- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1769 Courses

Pallet Stacker Course

By London Construction College

Take The Pallet Stacker Course. This Will Take You 7 Days To Complete. Enroll Now On To The Course! What Is The Pallet Stacker Course? A Pallet Stacker Training Course is a specialized program designed to provide individuals with the knowledge and skills necessary to operate pallet stackers safely and efficiently. Pallet stackers are material handling equipment used to lift and transport palletized loads within warehouses, distribution centers, and other industrial settings. Course Overview: 7 Days Course | Course Fee: £220 Payment Structure: £70 deposit and £150 payment in the office Why Choose A Pallet Stacker Course? Our Pallet Stacker Training Course is tailored to equip individuals with the knowledge and hands-on skills to excel as pallet stacker operators. Whether you’re new to the field or looking to enhance your skills, this course provides comprehensive training for safe and efficient pallet stacker operation. Specialized Expertise Our course focuses solely on pallet stacker operation, ensuring a deep understanding of this specific equipment and its applications. Safety First Safety is our utmost priority. We provide rigorous training in safety protocols, emphasizing safe load handling, pre-operation checks, and emergency response. Career Opportunities Certified pallet stacker operators are in high demand within industries relying on precise material handling. Completing our course opens doors to job opportunities and career advancement. Experienced Instructors Our course is designed and delivered by experienced pallet stacker operators, providing practical insights and real-world knowledge. Launching Your Career With Our Pallet Stacker Course Embark on a journey to elevate your career with our Pallet Stacker Course. Designed for individuals aspiring to become proficient pallet stacker operators, this program offers a comprehensive blend of theoretical knowledge and hands-on practical training. Led by experienced instructors, you’ll gain expertise in safe and efficient pallet stacking techniques. Obtain your Pallet Stacker Operator Certification and open doors to exciting opportunities in logistics, warehousing, and beyond. Course Highlights Our Pallet Stacker Training Course offers a comprehensive curriculum to ensure you’re fully prepared for the responsibilities of a certified operator: Pallet Stacker Operation Mastery over pallet stacker controls, steering, load handling techniques, and efficient maneuvering in confined spaces. Load Handling Techniques Proficiency in the safe handling and transportation of various palletized loads, with a focus on understanding load capacities and proper load placement. Maintenance Knowledge In-depth knowledge of pallet stacker maintenance, troubleshooting, and preventive care to ensure equipment reliability, longevity, and operator safety. Legal Compliance Understanding the legal and regulatory aspects of pallet stacker operation to ensure compliance with relevant laws and industry standards. FAQ Pallet Stacker Course What is the primary focus of the Pallet Stacker Course at London Construction College? The Pallet Stacker Course at London Construction College focuses on providing comprehensive training for individuals aspiring to become skilled pallet stacker operators. The course covers theoretical knowledge, practical skills, and safety protocols. What safety measures are emphasized in the Pallet Stacker Course? Safety is a top priority in the Pallet Stacker Course. Participants learn and practice safety protocols, risk mitigation strategies, and emergency response procedures to create a secure work environment. Is practical training included in the Pallet Stacker Course at London Construction College? Yes, practical training is a crucial component of the course. Participants engage in hands-on sessions, simulating real-world scenarios to apply theoretical knowledge and develop operational skills. What certification is awarded upon completion of the Pallet Stacker Course? Participants who successfully complete the Pallet Stacker Course receive a Pallet Stacker Operator Certification. This certification is recognized within the industry and validates their competence in pallet stacker operations. Can the training be customized for specific industry needs? Yes, the Pallet Stacker Course is designed to be adaptable. Modules can be customized to address specific industry requirements, ensuring participants receive training relevant to their sector or application. Are the instructors experienced in pallet stacker operations? Absolutely. Instructors leading the Pallet Stacker Course at London Construction College are industry-experienced professionals with expertise in pallet stacker operations. They bring practical insights and guidance to the training.

