- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Spanish language courses - online and in person - All levels

By Beatriz Luna Gijon - Lubidioms

https://www.lubidioms.com/spanish-language https://www.facebook.com/Lubidioms

Wet Shaving - Advanced Course

By Alan d Hairdressing Education

Learn the classic Wet Shaving in our Advanced Wet Shaving Course. Ideal for qualified barbers looking to learn a new skill and add to their services. In this 2-day course, you’ll learn shaving theory along with skin tensioning and lathering techniques.

EINTAC Vehicle Fire Blanket Training

By EINTAC Ltd

This training course has been designed to give all staff the knowledge of how to safely use a Vehicle Fire Blanket in the event of a fire. Those who attend the course will be taught how to safely deploy the blanket, remove the blanket and clean up and re-pack the blanket for its next use. As part of the training, the attendees will also be shown and taught the best practices for handling the fire blanket including the necessary steps of a periodic check of the blanket. Another key aspect to the Vehicle Fire Blanket Training Course is educating people on the possible fire situations with electric and hybrid vehicles and how to identify potential fire issues and risks. The course will end with a survey of the customers site to identify the best location for the fire blanket(s) to be located and determine any signage and additional equipment which may be required.

The Director/Writer Collaboration: From Script to Screen

By London Film School

A good script is the bottom line of any film project. Without it you don’t get the commission, the best actors, the desired result. Film and television are collaborative mediums, so how should a Director and a Writer collaborate to achieve the best outcome?

