- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

399 Courses in Cardiff delivered Live Online

Level 3 Award in Assessing Vocationally Related Achievement

By Panda Education and Training Ltd

Course Description By enrolling on this course you will: Understand the role of an assessor and the principles and practices of assessment Plan assessments in workshops or classroom with at least two learners Use different assessment methods, make assessment decisions and give feedback to learners Involve learners and others in the assessment process – ensuring decisions are countersigned, quality assured and that assessment practice is standardised Apply legal and regulatory requirements to your assessment Benefits Gain the industry standard qualification to be a classroom / workshop assessor Interactive online workshops and one to one support to complete assignments One to one mentoring to support achievement of the practical unit Receive mentoring and support form qualified and experienced assessors

Medical Terminology Training Courses - Level 3

By Mediterm Training

This course leads to the Mediterm Advanced Certificate in Medical Terminology (Level 3), the highest qualification in Medical Terminology, and can be studied flexibly over 20 weeks

Who is the course aimed at? This course is designed for both engineers with experience, and also for new entrants from a non-engineering background who want to pursue a new career as a Service Engineer. For those without an engineering background, it is recommended that you have a minimum grade C at GSCE Maths. Click here for more information

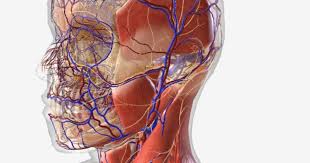

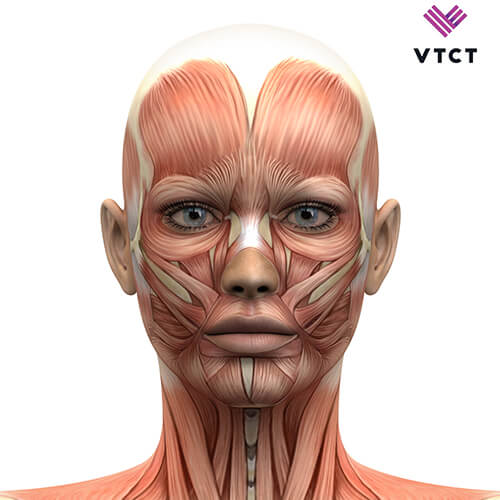

Level 3 Anatomy and Physiology

By FNBC Training Academy

Anatomy and physiology

Sketchup One to One Basic to Intermediate Level

By Real Animation Works

Sketchup face to face training customised and bespoke.

NVQ Level 2 Diploma in Construction Operations and Civil Engineering Services - Highways Maintenance

5.0(29)By Site Competence

Blue CSCS Card Level 2 NVQ Diploma in Construction Operations and Civil Engineering Services - Highways Maintenance Induction - As soon as you register you will be given a dedicated assessor. They will arrange an induction and together with your assessor, you will get to decide on the pathway which best proves your competency. The induction is used to plan out how you will gather the relevant evidence to complete the course. During the course - The assessor will work with you to build a portfolio of evidence that allows you to showcase your knowledge, skills and experience. The assessor will also regularly review and provide you with feedback. This will allow you to keep on track to progress quickly. You will be assessed through various methods such as observations, written questions, evidence generated from the workplace, professional discussion, and witness testimonials. On completion - Once all feedback has been agreed, the Internal Quality Assurer will review your portfolio and in agreement with your assessor the certificate will be applied for. To download our PDF for this course then please click here.

Level 3 Certificate in Assessing Vocational Achievement

By Step Into Learning

If you work with adults and young people and wish to gain a knowledge of the principles and practice of assessment as well as the practical aspects of carrying out assessment, then Level 3 Certificate in Assessing Vocational Achievement is for you.

Sage 50 Computerised Accounting / Bookkeeping Training - Fast Track

By Osborne Training

Sage 50 Computerised Accounting / Bookkeeping Training - Fast Track Overview: If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounting course will teach everything you need to know, while helping you gain a recognised qualification. This course is designed to provide individuals from beginner to advanced knowledge of bookkeeping and Sage 50 accounts. It is intended for individuals who aim to improve career prospects and to be able to better financial management and control of the business. This course covers Level 1-3 of Sage 50 Bookkeeping/Accounting Training. Every business, no matter how large or small, is required by law to 'keep books'. Therefore, Bookkeepers play a vital role within organisations; ensuring records of individual financial transactions are accurate, orderly, up to date and comprehensive. If you are organised and methodical, like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping is the career for you. You will receive a CPD Completion certificate from Osborne Training once you finish the course. Then, you have an option to attain a Certificate from SAGE(UK) subject to passing the exams. Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

This Level 3 anatomy & physiology (or A & P as it is commonly known) is a perfect course for those who are looking to build upon their existing knowledge of skincare, but is also open to complete beginners. Please confirm dates and availability with us prior to purchasing Who Is This Course Suitable For? Pre-requisites None required. Course Content You will cover: Skin, nails and hair The skeletal system The muscular system The nervous system The endocrine system The respiratory system The cardiovascular system The lymphatic system The digestive system You will have 1 Assignment and 1 Exam Course Duration & Cost No date required, please go ahead and BOOK, we will email across all relevant home studying information directly to your email address You have a minimum of 6 weeks to study for the exam and a maximum of one year This course is ALL home studying You will need inform us when you feel you are ready to sit your exam, we can take a look at a few assessment dates for you at our Leicester centre. Remote (Webcam) Exams If you cannot attend our assessment Centre we can arrange for you to take your final assessment remotely via webcam. Dates for remote exams are flexible and can be booked in with our team when you have completed your online coursework. £330 Categories: ofqual

Sage Payroll Training Course - Fast Track

By Osborne Training

Sage Payroll Training Course - Fast Track This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. You will receive a CPD Completion certificate from Osborne Training once you finish the course. What skills will I gain? In this course you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land on your dream job in Payroll sector. Level 1 Introduction to payroll Introduction to Real Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the payroll Procedures Level 2 Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3 Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay