- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

130 Courses

This course acts as an introduction to personal safety for lone workers and applies to those that work alone within business premises, mobile workers and homeworkers. It covers the legal responsibilities of both employers and employees, some of the common security precautions that can be implemented, practical steps you can take to avoid conflict in lone worker situations and other elements that can contribute to lone worker safety.

This course will start by covering the many benefits electricity brings to society, as well as its key components voltage, current and resistance. It will explain the two main types of electricity, cover UK accident and death statistics, and describe a simple way of remembering the electrical hazards. It then goes on to provide basic instructions about how you could safely help someone you suspect has received an electric shock.

This course defines behavioural safety and explains the origins of the concept. It covers how it can be implemented in the workplace and some of the potential benefits. It includes analysis of some examples of ‘at risk behaviours’ and some examples of ways you can measure how well your organisation is doing when it comes to safety. Finally it touches on some of the key laws regarding health and safety in the workplace and how to ensure positive workforce attitudes.

This course will start by covering some of the key terms you will need to understand before moving on to identifying critical control points and analysing some of the key hazards. It’ll show you how to determine control points and how to avoid cross-contamination in the food chain. It will also cover some of the control measures that can be taken along with how to address a problem if a critical limit is breached.

This course explores the risk to workers caused by the Covid-19 virus and covers actions that can be taken by employers and employees to protect themselves and each other as they return to work. The content of this course is based on the latest information from the UK government and the NHS. It covers information about the virus, risk assessments and personal safety, along with how to make changes to the daily work environment to address these risks.

At the end of this course, candidates will have an understanding of what a risk assessment is and how to complete one. To achieve this the course will define important terms, provide some basic background information to explain how important risk assessments are and discuss some of the legislation that applies. It will then go on to provide practical advice on how to identify hazards and analyse risk before finishing off by explaining the responsibilities of both employers and employees with regards to risk assessment.

This course is aimed at users of display screen equipment, or DSE as it’s often called. DSE is a term that covers a wide range of equipment. If DSE equipment like this is not set up correctly, users are at increased risk from certain disorders. As an employee, you share the responsibility to keep people safe at work. That means undergoing relevant training and ensuring that rules are followed.

Professional Diploma in Information Technology

By iStudy UK

Course Overview Are you looking to improve your computer literacy or kickstart a career in the IT sector? This Professional Information Technology Course covers all the basics, from the anatomy of a PC to programming language and essential software. You will also explore the role of an IT Technician and Computer Programmer, including career path and opportunities. Through tutor-led guidance, you will learn about the latest IT technologies and gain the core skills required to gain employment in this field. You will also deepen your understanding of IT security and troubleshooting issues, to protect your PC and networks. Once you have successfully completed this course, a range of professions will be open to you, and you will have the certification and skills to maintain and upgrade any PC with confidence. This Information Technology Course is an introductory course, with no specific entry requirements. Fast track your career online and gain the practical knowledge to become an IT Technician or Programmer! What You Will Learn This Diploma in Information Technology is ideal for aspiring IT professionals and those who wish to improve their computer literacy. It provides essential information and guidance on networking, programming, troubleshooting and other key topics, covering the fundamental components of a PC. Understanding the Components of a PC Do You Need to Upgrade Your PC? Essential Software Every PC Must Have How to Install and Organise Your PC Tips & Guidelines for Troubleshooting How to Speak to a Technician The Role of a Computer Programmer An Introduction to Programming Language The Basics of Computer Networking Network Routing, Switching, Bridging & Security Why You Should Choose This Course From iStudy Study at your own pace Full Tutor support on weekdays (Monday - Friday) Fully compatible with any device Free Printable PDF Certificate immediately after completion No prior qualifications are needed to take this course No hidden fees or exam charges CPD Qualification Standards and IAO accredited Efficient exam system, assessment, and instant results Our customer support team is always ready to help you Gain professional skills and better earning potential Certification After completing the course you'll receive a free printable CPD accredited PDF certificate. Hard Copy certificate is also available, and you can get one for just £9! Accreditation This course is accredited by Continuing Professional Development (CPD). It is a recognised independent accreditation service. Enrol today and learn something new with iStudy. You'll find a full breakdown of the course curriculum down below, take a look and see just how much this course offers. We're sure you'll be satisfied with this course.

