- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Sage Line 50 Accounting / Bookkeeping Training - Fast Track

By Osborne Training

Sage Line 50 Accounting / Bookkeeping Training - Fast Track If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounting course will teach everything you need to know, while helping you gain a recognised qualification. This Course is designed to provide individuals from beginner to advanced knowledge of bookkeeping and Sage 50 accounts. It is intended for individuals who aim to improve career prospects and to be able to better financial management and control of business. This course covers Level 1-3 of Sage 50 Bookkeeping/Accounting Training. Every business, no matter how large or small, is required by law to 'keep books'. Therefore, Bookkeepers play a vital role within organisations; ensuring records of individual financial transactions are accurate, orderly, up to date and comprehensive. If you are organised and methodical, like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping is the career for you. What qualification will I gain? You have the choice to gain certification from one of the following awarding bodies. CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Swimming Lessons In London - Emergency Learn To Swim

By Swimming Lessons London @ The Circle Spa

Emergency learn to swim, private 1-1 lessons are for those who need to learn to swim quickly. These are offered as single 2 hour sessions, ideal for swimmers or 5 x 2hr packages, ideal for non-swimmers. A swimming crash course can help you learn the skills and build the confidence in water in a very short period of time. Cruise ships, off-shore workers, oil workers - water safety. Flight attendants & Pilots swim proficiency test training. Holiday, vacation or honeymoon with water activities

Unpuzzling finance (In-House)

By The In House Training Company

Finance doesn't have to be a puzzle. And if you want to get anywhere with your career, it had better not be! Whatever your role, you have an impact on the financial wellbeing of the organisation you work for, whether you've got specific financial responsibilities or not. This thoroughly practical, fun and enjoyable one-day workshop will help unpuzzle finance for you. It's an ideal opportunity to master the terminology, get to grips with the concepts, learn how 'the finance department' works and understand the part you play. This course will help participants: Appreciate the role and importance of Finance within organisations Be able to recognise and describe some of the common items and jargon used Identify the elements of the Profit & Loss and the Balance Sheet Understand cashflow Make better decisions Manage budgets 1 Introduction Expectations Terminology Key financial principlesAccrualsConsistencyPrudenceGoing concern 2 The three main financial statements Profit & Loss accountIncomeCost of salesGross profitAdministrative expenses ('overheads')Net profit/(loss) for the financial year (the 'bottom line')P&L format Balance SheetTerminologyFixed AssetsCurrent AssetsCurrent LiabilitiesLong-term LiabilitiesCapitalB/S format Cashflow Statement Financial and management information systems 3 Budgets and forecasts Why budget? Types of budget - incremental or zero-based Budgeting for costs - fixed and variable Budgeting for income An eight point plan for budgeting for your department Case study: Small Brother Ltd Problems and solutions 4 Accruals Accruals - what and why? Prepayments 5 Open forum

Old Vic Theatre - Money, Money, Money: Fundraising and Development in the Arts Masterclass

4.4(69)By Central Film School

Location: Studio A, Central Film School Time: 6pm-7:30pm Date: Thursday 7th December Led by Zosha Nash, Head of Philanthropy at The Old Vic, this session will cover a broad range of topics in relation to funding in the arts. You will come away with knowledge of philanthropy, funding and development in theatre, associated roles and career paths as well as a range of skills to apply to your own creative journeys, projects and funding endeavours. Some topics covered will include: Why the arts need philanthropy Who becomes a fundraiser, and where it can take you? Who funds theatre and theatres? Types of funders: Trusts, individuals, corporates and events The funding pipeline: prospecting to applying to reporting Transferable skills in the arts and beyond Skills for funding your own projects PLACES MUST BE BOOKED BY MIDDAY ON MONDAY 4TH DECEMBER LATEST!

Advanced Bookkeeping Excel Courses online | Excel Training in Campus

By Osborne Training

Microsoft Excel is the world's most popular spreadsheet program, learning how to use the software with Osborne Training shows that you've taken one of the best Excel training courses available. A comprehensive training course with up to date material to practice at home and during your class. You will also be provided a step by step manual of all the tricks you can do using Excel spreadsheets to gain better management reporting and budgeting skills. It is a fundamental programme for professional Accountants. Excel spread sheets are the most powerful tool, extensively used for reporting and analysis. Having advanced skills on excel can excel your career and help you to stand ahead of the competitive job market. Advanced skills on excel is a must for any potential professional accountants. You will receive an attendance certificate once you complete the course successfully. Excel Course Content Creating worksheets, formatting text Simple and complex formulas Handling rows and columns Autocomplete, using styles, headers and footers, Average, max and min functions and using charts. Use of IF Formula Summing Techniques Cell References Formula Linking Sumifs Tables and Bordering Look up References (Vlookup, Hlookup,etc) Data Validation Conditional Formatting Date & Time Formulas Charts & Graphs Protection & Security Creating Pivot Table Pivot Table Analysis

Date: Thursday 15th June Time: 4pm Location: Studio A - Landor Road Event Details: Tim Haines is a television producer and director, having worked on several highly-respected documentary and drama productions over a storied career. Tim will speak about the following topics as well as others at the event: Approaches to Documentary How a Documentary Gets Made The Purpose of a Documentary Modern Combinations of CGI & Live Action Throughout students will have the chance to ask questions about the topics being discussed, before wrapping up with a wider Q+A session at the end. A multiple Emmy and BAFTA winner, Tim has worked on many well known series, including: - Walking with Dinosaurs - Director & Producer - Primeval - Producer - The Loch - Producer - Surviving Earth (currently in production) - Producer This is a free event that all students are welcome to attend. Be sure to book tickets in advance though so that you don't miss out!

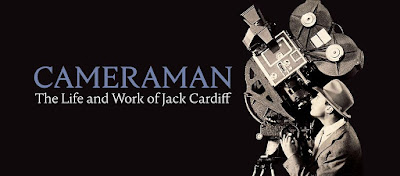

Date: Tuesday 12th December Time: 4pm Location: Studio A Noted documentarian Craig McCall will be joining us to show his documentary CAMERAMAN: The Life & Work of Jack Cardiff and to discuss the career of the legendary cinematographer, whose work includes some of the most acclaimed British films of the time (The Red Shoes, Black Narcissus, A Matter of Life and Death). Craig is a dedicated film historian, and this event is open to anyone interested in cinematography, film history or British cinema. Craig McCall’s documentary CAMERAMAN: The Life & Work of Jack Cardiff premièred at Cannes and subsequently screened at over fifty film festivals and was sold worldwide. As an Executive Producer he has made other film related docs including Me & Me Dad on film director John Boorman which also premièred at Cannes, Natan on the pioneering French filmmaker Bernard Natan, Behind The Sword In The Stone on the making of ‘Excalibur’ and Leslie Howard: The Man Who Gave A Damn. All his films have been made independently outside the broadcast system.

Search By Location

- career Courses in London

- career Courses in Birmingham

- career Courses in Glasgow

- career Courses in Liverpool

- career Courses in Bristol

- career Courses in Manchester

- career Courses in Sheffield

- career Courses in Leeds

- career Courses in Edinburgh

- career Courses in Leicester

- career Courses in Coventry

- career Courses in Bradford

- career Courses in Cardiff

- career Courses in Belfast

- career Courses in Nottingham