- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1322 Courses in London

Safeguarding Protection Safeguarding and protection Child protection Vulnerable adults Abuse prevention Neglect prevention Exploitation prevention Identifying abuse Reporting abuse Case studies on safeguarding Safeguarding training Recognizing signs of abuse Preventing abuse and neglect Safeguarding course with case studies

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Certified Business Analysis Professional (CBAP) Boot Camp

By IIL Europe Ltd

Certified Business Analysis Professional™ (CBAP®) Boot Camp The course provides targeted exam preparation support for IIBA® Level 3 - CBAP® exam candidates, including both a BABOK® Guide Version 3.0 content review and exam preparation tutorial. The class is interactive, combining discussion, application of concepts, study tips, and a practice exam. Knowledge Check quizzes and self-assessments allow candidates to identify areas of weakness and create a custom study plan tailored to their individual needs as well as study aids to support their exam preparation after the course. The course materials include a copy of A Guide to the Business Analysis Body of Knowledge® (BABOK® Guide) Version 3.0. What you will Learn Upon completion, participants will be able to: Demonstrate familiarity with the structure and content of the IIBA® BABOK® Guide Improve their probability of passing the Level 3 - CBAP® Exam Identify their knowledge gaps through the use of module Knowledge Check quizzes Gauge their readiness for taking the exam by IIBA® BABOK® Guide Knowledge Are Foundation Concepts for IIBA® CBAP® Prep IIBA® - the Organization Business Analysis - the Profession Knowledge Check Terminology and Key Concepts IIBA®'s BABOK® Guide - the Standard Underlying Competencies BA Techniques Business Analysis Planning and Monitoring Knowledge Check Overview BAP&M Tasks BAP&M Techniques Elicitation and Collaboration Knowledge Check Overview E&C Tasks E&C Techniques Requirements Life Cycle Management Knowledge Check Overview RLCM Tasks RLCM Techniques Strategy Analysis Knowledge Check Overview SA Tasks SA Techniques Requirements Analysis and Design Definition Knowledge Check Overview RA&DD Tasks RA&DD Techniques Solution Evaluation Knowledge Check Overview SE Tasks SE Techniques Exam Preparation Practice Exam and debrief Exam Preparation Study Tips Manage Study Plan Exam Process Exam day

Overview Objective Describing the HR role and Strategies Describe different approaches to employee training Describe different approaches to professional development Describe different approaches to performance appraisals Summarize different forms of employee compensation

