- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

This foundational course will help all managers to better understand what a supply chain is and how their roles impact and interact with, their end-to-end supply chain process. PARTICIPANTS WILL LEARN HOW TO: • Understand the role of the supply chain within the wider business context • Become aware of the fundamental trade-offs in the supply chain (e.g. supply chain cost vs service level, efficiency vs flexibility etc.) • Understand the importance of supply chain planning and be able to identify its key components • Develop awareness of the key challenges in modern inventory management and distribution; become familiar with tested practices that allow responding to these challenges • Understand the meaning of essential supply chain terminology • Understand how supply chain performance affects company financial results COURSE TOPICS INCLUDE: • What is supply chain management? Why is it important? • The importance of cost versus service • Purchasing and procurement • Manufacturing processes • Demand management • Warehouse and inventory management • Logistics and transport • Risk management

This course provides exceptional training on the principles and processes required to successfully operate a warehouse. PARTICIPANTS WILL LEARN HOW TO: • Learn about the characteristics of a warehouse and its function • Understand the basic principles of effective layout design and product storage prioritization • Gain an understanding of modern practices in warehouse operations, such as Kanban and 5S • Understand the importance of packaging and data inputs to improve the performance of pick and pack operations • Understand the role of KPIs in warehouse and supply chain management COURSE TOPICS INCLUDE: Material storage as part of supply chain management Evaluation of outsourcing issues Challenges of codification and traceability Performance management Automated and mechanized systems Different storage methodologies Use of Warehouse management systems Optimum cube utilization and labour productivity Picking and packing management systems Goods receipt and dispatch

Service Level Agreements (SLAs) are extensively utilised to define the scope of work and key responsibilities between a customer and a service provider. It is fundamental that all relevant personnel are familiar with the defining characteristics of SLAs and how the design and implementation of these contracts can impact operational efficiency and brand reputation. PARTICIPANTS WILL LEARN HOW TO: Understand why SLAs are so important for good business management Apply a process to develop effective SLAs that define service level expectations and drive desired behaviours Identify methods by which the SLA can be measured and performance monitored Have an understanding of KPI’s and the relevance of critical success factors COURSE TOPICS INCLUDE: Procurement cycle, process structure and tendering Best practice contract management and the 3 C’s Supplier performance measurement and KPIs SLA use, benefits and application The SLA development process The monitoring and control of SLAs

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This course covers distressed debt analysis and investing, focusing primarily on corporates but also including financial institutions and sovereign debt as special topics. The programme begins with the foundations of the distressed debt market, causes of and early warning signals, possible outcomes and how to evaluate the probability of outcomes in different scenarios. Restructuring is reviewed in detail, as well as estimation of sustainable debt levels, business valuation and the importance of capital and group structure. Differences between active control and passive non-control investments are highlighted, including stakeholder tactics and due diligence. Case studies cover a variety of companies across sectors and geographies, challenging delegates to make investment decisions on real distressed debt situations. Who the course is for Distressed debt investors, Loan portfolio managers and Private equity investors Hedge fund managers High yield credit analysts and Equity analysts High yield asset managers and Mergers and acquisitions bankers Debt capital markets/leveraged finance bankers Business turnaround/restructuring accountants/corporate finance professionals Lawyers Strategy consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A comprehensive and practical 3 days workshop on pricing, using and managing structured interest rate derivatives. What used to be called exotic interest rate derivatives are now commonplace and an essential part of the financial marketplace either as legacy transactions or embedded in new structures. This intensive course is for anyone who wishes to be able to use, price, manage, market or evaluate standard interest rate derivatives such as Constant Maturity Swaps, Range Accruals and Quantos. We also look in detail at such important products as CMS spread-linked structures and volatility/variance swaps, always from a pragmatic practitioner’s perspective. Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers IPV professionals Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Compassionate Leadership: 1-Day workshop. Groups for up to 16 learners

By Mindmaps Wellbeing

Compassion-focussed leadership is a transformative move for driving both individual and organisational performance. Long-term success comes from creating a workplace where people actually want to stay and thrive. For all leaders and managers of all levels to attend — Learn an actionable workplace wellbeing action plan that generates a real culture change to workplace wellbeing

