- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

222 Courses delivered Live Online

Overview This course covers distressed debt analysis and investing, focusing primarily on corporates but also including financial institutions and sovereign debt as special topics. The programme begins with the foundations of the distressed debt market, causes of and early warning signals, possible outcomes and how to evaluate the probability of outcomes in different scenarios. Restructuring is reviewed in detail, as well as estimation of sustainable debt levels, business valuation and the importance of capital and group structure. Differences between active control and passive non-control investments are highlighted, including stakeholder tactics and due diligence. Case studies cover a variety of companies across sectors and geographies, challenging delegates to make investment decisions on real distressed debt situations. Who the course is for Distressed debt investors, Loan portfolio managers and Private equity investors Hedge fund managers High yield credit analysts and Equity analysts High yield asset managers and Mergers and acquisitions bankers Debt capital markets/leveraged finance bankers Business turnaround/restructuring accountants/corporate finance professionals Lawyers Strategy consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Advanced financial analysis (In-House)

By The In House Training Company

In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions: all require some degree of financial knowledge. The key financial skills are not as difficult to learn as many people believe and in the hands of an experienced senior executive they can provide a formidable competitive advantage. After completing this course delegates will be able to: Understand fundamental business finance concepts; understand, analyse and interpret financial statements: Profit Statement, Balance Sheet and Cashflow Statement Understand the vital difference between profit and cashflow; identify the key components of working capital and how they can be managed to generate strong cashflow Evaluate pricing decisions based on an understanding of the nature of business costs and their impact on gross margin and break-even sales; managing pricing, discounts and costs to generate strong business profits; understand how lean manufacturing methods improve profit Use powerful analytical tools to measure and improve the performance of their own company and assess the effectiveness of their competitors Apply and interpret techniques for assessing and comparing investment opportunities in capital projects, business acquisitions and other ventures; understand and apply common methods of business valuation Understand the role of business finance in formulating and implementing competitive business strategy; the role of budgeting as part of the planning process and the various approaches to budgeting and performance measurement 1 Basic principles Delivering value to key stakeholders Accounting concepts, GAAP, IFRS and common terms Understanding and using the balance sheet Understanding and using the profit statement Recognising the vital difference between profit and cashflow Understanding and using the cashflow statement What financial statements can and cannot tell us 2 Managing and improving cashflow Sources of finance and their advantages and disadvantages What is working capital and why is it so important? Managing stocks, debtors and creditors Understanding how working capital drives business growth Understanding and avoiding the over-trading trap Unlocking the funds tied up in fixed assets: asset backed loans and leasing 3 Managing and improving profit Understanding how profits generate cashflow The fundamental nature of costs: fixed and variable business costs Understanding gross margin and break-even How common pricing methods affect gross margin and profit Effective strategies to improve gross margin Using value chain analysis to reduce costs Lean manufacturing methodsUnderstanding Just-in-time, 6 Sigma and Kaizen methods Improving profitEffective and defective strategies 4 Measuring and managing business performance Measures of financial performance and strength Investor behaviour: the risk and reward relationship Return on investment (ROI): the ultimate measure of business performance How profit margin and net asset turnover drive return on net assets Why some companies are more profitable that others Understanding competitive advantage: cost and differentiation advantage Why great companies failWhat happened to Kodak? Using a 'Pyramid of Ratios' to improve business performance Using Critical Success Factors to develop Key Performance Indicators 5 Budgeting and forecasting methods Using budgets to support strategy Objectives and methods for effective budgets Using budgets to monitor and manage business performance Alternative approaches to budgeting Developing and implementing Balanced Scorecards Beyond Budgeting Forecasting methods and techniques Identifying key business drivers Using rolling forecasts and 'what-if' models to aid decision-making

Join our Women in Insurance Leadership Workshop and gain insights from industry experts on how to succeed in the male-dominated insurance sector. This workshop is designed to empower women by providing valuable tools and resources to enhance leadership skills, build professional networks, and create a more inclusive workplace culture. Don't miss this opportunity to connect with other women in the industry and take your career to the next level. Register today!