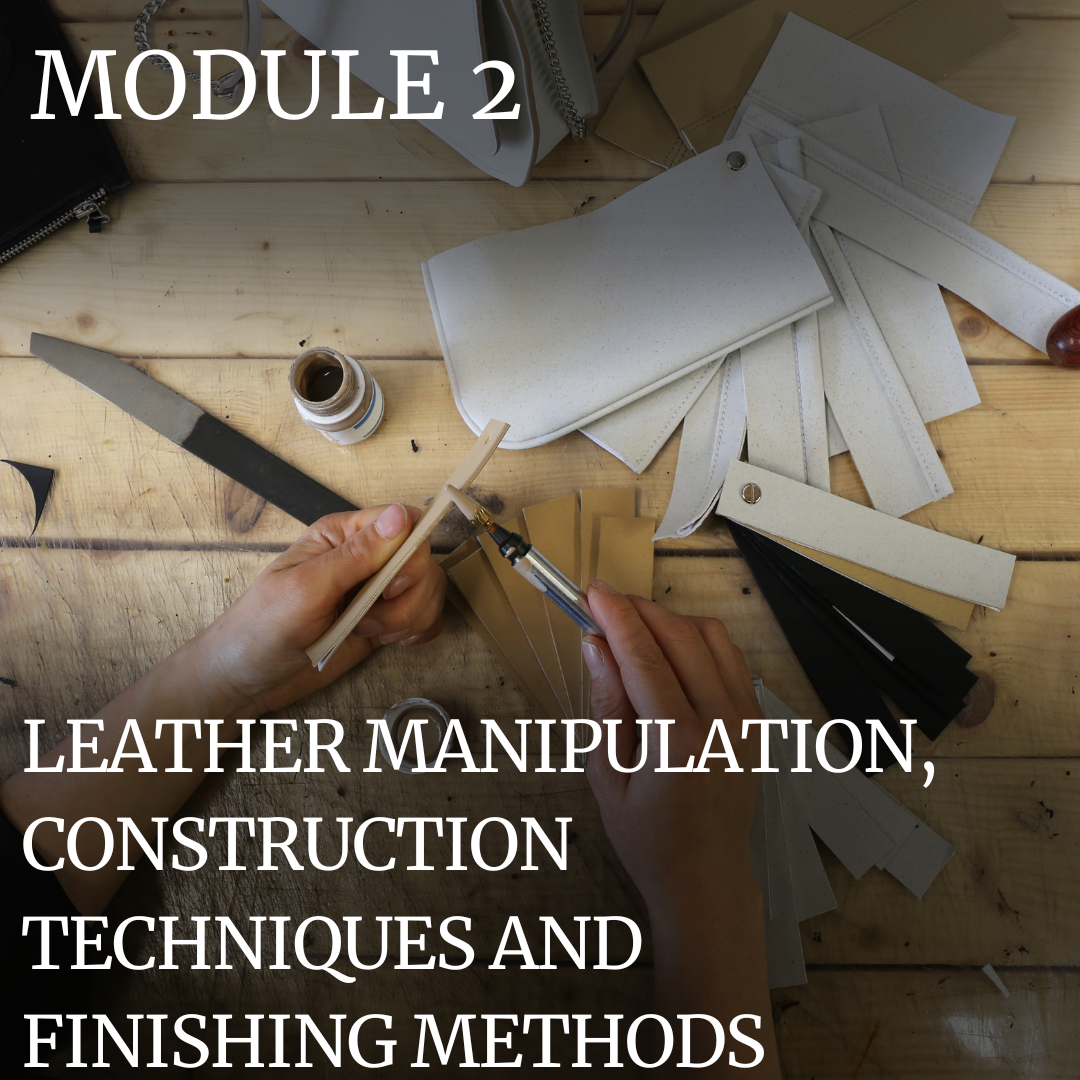

PROFESSIONAL TRAINING: MODULE 2 – LEATHER MANIPULATION, CONSTRUCTION TECHNIQUES AND FINISHING METHODS

5.0(52)By The London Leather Workshop

UNDERSTAND TO TO WORK WITH AND MANIPULATE LEATHER TO CONSTRUCT REFINED LEATHER GOODS This is the second module of a series designed to provide thorough, professional training in leatherworking and accessory making. Each module has been carefully designed to equip individuals with key skills for starting a career in this sector, broadening their industry knowledge, or embarking on their own journey with solid foundational skills. During this lesson, you will learn how to manipulate leather to create specific shapes, constructions, and finishing types. You will work with different kinds of leather, tools, and reinforcements to achieve specific volumes, shapes, and structures. You will gain an understanding of the technical aspects of finishing edges, such as folding, burnishing, inking, creasing, and more. This module covers some of the most challenging aspects of working with leather and provides you with a strong foundation for making informed choices in developing your projects. You will also receive valuable handouts, curated lists of leather and tool suppliers for ongoing reference, and create personalised samples for your own reference. Summary of topics covered in the class: – Leather manipulation techniques based on various leather types and tanning – Bags and accessory finishing choices based on construction types – Leather structure creation using a variety of tools, reinforcements, stabilisers, and stiffeners – Leather edging: inking, burnishing, folding, tucking, creasing By the end of the tuition, you will have: – Gained the ability to identify the best construction, manipulation, and edging techniques for a specific project – Learned to recognise which tools and techniques to use based on the specific leather type – Understood the pros and cons of each edging technique and been able to choose the most suitable one for your project – Created a catalogue of samples to take home – Developed confidence in utilising a wide range of specific tools for leatherworking – Acquired an understanding of working with diverse leather types and thicknesses, with the ability to source and select appropriate tools for the specific material you intend to use Included in the course: You will receive useful paper handouts containing: – A list of tools and materials used during the lesson(s), with descriptions and usage instructions – A list of recommended suppliers for leather and fittings, both in London and online – A glossary of leather types and characteristics Find all modules here: https://the-london-leather-workshop.cademy.co.uk/

Course Introduction Our Venepuncture and Phlebotomy training equips delegates with the skills and knowledge needed to take blood safely. Please note: this course is for health care professionals and nurses only. About this event Applicable to Nurses, Health Care Assistants and Phlebotomists in primary care, the community, hospitals or nursing homes, this course is interactive and involves a demonstration session on performing blood tests. Our venepuncture training will give delegates the theoretical and practical awareness to undertake a competence assessment framework in the workplace that will deem them competent to take blood safely and appropriately. Each delegate will receive a competence-based framework to allow them to do this. Course Aims Identify and describe equipment used for routine venepuncture Be able to assess and select suitable sites used for venepuncture as well as locations to avoid Describe and utilize the required steps to perform routine venepuncture Describe actions that ensure safety during performance of a venepuncture Identify suitable vein selection and identify factors influencing this Understand relevant professional and legal issues Be able to identify potential complications Understand anatomy and physiology and correct vein selection Be familiar with equipment and exercise choice in using most appropriate equipment Practice safely in terms of infection control and waste management Become skilled and competent at phlebotomy To recognise any complications arising and be able to take the appropriate action Course Content Background and importance of training and competence Supervision and practice Scope and responsibilities Accountability Professional and legal issues Consent and capacity What is phlebotomy? Tools of the trade-equipment Needles and patient safety Blood collection systems and devices Syringes and when to use them Blood collection tubes Labelling Anatomy and physiology Vein Selection: - Identification of Veins - Arm Veins - Hand Veins Vein assessment Unacceptable sites for venous collection Venepuncture procedure Attempts Order of Fill Specimen collection procedures Specimen handling post-phlebotomy Personal protective equipment Needle stick injuries Legislation-EU Directives Disposal Needle phobias Dealing with anxiety/fainting etc. Practical session Potential Complications (including infection control) Practical Application - techniques and troubleshooting Case scenarios Troubleshooting Audit Who should attend / would be applicable? Nurses HCAs Those interested in careers as Phlebotomists AB Health Group awards CPD points / certificate of attendance for each course. If you would prefer an accredited certificate by our accrediting body Aim Qualifications we can organise this. The charge for the certificate including postage is £30.00. Annie Barr AB Health Group Organiser Description Annie Barr is a leading provider of high quality, accredited healthcare training. With a selection of engaging healthcare training that has been developed by experts to equip you and your workforce with the skills, knowledge and competence needed to provide compassionate and high quality care.

Business Writing 1 Day Workshop in Bromley

By Mangates

Business Writing 1 Day Workshop in Bromley

Search By Location

- Professional Courses in London

- Professional Courses in Birmingham

- Professional Courses in Glasgow

- Professional Courses in Liverpool

- Professional Courses in Bristol

- Professional Courses in Manchester

- Professional Courses in Sheffield

- Professional Courses in Leeds

- Professional Courses in Edinburgh

- Professional Courses in Leicester

- Professional Courses in Coventry

- Professional Courses in Bradford

- Professional Courses in Cardiff

- Professional Courses in Belfast

- Professional Courses in Nottingham