- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Advanced Bookkeeping Excel Courses online | Excel Training in Campus

By Osborne Training

Why Join Digital Marketing Training Course at Osborne Training Osborne Training is well Recognised for quality Regular Lectures led by Industry Expert Tutors Unlimited Access to the State of the Art Virtual Learning Campus Exclusive Access to High quality study materials Flexible payment option available Join Digital Marketing Training course as Pure Online or Blended with Classroom Delivery Access to Digital Marketing Internship for 3 months at the end of the training Unlimited Tutorial Support from expert tutors Get a Student Discount Card from NUS* Get a Free Tablet PC for limited period* Practical Hands-on Projects, Practical focused Assignments and Group-work for greater skills enhancement and understanding real life issues for real life problems Once you complete the bookkeeping course, you will get a certificate from Osborne Training confirming your professional Digital Marketing Qualifications. What jobs could I qualify for? Senior Digital Marketing Manager Digital Marketing Coordinator Executive Digital Marketing Strategist Digital Marketing Consultant In these roles, you could earn on average more than £40,000 annually (source: Reed Salary Checker, UK). Moreover, many go on to become successful (Millionaire sometime) entrepreneur by offering Digital Marketing services or formulating successful Digital Marketing Strategy for their own business. Digital Marketing Qualifications Digital Marketing Qualifications at Osborne Training are developed in Association with Google. Osborne Training offers Total Digital Marketing Course which combines all major skills required to be a successful Digital Marketeer and you also have option to join a complementary Internship at the end of your course. In joining the Total Digital Marketing Course at Osborne Training, you will make one of the greatest decision of your career and can look forward to a successful career in digital marketing. Digital Marketing Course Overview Total Digital Marketing Course covers major areas of Digital Marketing to make you completely ready for the digital era. The Digital Marketing course comes with optional Internship at the end of the training making you highly employable. Practical focused and hands-on approach of the training method helps you to be ready to offer real life solutions for real life problems. Digital Marketing Training Course Content Basics of marketing Marketing In Digital Era All About Web Search Engine Optimization Search Engine Marketing Affiliate Marketing Social Media Marketing Email marketing and nurturing (inbound) Mobile app marketing Content marketing Web, mobile and app analytics Growth Hacking Creating robust digital marketing strategy

Date: Thursday 25th May Time: 4pm Location: Studio A - Landor Road Event Details: Matt Jones is a British producer and screenwriter who has worked on several television networks across the UK. Beginning his career writing for Doctor Who Magazine in 1995, he got his big break when he became a screen writer for the Channel 4 series Queer as Folk. Matt will share his experience as a television screenwriter and producer, covering: Writing for Television What producers look for How to write a pitch How to pitch in a room Some of the projects Matt has worked on: Skins - producer Shameless - producer Doctor Who - writer The Split - writer This is a free event that all students are welcome to attend (but tickets are limited so be quick!)

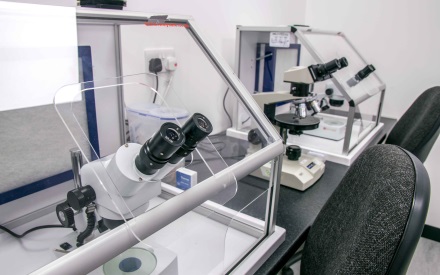

BOHS P400 - Asbestos Foundation Module Online

By Airborne Environmental Consultants Ltd

P400 - Asbestos Surveying and Analysis is a one day foundation level course, which provides candidates with the fundamental knowledge to start a career in the asbestos surveying and analysis professions, and as a progression route to the asbestos Proficiency qualifications. It gives candidates an introductory level of knowledge on the health risks of asbestos fibres, and how to manage asbestos-containing materials in their work. Candidates for this course are not expected to have prior knowledge and experience but having an awareness of the contents of both HSG248 Asbestos: The analysts' guide (July 2021) and HSG264 Asbestos: the survey guide January 2010), would be advantageous.

