- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

129 Courses in Liverpool delivered On Demand

Understanding financial risk is crucial for any individual or organisation looking to navigate the complexities of the modern financial world. The Financial Risk Management Basics Course offers a structured introduction to the principles that underpin effective risk management strategies. This course provides an overview of the key concepts used to assess and mitigate financial risks, covering areas such as credit risk, market risk, and operational risk. It equips learners with the fundamental knowledge needed to identify potential threats to financial stability and take informed actions to manage them effectively. By exploring essential risk management tools and techniques, this course helps individuals understand how businesses protect themselves against unforeseen financial setbacks. The course also delves into various risk measurement methods, empowering learners to evaluate different risk exposures and make sound decisions. Whether you are looking to enter the financial sector or simply seeking to grasp the basics of financial risk management, this course provides the foundational knowledge that is both practical and essential in today’s fast-moving economy. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Financial Risk Management Module 02: Risk Identification and Assessment Module 03: Risk Measurement and Quantification Module 04: Risk Mitigation and Control Module 05: Market and Credit Risk Management Module 06: Operational and Liquidity Risk Management Module 07: Regulatory Compliance and Risk Reporting Module 08: Risk Culture and Governance Learning Outcomes: Evaluate financial risks with precision, enhancing decision-making capabilities. Implement effective strategies for identifying and assessing diverse risks. Quantify risks using advanced tools, fostering data-driven risk management. Devise robust risk mitigation plans to safeguard financial stability. Navigate market and credit risks adeptly, ensuring proactive risk management. Foster a culture of compliance, governance, and risk-awareness in financial institutions. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals seeking advanced risk management skills. Analysts aiming to deepen their understanding of financial risks. Risk managers aspiring to enhance their strategic decision-making abilities. Banking professionals keen on strengthening their risk mitigation expertise. Auditors looking to broaden their knowledge of financial risk management. Compliance officers desiring a comprehensive grasp of regulatory frameworks. Individuals pursuing a career in financial risk assessment and control. Anyone eager to excel in the dynamic field of financial risk management. Career path Risk Analyst Credit Risk Manager Compliance Officer Financial Controller Treasury Analyst Operations Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Master the critical domain of Know Your Client (KYC) practices with this in-depth course. Gain a comprehensive understanding of KYC regulations, client due diligence, anti-money laundering, and more. Elevate your compliance acumen and set a new standard in client onboarding and risk assessment.