Dangerous Goods Safety Advisor (DGSA) Training: A Vital Step in Safety and Compliance

By HCPC Training Ltd

Moving dangerous goods is a big job. It must follow strict global rules. A Dangerous Goods Safety Advisor (DGSA) helps companies follow these rules and keep people safe. At HCPC Training, we offer DGSA courses that are clear and easy to follow. Our training gives workers the skills they need. They learn how to manage risks and stay within the law. With our help, they gain the confidence and certificate to do the job right. What is a Dangerous Goods Safety Advisor? A Dangerous Goods Safety Advisor (DGSA) plays an important role in organisations that transport hazardous materials. They make sure the company follows ADR regulations. This includes ensuring the correct classification, packaging, labelling, and transport of dangerous goods. Since January 2000, all companies must appoint a qualified DGSA. To become certified, candidates must pass the DGSA exam, which is run by the Scottish Qualifications Authority (SQA). Why is DGSA Training Important? Dangerous goods include chemicals, explosives, flammable liquids, and toxic substances. These materials need careful handling. The DGSA course helps people manage the complexities of transporting these goods safely. The course covers key topics, such as: ADR classification of dangerous goods (UN Classes 1 to 9). Transport categories, including limited and excepted quantities. Placarding and marking of vehicles for hazardous goods. Essential documentation for safe transport. By gaining a DGSA qualification, professionals can help prevent accidents, avoid fines, and ensure the safety of everyone involved in the transport process. What Does the DGSA Course Cover? Our 5-day classroom DGSA training course at HCPC Training gives a detailed look at the rules for transporting dangerous goods. The course is designed to give candidates both theory and practical knowledge. Here’s what you will learn: ADR Requirements The course covers the ADR rules that explain how dangerous goods must be handled. This includes how substances should be classified, packaged, labelled, and documented. DGSAs must know these steps to avoid mishandling during transport. Dangerous Goods Classification Classifying dangerous goods is one of the most important parts of the training. This ensures goods are sorted correctly based on their dangers. Proper classification helps keep the transport process safe and reduces the risk of accidents. Placarding and Marking of Vehicles Knowing how to place the correct placards and markings is key. This helps identify dangerous goods quickly during transport. You’ll learn how to display the right hazard signs and symbols on vehicles carrying these materials. Documentation Each shipment of dangerous goods must have the right paperwork. In this part of the training, you’ll learn which documents are needed for each consignment. This ensures the transport is smooth and complies with the law. Examination Preparation To become a qualified Dangerous Goods Safety Advisor, you must pass exams. The DGSA exam is split into three parts: Core, Road, and All Classes. You will need to register with SQA for the exams. Our training will fully prepare you for these tests. The DGSA Certification Process After finishing the DGSA training course, candidates must take the DGSA exam. The exam has three parts: Core – This part covers general rules for all dangerous goods. Road – This focuses on the transport of dangerous goods by road. All Classes – A detailed exam on dangerous goods in all UN classes. Exams are held quarterly. You must register directly with SQA for your exam. Once you pass, you will receive your DGSA certificate. This certificate shows your expertise in safely handling the transport of dangerous goods. Cost of the DGSA Course The DGSA course at HCPC Training costs £1,014.00 (including VAT). This covers 5 days of classroom training and all necessary materials. Payment is required at least three weeks before the course starts. There are no refunds for missed or partially attended sessions. The qualification lasts for 5 years. After that, you must take a refresher course and re-certify. Who Should Take the DGSA Course? The DGSA course is for anyone working in logistics, transport, or shipping who deals with dangerous goods. Whether you're part of a company transporting hazardous materials or a consultant advising on safety, this course will help you understand ADR regulations and offer expert compliance advice. Key Roles Include: Transport Managers and Logistics Coordinators. Safety Officers and Regulatory Compliance Experts. Consultants advising on dangerous goods handling. Final Thoughts Becoming a Dangerous Goods Safety Advisor helps improve transport safety. With HCPC Training, you’ll get the qualifications to handle hazardous materials safely and follow all rules. Want to take the next step in your career? Visit us for more details on how to enrol and upcoming courses.