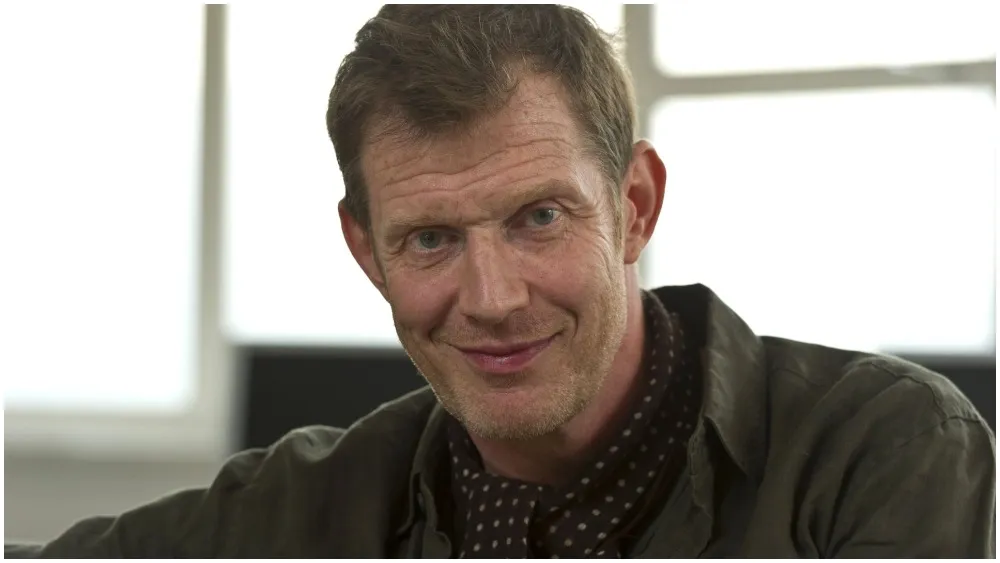

DATE: Tuesday 21st May TIME: 4pm LOCATION: Studio A The renowned and brilliantly-chameleonic actor Jason Flemyng is coming to Central Film School this month, and we couldn't be happier to have him. With an amazing CV including films and series such as Lock, Stock and Two Smoking Barrels, Boiling Point, A Town Called Malice and The Curious Case of Benjamin Button, Jason will be talking about his career, how the industry has changed and giving practical, down-to-earth advice for our actors. There will also be an opportunity for students to put their own questions to Jason, so make sure you book a ticket and come along!

DATE: 30th January TIME: 4pm LOCATION: Studio A We are pleased to reignite Professional Perspectives in 2024 with a fantastic first guest, legendary British actress and multi BAFTA-winner Jessica Hynes. Jessica has acted in numerous critically-acclaimed series and films over a stunning career, including Spaced, Twenty Twelve, Doctor Who, Years and Years, Paddington 2, Son of Rambow and There She Goes. A celebrated screenwriter and director as well, every student at Central Film School will benefit from hearing Jessica speak, as she offers insight and advice from her time in the entertainment industry. Be sure to book tickets in advance so that you don't miss out.

Date: Monday 11th December Time: 4pm Location: Studio A One of the most important British films of all time, Powell & Pressburger's Black Narcissus will be screened in advance of our December Professional Perspectives guest, Craig McCall, who will join us to speak about the career of Jack Cardiff, one of British cinema's most acclaimed cinematographers ever. Set in a mysterious monastery high in the Himalayas, the film focuses on the mental unravelling of a group of nuns trying to establish a school there, whilst erotic paintings on the ancient palace walls taunt their deepest, darkest desires. Come see the film that won Jack Cardiff the Oscar for Best Cinematography, and that lives on today as a prime example of psychological drama.