Inventory Manager - QLS Endorsed Bundle

By Imperial Academy

10 QLS Endorsed Courses for Inventory Manager | 10 QLS Endorsed Certificates Included | Life Time Access | Tutor Support

Professional Certificate Course in CSR Ethics in Risk Management in London 2024

4.9(261)By Metropolitan School of Business & Management UK

CSR Ethics in Risk Management equips professionals with the tools to navigate the complex landscape of ethical considerations and risk mitigation strategies in business. From understanding risk management fundamentals to evaluating the impact of ethical conduct, this course empowers individuals to foster a culture of responsibility and sustainability within their organizations. After the successful completion of this course, you will be able to: Explore the core elements of effective risk management systems and their practical application. Gain insights into Corporate Social Responsibility and its evolving role in contemporary business practices. Recognize the pivotal role of ethics in organizational culture and its impact on workplace behavior. Learn to apply STEP analysis as a tool to assess external factors influencing business environments. Comprehend the stages involved in managing CSR-related risks within an organizational context. Identify and understand the benefits stemming from ethical business practices and their broader impact. Develop skills to evaluate and mitigate the negative repercussions of a lack of ethical conduct in business settings. This course provides a holistic perspective on integrating CSR, ethics, and risk management. Participants will engage in practical exercises, case studies, and discussions to reinforce theoretical concepts. By the end of the course, individuals will possess the knowledge and skills necessary to navigate ethical dilemmas, contribute to effective risk management, and champion CSR initiatives within their organizations. Uncover the synergy between Corporate Social Responsibility (CSR) and Ethics in Risk Management. This course provides practical insights, linking ethical considerations to effective risk mitigation. Explore real-world applications and enhance your ability to integrate CSR principles into risk strategies for responsible business practices. Elevate your expertise in socially conscious risk management. Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. CSR Ethics in Risk Management Self-paced pre-recorded learning content on this topic. CSR Ethics in Risk Management Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CSR Risk Manager Ethical Compliance Officer Corporate Sustainability Analyst Business Ethics Consultant Risk Assessment Specialist CSR Strategist Workplace Ethics Coordinator Corporate Responsibility Advisor Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Description Fundamentals Of Risk Management Diploma The Fundamentals Of Risk Management Diploma is an online course designed to provide a comprehensive understanding of the principles and practices of risk management. With a growing emphasis on risk management in various industries and sectors, this diploma course offers a solid foundation for those looking to enter the field or enhance their existing knowledge. The course begins with an Introduction to Risk Management, where learners will explore the significance of risk management, its role in organisational planning, and the key terms and concepts associated with risk. This provides a strong grounding for the subsequent modules, ensuring that participants have a clear understanding of the topic. Risk Identification and Assessment is the next topic covered in this online diploma course. Here, learners will gain insights into the methods and tools for identifying risks, assessing their potential impact, and analysing the factors that contribute to their occurrence. The course emphasises the importance of proactive risk identification and assessment, which are crucial steps in preventing or mitigating adverse events. The course then moves on to Risk Mitigation Strategies, where learners will explore the various techniques and approaches to managing risks, including risk avoidance, risk reduction, risk transfer, and risk acceptance. The module equips participants with the knowledge and skills to develop and implement effective risk management strategies tailored to specific organisational contexts and needs. Risk Monitoring and Control is another important component of the course. This module covers the processes and tools for tracking, measuring, and evaluating risks and the effectiveness of risk management efforts. It also provides insights into the establishment of a risk management framework, risk management processes, and risk control measures. The Fundamentals Of Risk Management Diploma also addresses Risk Communication and Reporting. Participants will learn how to effectively communicate risk information to stakeholders, including employees, management, and external parties. The course emphasises the importance of clear, timely, and accurate communication in fostering a culture of risk awareness and informed decision-making within an organisation. Legal and Regulatory Requirements is a crucial topic for any risk management professional. This module covers the regulatory landscape, relevant laws, and compliance requirements related to risk management. Learners will gain an understanding of the legal implications of risks and how to ensure compliance with industry-specific regulations. The course also includes modules on Financial Risk Management, Cybersecurity Risk Management, and Human Factors and Behavioural Risk. These modules delve into the specifics of managing risks in areas such as finance, cybersecurity, and human behaviour, providing valuable insights into the unique challenges and approaches associated with these domains. Emerging Trends in Risk Management is the final module of the course, which covers the latest developments and trends in the field of risk management. This module provides participants with an understanding of how the risk landscape is evolving and equips them with the knowledge to stay ahead of the curve. Overall, the Fundamentals Of Risk Management Diploma is a comprehensive and up-to-date online course that provides participants with a deep understanding of risk management principles and practices. Whether you are a risk management professional or a newcomer to the field, this course will equip you with the knowledge and skills to effectively manage risks and create value for your organisation. What you will learn 1:Introduction to Risk Management 2:Risk Identification and Assessment 3:Risk Mitigation Strategies 4:Risk Monitoring and Control 5:Risk Communication and Reporting 6:Legal and Regulatory Requirements 7:Financial Risk Management 8:Cybersecurity Risk Management 9:Human Factors and Behavioural Risk 10:Emerging Trends in Risk Management Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

ICA Specialist Certificate in Anti-Corruption

By International Compliance Association

ICA Specialist Certificate in Anti-Corruption - Course Overview Manage your firm's bribery and corruption risk exposure more effectively with this accessible, online course. Manage your firm's bribery and corruption risk exposure more effectively with this accessible, online course. You will examine global anti-corruption frameworks and identify key anti-corruption controls to help mitigate the risks. You will consider and evaluate fundamental area's including PEPs, third parties and appraise geographical & sectoral risks. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Upon successful completion of this course, students will be awarded the ICA Certificate in Anti-Corruption and will be entitled to use the designation- Cert(ABC) What will you learn by studying the ICA Certificate in Anti-Corruption? Understanding corruption The craft of corruption Who are the stakeholders? High-risk countries, industries and customers Anti-corruption legislation Enforcement An holistic approach to corruption risk mitigation Future trends and the rise of the anti-corruption professionals

Operational Risk Management (ORM): A Practical, Step by Step Guide to Risk Measurement and Management

5.0(1)By LearnDrive UK

Master Operational Risk Management with our step-by-step guide. Learn risk identification, measurement, mitigation, and effective communication strategies. Ideal for professionals seeking to enhance their ORM expertise and apply practical solutions in various industries.

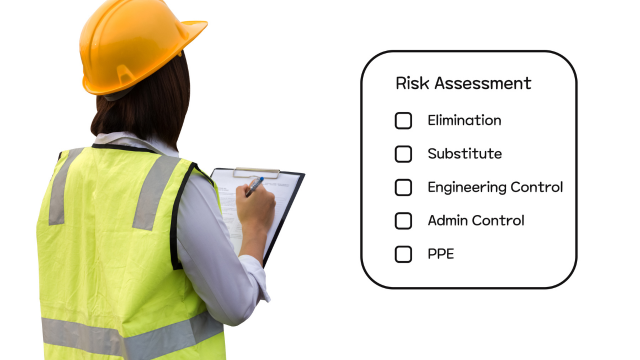

Empower yourself with crucial risk management skills in the workplace through our Risk Assessment course. Learn to identify, measure, and mitigate risks effectively, ensuring a safer and more resilient work environment. Ideal for professionals seeking to enhance workplace safety and decision-making.

