- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

168 Courses

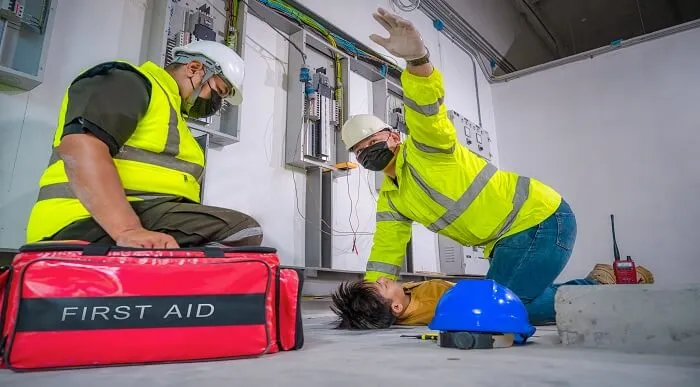

Emergency First Aid at Work Course

By Study Plex

Highlights of the Emergency First Aid at Work Course Course Type: Self-paced online course Duration: 2 Hours 30 Minutes Tutor Support: Tutor support is included Customer Support: 24/7 customer support is available Quality Training: The course is designed by an industry expert Recognised Credential: Recognised and Valuable Certification Completion Certificate: Free Course Completion Certificate Included Instalment: 3 Installment Plan on checkout What you will learn from this course? Understand the fundamentals of emergency first aid at work Apply various safety tools and techniques to deal with emergencies at work Recognise the barriers to emergency first aid and the recovery position Know how to control bleeding, choking, shock and burns with first aid Apply various first-aid procedures to control and prevent head, eye and spinal injuries Know how to manage an incident and effectively keep records Know how to perform CPR and operate AEDs Recognise the warning signs of heart attack and stroke Know how to administer first aid to patients experiencing heart attacks and strokes Demonstrate the first aid steps that are required to be taken in order to control diabetes Transform into a competent and confident workplace first aider Understand how to use the skills you gained in this course in a practical setting Emergency First Aid at Work Course This Emergency First Aid at Work Course is designed to equip you with the knowledge and skills required to provide first aid assistance during any type of first aid emergency at the workplace. You will learn from expert instructors with experience in the field who will impart the most relevant expertise and best practices. Effective use of CPR and AEDs Manage any kind of workplace incident and injuries Recognise the symptoms of various injuries Control sudden heart attack and stroke Provide effective first aid assistance at work Essential skills, confidence and competence to assist you in the health and safety industry Core competencies required to drive a successful career in the health and safety industry Who is this course for? This Emergency First Aid at Work Course is ideal for supervisors who are in charge of organising, directing, or overseeing the health and safety of their workplace Workplace first aiders who want to refresh their skills and knowledge can take this Emergency First Aid at Work Course Employers thinking of implementing a proper preventive measure within the workplace can also take this course This course can also be taken by employees who want to upgrade their skills and knowledge about emergency first aid at work in order to keep themselves and others around them safe. Entry Requirements This Emergency First Aid at Work Course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone and a reliable internet connection. Assessment This Emergency First Aid at Work Course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner can grasp from each section. In the assessment, the pass mark is 60% Advance Your Career This Emergency First Aid at Work Course will provide you with significant opportunities to enter the relevant job market and select your desired career path. Additionally, by showcasing these skills on your resume, you will be able to develop your career, face more competitors in your chosen sector, and increase your level of competition. If you are looking for the Allergen Awareness Course, enrol into our affordable and highly informative course, which will open your door towards a wide range of opportunities within your chosen sector. Recognised Accreditation This Emergency First Aid at Work Course is accredited by Continuing Professional Development (CPD), the International Institute of Risk and Safety Management (IIRSM) and the Institute of Hospitality. Course Curriculum Module 1: What is First Aid? Module 2: Barriers, ABCDs and the recovery position Module 3: CPR and AEDs Module 4: Choking Module 5: Bleeding Module 6: Shock Module 7: Spinal Injuries Module 8: Breaks Module 9: Head Injuries Module 10: Sprains Module 11: Managing an Incident & Record Keeping Module 12: Burns & Scalds Module 13: Electric Shock Module 14: Eye Injuries Module 15: Anaphylaxis and Diabetes Module 16: Heart Attack & Stroke Obtain Your Certificate Order Your Certificate of Achievement 00:00:00

Description: Financial Management is the effective management of money or funds to help in achieving the goals of a business or organization. This course will help in the financial security of a business to avoid bankruptcy or misused funds. To know about financial management, you have to develop your financial IQ. You also need to learn general finance and budgeting. Know about debt management for business-oriented people by signing up for this course. Who is the course for? Professionals or business-oriented people who want to secure the finances of the business. Anyone who is interested in financial management. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Diploma in Financial Management course will be useful and would be beneficial for people who want to know more about financial security for business and organization. Also, this will be useful to different accounting and management occupations especially the following careers: Accountant Bookkeeper Consultant Financial Adviser Financial Analyst Public Accountant. Module 1: Developing Financial IQ Introduction To Financial IQ 01:00:00 Essential Ways To Build Wealth 01:00:00 When's The Right Time To Invest? 01:00:00 The Methods Of Financial Mess 01:00:00 Module 2: Finance and Budgeting Financing Basics 01:00:00 Record Your Income 01:00:00 Make a List of Expenses First and Put Them in Categories 01:00:00 Countdown & Adjust 01:00:00 Review Regularly 01:00:00 Module 3: Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Module 4: Debt Management Where to Start When You Have to Start Over 00:30:00 Concept of Credit 01:00:00 Way To Become Debt-free - The Step-By-Step Plan 01:00:00 The Credit Counseling and Debt Settlement options 01:00:00 The Psychology of Money - Changing your mindset 01:00:00 Budegets 00:30:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- Diploma in Financial Management 00:30:00 Final Exam Final Exam- Diploma in Financial Management 00:30:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Listening Skills for Life

By Neupauer Ltd

Listening is the more important part of every conversation no matter what your job title is What you'll learn Active listening Skills Listen with the intention to understand not respond Better understand people Support people through active listening Understand what can stop you from listening The Power of Silence This course includes: 2.5 hours on-demand video 4 downloadable resources Access on mobile and TV Certificate of completion Requirements No requirements Description "You're not listening to me!" If this is something your loved ones are telling you, it's time you learned to listen. Because being heard and understood (even if you don't agree with what is being said) is often better than giving advice no one asked for. In this course you will learn: Barriers to listening what is stopping you from listening and what can you do about it? STOP the distractions - how to channel your focus on to the other person Listen to not only words but also tone and body language. With so much information, your brain will only pick up what's important to you, especially if you are not fully present. There is so much more in listening than just hearing the words. ASK good questions. If you're not getting the answers you want, maybe it's time to change your questions. Reflect- repeating the other person's words back to them will show you are listening. You can also lead the conversation, if necessary, by repeating part of the sentence you want to learn more about. Silence. Not only to meditate but silence in a conversation can be very powerful. Giving time and space to think, reflect and answer your questions. Because there is a chance that whatever it is someone is telling you, might be the first time they hear their own story. The world would be a happier place if only we listen to each other more, instead of making assumptions ... So, click that button...what have you got to lose? PS: How do I know listening is powerful? As a Listening volunteer at Samaritans, the best calls are those I say very little and let the other person talk without directing the conversation where I would want it to go or offering advice I wasn't asked for. Who this course is for: Kind people wanting to help others Counsellors Coaches Therapist Wellbeing officers Community Support workers Managers Sales assistants

PRINCE2® Practitioner

By London School of Science and Technology

The PRINCE2® Practitioner course provides delegates with in-depth knowledge of project management methodologies. In this 2-day PRINCE2® Practitioner course enables learners to tailor the PRINCE2® methodology to any given project scenario. At the end of this PRINCE2® Practitioner course, delegates will be able to do delegating tolerances Course Overview The PRINCE2® Practitioner course provides delegates with in-depth knowledge of project management methodologies. In this 2-day PRINCE2® Practitioner course enables learners to tailor the PRINCE2® methodology to any given project scenario. They will learn about various essential topics such as communication management approach, tailoring the SU process, giving Ad Hoc direction, setting up the project controls, risk management procedure, PRINCE2® quality requirements, PRINCE2® approach to plan, tailoring SB, and many more. At the end of this PRINCE2® Practitioner course, delegates will be able to do delegating tolerances and report actual and forecast progress effectively. They will also be able to properly prepare the risk management, change control approach, quality management, and communication management approaches. The PRINCE2® Practitioner enables learners to apply their acquired knowledge and obtain highly reputed jobs with upgraded salaries. Concepts covered: • Balance of justification • Create the project plan • Quality audit trail • Quality review technique • Designing a plan • Gantt chart and tailoring • Change control approach Who should attend this PRINCE2® training course? This PRINCE2® Practitioner training course is for anybody interested in the field of project management. This PRINCE2® course is also intended for anyone looking to build their knowledge of how to tailor the PRINCE2® method to workplace scenarios. Other individuals that would benefit from undertaking PRINCE2® certifications include: • Project Managers • Aspiring Project Managers • Project Board Members • Project Support Staff • Office Support and Line Managers • Product Deliver Managers • Senior Responsible Owners • Change Analysts PRINCE2® Practitioner Prerequisites: It is required that delegates provide sufficient evidence of having satisfied the prerequisites before attending the PRINCE2® Practitioner training course. Delegates must hold the 2009 or 2017 version of the PRINCE2® Foundation certification or another valid qualification such as PMP, CAPM, or an IPMA Level A-D qualification. What’s Included in this PRINCE2® Practitioner Training Course? The following is included in this PRINCE2® Practitioner course: • PRINCE2® Practitioner Examination • Pre-course material • Post-course material • PDUs • Experienced PRINCE2® Instructor • Certificate • Refreshments Course Content: Module 1: Organisation Theme: • Four Levels of Management • PRINCE2® Organisation Requirements • Project Management Team • Project Management Team Roles • Project Board • Project Assurance • Change Authority • Project Support • Communication Management Approach Module 2: Starting Up a Project (SU): • Process Overview • Feasibility Study and Mandate • Appoint the Executive and the Project Manager • Capture Previous Lessons • Design and Appoint the Project Management Team • Prepare the Outline Business Case • Project Product Description • Select the Project Approach and Assemble the Project Brief • Plan the Initiation Stage • Tailoring the SU Process Module 3: Directing a Project (DP): • Authorise Initiation • Authorise the Project • Authorise a Stage or Exception Plan • Authorise Project Closure • Give Ad Hoc Direction • Tailoring the DP Process • Theme Overview • Balance of Justification • Continued Business Justification • PRINCE2® Requirements • Contents of a Business Case • Business Case Development • Benefits Management Approach • Key Responsibilities Module 4: Initiating a Project (IP): • Agree the Tailoring Requirements • Prepare the Risk Management Approach • Prepare the Change Control Approach • Prepare the Quality Management Approach • Prepare the Communication Management Approach • Set Up the Project Controls • Create the Project Plan • Prepare the Benefits Management Approach • Assemble the Project Initiation Documentation • Tailoring the IP process Module 5: Risk Theme: • Risk Definition • Effective Risk Management • PRINCE2® Risk Requirements • Risk Management Approach • Probability/Impact Grid • Risk Register • Risk Management Procedure • Identify Step • Risk Budget • Key Responsibilities Module 6: Quality Theme: • Quality Definitions • Quality Management • Quality Planning and Control • What is Quality Assurance? • PRINCE2® Quality Requirements • PRINCE2® Quality Documentation Requirements • Quality Management Approach • Quality Audit Trail • Project Product Description • Product Description • Quality Review Technique • Quality Review