- Professional Development

- Medicine & Nursing

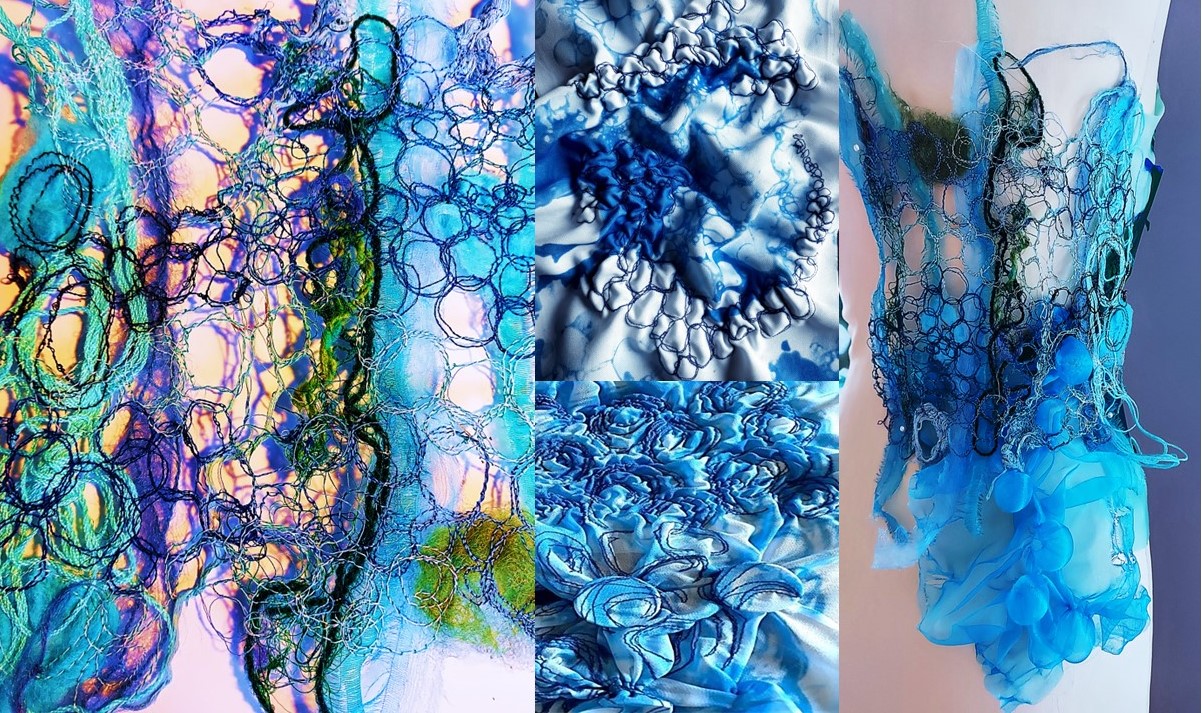

- Arts & Crafts

- Health & Wellbeing

- Personal Development

QA Level 3 Award In Emergency Paediatric First Aid (RQF) This page is here if you'd like us to run this course for you and your people, at our venue or yours (within 45 minute drive from Chesterfield, Derbyshire). If you'd like us to run this course for you and you're further away, please contact us direct for a quote. If, instead, you're interested in an open/public course, please go here. Full day course Would you know what to do if you saw a child in need of First Aid? Being able to deal with paediatric emergencies can make the difference between the life and death of children, and save them a lot of suffering Course Contents: The Roles and Responsibilities of an Emergency Paediatric First Aider Assessing an Emergency Situation Accident Recording Minor Injuries Cuts, Grazes and Bruises Minor Burns and Scalds Managing an Unresponsive Infant or Child Recovery Position CPR Safe Use of an AED (Automated External Defibrillator) Choking Anaphylaxis Seizures Wounds and Bleeding Shock Benefits of this course: Would you know what to do if you saw a child in need of First Aid? Children are prone to minor injuries, but suffer from serious injuries also In 2014, 2,269 children in the UK were so badly bitten by an animal they had to be admitted to hospital More than 2 million children have accidents in the home for which they're taken to A&E - every year, with Under 5s accounting for 7% of all hospital emergency treatments Being able to deal with peadiatric emergencies can make the difference between the life and death of children, and save them a lot of suffering. This QA Level 3 Award in Emergency Paediatric First Aid (RQF) qualification is ideal for: - Parents/carers or family members who want to learn key paediatric first aid skills - Those who work with children and are not required to comply with Ofsted’s Childcare Register or Early Years Foundation Stage (EYFS) 2014 requirements Those who want to provide additional support in their organisation to existing paediatric first aiders that are trained to meet Ofsted’s Childcare Register or Early Years Foundation Stage (EYFS) 2014 requirements. For those who will be directly responsible for children, Ofsted requires people to do our two day Paediatric First Aid course instead We also run a Paediatric Annual Refresher to keep those life-saving skills up to date Accredited, Ofqual regulated qualification: Our Emergency Paediatric First Aid at Work course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards.This means that you can be rest assured that your Emergency Paediatric First Aid certificate will fulfill the legal requirements. It is a very good way to make sure you and your employees are trained in First Aid for Children and Infants (babies).The Ofqual Register number for this course is 603/0786/9

