- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

313 Courses in London delivered Live Online

Certificate in Business and Commercial Law (CBCL) - Virtual Learning

By EMG Associates UK Limited

Certificate in Business and Commercial Law (CBCL) - Virtual Learning Why Attend This course is designed for professionals with little or no prior legal background but who are required to make organizational decisions involving legal matters. It will provide participants with the fundamental principles of commercial law, including commercial contracts and negotiation, sale of goods, intellectual property rights and employee relations. It also covers all the legal aspects of setting up a business, running a business and closing a business Participants will gain an in-depth understanding of international commercial law with emphasis on the common law system. Participants will have the opportunity to learn and analyze key legal issues regarding contracts and the business as a whole which they are likely to encounter within their organization. Course Methodology In this interactive training course participants will frequently work in pairs as well as in larger groups to complete exercises as well as regional and international case studies. Course Objectives By the end of the course, participants will be able to: Apply legal rules and principles to speciï¬c commercial situations through consideration of relevant case law Negotiate commercial contracts complying with commercial and legal requirements Increase proï¬tability within their organization by selecting appropriate methods of distribution of goods Recognize and analyze how intellectual property rights aï¬ect their organization Evaluate and modify organizational employment practices complying with labor law requirements Target Audience This course is suitable for those with little or no formal training in commercial law yet would be required to understand the fundamentals of commercial law as it may directly impact their work. It will particularly beneï¬t directors and executives who have direct responsibility for legal decisions within the organization. In-house council new to the region, and those working within a legal department, will also ï¬nd this course highly beneï¬cial. Target Competencies Drafting Contracts Contract Negotiation Understanding Commercial Terms Understanding Employment Law Implementing Organizational Employment Practices Understanding Intellectual Property Understanding corporate restructuring Understanding the effect of breach of commercial contract terms Note The Dubai Government Legal Aï¬airs Department has introduced a Continuing Legal Professional Development (CLPD) programme to legal consultants authorised to practise through a licensed ï¬rm in the Emirate of Dubai. We are proud to announce that the Dubai Government Legal Aï¬airs Department has accredited EMG Associates as a CLPD provider. In addition, all our legal programmes have been approved. This PLUS Specialty Training Legal course qualiï¬es for 4 elective CLPD points. Overview of commercial & business law Areas of commercial and business law Types of commercial contracts Commercial contracts in the civil law and common law systems Sources of English law Civil law v Common law Civil law in the GCC Formalities for a binding contract Elements required for an enforceable contract Rules for contract interpretation implied terms v express terms identifying risks and how to minimise risks Structure of a commercial contract Preliminary documents in international transactions Memorandum of Understanding/ Heads of Terms. Are they legally binding? Commercial implications Boilerplate/ miscellaneous provisions- the important but forgotten clauses- beware! Force majeure v Frustration Notices Set oï¬ No waiver Entire Agreement/ non- reliance clause Times is of the essence Assignment v Novation Governing law Common mistakes in choice of law Jurisdiction clause Exclusive v Non-exclusive Factors in deciding the jurisdiction clause International dispute resolution Litigation Importance of Alternative Dispute Resolution (ADR) Arbitration Mediations Conciliation Negotiation Remedies for breach of contract Damages Specific performance Injunctions Advantages and disadvantages of different business forms Types of business vehicles Sole trader Partnerships Limited Liability Partnerships Companies Cross Border Transactions Distributorship Agency Joint Venture Acquisitions Share purchase v Business purchase Apportioning risks and liabilities through warranties and indemnities Negotiating warranties and indemnities Corporate insolvency Tests identifying insolvency Consequence for directors who fail to react to insolvency Types of insolvency Administration Receivership Creditor Voluntary Liquidation Compulsory Liquidation Commercial Tort Tort of negligence Defamation Libel Slander Recent case law on defamation Managing risk Prevention is better than cure: Eï¬ective risk management Intellectual Property Rights management Types of Intellectual Property copyright trademark patent design rights confidential information Assignment v Granting a license The law of passing off Intellectual Property in the GCC Employment law issues in the common law systems and the GCC Types of employment contracts Grounds for dismissal Wrongful dismissal Redundancy Unfair dismissal Commercial real estate in the GCC Leasehold Freehold

Immigration Law Course

By Centre for Human Development CHD

www.linkedin.com/company/chdlondon www.instagram.com/chd_london www.facebook.com/CHDLondon www.twitter.com/CHD_London

Immigration Law Course - OISC Level 1

By Centre for Human Development

Are you interested in becoming a qualified immigration adviser? Do you want to practice immigration law in the UK? Our 3-month immigration law course will teach you everything you need to know! It’s taught by our skilled team of solicitors and qualified immigration advisers, and it includes CPD accredited training to help you further your career.

Introduction to Immigration Law

By Immigration Advice Service

Our Introduction to Immigration Law course is a full-day course designed for those who are interested in a career in immigration law. About the course Our introduction to UK Immigration Law course is aimed at those looking to venture into the increasingly popular and relevant world of immigration law. This exciting course will give you an overview of the various UK visa routes as well as looking into a “day in the life” of an immigration caseworker, with the opportunity to work through a real visa application form. During this course we’ll also guide you on the path to accreditation, providing valuable insights into the requirements and steps to become a recognised immigration professional. Course joining links, materials and instructions are sent out 24hours before the course starts. Course information Course: Introduction to Immigration Law Duration: 1 day Delivery Method: Online Trainer: Expert Immigration Trainer CPD: 6 Points Career Path: Immigration Advisor Entry Requirements: None Why Study with Immigration Advice Service. Immigration Advice Service has been providing professional immigration services for over 10 years in the public, private and corporate sectors. Our Introduction to Immigration Law course will give you an insight into UK Law, covering key fundamentals as well as how to become an accredited advisor. Our qualified and OISC regulated trainer will guide you through the process and ensure you are competent with elements covered within the course. Content covered in the course: General knowledge of immigration law A look at common visa routes:Entry clearanceFamily visasVisit visasPBS How to take instructions from a client Drafting letters for clients How to work through a visa application form How to become accredited

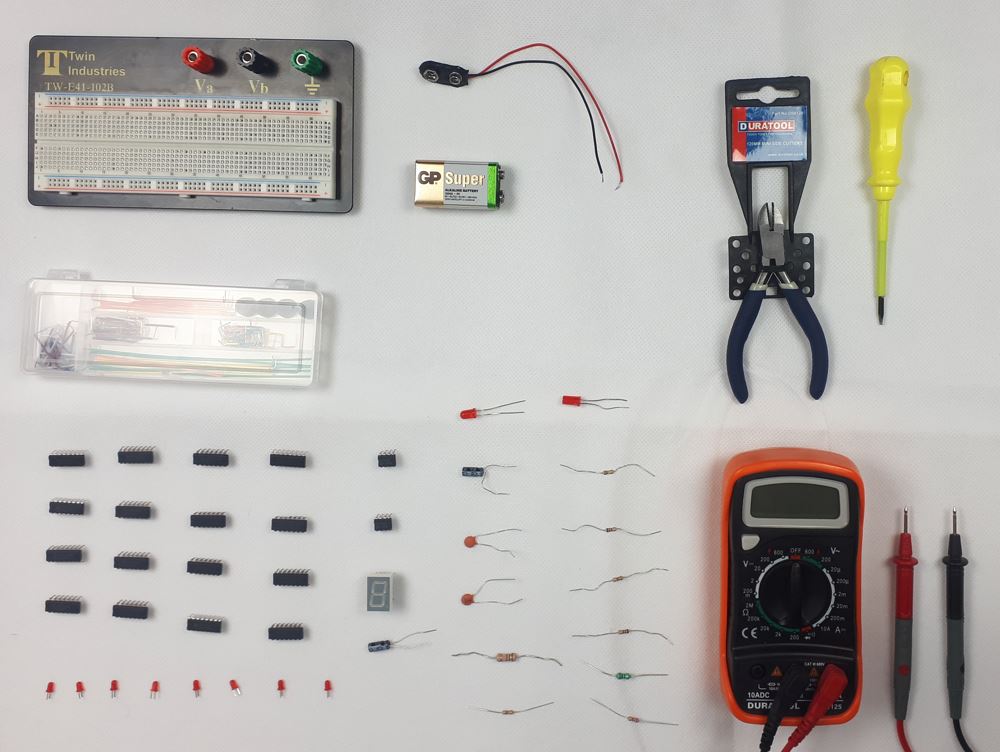

Digital Electronics Course Online

By Hi-Tech Training

This Digital Electronics Course is designed to give practical knowledge of the type of electronic circuitry used in a modern Computer System or in any type of Computer Controlled equipment such as Photocopiers, Cash Registers, Tablets, mobile phones and many other types of IT equipment. Digital Electronics involves the use of Silicon chips (Integrated Circuits). The internal structure of a computer is to a large extent comprised of Digital Electronic Circuits.

Immigration Case Law Updates Webinar

By Immigration Advice Service

Join our Immigration Case Law Updates Webinar and keep up to date with the latest changes in Immigration Law. Each webinar is between 30 – 45 minutes. Join Lawyers, Solicitors, Immigration Advisors and Organisations keeping up with these changes. Immigration Case Law Updates Webinar Stay ahead of the curve in the dynamic landscape of immigration law! Our Lunch and Learn Webinar Series is tailored for legal professionals, including lawyers, solicitors, immigration advisors, and organisations navigating the complexities of immigration law. Bring your lunch and join us for our bitesized webinar keeping you updated on major changes in Immigration Law. This monthly session ranges from 30 minutes to 45 minutes depending on the changes announced. 🔍 Highlights: In-Depth Case Law Analysis: Explore the latest updates and rulings shaping immigration law, providing you with a comprehensive understanding of recent changes. Interactive Discussions: Engage in interactive discussions with industry experts, sharing insights, best practices, and practical strategies to enhance your proficiency in handling immigration cases. Stay Current: Keep abreast of the ever-evolving legal landscape, ensuring you’re equipped with the knowledge to deliver the best possible outcomes for your clients. Monthly Sessions: Join us on the first Thursday of each month for an enriching and informative lunchtime session that fits seamlessly into your schedule. 🎓 Who Should Attend: Lawyers Solicitors Immigration Advisors Immigration Organisations 📚 Key Takeaways: Deepened understanding of recent case law developments Enhanced practical skills for effective immigration case management Networking opportunities with fellow legal professionals 📆 Save the Date: Mark your calendar for the first Thursday of every month and elevate your expertise in immigration law. Links to the webinar will be sent out 24hours before the start time to the email address used at the time of booking.

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Data Protection (GDPR) Practitioner Certificate - live, online

By Computer Law Training

GDPR Practitioner

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

IAAS: Casework Assistant Exam Preparation Course

By DG Legal

This half day online course will assist candidates in preparing for the forthcoming initial Casework Assistant exam.