- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

65657 Courses

Complications Course

By Harley Elite Academy (HeLa)

Emergencies & Complications 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! Additional information ATTENDANCE ONLINE (Theory), IN CLINIC (Practice) COURSE LEVEL INTERMEDIATE | Advanced Course

ProQual NVQ Level 3 Diploma - Plant Maintenance

By Learning for Hire Limited

NVQ Level 3 Plant Maintenance - on-site assessment - we come to you

Advanced Certificate in Fund Administration

By International Compliance Association

This qualification from our partner organisation CLTI will enable you to develop your knowledge of fund operations, across both accounting and administration and creates a training and education path for fund administrators where there have traditionally been limited training opportunities to evidence knowledge and support career development. Demonstrate a detailed understanding of the functions of key parties in a fund and how they meet the needs of stakeholders. Understand the lifecycle of different fund structures, including the processes involved in their closure, winding down and/or liquidation. Demonstrate awareness of the topical issues surrounding alternative investment funds, fund of funds and debt funds. Present a detailed knowledge of fund regulation and be able to interpret and apply Principal Documents, Scheme Particulars and investment restrictions. Understand the fundamentals of fund accounting and how to account for specific fund transactions. Carry out a range of advanced calculations in relation to a fund, including NAV, GAV, performance fees, and entry and exit charges. Calculate earnings per share and the total expense ratio, and use ratios to analyse a set of financial statements. Determine the impact of taxation on different fund structures and be able to carry out relevant tax calculations. This qualification covers the following topics: Fund structures, strategies and regulation Advanced find accounting and analysis

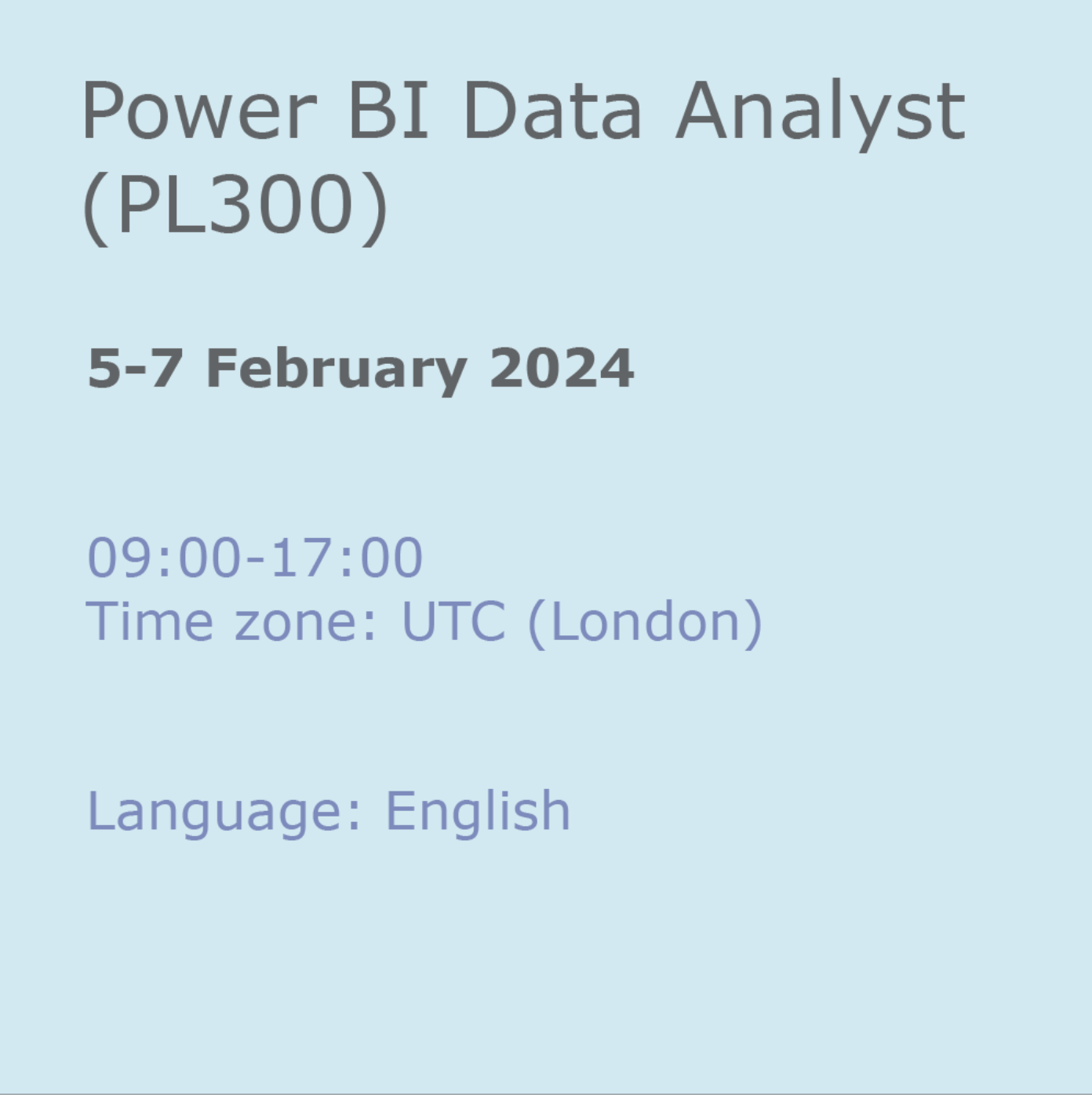

Power BI Data Analyst (PL300)

By Online Productivity Training

OVERVIEW This official Microsoft Power BI training course will teach you how to connect to data from many sources, clean and transform it using Power Query, create a data model consisting of multiple tables connected with relationships and build visualisations and reports to show the patterns in the data. The course will explore formulas created using the DAX language, including the use of advanced date intelligence calculations. Additional visualisation features including interactivity between the elements of a report page are covered as well as parameters and row-level security, which allows a report to be tailored according to who is viewing it. The course will also show how to publish reports and dashboards to a workspace on the Power BI Service. COURSE BENEFITS: Learn how to clean, transform, and load data from many sources Use database queries in Power Query to combine tables using append and merge Create and manage a data model in Power BI consisting of multiple tables connected with relationships Build Measures and other calculations in the DAX language to plot in reports Manage advanced time calculations using date tables Optimise report calculations using the Performance Analyzer Manage and share report assets to the Power BI Service Prepare for the official Microsoft PL-300 exam using Microsoft Official Courseware WHO IS THE COURSE FOR? Data Analysts with little or no experience of Power BI who wish to upgrade their knowledge to include Business Intelligence Management Consultants who need to conduct rapid analysis of their clients’ data to answer specific business questions Analysts who need to upgrade their organisation from a simple Excel or SQL-based management reporting system to a dynamic BI system Data Analysts who wish to develop organisation-wide reporting in the form of web reports or phone apps Marketers in data-intensive organisations who wish to build visually appealing, dynamic charts for their stakeholders to use COURSE OUTLINE Module 1 Getting Started With Microsoft Data Analytics Data analytics and Microsoft Getting Started with Power BI Module 2 Get Data In Power BI Get data from various data sources Optimize performance Resolve data errors Lab: Prepare Data in Power BI Desktop Module 3 Clean, Transform And Load Data In Power BI Data shaping Data profiling Enhance the data structure Lab: Load Data in Power BI Desktop Module 4 Design A Data Model In Power BI Introduction to data modelling Working with Tables Dimensions and Hierarchies Lab: Model Data in Power BI Desktop Module 5 Create Model Calculations Using DAX In Power BI Introduction to DAX Real-time Dashboards Advanced DAX Lab 1: Create DAX Calculations in Power BI Desktop, Part 1 Lab 2: Create DAX Calculations in Power BI Desktop, Part 2 Module 6 Optimize Model Performance Optimize the data model for performance Optimize DirectQuery models Module 7 Create Reports Design a Report Enhance the Report Lab 1: Design a Report in Power BI Desktop, Part 1 Lab 2: Design a Report in Power BI Desktop, Part 2 Module 8 Create Dashboards Create a Dashboard Real-time Dashboards Enhance a Dashboard Lab: Create a Power BI Dashboard Module 9 Perform Advanced Analytics Advanced analytics Data Insights through AI Visuals Lab: Perform Data Analysis in Power BI Desktop Module 10 Create And Manage Workspaces Creating Workspaces Sharing and managing assets Module 11 Manage Datasets In Power BI Parameters Datasets Module 12 Row-Level Security Security in Power BI Lab: Enforce Row-Level Security

