- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Safety Harness Awareness

By Vp ESS Training

This ESS course is suitable for operatives who during the daily activities have to wear a safety harness. It will give the delegate an understanding of the safe use of a harness, methods of inspection and awareness of the regulations. Book via our website @ ESS | Working at Heights training | Vp ESS (vp-ess.com) or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

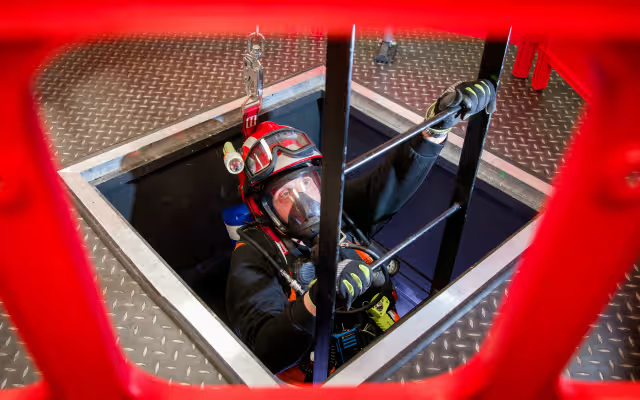

CS1 - (Medium Risk) Confined Space Entry And Entry Control

By Vp ESS Training

CS1 - (Medium Risk) Confined Space Entry And Entry Control - This course is designed to provide delegates that need to enter confined spaces with an in-depth understanding of the requirements of the law, associated regulations and safe systems of work. This course covers access, egress and safe working practices in confined spaces. Book via our website @ https://www.vp-ess.com/training/confined-spaces/cs1-confined-space-entry-with-escape-sets/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Moving & Positioning (People)

By Prima Cura Training

Working within Heath and Social Care settings often involves moving, lifting, or otherwise manually handling the people within your care. This moving and handling training course is designed to educate learners regarding both the requirements and risks associated with moving people safely. Learners will also participate in practical moving & positioning enabling competency sign-off.

AAT Courses | AAT Level 2 Course

By Osborne Training

AAT Level 2 is the first level of qualification for people with limited or no accounts knowledge. This Foundation Certificate in accounting training equips you for an entry-level role in an Accounting or Finance department. Moreover, this AAT course also lays the groundwork for a promising future in the accounting profession. By the end of the course, you will have a greater understanding and skills of manual and computerised accounts and how to use them in a 'real business world' setting. Why AAT? Want a new direction for your career? Think Accountancy, according to statistics, the average salary for Accountants is £50,000; it is the sector where the employ-ability rate is greater than any other sector. What are the benefits after completing AAT courses? A newly qualified AAT member can expect to earn an average of £21,600. Some accounting technicians work as accounts assistant; others go on to become managing directors or finance directors of well-known companies. Some go to work as a self employed accountant as AAT allows the student to become chartered. Osborne Training is an AAT Approved Training Provider in London. In taking the Association of Accounting Technicians qualification with Osborne Training, you will make one of the greatest decisions of your career. Duration You can expect this qualification to take 1-1.5 year to complete for most students. Tutors Tutors are highly qualified with extensive knowledge of accountancy. Study Options Classroom Based - evening, Weekend and Daytime sessions for AAT course from London Campus. Osborne Training continuously opening new campuses throughout the UK. Online Live - Interactive online sessions through world-class Virtual Learning Campus with study materials are delivered to your home address. Distance Learning- Self-Study with Study Material and access to Online study Material through Virtual Learning Campus. Once you finish the AAT qualification and pass all exams successfully, you will receive a globally recognised AAT Level 2 Foundation Certificate in Accounting from AAT. AAT Level 2 Course syllabus Bookkeeping transactions Bookkeeping Controls Elements of Cost Work effectively in finance Using Accounting Software (i.e SAGE)

City & Guilds Level 3 Award in Control Entry and Arrangements for Confined Spaces (High Risk) - 6160-04

By Vp ESS Training

City & Guilds Level 3 Award in Control Entry and Arrangements for Confined Spaces (High Risk) - 6160-04 - This course is designed to provide delegates that need to enter medium and high risk confined spaces with an in-depth understanding of legislation, regulations and safe systems of work. This course includes recognising all risk levels of confined spaces. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-04-level-3-award-in-control-entry-and-arrangements-for-confined-spaces-(high-risk)/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 2 Award in Working in High Risk Confined Spaces - 6160-03

By Vp ESS Training

City & Guilds Level 2 Award in Working in High Risk Confined Spaces - 6160-03 - This course is designed to provide delegates that need to enter medium and high risk confined spaces with an in-depth understanding of legislation, regulations and safe systems of work. This course includes recognising all risk levels of confined spaces. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-03-city-and-guilds-level-2-award-in-working-in-high-risk-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

10 practical ways to save time using ChatGPT and AI tools (In-House)

