate investment opportunities for decision-making. Gain knowledge of ISO 9001:2008 quality management standards. Why buy this Managing Budget: Financial Statements and Money Management? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Managing Budget: Financial Statements and Money Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Aspiring finance professionals looking to enhance their budgeting skills. Managers and team leaders involved in financial decision-making. Small business owners seeking to improve their money management abilities. Professionals in non-financial roles aiming to understand budgeting and financial statements. Prerequisites This Managing Budget: Financial Statements and Money Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Managing Budget: Financial Statements and Money Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Financial Analyst: Analyze financial data and provide insights to support decision-making. Budget Analyst: Create, manage, and review budgets for organizations. Financial Manager: Oversee financial operations and develop long-term financial strategies. Business Consultant: Advise clients on financial management, budgeting, and investment. Entrepreneur: Apply budgeting skills to manage financial resources and optimize profitability. Course Curriculum Budgets and Financial Reports Module One - Getting Started 00:15:00 Module Two - Glossary 00:30:00 Module Three - Understanding Financial Statements 00:30:00 Module Four - Analyzing Financial Statements (I) 01:00:00 Module Five - Analyzing Financial Statements (II) 00:30:00 Module Six - Understanding Budgets 00:30:00 Module Seven - Budgeting Made Easy 00:30:00 Module Eight - Advanced Forecasting Techniques 00:30:00 Module Nine - Managing the Budget 00:30:00 Module Ten - Making Smart Purchasing Decisions 01:00:00 Module Eleven - A Glimpse into the Legal World 01:00:00 Module Twelve - Wrapping Up 00:15:00 Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Recommended Reading Recommended Reading : Finance and Budgeting Diploma 00:00:00 Assignment Assignment - Managing Budget: Financial Statements and Money Management 00:00:00

Engage yourself in fiscal management with our comprehensive 'Business Finance' course. This educational journey illuminates the intricate landscape of corporate fiscal strategies, guiding learners through the complexities of monetary decision-making in businesses. Envision yourself mastering the art of balancing sheets, decoding income statements, and easily understanding cashflow statements. Our curriculum offers a deep dive into the essence of corporate fiscal health, exploring why some companies flourish while others flounder. As you progress, you'll unravel the layers of investment analysis that cements your newfound knowledge. This course enhances your understanding and equips you with the insight to become a pivotal finance business partner in any organisation. Learning Outcomes: Acquire a comprehensive understanding of business finance fundamentals, including interpreting balance sheets, income, and cashflow statements. Analyse and identify the reasons behind business failures, focusing on fiscal mismanagement and prevention strategies. Develop proficiency in applying principles of business financing, enhancing financial decision-making skills. Master investment analysis techniques, enabling effective evaluation and management of business investments. Gain practical insights and preparing for real-world application in a finance business partner role. Why buy this Business Finance Course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Certification After studying the course materials of the Business Finance there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Business Finance course for? Individuals aspiring to become finance business partners, seeking to enhance their expertise in business financing. Entrepreneurs requiring insights into 365 business finance for effective management and growth of their ventures. Professionals looking for finance business partner jobs, aiming to add value to organisations through financial acumen. Graduates and undergraduates pursuing careers in finance, eager to understand the nuances of business funded operations. Analysts and accountants aiming to broaden their skill set in corporate finance and fiscal analysis. Prerequisites This Business Finance does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Business Finance was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Finance Business Partner - Average Salary: £50,000 to £70,000 Per Annum Financial Analyst - Average Salary: £35,000 to £50,000 Per Annum Investment Analyst - Average Salary: £40,000 to £60,000 Per Annum Corporate Finance Manager - Average Salary: £60,000 to £80,000 Per Annum Financial Planner - Average Salary: £45,000 to £65,000 Per Annum Finance Consultant - Average Salary: £55,000 to £75,000 Per Annum Course Curriculum Business Finance Module 01: What is Business Finance? 00:06:00 Module 02: Why Businesses Fail 00:05:00 Module 03: The Principles of Business Finance Part 1 00:07:00 Module 04: The Principles of Business Finance Part 2 00:05:00 Module 05: The Balance Sheet 00:10:00 Module 06: The Income Statement 00:04:00 Module 07: The Cashflow Statement 00:07:00 Module 08: A Business Finance Exercise 00:06:00 Module 09: Financial Performance Indicators 00:11:00 Module 10: Investment Analysis 00:05:00 Module 11: Investment Analysis Exercise 00:03:00 Module 12: Key Learning Points in Business Finance 00:06:00 Assignment Assignment - Business Finance 00:00:00