ProQual NVQ Level 2 Diploma - Plant Maintenance

By Learning for Hire Limited

NVQ Level 2 Plant Maintenance - on site assessment - we come to you

Data Protection (GDPR) Practitioner Certificate

By CloudLearn

We are data protection specialists and this is our flagship training programme for Data Protection Officers, Data Protection Managers, Compliance Managers or anyone with a responsibility for Data Protection. The Data Protection (GDPR) Practitioner Certificate is an internationally recognised qualification, endorsed by TQUK, which is regulated by Ofqual, a UK Government department. It equips current and aspiring data protection officers and data protection managers with knowledge and skills to undertake data protection compliance activities throughout an organisation. It is a valuable course for anybody with data protection compliance responsibilities. The course takes account of the latest developments in this fast moving subject, together with the latest guidance from the ICO and includes real life, practical examples throughout. There are two versions of the course (with the same content and same trainer). The courses priced at £1200 are run by Computer Law Training and lead to the TQUK endorsed certificate. The courses priced at £1440+VAT are run in collaboration with, and are booked through, the Law Society of Scotland and, on successful completion, lead to the TQUK endorsed certificate and a 'Certified Specialist' certification from the Law Society of Scotland. Suitability - Who should attend? The training programme for Data Protection Officers, Data Protection Managers, Compliance Managers, Corporate Governance Managers or anyone with a responsibility for Data Protection. The Data Protection (GDPR) Practitioner Certificate is ideal for you if you: Are already undertaking the role of Data Protection Officer Expect to be filling the post of Data Protection Officer in their current employment Are looking for employment as a Data Protection Officer Have, or expect to have, data protection responsibilities in their organisation Need to advise others on data protection compliance Wish to be able to demonstrate verifiable practical skills and learning in this area. It is suitable for those working in: the public sector, the private sector and the third sector. In either case, it will teach participants essential data protection skills and in depth knowledge. Outcome / Qualification etc. Understand the importance of data protection legislation and compliance in the UK and beyond. Interpret key terminology of the UK GDPR and Data Protection Act 2018 (DPA) in a practical context Understand the key obligations of the UK GDPR and DPA Create appropriate policies and procedures necessary for data protection compliance Carry out a data protection audit and gap analysis Develop an action plan to address a data protection gap analysis Respond appropriately to data protection issues arising in an organisation Carry out the duties of a data protection officer Undertake accountability and risk analysis activities Training Course Content Day 1 Data Protection – history and background GDPR Overview What, really, is personal data Purposes & Legal Bases Day 2 Consent Special Categories of Personal Data Data Subject Rights Transparency Requirements Data Processors and Controllers Information Security Obligations Breach Reporting and Recording Day 3 Restricted (International) Transfers Cloud Services Accountability The Personal Data Audit & Record of Processing The “Accountability Portfolio” Data Protection by Design & Default Data Protection Impact Assessments Privacy Enhancing Technologies Data Protection Officers Direct Marketing & Cookies Day 4 Data Protection Act 2018 HR Issues Risk Frameworks Data Protection Governance Day 5 Data Protection Audit Gap Analysis Action Plan Implementation The ICO and Enforcement Brexit and the future (crystal ball!) The European Data Protection Board (EDPB) Questions Course delivery details The course is delivered on Zoom. It lasts 5 days over 3 weeks, 9.30-16.30. The advertised start date is usually a Tuesday which is the first day of the course. The course normally continues on the Thursday of that week, Tuesday and Thursday the following week and one day in the third week: 24, 26, 31 January & 2, 7 February 2023 The one-hour test to obtain the certificate is online by arrangement in the week or two following the course. The trainer for the course is Tim Musson, who has a Master of Laws degree in IT and Telecoms Law, is a Certified Information Privacy Professional (CIPP/E) and a Certified Information Privacy Technologist (CIPT).

