- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

70 Courses in Nottingham delivered Live Online

Smart Property Business Builder

By Property SQ2

Build a smarter property business. Entrepreneurial Property Strategies. Treat property like a business and supercharge your investment returns.

Elite EA PA Forum 🇬🇧

By Elite Forums UK

Elite EA/PA Forum We are delighted to announce the Elite EA/PA Forum for the UK & Ireland will be on the 13th November 2025. Our workshop aims to: Enhance your influence and impact by mastering assertive communication, negotiation, and self-advocacy skills. Stay composed and solution-focused in high-pressure situations with practical tools for crisis management and clear decision-making. Embrace evolving technology by understanding how AI and automation can streamline your role and boost efficiency. Future-proof your career by building strategic value, resilience, and adaptability in an ever-changing professional landscape. Keynote Address with Q&A from the audience: What to expect from Sam's Keynote: With over 30 years supporting leaders at the highest levels, Sam Cohen brings a wealth of insight, experience, and stories (the kind she can share) to the stage. From 18 years serving within The Royal Household - including as Deputy Private Secretary and Press Secretary to Her late Majesty Queen Elizabeth II - to working with The Duke and Duchess of Sussex, running the Prime Minister’s Office at Downing Street, and serving as Chief of Staff to the global CEO of Rio Tinto, Sam’s career is a masterclass in discretion, diplomacy, and delivering at the top. In this exclusive keynote, Beyond the Role, Sam will explore how Executive Assistants don’t just support leaders - they shape leadership, drive strategy, and build legacy from behind the scenes. Join us for this rare opportunity to hear from someone who’s been at the epicentre of power - and bring your questions! The keynote will include a live Q&A, where you can ask Sam about her remarkable career, leadership insights, and how to truly excel in high-performance environments. (Don’t ask her what the Queen kept in her handbag - she’s not telling.) Sam Cohen Career Bio: Sam Cohen has spent the last 30 years working to support leaders in the public and private sectors. Sam spent 18 years serving The Royal Household, as Deputy Private Secretary to Her late Majesty Queen Elizabeth II and Press Secretary to The Queen. Sam also served as Private Secretary to The Duke and Duchess of Sussex. Following this time, Sam worked as Director of the Prime Minister’s Office at Downing Street under Boris Johnson and, most recently, was Chief of Staff to the global CEO at Rio Tinto. Source: ABC News - YouTube Channel. Facilitator - AM: Monika Turner The Confident Assistant - Speak Up, Go After What You Want & Create The Future You Deserve: Develop practical strategies to negotiate workload, boundaries, and career growth with confidence. Learn assertive communication techniques to handle challenging conversations effectively. Build self-advocacy skills to articulate your value and influence outcomes in the workplace. Monika Turner Career Bio: Monika Anna Turner is an ICF-certified Leadership and Executive coach with over seven years of experience helping professionals unlock their confidence, elevate their voice, and lead with authenticity. Before stepping into coaching, she built a successful career as a Personal Assistant, Executive Assistant, and ultimately Chief Of Staff —giving her a deep understanding of the unique challenges and strengths of support roles. Originally from Poland, Monika knows firsthand what it’s like to question your voice and your value—especially in a second language. Her journey from self-doubt to self-assurance informs everything she does today. Through her coaching, she empowers assistants and leaders alike to move beyond fear, speak up and create fulfilling careers they’re proud of. Panel Suzie Joughin Senior Executive Assistant at the Houses of Parliament Restoration & Renewal. Suzie is an experienced senior executive assistant, specialising in the public and third sectors. Suzie’s career highlights include senior administrative roles in Cancer Research UK, the largest independent cancer research charity in the world; UK Research and Innovation, the UK’s national funding agency investing in science and research in the UK during the Covid-19 pandemic; and her current role on the Houses of Parliament Restoration and Renewal Programme. Rebecca Polson Executive Support Manager to the Chief Executive An award-winning Executive Assistant with over 10 years’ experience across the higher education, charity, private, and public sectors. Currently Executive Support Manager to the Chief Executive at Alzheimer’s Research UK, she provides high-level support in the fast-paced, mission-driven environment of the largest dementia research charity in the UK. Her previous roles include supporting senior leaders at the Natural History Museum, the Incorporated Society of Musicians, and the Royal College of Music. She brings expertise in executive support, governance, stakeholder engagement, and complex diary and project management. Named PA of the Year in 2023 and a finalist in the SecsintheCity PA of the Year Awards, she is known for her professionalism, discretion, and ability to stay ahead of the needs of the people and organisations she supports. Ola Boddington Senior Executive Assistant As a seasoned Executive Assistant, she has honed her skills in management and project planning over the years. She has worked with various organisations, including Zoa, Signal AI, and ConsenSys, where she provided high-level administrative support to senior executives. Her expertise