- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

184 Courses in Coventry delivered On Demand

Unveil the art and science of value investing to amplify your returns in the stock market. Understand the principles of margin of safety, moats, and conservative valuation while uncovering the psychological elements that make you a successful value investor.

Explore the intricacies of tax strategy and financial planning for beginners in this comprehensive course. From income tax to VAT, gain insights into key topics like accounting, capital gains tax, and self-assessment. Master tax compliance and optimize your financial decisions with expert guidance. Start planning your financial future today!

Basic Accounting & Personal Finance

By Course Cloud

Course Overview Are you clueless when it comes to managing your personal finances? In the Basic Accounting & Personal Finance course, you will gain the practical skills and knowledge needed to take control of your personal finances and make smarter financial decisions. It will teach you how to manage your money to meet your long-term financial goals, how to save for your retirement, budget, and plan an emergency fund. Through this course, you will learn how to use up-to-date budgeting software and create a budget analysis report to gain complete control of your finances. You will be able to build a better relationship with your money by understanding how to balance your personal expenses and income. This best selling Basic Accounting & Personal Finance has been developed by industry professionals and has already been completed by hundreds of satisfied students. This in-depth Basic Accounting & Personal Finance is suitable for anyone who wants to build their professional skill set and improve their expert knowledge. The Basic Accounting & Personal Finance is CPD-accredited, so you can be confident you're completing a quality training course will boost your CV and enhance your career potential. The Basic Accounting & Personal Finance is made up of several information-packed modules which break down each topic into bite-sized chunks to ensure you understand and retain everything you learn. After successfully completing the Basic Accounting & Personal Finance, you will be awarded a certificate of completion as proof of your new skills. If you are looking to pursue a new career and want to build your professional skills to excel in your chosen field, the certificate of completion from the Basic Accounting & Personal Finance will help you stand out from the crowd. You can also validate your certification on our website. We know that you are busy and that time is precious, so we have designed the Basic Accounting & Personal Finance to be completed at your own pace, whether that's part-time or full-time. Get full course access upon registration and access the course materials from anywhere in the world, at any time, from any internet-enabled device. Our experienced tutors are here to support you through the entire learning process and answer any queries you may have via email.

Payroll with Xero

By Compete High

Interested in Payroll with Xero. This is a great place to start. Take a look at this course if you want a quick and simple introduction to Payroll Management with Xero

Insurance Coaching Mini Bundle

By Compete High

Insurance finance demands accuracy, detailed analysis, and a strong grasp of numbers. This mini bundle covers payroll, accounting, forensic accounting, data analysis, and tax—all key skills for anyone involved in insurance financial functions. This bundle offers a solid foundation in how insurance firms manage their accounts and analyse data to detect discrepancies or trends. Whether your role involves payroll, tax reporting, or investigative accounting, these courses deliver clear, focused knowledge that supports decision-making and operational accuracy. Fully online and structured, it avoids jargon and instead provides a direct, practical approach to financial management within insurance. Learning Outcomes: Understand payroll processes within insurance finance environments. Apply accounting principles relevant to insurance operations. Use forensic accounting techniques to investigate financial records. Analyse data to support insurance financial decisions. Gain knowledge of tax regulations affecting insurance firms. Develop skills to support insurance financial reporting accuracy. Who Is This Course For: Insurance finance staff handling payroll and tax duties. Accountants specialising in insurance industry requirements. Data analysts working with insurance financial datasets. Investigators involved in forensic accounting for insurance claims. Tax professionals managing insurance-related tax filings. Payroll officers within insurance companies. Auditors reviewing insurance financial compliance. Students or professionals entering insurance finance roles. Career Path (UK Average Salaries): Insurance Accountant – £35,000 per year Payroll Officer – £28,000 per year Forensic Accountant – £40,000 per year Data Analyst (Insurance) – £33,000 per year Tax Advisor – £38,000 per year Insurance Auditor – £36,000 per year