European Market Infrastructure Regulation (EMIR)

5.0(4)By LGCA | London Governance and Compliance Academy

EMIR requires the reporting of all derivatives, whether OTC or exchange traded, to a trade repository. EMIR covers entities that qualify for derivative contracts in regards to interest rate, equity, foreign exchange, or credit and commodity derivatives. Group rates available! Contact us here Description This course offers a comprehensive overview of the EMIR. It addresses the EMIR requirements, the types of counterparties and the clearing obligations. It provides a sound grounding to reporting requirements and risk management. It covers the risk mitigation processes and techniques as well as the EU margin rules and eligible collateral. Training Duration This course may take up to 2 hours to be completed. However, actual study time differs as each learner uses their own training pace. Participants This course is ideal for anyone wishing to be introduced to the EMIR and the respective regulatory provisions. It is also suitable to professionals pursuing regulatory CPD in Financial Regulation such as the FCA. Training Method The course is offered fully online using a self-paced approach. The learning units consist of video presentations and reading material. Learners may start, stop and resume their training at any time. At the end of the training, participants take a Quiz to complete their learning and earn a Certificate of Completion. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution in collaboration with the European Institute of Management and Finance (EIMF). The syllabus is verified by external subject matter experts and can be accredited by regulators and other bodies for 2 CPD Units that approve education in financial regulation, such as the FCA. The course may be also approved for CPD Units by institutions which approve general financial training, such as the CISI. Eligibility criteria and CPD Units are verified directly by your association, regulator or other bodies which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk. Access to the course is valid for 365 days.

Take on a journey of knowledge that transcends the ordinary - a riveting exploration into the microscopic world of Legionella. In the unfolding chapters of understanding, we unravel the enigma, delving into the essence of Legionella and its clandestine presence. Picture this: navigating the legal labyrinth, where obligations metamorphose into responsibilities, forging a path through the legislative landscape. It's not just about compliance; it's about stewardship, a commitment to safeguarding spaces from the elusive Legionella threat. Key Features This Legionella Awareness Course Includes: This Legionella Awareness Course is CPD Certified Free Certificate Developed by Specialist Lifetime Access As the narrative unfolds, hazardous environments materialise before your eyes. Here, we venture beyond the visible, peeling back the layers of seemingly innocuous settings to expose potential Legionella breeding grounds. The tale takes a strategic turn with risk assessments, an art form meticulously crafted to decipher the cryptic language of Legionella's potential emergence. In a post-Covid world, our journey culminates with heightened Legionella awareness, a beacon guiding us through the challenges of the new normal. Join us in this intellectual odyssey, where knowledge is not just power - it's the key to a Legionella-resilient future. Course Curriculum Legionella Awareness Course: Module 01: Understanding Legionella Module 02: Legal Obligations and Responsibilities Module 03: Identifying Hazardous Environments Module 04: Conducting Legionella Risk Assessments Module 05: Risk Mitigation and Control Measures Module 06: Post-Covid Legionella Awareness Learning Outcomes After completing this Legionella Awareness Course, you will be able to: Understand Legionella's biology, transmission, and associated health risks in diverse settings. Comprehend legal obligations, ensuring compliance with Legionella control regulations and standards. Identify hazardous environments susceptible to Legionella growth and assess potential risks. Conduct thorough Legionella risk assessments, evaluating water systems for contamination sources. Implement effective risk mitigation and control measures to prevent Legionella proliferation. Enhance awareness by addressing Legionella concerns in post-Covid environments proactively. Certification After completing this Legionella Awareness course, you will get a free Certificate. CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? This Legionella Awareness course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Legionella Awareness. Moreover, this course is ideal for: Facility Managers and Supervisors Health and Safety Officers Environmental Compliance Officers Building Maintenance Staff Water Treatment and Plumbing Professionals Requirements There are no requirements needed to enrol into this Legionella Awarenesscourse. We welcome individuals from all backgrounds and levels of experience to enrol into this Legionella Awareness course. Career path After finishing this Legionella Awareness course you will have multiple job opportunities waiting for you. Some of the the following Job sectors of Legionella Awareness are: Health and Safety Advisor Environmental Compliance Manager Facilities Management Coordinator Water Hygiene Technician Risk Assessment Consultant Plumbing and Water Systems Inspector Certificates Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.