QA Level 3 Award In Emergency First Aid At Work (RQF) This page is here if you'd like us to run this course for you and your people, at our venue or yours (within 45 minute drive from Chesterfield, Derbyshire). If you'd like us to run this course for you and you're further away, please contact us direct for a quote. If, instead, you're interested in an open/public course, please go here. Full day course Gives learners the knowledge and skills to be an emergency first aider Recommended by HSE for low-risk workplaces Course Contents: The Roles and Responsibilities of an Emergency First Aider Assessing an Incident Minor Injuries Cuts, Grazes and Bruises Minor Burns and Scalds Managing an Unresponsive Casualty CPR Safe Use of an AED (Automated External Defibrillator) Choking Seizures Wounds and Bleeding Shock Benefits of this course: 1.1 million workers in Britain had an accident at work in 2014/2015 Of those, 2,700 were from the East Midlands On average, one out of every 370 people received an injury at work The estimated cost of injuries and ill health last year was £15 billion The Health and Safety (First Aid) Regulations 1981 require all employers to make arrangements to ensure their employees receive immediate attention if they are injured or taken ill at work. This includes carrying out a risk assessment, appointing a suitable amount of first aiders and providing adequate first aid training Typically, first aiders will hold a valid certificate in either First Aid at Work (FAW) or Emergency First Aid at Work (EFAW) Our QA Level 3 Award in Emergency First Aid at Work (RQF) - EFAW - training course is the one recommended for first aiders in a low risk workplace Having the correct first aid provision in the workplace is not just a legal requirement, it is incredibly important for the safety of all members of staff! As this is a Regulated Qualification, employers can book this course for their employees in the safe knowledge that they have fulfilled their legal responsibilities for providing quality first aid training, without having to undertake any lengthy due diligence checks Accredited, Ofqual regulated qualification: Our Emergency First Aid at Work course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards.This means that you can be rest assured that your Emergency First Aid at Work Certificate fulfills the legal requirements and is a very good way to make sure you and your employees are trained in First Aid.The Ofqual Register number for this course is 603/2367/X

Skin Booster Training Course

By Harley Elite Academy (HeLa)

ADVANCED 8 CPD POINTS 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! This course theory will help you to understand: We will cover all you need to know in order for you to treat your patients confidently and safely. The Theory will cover; Anatomy and physiology Ageing Characteristic of the ideal skin booster Product Introduction Treatment Method Contraindication Complication management Pre & Post-treatment advices Using Products like Toskani, Skinecos, Jalupro etc. Using Products , PROFHILO, recommended for midd and low part of the face as well as other delicate areas of skin such as the neck, décolletage, hands or knees. Practice will enable you to learn in 1-day ONE-TO-ONE Training We will cover pertinent information including mechanism of action, safety and efficacy issues, management and treatment of complications, dilution guidelines, and more. A certification of hands-on training will be provided upon completion of the course. You will perform this procedure on live models injecting superficially and administrating the product (skinbooster) into the subcutaneous layer. This will happen under the supervision and guidance of highly experienced aesthetic practitioners. You will practice injectables with needle on; Face, Neck, Decolatege & Hands You need to be medically qualified as a doctor, dentist, nurse, pharmacist or paramedic with full governing body registration and have completed a Foundation Filler Course and to have administered a number of cases. Additional information ATTENDANCE ONLINE (Theory), IN CLINIC (Practice) COURSE LEVEL INTERMEDIATE | Advanced Course

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Course Summary Taught by Sports Massage Therapist Laura Simmons, this practical course will cover everything you need to know, enabling you to incorporate Dry Suction Cupping into your current treatments. Covering all the theory as well as ensuring you have plenty of practical demonstration and practice during the course. This is a great addition to any manual therapist treatment for both the therapist and the patient. You will be introduced to the use of Dry Cupping therapy for the purpose of muscular pain relief via a blend of theory and practical components. With a substantial amount of practical work where you will gain adequate practice to hone your skills enabling you to use all the techniques shown within your practice. Course Content Introduction History of Cupping Different Cups Cupping Application Effects of Cupping Contractions & Contraindications Effects of Cupping Gathering Information Cupping Application; Massage, Stationary, Pin and Stretch and Active Cupping We only have small numbers on all our courses ensuring you have plenty of time with Laura to really develop your technique and feel confident in offering this technique to your patients. We pride ourselves on always being there ready to help and offer advise not only during the course but after as well, all you need to do is ask! Course Prerequisites Physiotherapists Osteopaths Chiropractors Manual Therapists Sports Therapists Sports Massage Therapists Personal trainers We may ask you to provide a copy of your qualification. Assessment Observation during the course day Once completed you will be able to add Dry Cupping therapy on to your own indemnity insurance Venue BTST Academy & Clinic, Holly Farm, Clipstone Road, Edwinstowe, Nottingham, NG21 9JD Course Times 9:30am – 4:30pm Course Price £ 175 Course Terms & Conditions: Course payment is non refundable , Click here for the terms and conditions. Course Accreditation Accredited by Active IQ

Values Based Recruitment

By Mpi Learning - Professional Learning And Development Provider

Recruiting great people to our organisations is the key to high performance and sustainable business success.

Search By Location

- HR Courses in London

- HR Courses in Birmingham

- HR Courses in Glasgow

- HR Courses in Liverpool

- HR Courses in Bristol

- HR Courses in Manchester

- HR Courses in Sheffield

- HR Courses in Leeds

- HR Courses in Edinburgh

- HR Courses in Leicester

- HR Courses in Coventry

- HR Courses in Bradford

- HR Courses in Cardiff

- HR Courses in Belfast

- HR Courses in Nottingham