Personal Tax Return Mini Bundle

By Compete High

Handle personal tax returns with confidence. Learn accounting, law, Power BI, and more—all online and on your schedule. 🔹 Overview: Personal tax can often feel like a yearly visit to a confusing maze. This Personal Tax Return Mini Bundle aims to straighten the path, offering key lessons on income tax, accounting, and how the law fits in—no Latin required. Whether you’re managing your own return or just trying not to cry during tax season, this bundle teaches you the essentials in a smart, structured way. With the added flair of Power BI and a dose of business law, you’ll be able to interpret, calculate, and report your tax matters like a pro (minus the stress headache). 🔹 Learning Outcomes: Understand personal income tax processes and key components Analyse personal financial data using structured accounting methods Interpret tax implications through a legal lens Use Power BI to visualise and explore financial return data Apply business law basics to tax-related financial decisions Improve accuracy in self-submitted personal tax return cases 🔹 Who is this Course For: Individuals handling their own personal tax each year Freelancers needing structured tax and finance understanding Business owners filing personal and business returns separately Students learning financial reporting and tax law basics Aspiring accountants focused on personal tax services Data enthusiasts exploring Power BI for financial reporting People wanting legal clarity in financial planning Professionals revisiting personal tax procedures and updates 🔹 Career Path: Personal Tax Advisor – £28,000–£40,000 per year Accounting Assistant – £23,000–£29,000 per year Finance Analyst – £30,000–£42,000 per year Power BI Finance Analyst – £32,000–£44,000 per year Business Law Assistant – £26,000–£35,000 per year Tax Return Support Officer – £25,000–£33,000 per year

Mastering Financial Stability- Part 1- Essential Principles

By Compete High

ð Unlock Financial Mastery with 'Mastering Financial Stability - Part 1: Essential Principles' Online Course! ð Are you ready to take control of your financial destiny? Dive into the world of financial stability and empowerment with our groundbreaking online course: 'Mastering Financial Stability - Part 1: Essential Principles.' This transformative program is designed to equip you with the fundamental knowledge and skills needed to navigate the complexities of personal finance confidently. ð Course Curriculum: Module 1: Introduction Lay the foundation for your financial journey by understanding the core principles of financial stability. Discover the mindset shift needed to embark on a path towards lasting financial success. Module 2: Justifying Your Financials For Best Results Learn how to analyze and justify your financial decisions for optimal results. Gain insights into making informed choices that align with your long-term goals. Module 3: Overcome Roadblocks to Financial Planning Identify and overcome common roadblocks that hinder effective financial planning. Develop strategies to navigate challenges and stay on course towards financial stability. Module 4: Create Your Financial Plan Practical guidance on crafting a personalized financial plan tailored to your unique circumstances. Understand the key components of a robust financial strategy and how to implement them effectively. ð What Sets Our Course Apart? ⨠Expert Guidance: Learn from industry experts with proven track records in financial planning and stability. ð¤ Interactive Learning: Engage with interactive modules, quizzes, and practical exercises that reinforce your understanding. ð Lifetime Access: Once enrolled, you enjoy lifetime access to the course material, allowing you to revisit and reinforce your learning whenever needed. ð¡ Real-world Application: Gain practical insights and actionable strategies that you can immediately apply to your financial life. ð Why Wait? Start Your Journey to Financial Mastery Today! Whether you're a financial novice or looking to enhance your existing knowledge, 'Mastering Financial Stability - Part 1: Essential Principles' is your gateway to a secure and prosperous financial future. ð¨ Limited Time Offer: Enroll Now and Take Control of Your Financial Destiny! Don't miss this opportunity to revolutionize your relationship with money. Secure your spot now and embark on a transformative journey towards financial stability! Course Curriculum Introduction Financial Concepts Covered 00:00 Justifying Your Financials For Best Results Justifying Your Financials 00:00 Why Financials Matter 00:00 Keys to Success 00:00 Why Are Financials Important to Investors 00:00 Why Businesses Fail 00:00 Overcome Roadblocks to Financial Planning Financial Challenges of Entrepreneurs 00:00 Financial Resolve 00:00 Create Your Financial Plan Financial Projections Top-Down 00:00 Financial Projections Bottom-Up 00:00 Advantages and Disadvantages of Top-Down vs Bottom-Up 00:00 Revenue Models 00:00 Financial Statements 00:00 Make Your Financials Believable 00:00

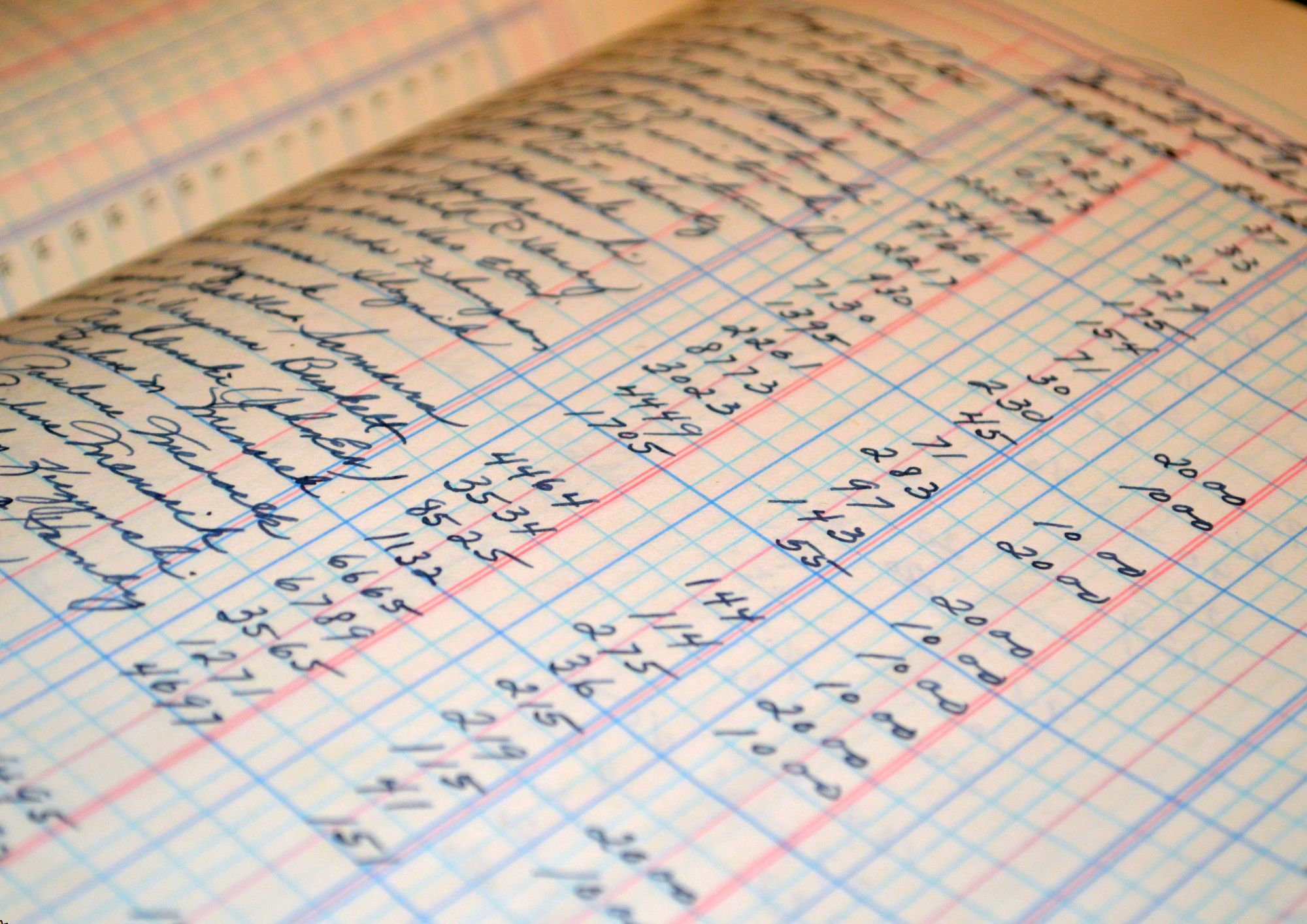

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Financial Management with Xero

By Compete High

Unleash Financial Mastery with 'Financial Management with Xero' Course! ð°ð Are you ready to take control of your finances and elevate your financial management skills to new heights? Look no further than our comprehensive 'Financial Management with Xero' course! ð Why Choose 'Financial Management with Xero'? ð Unlock the Power of Xero: Dive into the world of Xero, the leading cloud-based accounting software trusted by millions worldwide. Learn how to harness its robust features and functionalities to streamline your financial processes with ease. ð Gain Financial Clarity: Master the art of financial management, from budgeting and forecasting to cash flow management and financial analysis. Acquire the skills needed to make informed financial decisions that drive growth and success. ð¼ Enhance Career Opportunities: Stand out in today's competitive job market with in-demand financial management skills. Whether you're an aspiring accountant, small business owner, or finance professional, this course equips you with the expertise employers crave. ð§ Practical Hands-On Learning: Dive into real-world case studies, practical exercises, and interactive simulations to reinforce theoretical concepts and apply them to real-life scenarios. Gain practical experience that sets you apart from the competition. ð¨âð« Expert-Led Instruction: Learn from industry experts and seasoned financial professionals who bring years of experience and insights to the table. Benefit from their expertise as they guide you through every step of your financial management journey. Who is this for? ð©âð¼ Business Owners: Whether you're running a small startup or managing a growing enterprise, mastering financial management with Xero is essential for driving profitability and sustainable growth. ð Students: Aspiring accountants, finance majors, and business students looking to enhance their financial acumen and gain a competitive edge in their future careers will find immense value in this course. ð¼ Finance Professionals: From financial analysts and controllers to CFOs and accounting professionals, anyone looking to advance their career and excel in the field of finance will benefit from mastering Xero and financial management principles. Career Path ð Accountant: Unlock exciting opportunities as a certified accountant equipped with Xero expertise, offering financial management services to businesses of all sizes. ð¼ Financial Analyst: Dive into the world of financial analysis and reporting, leveraging your Xero skills to provide valuable insights and recommendations that drive business growth. ð Finance Manager: Lead financial strategy and decision-making processes as a finance manager, utilizing your Xero proficiency to optimize financial performance and drive profitability. ð Small Business Owner: Take your business to new heights with a solid understanding of financial management and Xero, empowering you to make informed decisions that fuel success and growth. FAQ Q: Is prior experience required to enroll in this course? A: No prior experience is necessary. This course is designed to accommodate learners of all levels, from beginners to advanced users. Q: How long does it take to complete the course? A: The duration of the course varies depending on individual learning pace and commitment level. However, most learners typically complete the course within [insert estimated duration]. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course requirements, you will receive a certificate of completion, showcasing your mastery of financial management with Xero. Q: Is this course accredited? A: While this course may not be accredited by a specific governing body, it provides valuable skills and knowledge that are highly sought after in the finance industry. Q: Can I access the course materials on any device? A: Yes, the course materials are accessible on any device with an internet connection, allowing you to learn anytime, anywhere. Q: Is there ongoing support available during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey, addressing any questions or concerns you may have along the way. Q: Will I have access to updated course materials? A: Yes, as part of your enrollment, you will have access to updated course materials to ensure you stay informed of the latest industry trends and developments. Enroll Now and Empower Your Financial Future! Don't miss out on this incredible opportunity to master financial management with Xero and take your career to new heights. Enroll now in our 'Financial Management with Xero' course and unlock the door to financial success and prosperity! ðð¼ð Course Curriculum Module 1 Introduction to Financial Management and Xero Introduction to Financial Management and Xero 00:00 Module 2 Financial Data Entry and Recording with Xero Financial Data Entry and Recording with Xero 00:00 Module 3 Streamlining Financial Workflows and Efficiency with Xero Streamlining Financial Workflows and Efficiency with Xero 00:00 Module 4 Advanced Financial Management and Compliance in Xero Advanced Financial Management and Compliance in Xero 00:00 Module 5 Integration Strategies and Continuous Improvement with Xero Integration Strategies and Continuous Improvement with Xero 00:00 Module 6 Cash Flow Management and Financial Planning with Xero Cash Flow Management and Financial Planning with Xero 00:00