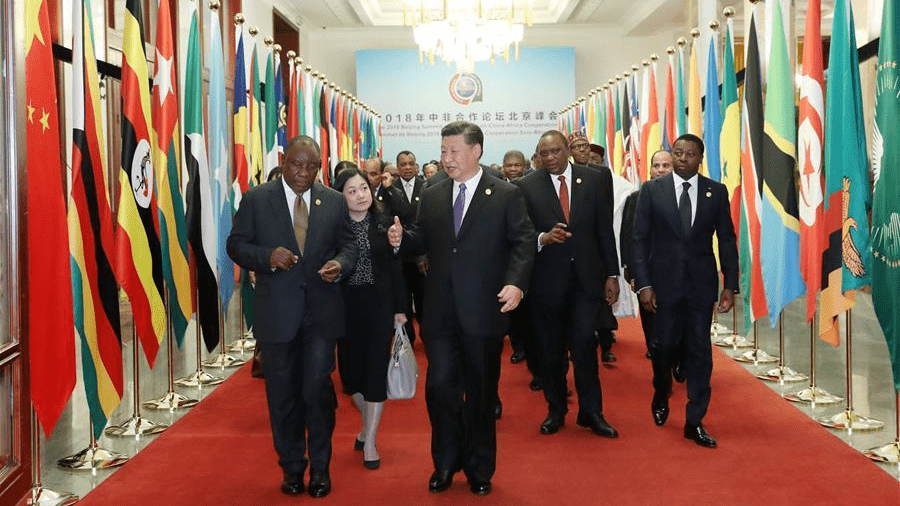

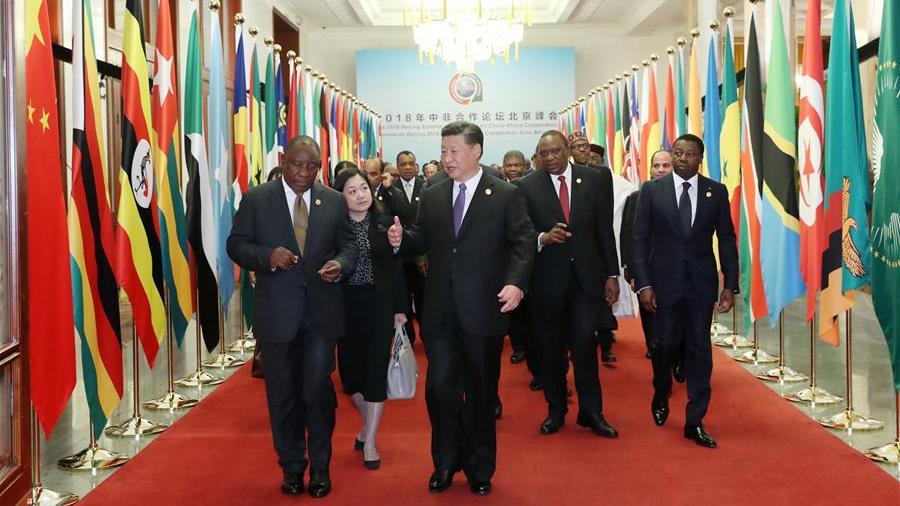

Global Power Shifts and China's Evolving Role in Africa | Live Online Learning

By Gada Academy

Explore China’s growing influence in Africa through this in-depth course. Weekly themes blend history, trends, and analysis to unpack the economic, political, and social layers of this evolving relationship. Gain a nuanced view of its impact on Africa’s global role

Global Power Shifts and China's Evolving Role in Africa | Live Online Learning

By https://gada-academy.cademy.io/

Explore China’s growing influence in Africa through this in-depth course. Weekly themes blend history, trends, and analysis to unpack the economic, political, and social layers of this evolving relationship. Gain a nuanced view of its impact on Africa’s global role