By The In House Training Company

ChatGPT, along with other AI tools, aims not to replace the human touch in management, but to enhance it. By addressing repetitive, daily tasks, these tools free up managers to concentrate on core responsibilities like strategic decision-making, team development, and innovation. As we move further into the digital age, integrating tools such as ChatGPT isn't a luxury; it's the future of proactive leadership. In this guide, we'll delve into 10 practical ways through which AI can elevate your efficiency and refine the quality of your work. Gain familiarity with prominent AI tools in the market Efficiently compose and respond to emails Generate concise summaries of complex reports and data. Obtain quick insights, data, and research across varied topics Streamline the writing of articles, training notes, and posts Craft interview tests, form relevant questions, and design checklists for the hiring process 1 Streamlining emails An inbox can be a goldmine of information but also a significant time drain for managers. Here's how to optimise it: Drafting responses: Give the AI a brief, and watch it craft a well-structured response. Sorting and prioritising: By employing user-defined rules and keywords, ChatGPT can flag important emails, ensuring no vital communication slips through the cracks. 2 Efficient report writing Reports, especially routine ones, can be time-intensive. Here's a smarter approach: Automate content: Supply key data points to the AI, and let it weave them into an insightful report. Proofreading: Lean on ChatGPT for grammar checks and consistency, ensuring each report remains crisp and error-free. 3 Rapid research From competitor insights to market trends, research is a pivotal part of management. Data synthesis: Feed raw data to the AI and receive succinct summaries in return. Question-answering: Pose specific questions about a dataset to ChatGPT and extract swift insights without diving deep into the entire content. 4 Reinventing recruitment Hiring can be a lengthy process. Here's how to make it more efficient: Resume screening: Equip the AI to spot keywords and qualifications, ensuring that only the most fitting candidates are shortlisted. Preliminary interviews: Leverage ChatGPT for the initial rounds of interviews by framing critical questions and evaluating the responses. 5 Enhancing training Especially for extensive teams, training can be a monumental task. Here's how ChatGPT can assist: Customised content: Inform the AI of your training goals, and it will draft tailored content suitable for various roles. PowerPoint design: Create visually appealing slide presentations on any topic in minimal time.

City & Guilds Level 2 Award in Entrant and Entry Controller for Confined Spaces (Medium Risk) - 6160-09

By Vp ESS Training

City and Guilds level 2 Award in Entrant and Entry Controller for Confined Spaces (Medium Risk) - 6160-09 - This course is designed to provide delegates that need to enter confined spaces and hazardous areas with an in-depth understanding of the Legal requirements and the associated legislation, hazard identification and suitable control measures. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-09-city-and-guilds-level-2-award-in-entrant-and-entry-controller-for-confined-spaces-(medium-ri/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Dementia Awareness

By Prima Cura Training

This course will explore what we mean when we say someone has dementia. The course will challenge you to think more about how we can best care for and support people with dementia.

Access to Payroll | Sage Payroll Courses

By Osborne Training

Payroll courses in London | Online Courses | Distance Learning Course Overview: Broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll, and it incorporates all the new government requirements for RTI reporting Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. What support is available? Free high-quality course materials Tutorial support Highly equipped IT lab Student Discount with NUS card Exam fees and exam booking service Personalised individual study plan Specialist Career Management service State of the Art Virtual Learning Campus Free Sage Payroll Software Duration 6 Weeks Study Options Classroom Based - Osborne Training offers Daytime and Weekend sessions for Payroll Training Course from London campus. Online Live - Osborne Training offers Live Online sessions for Sage Payroll Training Classes through the Virtual Learning Campus. Distance Learning - Self Study with Study Material and access to Online study Material through Virtual Learning Campus. Benefits for Trainees Sage Payroll Qualifications open new doors to exciting careers, as well as extending payroll skills if you are currently employed. State of the Art Virtual Learning Campus Start your own payroll bureau Work in small businesses A payroll career can lead to great things Update your knowledge of Sage payroll Improve your employability prospects A career path into payroll Ideal Continuing Professional Development course Gain a qualification to boost your CV Option to gain IAB accredited qualification Start your training immediately without having to wait for the new term to begin Certification You will receive a certificate from Osborne Training once you finish the course. You have an option to get an IAB Certificate subject to passing the IAB exam or Sage certified exam. Syllabus Advanced processing of the payroll for employees Preparation and use of period end HMRC forms and returns preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Processing Payroll Giving Scheme Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Introduction to Auto-enrolment Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Search By Location

- training, Courses in London

- training, Courses in Birmingham

- training, Courses in Glasgow

- training, Courses in Liverpool

- training, Courses in Bristol

- training, Courses in Manchester

- training, Courses in Sheffield

- training, Courses in Leeds

- training, Courses in Edinburgh

- training, Courses in Leicester

- training, Courses in Coventry

- training, Courses in Bradford

- training, Courses in Cardiff

- training, Courses in Belfast

- training, Courses in Nottingham