- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2485 Courses

Film and Game Design Training Classes

By ATL Autocad Training London

Who is this course for? Film and Game Design Training Classes is tailored for individuals passionate about 3D for Games. Ideal for those in London seeking specialized skills for lucrative job opportunities in the gaming industry. Software we teach: 3ds max or Maya, Vray, After effects and Photoshop. Check our Website Duration: 40 hours. 1-on-1 Training. When can I book: 9 am - 4 pm (Choose your preferred day and time once a week). Monday to Saturday: 9 am - 7 pm (Flexible timing with advance booking). Course Title: Film & Game Design Training Classes Option A - 40-Hour Program: Option A offers comprehensive training for aspiring film and game designers, covering vital industry software and skills. Module 1: 3ds Max and Advanced Animation (20 hours) - Introduction to 3ds Max: Interface overview. - Basic 3D Modeling: Creating simple 3D objects. - Advanced 3D Modeling: Complex modeling techniques. - Texturing and Materials: Applying textures and materials. - Lighting and Rendering: Scene lighting and rendering setup. - Character Animation: Rigging and animating characters. - Advanced Animation Techniques: Keyframes, motion paths, and more. - Scene Composition: Assembling complex scenes. Module 2: Vray (6 hours) - Vray Introduction: Understanding Vray renderer. - Lighting with Vray: Creating realistic lighting setups. - Material Creation: Crafting materials for realistic surfaces. - Rendering with Vray: Optimization and execution. Module 3: Photoshop (6 hours) - Photoshop Basics: Navigating the interface. - Image Editing: Crop, resize, and enhance. - Layer Management: Working with layers. - Text and Typography: Adding and manipulating text. - Photo Manipulation: Advanced image techniques. - Creating Visual Assets: Designing textures and graphics. Module 4: After Effects: Video and Sound Editing (8 hours) - Introduction to After Effects: Interface overview. - Video Editing: Cut, trim, and arrange video clips. - Transitions and Effects: Apply visual effects and transitions. - Sound Editing: Add and edit audio tracks. - Motion Graphics: Create motion graphics and titles. - Exporting and Rendering: Prepare projects for final output. Film & Game Design Training Course Information Are you ready to explore our Training Course for Film & Game Designers? Here's a comprehensive overview to guide you through: When Can I Book This Training Course? Personalize your training with our flexible 1-on-1 sessions. Tailor your schedule by pre-booking your preferred hours. Available Monday to Saturday, 9 a.m. to 7 p.m. For phone bookings, call 02077202581. Training Duration The course spans 40 hours, allowing flexibility for your ideal schedule. Training Method Experience 1-on-1 training, in-person Face to Face or Live Online. Expect personalized attention, tailored content, flexible learning, and individual support. Opt for Live Online 1-on-1 sessions via Zoom for convenience. Enroll Today Ready to start your exciting journey? Click the link below to enroll in our 1-on-1 Course. Film & Game Design Training Overview In our comprehensive training program for film and game designers, refine your skills using industry-leading software tools. This prepares you to bring your creative visions to life. Option A: 3ds Max and Advanced Animation (20 hours) Vray (6 hours) Photoshop (6 hours) Aftereffects: Video and Sound Editing (8 hours) Option B: Maya and Advanced Animation (20 hours) Vray (6 hours) Photoshop (6 hours) Aftereffects: Video and Sound Editing (8 hours) Both options offer flexibility for Mac and Windows operating systems, ensuring accessibility for all learners. Key Benefits Price Assurance: Exceptional value for your film and game design career investment. One-on-One Training: Customized learning for your unique style. Flexible Scheduling: Choose your training time, available Monday to Sunday, 9 am to 8 pm. Lifetime Email and Phone Support: Ongoing assistance beyond training for your career growth. Computer Configuration Assistance: Guidance for seamless software installation. Referral Benefits: Special discounts for referrals and savings on group training. Embark on a transformative journey and unlock your potential in the thrilling fields of film and game design!