Excavator Training

By Excavator training

Excavator training for all levels from experienced operators to complete novice excavator training

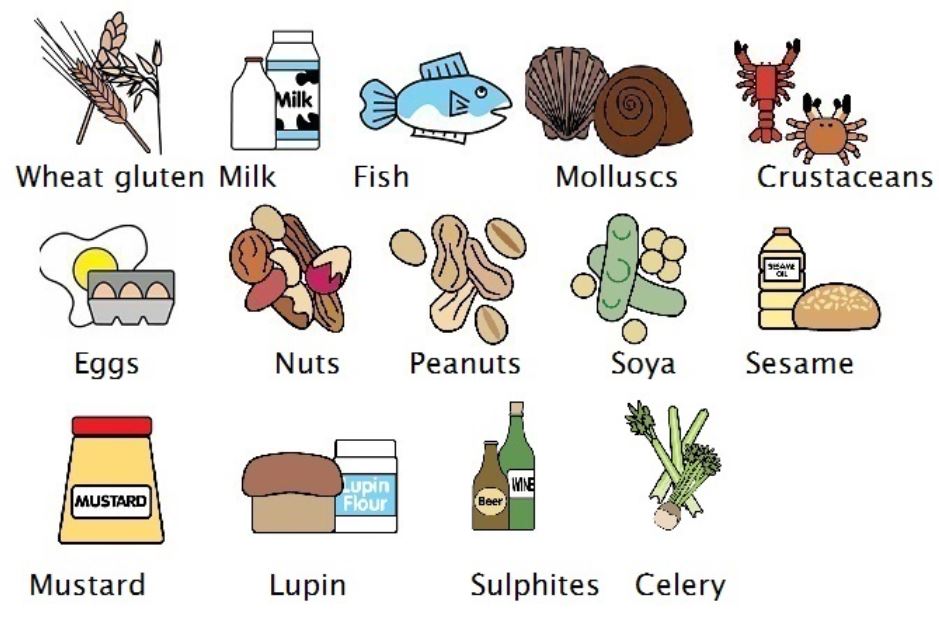

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course

By Kitchen Tonic Training Company and Food Safety Consultants

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course Do you need an allergy trainer to come to your food business and teach your staff face to face about food and drink allergens, their dangers and how to control them? Our allergy trainer can come to your business and deliver this course at your business premises. Although we are based in London, we are happy to travel and deliver this course at your business location. (Trainer travel fees may be applicable depending on your location). Staff will receive interactive training and coaching on allergens and intolerances with an experienced trainer. We can also tweak the training to include issues you would like to cover. See our website for more details. Special offer for on-site allergy training. £250 plus £20pp includes RSPH exam fees (usually £350 plus £30pp) This course is suitable for any catering business such as restaurants, pubs, hotels, cafes, catering companies, cooks, self employed, artisans, event caterers and more. This course is also important for staff who are Front of House, who take customer orders and relay the orders to cooks and chefs and other people who are preparing food for customers who have allergies and or intolerances. This is a short one day training course, typically 9am-3pm. Topics covered include- Allergens, Allergen Identification, Cross contact, Cross Contamination, Allergic Reactions, Food Intolerances, Coeliac, Anaphylaxis, Natasha's Law, UK Food Safety Regulations, Allergy Controls, Substituting ingredients, Customer Communication and what to do in an Emergency. Contact us to book training.

Search By Location

- import Courses in London

- import Courses in Birmingham

- import Courses in Glasgow

- import Courses in Liverpool

- import Courses in Bristol

- import Courses in Manchester

- import Courses in Sheffield

- import Courses in Leeds

- import Courses in Edinburgh

- import Courses in Leicester

- import Courses in Coventry

- import Courses in Bradford

- import Courses in Cardiff

- import Courses in Belfast

- import Courses in Nottingham