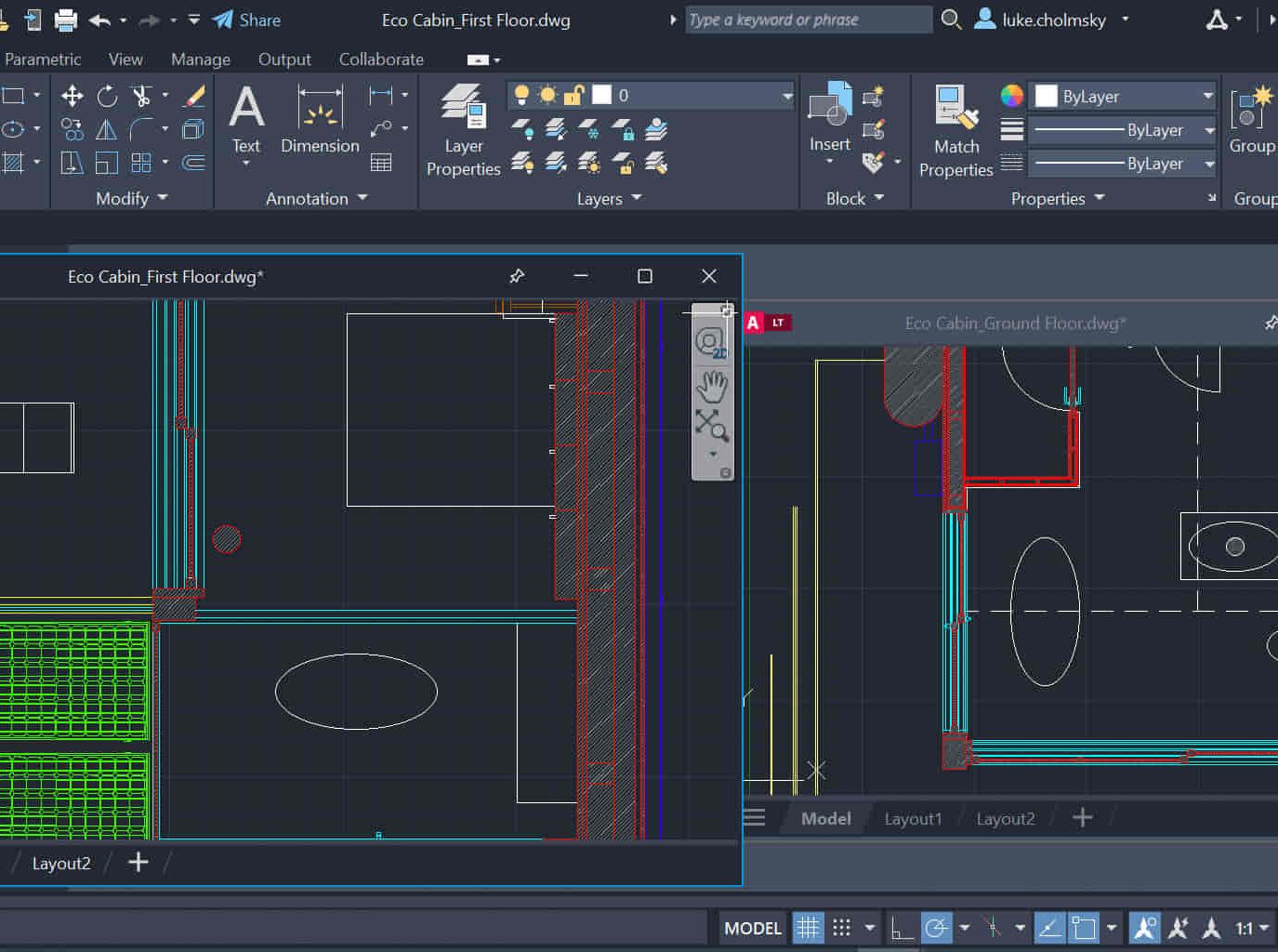

AutoCAD Night Training Course

By ATL Autocad Training London

Why AutoCAD Night Training Course? This Autodesk AutoCAD 2D Evening Course, 10 hours, is perfect for beginners aiming to create 2D plans, elevations, sections. It covers all tools in AutoCAD 2D, making it valuable for both newcomers and those aspiring to enhance their skills. Click here for more info: Website When: Personalized 1-on-1 sessions. Available from Mon to Sat 9 am to 7 pm. Book over the phone, call 02077202581 Duration: 10 hours (Split 10 hrs over as many as days you want) Method: In-person or live online training Course Content: Foundational Shape Construction Manipulating Lines, Arcs, and Polylines Optimizing Object Alignment with Grip Tools Data Management and Backup Protocols File Format Exploration and Understanding Disaster Recovery Strategies Advanced Object Creation Techniques Precision Measurement Unit Handling Dynamic Input Methods Utilizing Inquiry Commands and Measurement Tools Effective Object Visualization and Navigation Zoom, Pan, and Object Manipulation Swift Object Management Strategies Object Transformation and Alteration Techniques Functions for Trimming, Extending, and Offsetting Objects Creating Various Geometric Shapes Object Editing, Joining, and Filleting Stretching and Organizing Objects Layer Management and Customization Configuring Object Properties and Linetypes Designing Layouts and Efficient Page Configurations Scaling Drawing Views and Adding Annotations Text Creation, Styling, and Editing Dimensioning Principles and Customization Implementing Multileaders for Annotations Object Hatching and Editing Techniques Managing Reusable Content: Blocks and Symbols Utilizing Tool Palettes and Working with Groups Understanding Model Space and Paper Space Creating Layouts and Viewports Scaling Viewports and Plotting/PDF Output Managing Multiple Sheet Drawings Optimizing Plotstyles for Printing Creating Custom Drawing Templates To download AutoCAD, visit Autodesk's official website. Advantages: AutoCAD stands as the industry-leading computer-aided design (CAD) software, widely adopted for creating architectural, engineering, and construction drawings. Acquire essential skills applicable across a diverse spectrum of industries. Assessment: Evaluation will occur informally during classes, which comprehensively cover specific topics, complemented by practical drawing exercises to reinforce skills and knowledge. Additionally, we offer longer, independent drawing tasks that encompass multiple acquired skills, evaluated against professional benchmarks. Requirements: Prospective participants should possess basic computer literacy and engagement in professions where CAD is utilized. English Proficiency: Applicants are expected to demonstrate proficiency in both written and spoken English. Why Opt for This Course? Our AutoCAD course is your gateway to mastering the essential skills for creating top-notch technical drawings. Designed with beginners in mind, this course is perfect for individuals who have little to no prior experience with AutoCAD. If your work or studies involve CAD drawings, gaining a solid grasp of the program is crucial for confidence and proficiency. Upon enrollment, students gain access to a free 30 days trial. While classes are conducted using AutoCAD on PC, it's worth noting that the course is compatible with AutoCAD on Mac, albeit with slight interface variations. Who Should Attend? This course caters to those eager to acquire the skills necessary for creating and interpreting drawings produced in AutoCAD. Our diverse system hails from various industries, including engineering, architecture, landscape architecture, construction, electronics, and product design. Why Opt for CAD Training? Practical Learning Experience: Immerse yourself in hands-on training. Personalized One-to-One AutoCAD Classes: Benefit from individualized attention. Expert and Knowledgeable Instructors: Learn from skilled and experienced teachers. Online Training Recordings: Access recorded AutoCAD training sessions online. Best Price Guarantee: Enjoy competitive pricing with a satisfaction guarantee. Pre and Post-Training Support: Receive lifetime free support before and after completing your training. Flexible Schedule: Choose your class timings and dates-weekdays, weekends, or evenings. Tailored Course Content: Customize the AutoCAD course to align with your specific needs. Access Anywhere: Access AutoCAD training and support from any location.