Raising Equity Capital

By Capital City Training & Consulting Ltd

A comprehensive understanding of equity as a means of corporate funding, offering insights into both the private equity and public equity landscapes, venture capital, and the strategic considerations involved in raising and managing equity investments. What is Inside the manual? Introduction to Equity This section lays the groundwork by explaining the features of equity, its additional characteristics, and the different types of equity available. It also provides an overview of corporate funding options, setting the stage for a deeper dive into more specific equity-related topics. Private Equity Covering everything from the basics of private equity, the goals of private equity investments, and the structure of private equity firms to the process of attracting private equity, including preparing a business plan and approaching investors. Venture Capital Offering an overview of venture capital, including the types of investors involved, such as venture capital funds and business angels, and the lifecycle of a venture capital investment. This section is crucial for understanding the role of venture capital. Raising Public Equity Detailed exploration of public equity markets, the process and terminology of equity capital markets, the advantages and disadvantages of raising public equity, and the criteria for listing on various markets. It includes a comprehensive guide to the Initial Public Offering (IPO) process,. Private Equity Exits and the IPO Process Highlighting the end goals of private equity investment through exit strategies, including a detailed look at the IPO process as a key exit route. This includes due diligence, drafting the prospectus, launching the IPO, and the obligations following a public listing. Raising Equity Capital Raising Equity Capital is a guide which explores the essentials of equity financing, breaking down private equity, venture capital, and public equity markets. It covers the characteristics of equity, different funding options, and the detailed process of securing private equity, including deal structures and exits.

Professional Certificate Course in Introduction to Commercial Banks in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of the Introduction to Commercial Banks course is to provide students with a foundational understanding of commercial banking operations and their role in the economy. The course will equip students with the knowledge and skills to evaluate the risks and opportunities associated with banking, as well as the regulatory framework that governs banks. After the successful completion of the course, you will be able to learn about the following, Identify types of commercial banks and their roles. Analyze the evolution of commercial banks. Evaluate services provided by commercial banks. Assess the relationship between commercial banks and competitors. Evaluate the impact of key trends on banks. Explain the functions of central banks. Compare central banks and commercial banks. Analyze the concept of Central Bank Digital Currency (CBDC). Evaluate the role of commercial banks in CBDCs. Recognize the significance of commercial banks. The Introduction to Commercial Banks course provides an overview of the role of commercial banks in the economy, including their functions, products, and services. Students will learn about the regulatory environment that governs banks, as well as the risks and opportunities involved in banking operations. By the end of the course, students will have a comprehensive understanding of how commercial banks operate and their impact on the financial system. Introduction to Commercial Banks is a comprehensive course designed to provide an understanding of the role and function of commercial banks in the financial system. The course covers the basics of banking, including the types of commercial banks, their operations, and their regulatory framework. Students will gain practical knowledge of banking practices, such as loans, deposits, and investment management. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Introduction to Commercial Banks Self-paced pre-recorded learning content on this topic. Introduction to Commercial Banks Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Bank Teller Personal Banker Loan Officer Credit Analyst Commercial Bank Manager Investment Banker Treasury Analyst Financial Consultant Risk Manager Compliance Officer. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

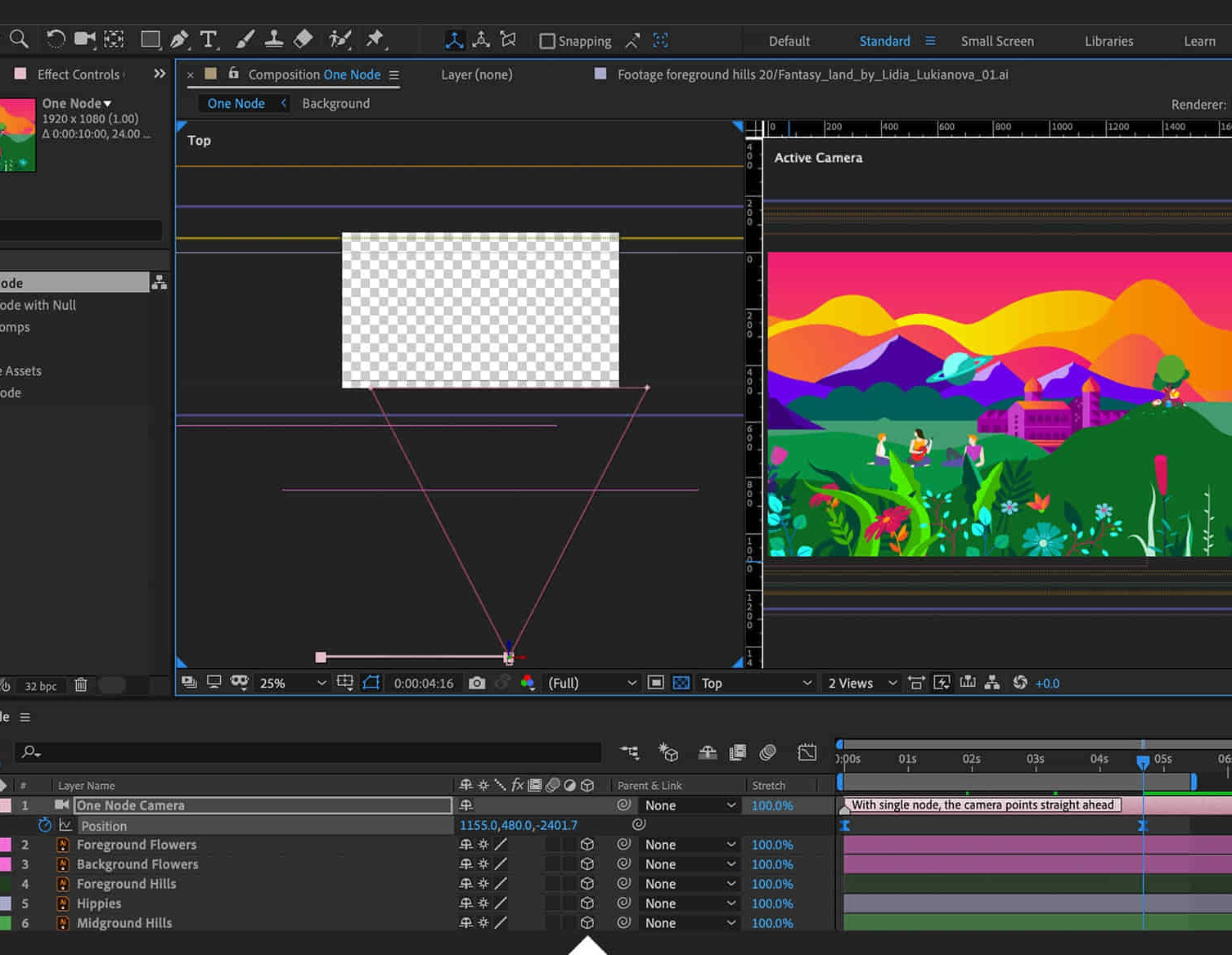

Adobe After Effects Beginners to Advanced Course

By ATL Autocad Training London

Adobe After Effects Beginners to Advanced Course Tailored for motion graphics designers basic to expert level. Explore advanced topics including motion tracking, green screen compositing, text animation, and techniques like expressions. Learn animations based on geometric proportions in our Advanced Motion Methods module. Click here for more info: Website Duration: 40 hours Approach: 1-on1 sessions and Customized content. Schedule: Choose your own day and time. Mon to Sat between 9 am and 5 pm. Module 1: Introduction to After Effects Exploring Adobe After Effects Navigating the Interface Configuring Preferences Utilizing Auto-Save Feature Module 2: Projects and Compositions Creating New Projects/Compositions Importing and Organizing Assets Working with Layers Module 3: Animation Techniques Keyframe Essentials Motion Paths and Modifications Graph Editor Insights Motion Control Tools Module 4: Layer Management Organizing and Navigating Layers Layer Visibility and Locking Switches and Modes in Detail Module 5: Shape Manipulation Shape Layers Fundamentals Creating and Animating Shapes Anchor Point Adjustment Module 6: Effects Mastery Applying and Customizing Effects Exploring Various Effects Examples Module 7: Masks and Track Mattes Mask Creation and Animation Track Matte Techniques Module 8: Text and Typography Animation Working with Text Layers Text Animation Presets Layer Styles for Typography Module 9: Exporting Your Creations Export Options Overview Direct Export from After Effects Utilizing Media Encoder After Effects https://www.adobe.com By the end of this 40-hour After Effects training, you will: Master Essentials: Understand fundamental and advanced After Effects features for diverse projects. Create Impactful Visuals: Craft compelling motion graphics, animations, and visual effects. Expert Animation Skills: Perfect keyframing, motion paths, and dynamic animations. Streamlined Workflow: Organize projects efficiently, ensuring smooth project execution. Creative Expression: Manipulate shapes, animate text, apply effects, and create masks creatively. Professional Exporting: Master export techniques for various platforms and media. Confidence and Expertise: Solve challenges confidently, applying skills in real-world projects. Industry-Ready: Gain skills applicable in filmmaking, animation, marketing, and creative sectors. Ongoing Support: Access post-training support for continued assistance. Certification: Receive a recognized certification, enhancing your professional profile. Course Title: Adobe After Effects Comprehensive Training Key Details: Duration: 40 hours Learning Approach: Personalized Training: Tailored content with 1-2-1 sessions. Flexible Schedule: Choose hours between 9 am and 7 pm, Monday to Saturday. Method: Hands-on learning with step-by-step demonstrations. Course Highlights: Master Essential Tools: From basics to advanced features for motion graphics and visual effects. Expert Guidance: Certified trainers provide personalized attention. Creative Animation: Learn advanced animation techniques, motion paths, and effects application. Efficient Workflow: Optimize project organization, layer management, and export techniques. Real-World Projects: Apply skills in filmmaking, animation, marketing, and more. Post-Training Support: Lifetime access to email and phone assistance for continued guidance. Certification: Receive a recognized certificate upon course completion. Benefits: Industry-Relevant Skills: Gain expertise for diverse creative sectors. Unleash Creativity: Craft compelling motion graphics, animations, and visual effects. Confidence in Execution: Solve challenges confidently with real-world application. Professional Recognition: Enhance your profile with a certified After Effects proficiency. Course Materials and Certification: Upon enrollment, you will receive a valuable After Effects training guide in PDF format, serving as a useful resource during and after the course. Additionally, upon successful completion, you'll be awarded an e-certificate, validating your achievement in the Adobe After Effects training program. Post-Course Support: Rest assured, you'll have access to lifetime email support from your dedicated After Effects trainer, providing assistance for any inquiries or challenges arising after the course. Prerequisites and Software Version: No prior After Effects knowledge is required for enrollment. The training is tailored for After Effects 2023, with techniques applicable to recent software releases. Whether you're a Windows or Mac user, the training suits your needs. Our Guarantees: We prioritize your satisfaction with our double guarantee - a price assurance ensuring the best value for your investment and a training guarantee ensuring you master essential concepts and skills.

Enter the exciting world of commerce with our "Business (Development, Management and Marketing)" course bundle. This remarkable package consists of 3 QLS-endorsed courses - 'Business Development', 'Business Management', and 'Marketing Strategies for Business', each offering a prestigious hardcopy certificate upon completion. But the journey doesn't end there! We've included 5 CPD QS accredited courses covering key areas of business - 'Diploma in Business Analysis', 'Business Plan', 'Basic Business Finance', 'Digital Marketing Business Tips', and 'Basic Business Communication Skills'. Together, these eight courses provide comprehensive theoretical knowledge, laying the groundwork for your success in the business sphere. Key Features of the Business (Development, Management and Marketing) Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Business (Development, Management and Marketing) bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Business Development QLS Course 02: Business Management QLS Course 03: Marketing Strategies for Business 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Diploma in Business Analysis Course 02: Business Plan Course 03: Basic Business Finance Course 04: Digital Marketing Business Tips Course 05: Basic Business Communication Skills In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our Business (Development, Management and Marketing) courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: Develop a comprehensive understanding of business development and management. Master the intricacies of marketing strategies for business success. Gain theoretical knowledge on conducting effective business analysis. Learn to develop compelling business plans that attract investment. Understand the basics of business finance to ensure financial health. Obtain insights into digital marketing tactics for today's digital era. This bundle is a comprehensive collection of courses that have been meticulously designed to provide you with a well-rounded education in Business (Development, Management and Marketing). With a combination of 3 QLS-endorsed courses and 5 CPD QS-accredited courses, this bundle offers you the perfect balance of essential knowledge and valuable skills. What's more, we are proud to offer free hardcopy certificates for each course within the bundle, giving you the recognition you deserve. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Career path Business Development Manager - £30,000-£70,000 Marketing Manager - £25,000-£60,000 Project Manager - £25,000-£60,000 Operations Manager - £25,000-£50,000 Sales Manager - £25,000-£50,000 Brand Manager - £25,000-£45,000 Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Level 3 Diploma in Accounting and Financial Management

By Online Training Academy

This Level 3 Diploma in Accounting and Financial Management course is for anyone, whether you're looking to advance in your current role or explore new career horizons. Learn the fundamental principles of accounting and financial management, equipping yourself with the knowledge and expertise needed to thrive in today's competitive landscape. Stand out in the job market with a prestigious qualification that showcases your dedication to mastering the intricacies of finance. And, according to Reed an Accountant can earn upto £25,000 to £35,000 in a year depending on experience, location and many other factors. Don't miss out on this opportunity to unlock your full potential and take your career to new heights. Enrol in our Level 3 Diploma in Accounting and Financial Management today and start down the path to a wealthy future! Key Features: This Level 3 Diploma in Accounting and Financial Management Course Includes: This Accounting and Financial Management Course is CPD Certified Free Certificate from Reed CIQ Approved Accounting and Financial Management Course Developed by Specialist Lifetime Access Course Curriculum Level 3 Diploma in Accounting and Financial Management Course: Module 01: Fundamentals of Accounting Module 02: Responsibilities of an Accountant Module 03: Core Accounting Concepts and Standards Module 04: Principles of Double-Entry Bookkeeping Module 05: Understanding the Balance Sheet Module 06: Analysis of the Income Statement Module 07: Comprehensive Overview of Financial Statements Module 08: Exploring Cash Flow Statements Module 09: Profound Understanding of Profit and Loss Statement Module 10: Financial Budgeting and Strategic Planning Module 11: Overview of Auditing Practices Module 12: Introduction to Finance Module 13: Essential Skills for Financial Advisors Module 14: Accounting and Financial Planning Strategies Module 15: Wealth Management and Creating Personal Financial Statements Module 16: Financial Risk Management and Evaluation Module 17: Investment Planning Strategies Module 18: Planning for Divorce Module 19: Leveraging Google Analytics for Financial Advisors Learning Outcomes of this Accounting and Financial Management Course: Apply Double-Entry Bookkeeping Principles for Accurate Financial Record-keeping. Analyse Financial Statements for Informed Decision-making and Reporting. Develop Strategic Accounting and Financial Management Plans Integrating Budgeting and Risk Management. Demonstrate Proficiency in Auditing Practices and Compliance with Standards. Evaluate Investment Planning Strategies for Optimal Accounting and Financial Management Decision-making. Utilise Google Analytics Effectively for Accounting and Financial Management Advisory and Planning. Certification After completing this Accounting and Financial Management course, you will get a free Certificate. Please note: The CPD approved course is owned by E-Learning Solutions Ltd and is distributed under license. CPD 10 CPD hours / points Accredited by The CPD Certification Service Level 3 Diploma in Accounting and Financial Management 4:11:52 1: Module 01: Fundamentals of Accounting 08:40 2: Module 02: Responsibilities of an Accountant 09:17 3: Module 03: Core Accounting Concepts and Standards 12:39 4: Module 04: Principles of Double-Entry Bookkeeping 12:07 5: Module 05: Understanding the Balance Sheet 11:39 6: Module 06: Analysis of the Income Statement 10:41 7: Module 07: Comprehensive Overview of Financial Statements 13:38 8: Module 08: Exploring Cash Flow Statements 09:42 9: Module 09: Profound Understanding of Profit and Loss Statement 09:53 10: Module 10: Financial Budgeting and Strategic Planning 14:58 11: Module 11: Overview of Auditing Practices 08:56 12: Module 12: Introduction to Finance 14:41 13: Module 13: Essential Skills for Financial Advisors 19:03 14: Module 14: Financial Planning Strategies 23:00 15: Module 15: Wealth Management and Creating Personal Financial Statements 09:31 16: Module 16: Financial Risk Management and Evaluation 17:51 17: Module 17: Investment Planning Strategies 14:41 18: Module 18: Planning for Divorce 15:02 19: Module 19: Leveraging Google Analytics for Financial Advisors 14:53 20: CPD Certificate - Free 01:00 Who is this course for? This Level 3 Diploma in Accounting and Financial Management course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Accounting and Financial Management. Moreover, this course is ideal for: Aspiring Accounting and Financial Management Professionals Individuals Seeking Comprehensive Accounting and Financial Management Knowledge Those Pursuing Career Advancement in Accounting and Financial Management Sectors Professionals Transitioning to Accounting and Financial Advisory Roles Business Owners and Entrepreneurs Enhancing Accounting and Financial Management Literacy Requirements There are no requirements needed to enrol into this Level 3 Diploma in Accounting and Financial Management course. We welcome individuals from all backgrounds and levels of experience to enrol into this Level 3 Diploma in Accounting and Financial Management course. Career path After finishing this Diploma in Accounting and Financial Management course you will have multiple job opportunities waiting for you. Some of the the following Job sectors of Accounting and Financial Management are: Accountant - £25K to 45K/year. Financial Advisor - £30K to 60K/year. Financial Analyst - £35K to 55K/year. Audit Assistant - £20K to 35K/year. Investment Analyst - £40K to 70K/year. Certificates Reed Courses Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Level 3 Diploma in Accounting and Financial Management

By Online Training Academy

This Level 3 Diploma in Accounting and Financial Management course is for anyone, whether you're looking to advance in your current role or explore new career horizons. Learn the fundamental principles of accounting and financial management, equipping yourself with the knowledge and expertise needed to thrive in today's competitive landscape. Stand out in the job market with a prestigious qualification that showcases your dedication to mastering the intricacies of finance. And, according to Reed an Accountant can earn upto £25,000 to £35,000 in a year depending on experience, location and many other factors. Don't miss out on this opportunity to unlock your full potential and take your career to new heights. Enrol in our Level 3 Diploma in Accounting and Financial Management today and start down the path to a wealthy future! Key Features: This Level 3 Diploma in Accounting and Financial Management Course Includes: This Accounting and Financial Management Course is CPD Certified Free Certificate from Reed CIQ Approved Accounting and Financial Management Course Developed by Specialist Lifetime Access Course Curriculum Level 3 Diploma in Accounting and Financial Management Course: Module 01: Fundamentals of Accounting Module 02: Responsibilities of an Accountant Module 03: Core Accounting Concepts and Standards Module 04: Principles of Double-Entry Bookkeeping Module 05: Understanding the Balance Sheet Module 06: Analysis of the Income Statement Module 07: Comprehensive Overview of Financial Statements Module 08: Exploring Cash Flow Statements Module 09: Profound Understanding of Profit and Loss Statement Module 10: Financial Budgeting and Strategic Planning Module 11: Overview of Auditing Practices Module 12: Introduction to Finance Module 13: Essential Skills for Financial Advisors Module 14: Accounting and Financial Planning Strategies Module 15: Wealth Management and Creating Personal Financial Statements Module 16: Financial Risk Management and Evaluation Module 17: Investment Planning Strategies Module 18: Planning for Divorce Module 19: Leveraging Google Analytics for Financial Advisors Learning Outcomes of this Accounting and Financial Management Course: Apply Double-Entry Bookkeeping Principles for Accurate Financial Record-keeping. Analyse Financial Statements for Informed Decision-making and Reporting. Develop Strategic Accounting and Financial Management Plans Integrating Budgeting and Risk Management. Demonstrate Proficiency in Auditing Practices and Compliance with Standards. Evaluate Investment Planning Strategies for Optimal Accounting and Financial Management Decision-making. Utilise Google Analytics Effectively for Accounting and Financial Management Advisory and Planning. Certification After completing this Accounting and Financial Management course, you will get a free Certificate. Please note: The CPD approved course is owned by E-Learning Solutions Ltd and is distributed under license. CPD 10 CPD hours / points Accredited by The CPD Certification Service Level 3 Diploma in Accounting and Financial Management 4:11:52 1: Module 01: Fundamentals of Accounting 08:40 2: Module 02: Responsibilities of an Accountant 09:17 3: Module 03: Core Accounting Concepts and Standards 12:39 4: Module 04: Principles of Double-Entry Bookkeeping 12:07 5: Module 05: Understanding the Balance Sheet 11:39 6: Module 06: Analysis of the Income Statement 10:41 7: Module 07: Comprehensive Overview of Financial Statements 13:38 8: Module 08: Exploring Cash Flow Statements 09:42 9: Module 09: Profound Understanding of Profit and Loss Statement 09:53 10: Module 10: Financial Budgeting and Strategic Planning 14:58 11: Module 11: Overview of Auditing Practices 08:56 12: Module 12: Introduction to Finance 14:41 13: Module 13: Essential Skills for Financial Advisors 19:03 14: Module 14: Financial Planning Strategies 23:00 15: Module 15: Wealth Management and Creating Personal Financial Statements 09:31 16: Module 16: Financial Risk Management and Evaluation 17:51 17: Module 17: Investment Planning Strategies 14:41 18: Module 18: Planning for Divorce 15:02 19: Module 19: Leveraging Google Analytics for Financial Advisors 14:53 20: CPD Certificate - Free 01:00 Who is this course for? This Level 3 Diploma in Accounting and Financial Management course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Accounting and Financial Management. Moreover, this course is ideal for: Aspiring Accounting and Financial Management Professionals Individuals Seeking Comprehensive Accounting and Financial Management Knowledge Those Pursuing Career Advancement in Accounting and Financial Management Sectors Professionals Transitioning to Accounting and Financial Advisory Roles Business Owners and Entrepreneurs Enhancing Accounting and Financial Management Literacy Requirements There are no requirements needed to enrol into this Level 3 Diploma in Accounting and Financial Management course. We welcome individuals from all backgrounds and levels of experience to enrol into this Level 3 Diploma in Accounting and Financial Management course. Career path After finishing this Diploma in Accounting and Financial Management course you will have multiple job opportunities waiting for you. Some of the the following Job sectors of Accounting and Financial Management are: Accountant - £25K to 45K/year. Financial Advisor - £30K to 60K/year. Financial Analyst - £35K to 55K/year. Audit Assistant - £20K to 35K/year. Investment Analyst - £40K to 70K/year. Certificates Reed Courses Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Insurance : UK Insurance (General, Commercial, Liability, Life) Diploma

4.7(26)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** UK Insurance Diploma Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you passionate about finance and intrigued by the UK insurance industry? The UK boasts a thriving insurance sector, contributing significantly to its economy and employing over 300,000 individuals. But do you have the necessary knowledge and skills to navigate this dynamic field? This UK Insurance (General, Commercial, Liability, Life) Diploma bundle addresses that need, equipping you with the expertise to launch or advance your career in UK insurance. Our UK Insurance (General, Commercial, Liability, Life) Diploma bundle empowers you to become an insurance expert in the UK. Master insurance agent training, navigate UK tax complexities, and excel in financial advising, management, and investigation. Gain specialised knowledge in pensions, mortgages, financial crime, and anti-money laundering. Sharpen your accounting skills with industry-standard software. Build a strong foundation for a successful career in the dynamic UK insurance industry. But that's not all. When you enrol in UK Insurance Diploma Online Training, you'll receive 25 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this UK Insurance Diploma Career Bundle: Course 01: UK Insurance Diploma Course 02: UK Tax Accounting Course 03: Financial Advisor Course 04: Financial Management Course 05: Financial Investigator Course 06: Pension UK Course 07: Investment Banking Course 08: Mortgage Adviser Course Course 09: Financial Crime Consultant Course 10: Anti-Money Laundering (AML) Course 11: Sage 50 Accounts Course 12: Xero Accounting - Complete Training Course 13: QuickBooks Online Bookkeeping Diploma Course 14: Financial Accounting Course 15: Financial Analysis Course Course 16: Accountancy Course 17: Banking and Finance Accounting Statements Financial Analysis Course 18: Business Law Course 19: Improve your Financial Intelligence Course 20: Corporate Finance: Profitability in a Financial Downturn Course 21: Corporate Paralegal Course 22: Negotiation Skills Certificate Course 23: Document Control Course 24: Compliance and Risk Management Course 25: Financial Consultant Training: Financial Advisor With UK Insurance Diploma, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Learning Outcomes of UK Insurance Diploma Master the essentials of UK insurance regulations and practices. Develop advanced financial management and analysis skills. Gain expertise in specialized areas like pensions, mortgages, and financial crime. Enhance your accounting proficiency with industry-standard software. Understand and apply anti-money laundering regulations effectively. Build a strong foundation for a rewarding career in UK insurance. Don't let this opportunity pass you by. Enrol in the UK Insurance Diploma today and take the first step towards achieving your goals and dreams. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of UK Insurance Diploma Get a free student ID card with UK Insurance Diploma Training program (£10 postal charge will be applicable for international delivery) The UK Insurance Diploma is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the UK Insurance Diploma course materials The UK Insurance Diploma comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Course 01: UK Insurance Diploma Module 01: Definition Of Insurance Module 02: An Overview Of The Insurance Industry In The UK Module 03: Basics Of Insurance Module 04: Principles And Practices Of Insurance Module 05: Insurance Contract: Elements And Clauses Of Insurance Contract Module 06: Home Insurance Module 07: Life And Health Insurance Module 08: Business Insurance Module 09: Vehicle Insurance Module 10: Human Behaviour In Insurance Module 11: Essential Skills For The Insurance Account Manager And Broker Module 12: Underwriting Essentials Module 13: Insurance Fraud Course 02: UK Tax Accounting Module 01: Introduction To Accounting Module 02: Income Statement And Balance Sheet Module 03: Tax System And Administration In The UK Module 04: Tax On Individuals Module 05: National Insurance Module 06: How To Submit A Self-Assessment Tax Return Module 07: Fundamentals Of Income Tax Module 08: Payee, Payroll And Wages Module 09: Value Added Tax Module 10: Corporation Tax Module 11: Double Entry Accounting Module 12: Career As A Tax Accountant In The UK Course 03: Financial Advisor Module 01: Introduction To Finance Module 02: Essential Skill For Financial Advisor Module 03: Financial Planning Module 04: Wealth Management And Guide To Make Personal Financial Statements Module 05: Financial Risk Management And Assessment Module 06: Investment Planning Module 07: Divorce Planning Module 08: Google Analytics For Financial Advisors =========>>>>> And 22 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*25 = £325) CPD Hard Copy Certificate: £29.99 CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Insurance Sales Aspirants Financial Advisors Business Owners Risk Managers Consumers Requirements You will not need any prior background or expertise to enrol in this bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Insurance Broker Underwriter Claims Adjuster Risk Analyst Financial Planner Agent Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Search By Location

- Investment Courses in London

- Investment Courses in Birmingham

- Investment Courses in Glasgow

- Investment Courses in Liverpool

- Investment Courses in Bristol

- Investment Courses in Manchester

- Investment Courses in Sheffield

- Investment Courses in Leeds

- Investment Courses in Edinburgh

- Investment Courses in Leicester

- Investment Courses in Coventry

- Investment Courses in Bradford

- Investment Courses in Cardiff

- Investment Courses in Belfast

- Investment Courses in Nottingham