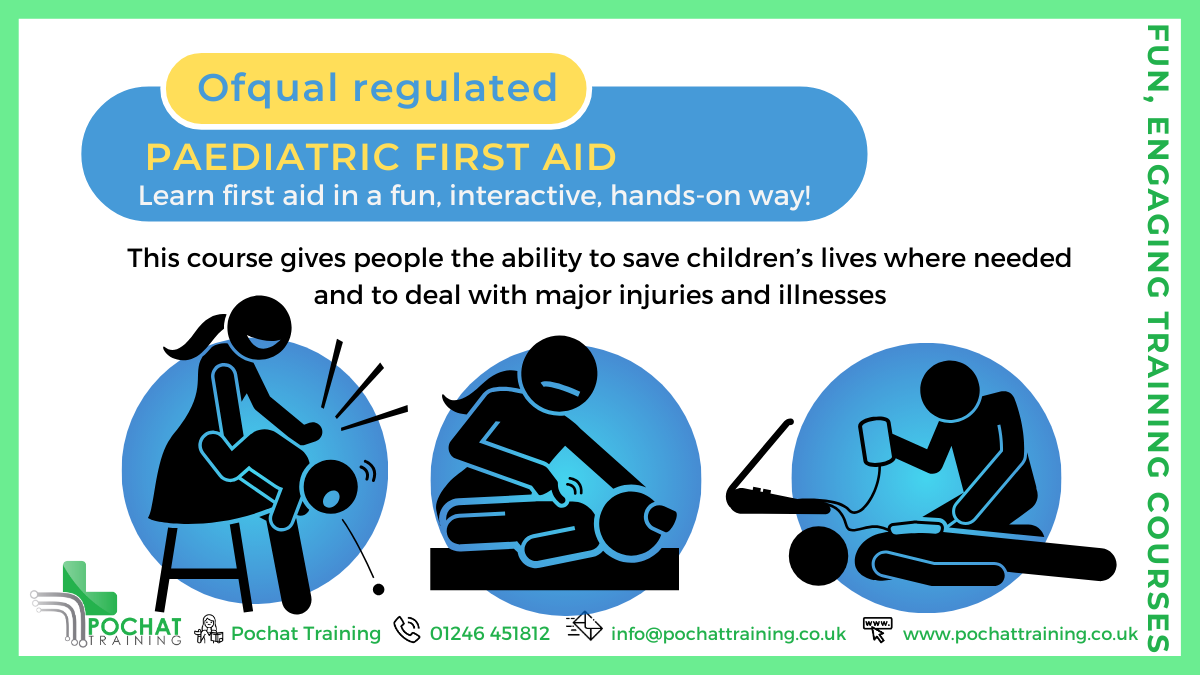

QA Level 3 Award In Paediatric First Aid (RQF) Two day course HSE highly recommends this course for those who work with children in a childcare setting Being able to deal with peadiatric emergencies can make the difference between the life and death of children, and save them a lot of suffering Course Contents: The Roles and Responsibilities of an Emergency Paediatric First Aider Assessing an Emergency Situation Accident Recording Minor Injuries Cuts, Grazes and Bruises Minor Burns and Scalds Managing an Unresponsive Infant and Child Recovery Position Infant and Child CPR Infant and Child Safe Use of an AED (Automated External Defibrillator) Choking Anaphylaxis Seizures Wounds and Bleeding Hypovolaemic Shock Head, Neck and Back Injuries Sprains, strains, dislocations and fractures Meningitis Asthma Diabetes Eye, Ear and Nose Conditions Poisoning Electric Shock Bites and Stings Hot and Cold Temperatures Benefits of this course: Would you know what to do if you saw a child in need of First Aid? Children are prone to minor injuries, but suffer from serious injuries also In 2014, 2,269 children in the UK were so badly bitten by an animal they had to be admitted to hospital More than 2 million children have accidents in the home for which they're taken to A&E - every year, with Under 5s accounting for 7% of all hospital emergency treatments Being able to deal with peadiatric emergencies can make the difference between the life and death of children, and save them a lot of suffering. This QA Level 3 Award in Paediatric First Aid (RQF) qualification is ideal for: - Parents/carers or family members who want to learn key paediatric first aid skills - those who work with, or intend to work with children in a childcare setting as it is designed to fulfill Ofsted’s First Aid requirements for early years teachers, nursery workers and childminders (as defined within the Statutory Framework for the Early Years Foundation Stage (EYFS) 2014 and within the Child Care Register guide) Childcare settings who are working towards Millie’s Mark We also run a Paediatric Annual Refresher to keep those life-saving skills up to date Accredited, Ofqual regulated qualification: Our Paediatric First Aid at Work course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards. This means that you can be rest assured that your Paediatric First Aid certificate will fulfill the legal requirements. It is a very good way to make sure you and your employees are trained in First Aid for Children and Infants (babies). The Ofqual Register number for this course is 603/0785/7

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

H&S for FM (In-House)