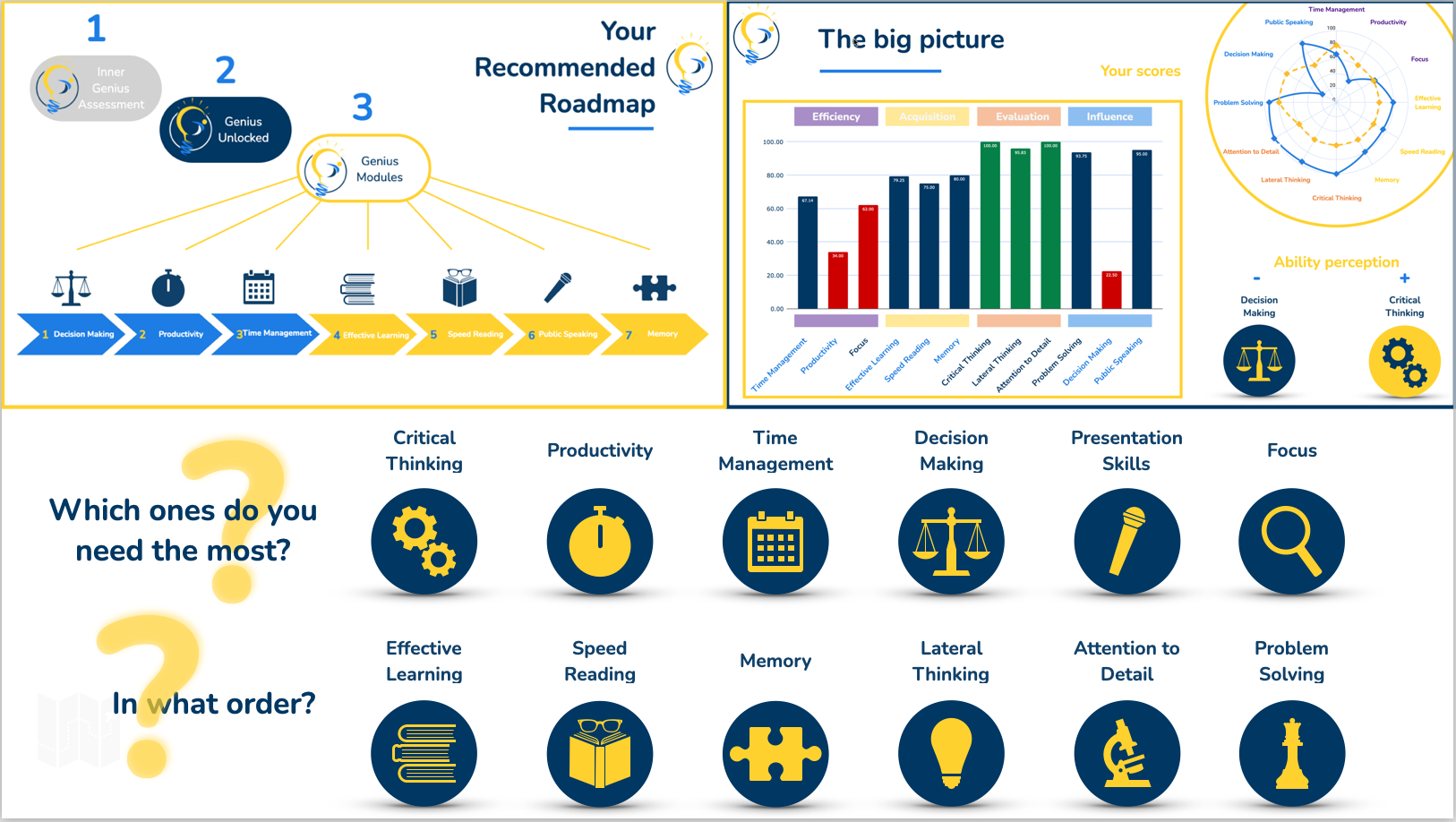

Cognitive Assessment

By inGeniusly

Prioritising and creating order is the first step towards your success. There may be some skills that are fundamental to your results, while others are not something you should focus your efforts on. The Inner Genius Assessment is the perfect tool for you to identify your own personal roadmap.

From Stuck to Soaring: 1:1 Career Coaching with Sarah J Naylor

By Sarah J Naylor

Clarity. Confidence. Career breakthroughs. Are you ready to stop second-guessing and start taking bold action towards the career (and life) you truly want? This 90-minute intensive coaching session is designed for action-ready professionals who are ready to: Gain clarity on their next career move or business pivot Navigate redundancy, reinvention, or a midlife career crossroads with confidence Identify strengths, passions, and values that fuel success Overcome mindset blocks that keep you playing small Create an aligned action plan that gets results With 36 years in recruitment and over a decade as a qualified Level 5 Performance Coach, I blend insider industry expertise with mindset, manifestation, and practical strategies to help you transform confusion into clarity and hesitation into momentum. 💡 This isn’t just a coaching chat — it’s a power-packed session that will leave you with: Crystal-clear insight into your goals and next steps Practical career strategies recruiters actually notice Personalised tools to align mindset + manifestation with action The confidence to take your next leap with energy and purpose Perfect if you’re: ✅ Serious about making a career change and want a fast track to clarity ✅ Ready to bounce forward after redundancy with renewed focus ✅ Curious about blending career strategy with the energetics of manifesting opportunities ✅ Done with dabbling — you’re ready to commit to change ✨ Investment: £197 Take the leap, back yourself, and watch the shifts begin. 🌟 👉 [Book your session today and let’s make things happen.]

GLOBALIZATION AND THE GLOBAL POLITICAL ECONOMY | Live Online | Learning University-Level Course (Non-Credit)

By Gada Academy

Master Globalization and the Global Economy 🌍💡 Discover the forces driving our interconnected world in this live online course. Explore the interplay of politics and economics through key theories, global trade, finance, and governance. Perfect for aspiring policymakers, business leaders, and global thinkers—enroll today to unlock the skills to navigate the global political economy!

GLOBALIZATION AND THE GLOBAL POLITICAL ECONOMY | Live Online | Learning University-Level Course (Non-Credit)

By Gada Academy

This course offers a dynamic introduction to Globalization and the Global Political Economy (GPE), exploring the intricate relationship between political actors and the global economic marketplace. Through a theoretically rich and historically grounded lens, you’ll examine the development, operations, and future trajectory of the global political economy. You’ll learn to apply diverse theoretical frameworks to critically analyze global economic processes. The course begins with an in-depth look at foundational GPE perspectives—mercantilism, liberalism, and structuralism—each built on distinct assumptions that shape our understanding of global economic events. From there, we’ll investigate the international "structures" of production, trade, finance, and knowledge, addressing critical questions: Who controls these structures, and to what end? What rules govern international trade? How do institutions like the IMF, World Bank, and multinational corporations shape global flows of goods and investment? Who benefits from controlling knowledge? The course culminates with an exploration of 21st-century global governance, highlighting the rise of new economic and political power centers and their evolving roles in the world. The course concludes with an exploration of 21st-century global governance, spotlighting the emergence of new economic and political power centers, such as BRICS, and their evolving roles in the world. We’ll also examine how the United States under Donald Trump shifted from traditional liberal internationalism toward more transactional and bilateral approaches, reshaping global relationships and challenging established norms Learning Outcomes By the end of this course, you will be able to: Analyze the major political themes in the historical evolution of the international economy. Understand debates surrounding the emergence and impacts of a globalized economy, including patterns of inequality. Evaluate key GPE theories and perspectives in both historical and contemporary contexts. Apply theoretical insights to explain the causes and effects of international trade, capital flows, monetary relations, and globalization debates. Recognize the vital role of human and environmental security in political economy studies. Demonstrate strong analytical and critical thinking skills when assessing political phenomena. Why Study Global Political Economy? Global Political Economy (GPE), also known as International Political Economy (IPE), untangles the complex interplay between global politics and economics. It’s an ideal field for anyone eager to understand how international policies, trade, finance, and institutions shape the world’s economic landscape. Whether you’re aiming for a career in policymaking, international relations, or a related field, this course equips you with essential tools to navigate the complexities of the global economic system and its profound influence on our world. Who Should Take This Course? This course is perfect for professionals, academics, and students interested in international relations, the global economy, or related disciplines. Whether your focus is policymaking, economic analysis, or global studies, you’ll gain valuable insights and analytical skills to deepen your understanding. Take the Next Step Don’t miss out—register today to secure your spot and immerse yourself in the fascinating world of globalization and political economy!

Learning & Development Level 5

By Rachel Hood

Ensuring learning and development contributes to improved performance in the workplace at an individual, team and organisation level.