EINTAC IMI Level 3 Award In Electric/Hybrid System Repair And Replacement

By EINTAC Ltd

This IMI qualification is designed for technicians who maintain, diagnose and repair high and low voltage operating systems on electric/hybrid vehicles. It contains the skills and knowledge required to work safely around a vehicles high and low voltage electrical system and electric drive train system, whilst carrying out repairs or maintenance. It also contains the knowledge and skills required to work safely around the vehicle that may have had damage to its high energy/electrical system. On completing this qualification, technicians will have gained knowledge of both low and high voltage technologies and an understanding of their dangers. The content of this qualification has been designed to give learners the knowledge and skills required to work safely around Electric/Hybrid vehicles whilst carrying our diagnostic, testing and repair activities.

AAT Level 2 Certificate in Bookkeeping

By London School of Science and Technology

Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. Course Overview Students studying this qualification will develop practical accountancy skills in the double-entry bookkeeping system and in using associated documents and processes. They will cover transactions for accuracy, make entries in appropriate books and ledgers and calculate sales invoices and credit notes. Gain the skills and essential knowledge needed for completing the manual bookkeeping activities that underpin all accountancy and finance roles. The jobs it can lead to: • Trainee bookkeeper • Finance assistant • Accounts administrator • Clerical assistant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin the double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They will use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. DURATION 3 Months WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Fizz, Fish and Chips!

By Thames Valley Local Wine School

Join us for the tastiest date at Thames Valley Wine School! Your Fish and Chip Supper will be served alongside a tasting of 6 perfectly picked wines. Starting with classics like Picpoul and Albariño, we'll finish with both English Sparkling Wine and Champagne.

EINTAC IMI Accredited Electric Vehicle Dismantling – Competent/Authorised Combined Fast Track

By EINTAC Ltd

Electric Vehicle Technicians have had access to certified training at different levels of competency for a number of years, but this has not been the case for Vehicle Dismantling Technicians until now. Vehicle repairers have been taught how to diagnose faults on Electric or Hybrid vehicles, make them safe, repair or replace the high voltage component and then put the vehicle back together and make them work. Vehicle dismantlers need to know how to assess Electric and Hybrid vehicles, store them properly, make them safe and dismantle them, store the parts and ship them out for re-use, repurposing or recycling, so the accredited and certified training for vehicle repair technicians met some of the criteria for dismantling but not all. Electric Vehicle Dismantling Training raises the professional standards of the vehicle dismantling and recycling industry, provides consistent training standards across the world, helps develop knowledge and understanding, enables team members to grow their own abilities, and achieve accredited training.

Search By Location

- English Courses in London

- English Courses in Birmingham

- English Courses in Glasgow

- English Courses in Liverpool

- English Courses in Bristol

- English Courses in Manchester

- English Courses in Sheffield

- English Courses in Leeds

- English Courses in Edinburgh

- English Courses in Leicester

- English Courses in Coventry

- English Courses in Bradford

- English Courses in Cardiff

- English Courses in Belfast

- English Courses in Nottingham