By The In House Training Company

This workshop has been designed to help managers understand their responsibilities and what they need to do to ensure compliance with current workplace legislation - including the fire safety and CDM regulations. The day will cover the legal background - including an appreciation of how safety legislation has evolved and why; the logic behind recent developments and the implications for staff and employers; key areas of current legislation; roles and responsibilities in health and safety management, including monitoring contractors and suppliers effectively; implementing sound health and safety policies and procedures; getting staff on board, and implementing effective systems. Also, recognising potential risks and hazards and developing strategies to minimise their impact in the workplace. This course will give participants an understanding of: The broader context of the key areas of health and safety regulation which apply to your organisation Existing health and safety practice and guide them in how to shape and implement an effective health and safety policy What they should do and the procedures to support it Potential areas of risk in the workplace - and how to take action to minimise the threat to staff safety How sound health and safety processes can contribute to business performance 1 Understanding the workplace legislation Overview of health and safety and workplace legislation Compliance, the role of the facilities manager, and who is accountable? Breakout session to discuss where we are now and to highlight issues of concern Applying required policies and procedures Developing and implementation/review of the safety policy Communicating with users, clients and contractors Health and safety manual 'Selling' health and safety 2 Key legislation - a practical working guide Asbestos Regulations Construction (Design and Management) Regulations 2007 / 2015 Control of Substances Hazardous to Health (COSHH) Regulations Disability Discrimination Act (DDA) Display Screen Equipment (DSE) Regulations 1992 Electricity at Work Regulations 1989 Fire Precautions (Workplace ) Regulations 2006 Health and Safety (Consultation with Employees) Regulations 1996 Health and Safety (First Aid) Regulations 1981 Health and Safety at Work etc. Act 1974 Management of Health and Safety at Work Regulations 1992 Manual Handling Operations Regulations 1992 Portable Appliance Testing (PAT) Provision and Use of Work Equipment Regulations 1992 REACH - Registration, Evaluation, Authorisation and restriction of Chemicals Reporting of Injuries, Diseases, and Dangerous Occurrences Regulations (RIDDOR) 1995 Waste Electrical and Electronic Equipment (WEEE) Regulations 2006 Work Equipment Regulations 3 Controlling contractors Understanding the Regulations Selecting and assessing contractors Understanding and setting accountability Why a method statement? How to apply a permit to work system Safe systems of work Round-table discussion to bring out issues from participants' own experience 4 Risk assessment Understanding your hazards Identifying specialist areas How to undertake these assessments Implementation of sound systems and processes Syndicate exercise identifying where assessments are needed and carrying out assessments 5 Keeping the work environment safe Sick building syndrome and legionella Asbestos Waste management Pest control Provisions for first aid Accident reporting and investigation At-work driver safety Security 6 Fire safety Understanding the Regulatory Reform Fire Safety Order Fire certificates The fire risk assessment Testing fire-fighting equipment? Emergency procedures Workshop to examine the procedures for dealing with different types of emergencies 7 Ergonomics programme Ergonomics - important or irrelevant? Are you complying with HSE regulations? Furniture and equipment Display screen equipment assessments Homeworking - your concern or not? Syndicate exercise to review what to do when relocating or refurbishing an office 8 Inspecting and auditing Role of Health and Safety Executive Inspectors - 'be prepared' FM role Staff/trade union involvement Independent audits Records and reports Communicating the results 9 Action plan Participants to list actions they need to take after the course

Expand your scope and become a Domestic LPG install/service/maintenance/breakdown engineer today! Or, renew your LPG qualifications for a great price whilst improving your skills & knowledge! This course is the ACS LPG Changeover, you will be asked if you require Initial or Renewal at check out.

Black CSCS Card NVQ Level 6 Diploma in Occupational Health and Safety Practice This qualification is aimed at health and safety managers who are responsible for developing and applying health and safety procedures day-to-day in their organisation. They may be a staff member, supervisor or manager looking to improve their knowledge and skills. Furthermore, once you have completed this NVQ you will be able to apply for GRADIOSH status. Induction - As soon as you register you will be given a dedicated assessor. They will arrange an induction and together with your assessor you'll get to decide on the pathway which best proves your competency. The induction is used to plan out how you will gather the relevant evidence to complete the course. During the course - The assessor will work with you to build a portfolio of evidence that allows you to showcase your knowledge, skills and experience. The assessor will also regularly review and provide you with feedback. This will allow you to keep on track to progress quickly. You will be assessed through various methods such as observations, written questions, evidence generated from the workplace, professional discussion and witness testimonials. On completion - Once all feedback has been agreed, the Internal Quality Assurer will review your portfolio and in agreement with your assessor the certificate will be applied for. To download our PDF for this course then please click here.

Search By Location

- Compliance Courses in London

- Compliance Courses in Birmingham

- Compliance Courses in Glasgow

- Compliance Courses in Liverpool

- Compliance Courses in Bristol

- Compliance Courses in Manchester

- Compliance Courses in Sheffield

- Compliance Courses in Leeds

- Compliance Courses in Edinburgh

- Compliance Courses in Leicester

- Compliance Courses in Coventry

- Compliance Courses in Bradford

- Compliance Courses in Cardiff

- Compliance Courses in Belfast

- Compliance Courses in Nottingham