Loans

By Compete High

Unleash Your Financial Freedom with 'Loans' Text Course! Are you ready to master the world of loans and unlock the keys to financial empowerment? Welcome to our comprehensive 'Loans' text course, your ultimate guide to understanding the ins and outs of borrowing, lending, and managing finances like a pro! ð Why Choose 'Loans' Text Course? In today's fast-paced world, financial literacy is the key to success. Whether you're a student, a working professional, or a seasoned entrepreneur, having a solid understanding of loans is essential for making informed financial decisions. Our 'Loans' text course offers a convenient and accessible way to dive deep into this crucial topic, providing you with the knowledge and skills you need to navigate the complex world of borrowing with confidence. By enrolling in our text course, you'll: Gain In-Depth Knowledge: From different types of loans to interest rates, terms, and repayment options, our course covers everything you need to know about loans, ensuring you have a comprehensive understanding of the subject. Learn Practical Strategies: Discover practical tips and strategies for choosing the right loan products, managing debt effectively, and optimizing your financial health. Stay Up-to-Date: With constantly updated content, you'll always have access to the latest information and trends in the world of loans, keeping you ahead of the curve. Access Anytime, Anywhere: Whether you're at home, in the office, or on the go, our text-based format allows you to learn at your own pace and convenience, eliminating the constraints of traditional classroom settings. Who is this for? Our 'Loans' text course is designed for individuals of all backgrounds and experience levels who want to enhance their financial literacy and take control of their financial future. Whether you're a college student preparing to enter the workforce, a young professional looking to build a solid financial foundation, or a seasoned investor seeking to expand your knowledge, this course is for you! Career Path Mastering the fundamentals of loans can open up a world of opportunities across various industries and professions. Here are just a few career paths where a strong understanding of loans can be invaluable: Finance Professionals: From financial analysts to loan officers, professionals working in the finance industry can benefit greatly from a deep understanding of loans, allowing them to better serve their clients and make informed investment decisions. Entrepreneurs: For aspiring entrepreneurs and small business owners, knowing how to navigate the world of business loans and financing options is essential for fueling growth and achieving success. Real Estate Agents: Understanding mortgage loans and financing options is crucial for real estate agents helping clients buy or sell properties, enabling them to provide valuable guidance throughout the home buying process. Personal Finance Advisors: Whether working independently or for financial institutions, personal finance advisors play a vital role in helping individuals and families manage their finances and plan for the future, making expertise in loans a valuable asset. FAQs Q: Is this course suitable for beginners? A: Absolutely! Our 'Loans' text course is designed to cater to individuals of all experience levels, including beginners who may have little to no prior knowledge of loans. Q: How long does it take to complete the course? A: The duration of the course can vary depending on your pace and schedule. However, most learners complete the course within a few weeks by dedicating a few hours each week to study. Q: Can I access the course materials on my mobile device? A: Yes, our text-based format allows you to access the course materials on any internet-enabled device, including smartphones and tablets, giving you the flexibility to learn on the go. Q: Are there any prerequisites for enrolling in the course? A: There are no specific prerequisites for enrolling in the course. However, having a basic understanding of financial concepts may be beneficial. Q: Will I receive a certificate upon completion of the course? A: While our course does not offer a formal certificate, you'll gain valuable knowledge and skills that can enhance your financial literacy and boost your confidence in managing loans. Q: Is there a money-back guarantee? A: Yes, we offer a 100% satisfaction guarantee. If you're not completely satisfied with the course, simply reach out to our support team within 30 days of enrollment for a full refund, no questions asked. Enroll Today and Take Control of Your Financial Future! Don't let confusion and uncertainty hold you back from achieving your financial goals. Empower yourself with the knowledge and skills you need to make informed decisions and secure your financial future. Enroll in our 'Loans' text course today and embark on a journey towards financial freedom! ð Course Curriculum Module 1 Introduction to Loans Introduction to Loans 00:00 Module 2 Personal Loans - Meeting Short-Term Financial Needs Personal Loans - Meeting Short-Term Financial Needs 00:00 Module 3 Mortgages - Unlocking Homeownership Mortgages - Unlocking Homeownership 00:00 Module 4 Business Loans - Fueling Entrepreneurial Ventures Business Loans - Fueling Entrepreneurial Ventures 00:00 Module 5 Student Loans - Investing in Education and Future Student Loans - Investing in Education and Future 00:00 Module 6 Auto Loans - Driving Towards Ownership and Mobility Auto Loans - Driving Towards Ownership and Mobility 00:00