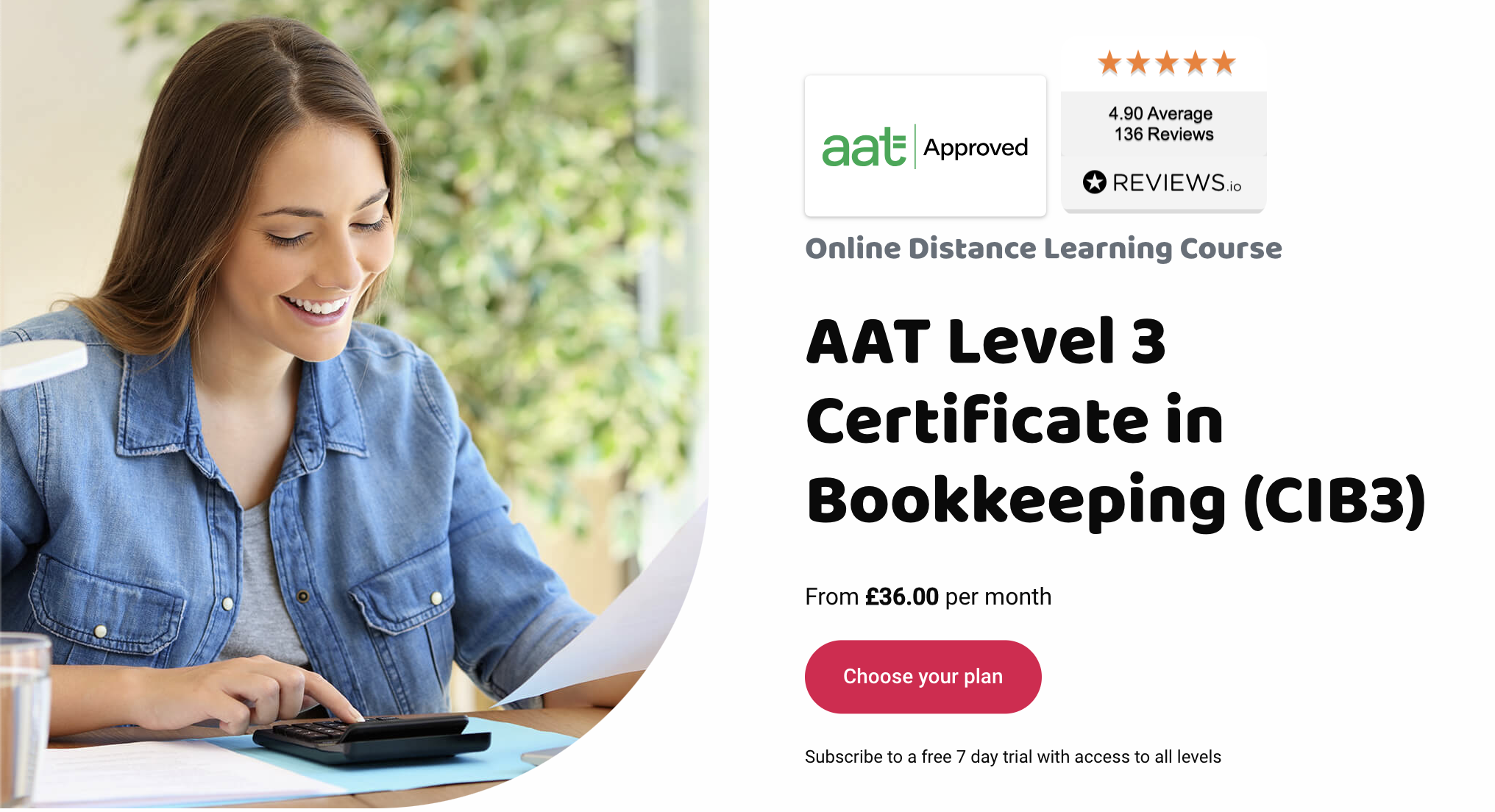

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Search By Location

- Tutor led Courses in London

- Tutor led Courses in Birmingham

- Tutor led Courses in Glasgow

- Tutor led Courses in Liverpool

- Tutor led Courses in Bristol

- Tutor led Courses in Manchester

- Tutor led Courses in Sheffield

- Tutor led Courses in Leeds

- Tutor led Courses in Edinburgh

- Tutor led Courses in Leicester

- Tutor led Courses in Coventry

- Tutor led Courses in Bradford

- Tutor led Courses in Cardiff

- Tutor led Courses in Belfast

- Tutor led Courses in Nottingham