Thinking Commercially

By Mpi Learning - Professional Learning And Development Provider

This course will provide an opportunity to begin to understand what commercial and financial awareness means and the importance of everyone in thinking commercially.

For those seeking perfection in polishing techniques. The UKDA Advanced Machine Polishing (professional) Course is a day for those who would like to develop their technique further on all machine styles to produce the high-end, high-efficiency finish that is the marque of the most accomplished detailers. Taking cues from any existing experience, we will push the boundaries of your polishing abilities over the edge, running rotary DA and forced drives to their limit to give to the skills to drive up your efficiency and perfect paint like never before. The UKDA Advanced Machine Polishing (professional) Course is a 2 day for those who would like to develop their technique further on all machine styles to produce the high-end, high-efficiency finish that is the marque of the most accomplished detailers. Far from there being a consistent method - there are a number of subtle variations you can make to what would be termed a 'standard' technique which will speed up your process, enhance further your gloss extracting capabilities and make the right choice in machine based on paint types, conditions and ancillary equipment. On this day we will run through variables in speed and pad choices, show the differences ambient temperature and rebound can make to a job, explain the different approaches based on clear coat solids, look at how far you can push a painted surface, and much much more. The course is run over two full days (9.30 am - 4.30 pm) and picks up where both our introduction course and the Flexxpert Seminar leave off, so is also the perfect follow-up to those who have attended either course, in addition to those who want to learn all about machine polishing in every style. Alternatively, if you are machine polishing in your day-to-day work outside of detailing and feel you have scope to improve, or you keep coming up against small issues, this is the course for you. Not sure if it suits you? Why not call or message one of our team, and we'll be happy to discuss which course is right for you. Course Length 2 Days (0930-1600) Group Size One-to-One, Up to 2 people Location UK Detailing Academy, 2 Purlieus Barn, Ewen, Cirencester, GL7 6BY Experience / Qualification Competent with preparation and decontamination procedures Refreshments or Lunch Lunch NOT included, Refreshments included

CPCS A66 Compact Crane

By BAM Construction Training Ltd

4 Days We run weekly open courses for accreditations including CPCS, CSCS Health & Safety, NPORS, IFAP, SMSTS and more. We also offer bespoke training courses or in house training nationwide. Upon arrival at our centres candidates will be inducted to the site by their qualified instructor who will be training them for the day. After registration candidates will be issued with a pack full of information relevant to the category they are being trained in. Included in this pack are theory questions, practical specifications, pre-start check lists, marking sheets and more. We ensure that these materials provided excel the individual to successfully complete their course. We are aware that having good quality machines give candidates a significant advantage when undertaking their training. We endeavour to supply candidates with the highest quality plant training and machinery on our site using a variety of certified suppliers. These machines come equipped with all the health and safety features and include – but are not limited to – JCB, Magni, Merlo, Caterpillar, Thwaits and Manitou. Get in touch with us today to find the right course for you. Our team are on-hand and ready to support you with your construction training requirements.

CPCS A61 Appointed Person

By BAM Construction Training Ltd

5 Days We run weekly open courses for accreditations including CPCS, CSCS Health & Safety, NPORS, IFAP, SMSTS and more. We also offer bespoke training courses or in house training nationwide. Upon arrival at our centres candidates will be inducted to the site by their qualified instructor who will be training them for the day. After registration candidates will be issued with a pack full of information relevant to the category they are being trained in. Included in this pack are theory questions, practical specifications, pre-start check lists, marking sheets and more. We ensure that these materials provided excel the individual to successfully complete their course. We are aware that having good quality machines give candidates a significant advantage when undertaking their training. We endeavour to supply candidates with the highest quality plant training and machinery on our site using a variety of certified suppliers. These machines come equipped with all the health and safety features and include – but are not limited to – JCB, Magni, Merlo, Caterpillar, Thwaits and Manitou. Get in touch with us today to find the right course for you. Our team are on-hand and ready to support you with your construction training requirements.

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham