- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

COSHH & RIDDOR

By Prima Cura Training

This course is designed to provide delegates with awareness in the Control of Substances Hazardous to Health (COSHH) and how it may affect them, their colleagues, and their employer.

First Aid for Mental Health 1-day

By Prima Cura Training

This course is suitable for everybody although it has been specifically designed to help employers to provide a positive mental health culture within their organisation. Learners will gain a comprehensive knowledge of a range of the most common mental health conditions and the skills of how to act.

2-Day Paediatric & Early Years First Aid (Ofsted Approved)

By Prima Cura Training

The Paediatric First aid course provides the comprehensive set of practical skills needed by first aiders in childcare settings. Giving both the ability and knowledge to deal with first aid emergencies and common childhood illnesses. It meets the standards required to help comply with Ofsted regulations.

Drug & Alcohol Awareness (Substance Misuse)

By Prima Cura Training

This course is developed for staff and volunteers to raise awareness of drug and alcohol misuse issues and are adequately informed and enabled to work effectively with individuals with dependencies.

Awareness of First Aid for Mental Health

By Prima Cura Training

The half-day First Aid for Mental Health Awareness course provides a concise yet impactful overview of essential mental health concepts. Participants gain a foundational understanding of common mental health conditions, learn to recognize signs and symptoms, and explore effective communication strategies.

Role of the Care Worker and Personal Development

By Prima Cura Training

This course presents the role of the care worker using demonstrations of good and bad practices. It includes information on Core Values, Code of Conduct, and Continual Professional Development. This subject forms Standard 1 of the Care Certificate.

Advanced Bookkeeping Excel Courses online | Excel Training in Campus

By Osborne Training

Why Join Digital Marketing Training Course at Osborne Training Osborne Training is well Recognised for quality Regular Lectures led by Industry Expert Tutors Unlimited Access to the State of the Art Virtual Learning Campus Exclusive Access to High quality study materials Flexible payment option available Join Digital Marketing Training course as Pure Online or Blended with Classroom Delivery Access to Digital Marketing Internship for 3 months at the end of the training Unlimited Tutorial Support from expert tutors Get a Student Discount Card from NUS* Get a Free Tablet PC for limited period* Practical Hands-on Projects, Practical focused Assignments and Group-work for greater skills enhancement and understanding real life issues for real life problems Once you complete the bookkeeping course, you will get a certificate from Osborne Training confirming your professional Digital Marketing Qualifications. What jobs could I qualify for? Senior Digital Marketing Manager Digital Marketing Coordinator Executive Digital Marketing Strategist Digital Marketing Consultant In these roles, you could earn on average more than £40,000 annually (source: Reed Salary Checker, UK). Moreover, many go on to become successful (Millionaire sometime) entrepreneur by offering Digital Marketing services or formulating successful Digital Marketing Strategy for their own business. Digital Marketing Qualifications Digital Marketing Qualifications at Osborne Training are developed in Association with Google. Osborne Training offers Total Digital Marketing Course which combines all major skills required to be a successful Digital Marketeer and you also have option to join a complementary Internship at the end of your course. In joining the Total Digital Marketing Course at Osborne Training, you will make one of the greatest decision of your career and can look forward to a successful career in digital marketing. Digital Marketing Course Overview Total Digital Marketing Course covers major areas of Digital Marketing to make you completely ready for the digital era. The Digital Marketing course comes with optional Internship at the end of the training making you highly employable. Practical focused and hands-on approach of the training method helps you to be ready to offer real life solutions for real life problems. Digital Marketing Training Course Content Basics of marketing Marketing In Digital Era All About Web Search Engine Optimization Search Engine Marketing Affiliate Marketing Social Media Marketing Email marketing and nurturing (inbound) Mobile app marketing Content marketing Web, mobile and app analytics Growth Hacking Creating robust digital marketing strategy

Equality, Diversity and Inclusion

By Prima Cura Training

Our Equality and Diversity Training course covers the Equality Act 2010 and discusses the details relating to discrimination as well as unfair treatment within a professional environment.