lies in managing complex schedules, coordinating travel arrangements, and ensuring seamless communication among team members. She is also proficient in using various software tools to streamline workflows and enhance productivity. She is passionate about delivering exceptional service and contributing to the success of the teams she works with. Claudine Martin Senior Executive Assistant Claudine is a highly skilled Senior Executive Assistant, currently supporting the Head of BNY Pershing EMEA. With a distinguished career spanning nearly 17 years in the British Army, Claudine retired in 2023 at the rank of Staff Sergeant, bringing a wealth of experience in high-pressure environments and strategic operations to her current role. Throughout her military career, Claudine specialised in Human Resources, and served as the Personal Assistant to the Army Director of Engagement and Communication at the Ministry of Defence. In this capacity, she played a pivotal role in the planning and execution of significant events and initiatives, showcasing her exceptional organisational skills and attention to detail. Her dedication and professionalism were recognised when she was awarded PA of the Year in 2019 by PA Life. An advocate for the Executive Assistant profession, Claudine is also a sought-after public speaker. She regularly shares her insights at industry events, including the PA Show, and serves as an advisory board member, contributing to the ongoing development and recognition of the profession. Claudine is passionate about empowering others and has previously mentored young people through the Diana Award, a programme established in honour of Princess Diana to support disadvantaged youth. Additionally, she has participated in Fast Forward 15, a mentoring initiative aimed at women aspiring to build careers in events, hospitality, or related industries. With her extensive experience, dedication to excellence, and commitment to mentorship, Claudine continues to make a significant impact in her field and inspire the next generation of leaders. She proudly represented the UK at the Invictus Games 2023, showcasing her unwavering determination and unwavering spirit. In her spare time, Claudine enjoys park run and writing poems. The Importance of Becoming a Strategic Advisor Learn how to shift from reactive to proactive. Develop the mindset and behaviours of a strategic advisor. Understand how to add value beyond your job description. Facilitator - PM: Justin Kabbani AI Is Not Here to Replace You. It's Here to Upgrade You. We'll explore Justin's proven 3P framework: Priming – How to set up AI like a strategic advisor by feeding it context, tone and mindset Prompting – How to craft clear, structured instructions to get consistently great results Producing – How to turn AI outputs into high-leverage work that makes you stand out Your session outcomes: Real examples from admin professionals already using AI to elevate their work Prompts you can copy, adapt, and test live Interactive exercises to build confidence fast A practical challenge to implement right after the session If you’ve been overwhelmed by AI, or underwhelmed by its impact, this session will change that. You'll leave with tools you can use today, and a mindset you’ll carry forward for the rest of your career. Justin Kabbani Career Bio: Justin Kabbani is one of Australia’s most in-demand AI trainers and keynote speakers, known for making AI feel simple, powerful, and immediately useful. He’s worked with brands like Uber, Treasury Wine Estates, and Udemy, helping their teams embed AI into daily workflows, strategic planning, and executive communication. Over the past two years, Justin has trained more than 2,000 professionals across Australia and beyond, consistently earning feedback like “mind-blowing,” and “game-changing”. His signature Prime, Prompt, Produce framework has transformed how business leaders, executive assistants, marketers, and teams think, work, and communicate with AI, without needing to be “tech people.” Justin believes AI isn’t here to replace people. It’s here to take the robotic work off our plate, so we can focus on what humans do best. LinkedIn: https://www.linkedin.com/in/justinkabbani/ Website: https://justinkabbani.com/ Speed Connections Networking Session Join us for Speed Connections, a lively 30-minute networking session designed to foster meaningful connections in a fun, fast-paced environment. Every 10 minutes, attendees will be placed into new breakout rooms with small groups, giving everyone the chance to meet a diverse range of peers. Each breakout session will feature engaging prompts to spark conversations and make networking enjoyable and memorable! Who will attend this event? Executive Assistant (EA) Personal Assistant (PA) Virtual Assistant (VA) Legal Secretary Legal Executive Assistant Administrative Assistant Office Manager Health Care Office Manager Chief of Staff Additional roles may be relevant depending on role responsibilities along with development opportunities. This workshop is open to females, male including trans women/males and non-binary professionals. Group Rate Discounts To discuss our group rates in more detail, please email support@elite-forums.com and provide the following: Group Number (How many would like to attend) Event Date (If numerous dates, please advise if we are splitting attendees across multiple dates) Attendee Contact details (Or request our Group Rate Document. Complete and return - we'll sort the rest.) Group discounts are on request - see below group rate discount brackets: 🧩 You just need one piece to come together - to unlock your Elite Potential. 🔑 Media outlets/organisations will not be permitted to attend this event.

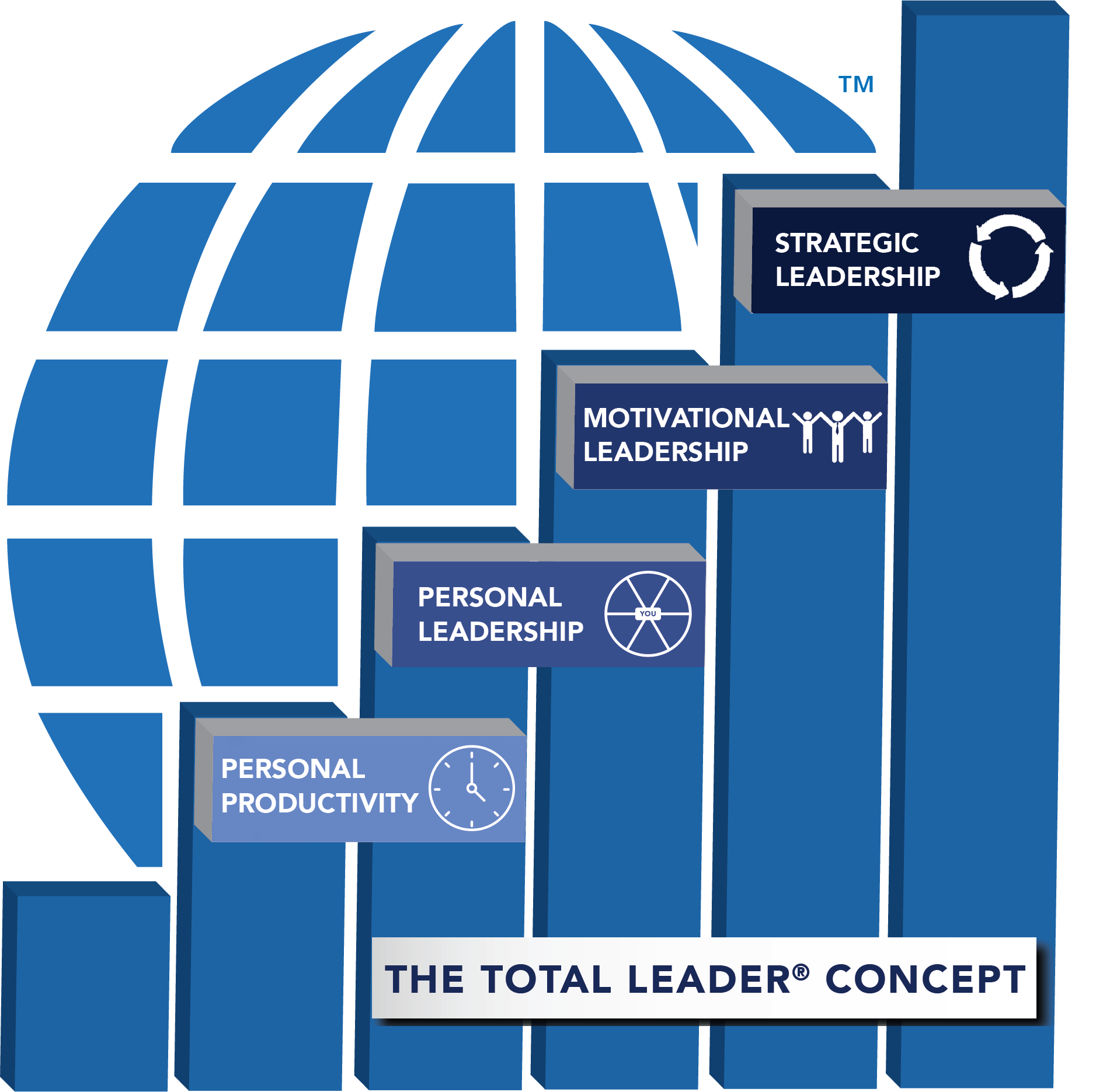

Foundations of Success

By Leadership Management International (LMI) UK

The LMI Foundations of Success workshop introduces the concepts and practical tools used to help countless individuals within thousands of organisations, of all sizes and complexity in both the public and private sector, realise more of their true potential.