Sage Accounting Courses

By Osborne Training

Sage Accounting Courses Every business, no matter how large or small, is required legally to 'keep books'. Bookkeepers play a vital role in organisations. Thus, they ensure accurate records of individual financial transactions in an orderly, up to date and comprehensive method. Sage 50 Accounts software is widely used in various business sectors in the UK and internationally. If you are organised and like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping or accountancy with Sage 50 Accounts is the career for you. If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounts course will teach everything you need to know, while helping you gain a recognised qualification. At the end of the training you have the option to gain some practical experience in accounting by joining the optional job placement with our sister company, Osborne certified accountants.

Date: Monday 2nd October Time: 4pm Location: Studio A - Landor Road Events Details: Come and join our first Film Club screening of the year as we kick off the 'QUEER COMING-OF-AGE' season with a modern classic of the genre; Desiree Akhavan's 2018 Sundance champion, The Miseducation of Cameron Post. Featuring a career-best performance from Chloe Grace Moretz, we follow Cameron's journey of self-discovery in mid-90s America, as she's sent to a gay conversion camp. Under the strict enforcement of anti-LGBT teachings, Cameron learns to grow and be defiant in her own quiet way, whilst bonding with her peers. A powerful film in the mode of John Hughes, you won't want to miss this screening. After the film we'll head to The Landor pub next door where we'll discuss what we've seen over some drinks. Don't miss out, book your ticket now!

Sage Line 50 Accounting / Bookkeeping Training - Fast Track

By Osborne Training

Sage Line 50 Accounting / Bookkeeping Training - Fast Track If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounting course will teach everything you need to know, while helping you gain a recognised qualification. This Course is designed to provide individuals from beginner to advanced knowledge of bookkeeping and Sage 50 accounts. It is intended for individuals who aim to improve career prospects and to be able to better financial management and control of business. This course covers Level 1-3 of Sage 50 Bookkeeping/Accounting Training. Every business, no matter how large or small, is required by law to 'keep books'. Therefore, Bookkeepers play a vital role within organisations; ensuring records of individual financial transactions are accurate, orderly, up to date and comprehensive. If you are organised and methodical, like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping is the career for you. What qualification will I gain? You have the choice to gain certification from one of the following awarding bodies. CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Unpuzzling finance (In-House)

By The In House Training Company

Finance doesn't have to be a puzzle. And if you want to get anywhere with your career, it had better not be! Whatever your role, you have an impact on the financial wellbeing of the organisation you work for, whether you've got specific financial responsibilities or not. This thoroughly practical, fun and enjoyable one-day workshop will help unpuzzle finance for you. It's an ideal opportunity to master the terminology, get to grips with the concepts, learn how 'the finance department' works and understand the part you play. This course will help participants: Appreciate the role and importance of Finance within organisations Be able to recognise and describe some of the common items and jargon used Identify the elements of the Profit & Loss and the Balance Sheet Understand cashflow Make better decisions Manage budgets 1 Introduction Expectations Terminology Key financial principlesAccrualsConsistencyPrudenceGoing concern 2 The three main financial statements Profit & Loss accountIncomeCost of salesGross profitAdministrative expenses ('overheads')Net profit/(loss) for the financial year (the 'bottom line')P&L format Balance SheetTerminologyFixed AssetsCurrent AssetsCurrent LiabilitiesLong-term LiabilitiesCapitalB/S format Cashflow Statement Financial and management information systems 3 Budgets and forecasts Why budget? Types of budget - incremental or zero-based Budgeting for costs - fixed and variable Budgeting for income An eight point plan for budgeting for your department Case study: Small Brother Ltd Problems and solutions 4 Accruals Accruals - what and why? Prepayments 5 Open forum

Search By Location

- #career Courses in London

- #career Courses in Birmingham

- #career Courses in Glasgow

- #career Courses in Liverpool

- #career Courses in Bristol

- #career Courses in Manchester

- #career Courses in Sheffield

- #career Courses in Leeds

- #career Courses in Edinburgh

- #career Courses in Leicester

- #career Courses in Coventry

- #career Courses in Bradford

- #career Courses in Cardiff

- #career Courses in Belfast

- #career Courses in Nottingham