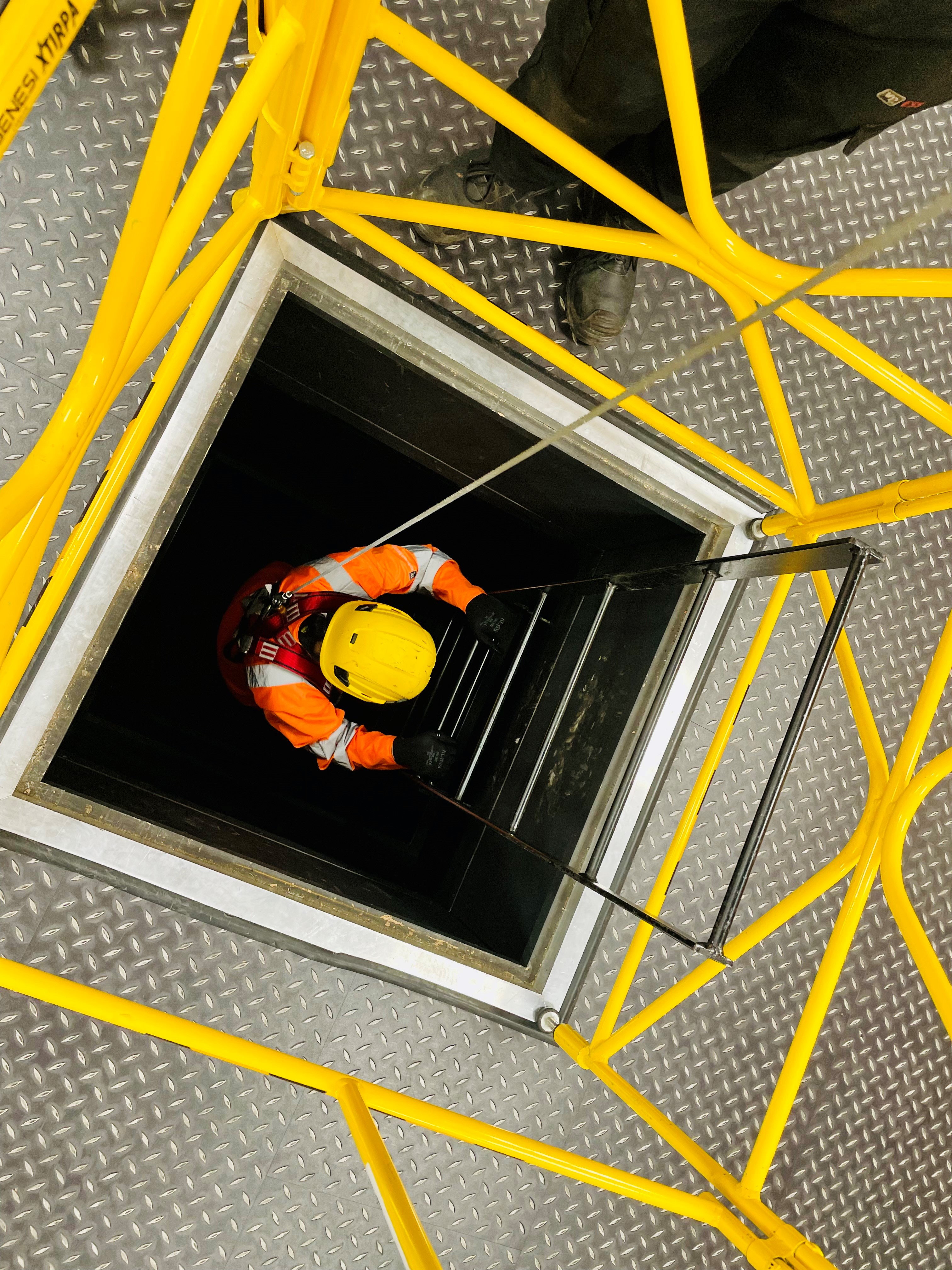

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Search By Location

- Course Courses in London

- Course Courses in Birmingham

- Course Courses in Glasgow

- Course Courses in Liverpool

- Course Courses in Bristol

- Course Courses in Manchester

- Course Courses in Sheffield

- Course Courses in Leeds

- Course Courses in Edinburgh

- Course Courses in Leicester

- Course Courses in Coventry

- Course Courses in Bradford

- Course Courses in Cardiff

- Course Courses in Belfast

- Course Courses in Nottingham