Advanced financial analysis (In-House)

By The In House Training Company

In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions: all require some degree of financial knowledge. The key financial skills are not as difficult to learn as many people believe and in the hands of an experienced senior executive they can provide a formidable competitive advantage. After completing this course delegates will be able to: Understand fundamental business finance concepts; understand, analyse and interpret financial statements: Profit Statement, Balance Sheet and Cashflow Statement Understand the vital difference between profit and cashflow; identify the key components of working capital and how they can be managed to generate strong cashflow Evaluate pricing decisions based on an understanding of the nature of business costs and their impact on gross margin and break-even sales; managing pricing, discounts and costs to generate strong business profits; understand how lean manufacturing methods improve profit Use powerful analytical tools to measure and improve the performance of their own company and assess the effectiveness of their competitors Apply and interpret techniques for assessing and comparing investment opportunities in capital projects, business acquisitions and other ventures; understand and apply common methods of business valuation Understand the role of business finance in formulating and implementing competitive business strategy; the role of budgeting as part of the planning process and the various approaches to budgeting and performance measurement 1 Basic principles Delivering value to key stakeholders Accounting concepts, GAAP, IFRS and common terms Understanding and using the balance sheet Understanding and using the profit statement Recognising the vital difference between profit and cashflow Understanding and using the cashflow statement What financial statements can and cannot tell us 2 Managing and improving cashflow Sources of finance and their advantages and disadvantages What is working capital and why is it so important? Managing stocks, debtors and creditors Understanding how working capital drives business growth Understanding and avoiding the over-trading trap Unlocking the funds tied up in fixed assets: asset backed loans and leasing 3 Managing and improving profit Understanding how profits generate cashflow The fundamental nature of costs: fixed and variable business costs Understanding gross margin and break-even How common pricing methods affect gross margin and profit Effective strategies to improve gross margin Using value chain analysis to reduce costs Lean manufacturing methodsUnderstanding Just-in-time, 6 Sigma and Kaizen methods Improving profitEffective and defective strategies 4 Measuring and managing business performance Measures of financial performance and strength Investor behaviour: the risk and reward relationship Return on investment (ROI): the ultimate measure of business performance How profit margin and net asset turnover drive return on net assets Why some companies are more profitable that others Understanding competitive advantage: cost and differentiation advantage Why great companies failWhat happened to Kodak? Using a 'Pyramid of Ratios' to improve business performance Using Critical Success Factors to develop Key Performance Indicators 5 Budgeting and forecasting methods Using budgets to support strategy Objectives and methods for effective budgets Using budgets to monitor and manage business performance Alternative approaches to budgeting Developing and implementing Balanced Scorecards Beyond Budgeting Forecasting methods and techniques Identifying key business drivers Using rolling forecasts and 'what-if' models to aid decision-making

Investment

By NextGen Learning

Course Overview: This Investment course offers learners a comprehensive understanding of investment strategies and financial markets. The course covers a range of essential topics, including different investment types, portfolio management, and risk assessment. Learners will gain valuable insights into bond and stock markets, enabling them to make informed decisions in diverse investment environments. The course is designed for those looking to enhance their investment knowledge, regardless of their current financial expertise, providing a solid foundation in the principles of investing. Course Description: In this course, learners will explore various investment methods, from bonds to stocks, and gain an understanding of core financial concepts such as portfolio diversification and risk management. The course delves into investment theory, focusing on how markets function, the evaluation of potential returns, and the identification of risk factors. With an emphasis on building a structured investment strategy, learners will also gain an understanding of how to manage and optimise their portfolios. By the end, learners will have the tools and knowledge to evaluate different investment opportunities, supporting their financial growth and decision-making processes. Course Modules: Module 01: Introduction to Investment Overview of investment basics The role of investments in personal finance Understanding risk and return Module 02: Types and Techniques of Investment Stock market, bonds, and real estate investments Active vs passive investing Introduction to alternative investments Module 03: Key Concepts in Investment Compound interest and time value of money Diversification and asset allocation Financial instruments overview Module 04: Understanding the Finance Basics of financial statements Financial ratios and metrics Introduction to valuation techniques Module 05: Investing in Bond Market Types of bonds and their characteristics Bond pricing and yields Understanding interest rates and bond durations Module 06: Investing in Stock Market Stock market indices and trading Analysis of stock performance Fundamentals of stock picking Module 07: Risk and Portfolio Management Measuring and managing investment risk Portfolio construction and diversification strategies Evaluating portfolio performance (See full curriculum) Who is this course for? Individuals seeking to develop investment skills for personal financial growth. Professionals aiming to enhance their understanding of financial markets. Beginners with an interest in investing and financial markets. Anyone interested in building a solid foundation in investment strategies. Career Path: Investment Analyst Financial Planner Portfolio Manager Stock Broker Risk Manager Wealth Manager Financial Consultant

Talent Management and Succession Planning

By FD Capital

Talent Management and Succession Planning,” the podcast where we explore the critical aspects of attracting and retaining top finance talen Talent management is the lifeblood of any organisation, and finance departments are no exception. In a competitive business landscape, attracting and retaining top finance talent can make a significant difference. Highly skilled and motivated professionals drive innovation, improve financial performance, and contribute to strategic decision-making. By investing in talent management, CFOs ensure their organisations have the right people in the right roles, which is vital for sustainable growth and success. Talent management also enables CFOs to build a culture of continuous learning and development. By nurturing the skills and capabilities of finance professionals, we create an environment that fosters innovation and adaptability. This is crucial in today’s rapidly changing business landscape, where finance teams need to keep pace with evolving technologies, regulations, and industry trends. Talent management provides a foundation for building a resilient and agile finance function. Succession planning is an integral part of talent management. How do CFOs approach succession planning, particularly in finance leadership roles? Succession planning is a proactive approach to ensure a smooth transition of leadership roles. CFOs need to identify high-potential individuals within their finance teams and provide them with opportunities for growth and development. This includes mentorship, training programs, and exposure to cross-functional experiences. By preparing a pipeline of future finance leaders, CFOs can mitigate the risks associated with unexpected departures or retirements, ensuring continuity and stability in finance leadership. Additionally, succession planning should encompass diversity and inclusion. CFOs recognize the importance of building diverse finance teams that reflect the broader talent pool. By providing equal opportunities for underrepresented groups and promoting inclusivity, we foster a culture of belonging and tap into a wider range of perspectives and ideas. Diverse teams drive innovation and improve decision-making, contributing to the overall success of the organisation. How do CFOs create a talent development culture within their finance teams, and what initiatives can be implemented to foster continuous growth? CFOs can create a talent development culture by prioritizing learning and development initiatives. This includes offering ongoing training programs, supporting professional certifications, and providing access to resources that enhance technical and soft skills. CFOs should encourage finance professionals to take ownership of their own development and provide opportunities for them to stretch their capabilities. This may involve cross-functional projects, exposure to different areas of the business, or participation in industry conferences and networking events. Additionally, mentorship and coaching programs play a crucial role in talent development. CFOs can pair experienced finance leaders with up-and-coming talent, fostering knowledge transfer, and providing guidance and support. Encouraging regular feedback and performance discussions helps finance professionals understand their strengths and areas for improvement, enabling targeted development plans. By creating a culture that values continuous learning and growth, CFOs empower their finance teams to reach their full potential. https://www.fdcapital.co.uk/podcast/talent-management-and-succession-planning/ Tags Online Events Things To Do Online Online Classes Online Business Classes #leadership #development #successionplanning #employees #talentmanagement

Are you looking to enter the dynamic world of real estate? Our course is designed to equip you with the knowledge and tools you need to communicate effectively with real estate professionals and develop key skills in real estate investment strategy and analytics. At the end of the course, you'll be able to read and interpret real estate market reports, and have a firm grasp of how iconic buildings, cities, and companies fit into the overall picture of the real estate sector. On this course, you will… Become familiar with the players, structure, general terminology and overall needs of Real Estate. Learn what is Real Estate and why it is different from other asset classes Get to grips with the overall size and structure of the UK Real Estate Market Learn and analyse the links between the different parts of the property market Understand who works in the Real Estate Market, their qualifications and their job descriptions Recognise how and when to use basic real estate concepts: Rent, Value, Yield, Risk and Return, etc… Learn how to read a real estate market report Understand how current affairs, politics and economics affects Real Estate Investment Use household names and iconic companies, cities and buildings to help consolidate your appreciation of this exciting sector Who will benefit from this course: Graduates or undergraduates studying economics, finance. Professionals working in Marketing or Accounting teams within Real Estate firms. APC students. Anyone interested in Real Estate. School leavers/A-Level Students looking to gain an understanding of Real Estate. Non cognate students who wish to transfer into Real Estate/Finance careers. Course Outline Module 1: What is and why buy Real Estate? The property Market The Size and Structure of the UK property market The impact of Real Estate in the Economy Module 2: The Real Estate Market System The Space Market The Asset Market The Development Market Module 3: How to value Real Estate An Introduction to Financial Mathematics The difference between Price, Value and Worth Property Yield Conventional Valuation Methods Module 4: How to read a Real Estate Market Report Property Market Indicators: Stock Indicators Property Market Indicators: Investment Indicators Module 5: Who works in Real Estate? The build Environment by Cobalt Recruitment Rea; Estate Agents Examples of Real Estate Market Agents CVs Real Estate Network

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please click here. To learn more about schedule, pricing & delivery options speak to a course specialist now