Roles/Responsibilities • Quality Review Meeting • Off-Specifications and Concessions • Review Follow-Up • Quality Review Benefits • Key Responsibilities • Communication Management Approach Module 7: Plans Theme: • Dealing with the Planning Horizon • PRINCE2® Planning Requirements • Documentation Requirements • Project and Stage Plans • Team Plans and Work Packages • Plans Relationship • What is in a Plan? • PRINCE2® Approach to Plans • Designing a Plan • Delivery Approaches • Defining and Analysing the Products • Product Breakdown Structures • Product Description • Product Flow Diagram • Identify the Activities and Dependencies • Preparing Estimates • Preparing a Schedule • Documenting the Plan • Analysing Risks to a Plan • Gantt Chart and Tailoring • Key Responsibilities Module 8: Progress Theme: • Progress Definition • PRINCE2® Requirements • Progress Control • Management by Exception • Delegating Tolerances and Reporting Actual and Forecast Progress • Types of Control • Management Products and Progress Control Module 9: Change Theme: • Issue Definition • PRINCE2® Approach to Change • PRINCE2® Change Documentation • Issue Register • Change Control Approach • Change Budget • Issue and Change Control Procedure • Issue Report • Exception Report Module 10: Controlling a Stage (CS): • Activity Breakdown • Authorise a Work Package • Work Package • Review Work Package Status • Receive Completed Work Packages • Review the Management Stage Status • Report Highlights • Highlight Report • Capture and Assess Issues and Risks • Escalate Issues and Risks • Take Corrective Action • Tailoring CS Module 11: Managing Product Delivery (MP): • Accept a Work Package • Execute a Work Package • Checkpoint Report • Deliver a Work Package • Tailoring MP Module 12: Managing a Stage Boundary (SB) : • Plan the Next Management Stage • What is in a Plan? • Update the Project Plan • Update the Business Case • Report the Management Stage End • End-Stage Report • Produce an Exception Plan • Tailoring SB Module 13: Closing a Project (CP): • Prepare Planned Closure • Hand Over Products • Evaluate the Project • End Project Report • Recommend Project Closure • Tailoring CP DURATION 2 Days WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Embark on a journey into the world of financial mastery with our 'Budget Analysis and Financial Report Building' course. In an age where informed decision-making is the key to thriving, understanding the nuances of budgets and financial reports is more vital than ever. From deciphering financial statements to forecasting with precision, our meticulously structured modules empower you to harness the power of finance. Dive deep into budgeting intricacies, make impeccable purchasing choices, and even gain insights into the legal world, all designed to refine your financial acumen. Learning Outcomes Comprehend the foundational elements of financial statements and their analysis. Develop a robust understanding of budget formulation, management, and monitoring. Utilise advanced forecasting techniques for more informed financial planning. Understand the strategic nuances in making astute purchasing decisions. Gain insights into legal considerations in the financial realm. Why choose this Budget Analysis and Financial Report Building course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Budget Analysis and Financial Report Building Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Budget Analysis and Financial Report Building course for? Finance students aiming to bolster their analytical skills. Business owners seeking to optimise their financial decision-making. Managers responsible for departmental budgeting and forecasting. Financial analysts keen to deepen their knowledge base. Professionals looking to transition into finance roles. Career path Budget Analyst: £30,000 - £50,000 Financial Reporting Manager: £50,000 - £70,000 Finance Officer: £28,000 - £40,000 Financial Planner: £35,000 - £55,000 Purchasing Manager: £40,000 - £60,000 Legal Financial Advisor: £45,000 - £70,000 Prerequisites This Budget Analysis and Financial Report Building does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Budget Analysis and Financial Report Building was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Budgets and Financial Reports Module One - Getting Started 00:15:00 Module Two - Glossary 00:30:00 Module Three - Understanding Financial Statements 00:30:00 Module Four - Analyzing Financial Statements (I) 01:00:00 Module Five - Analyzing Financial Statements (II) 00:30:00 Module Six - Understanding Budgets 00:30:00 Module Seven - Budgeting Made Easy 00:30:00 Module Eight - Advanced Forecasting Techniques 00:30:00 Module Nine - Managing the Budget 00:30:00 Module Ten - Making Smart Purchasing Decisions 01:00:00 Module Eleven - A Glimpse into the Legal World 01:00:00 Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00

Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE)

By Training Tale

Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Do you want to delve deeper into the intriguing fields of Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE)? we have designed a special solution for you to make you aware and provide knowledge about Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE). By attending our Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course, practitioners will have a deeper understanding of the complexities surrounding child exploitation problems. This Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course, will cover the risk factors and the role of children. A number of exploitation warning signs are also explained in this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course. The reasoning behind young people's reactions to them is also explained in Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE). Best practices for handling problems and directing pupils to social services are described in our Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course. Join this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course to realize all that you can achieve! Learning Outcome of this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course After completing the Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course, learners will know about: A clear overview of CSE and CCE from this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course. This Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course also describes risk factors, warning signs, and consequences. The in-depth information about CCE, you will get from the Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course. Overall this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course will help to acquire the best practices for the concerns. Special Offers of this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course This Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course includes a FREE PDF Certificate. Lifetime access to this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course Instant access to this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course Get FREE Tutor Support from Monday to Friday in this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course Main Course: Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Course Free Courses Course 01: Speech & Language Therapy Course 02: Level 4 Early Years Course [Note: Free PDF certificate as soon as completing the Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course] Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Industry Experts Designed this Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE)Course into 04 detailed modules. Course Curriculum of Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Module 01: An Overview of CSE and CCE Module 02: CSE: Risk Factors, Warning Signs, and Consequences Module 03: A Closer Look to CCE Module 04: Best Practice for Responding to Concerns Assessment Method of Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) After completing each module of the Child Sexual Exploitation & Child Criminal Exploitation Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) After completing the MCQ/Assignment assessment for this Child Sexual Exploitation & Child Criminal Exploitation course, you will be entitled to a Certificate of Completion from Training Tale. Who is this course for? Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) This Child Sexual Exploitation & Child Criminal Exploitation: Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course is very beneficial for anybody who works with children, adolescents, or families. Requirements Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Students who intend to enroll in this Child Sexual Exploitation & Child Criminal Exploitation: Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) course must meet the following requirements: Child Sexual Exploitation: Good command of the English language Child Sexual Exploitation: Must be vivacious and self-driven. Child Sexual Exploitation: Basic computer knowledge Child Sexual Exploitation: A minimum of 16 years of age is required. Career path Child Sexual Exploitation & Child Criminal Exploitation: Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) Start a lucrative career in the rapidly expanding Child Sexual Exploitation & Child Criminal Exploitation (CSE & CCE) field with the aid of this in-depth training. Certificates Certificate of completion Digital certificate - Included

Are you having trouble tracking your finances? Or do you just want to be able to learn how to budget and manage your finances? If these are your concerns, then this course is for you! Description: In this course, you will get tips and tools to create a budget that is suitable for your lifestyle, and you will know how to stick to it so that you can reach your financial goals. Then you will also be able to learn about the basics of banking from checking accounts to the importance of saving and find out more about investment choices. The primary goal of this course is to free yourself and your family from money problems and lead a happy life without worrying about your finances. You will be able to understand the basics of credit, bank fees and fix your credit status. Who is the course for? Financial advisers who want to learn more on how they can advise people on their finances. People who want to change their financing and budgeting. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Personal Banking Finance course would be beneficial for the following careers: Financial Analyst Forecasting Investment Banking Portfolio Manager And Other Different Financial-related jobs. Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Personal Banking and Finance 4 Tips For Understanding The Basic Banking Processes 01:00:00 5 Great Tips On Understanding Your Credit 00:30:00 4 Great Tips On Understanding Bank Fees 00:30:00 3 Great Tips On Setting Up And Maintaining A Budget 00:15:00 4 Great Tips On Reaching Your Savings Goals 01:00:00 4 Great Tips On Dealing With Errors And ID Theft 00:30:00 5 Great Tips On Fixing Your Credit Report 00:15:00 3 Great Tips On Choosing A Credit Card 00:30:00 3 Great Tips On Choosing An Installment Loan 00:30:00 3 Great Tips On Buying A Home 00:30:00 Mock Exam Mock Exam- Personal Banking, Finance & Budgeting Course 00:30:00 Final Exam Final Exam- Personal Banking, Finance & Budgeting Course 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview Imagine navigating the bustling streets of London without a guiding force directing the traffic chaos; it's an image filled with confusion and potential danger. Enter the realm of the Traffic Marshal, a profession designed to bring order to the roads and safety to pedestrians and drivers alike. This Traffic Marshal course not only introduces you to the essential concepts of marshalling but delves deeper into the intricacies of traffic management, temporary traffic control, risk assessments, and the art of vehicle signalling. Whether you're in the heart of London or any other UK city, the skills you acquire here will pave the way for numerous traffic marshall jobs, from the simplest routes to the most complex junctions. Navigating through each module, learners will grasp the importance of each element in traffic marshalling. From understanding reversing vehicles to upholding health and safety standards, this comprehensive online course ensures you are well-equipped to handle real-world situations. Plus, for those looking specifically in the capital, the chances of securing traffic marshall jobs in London increase substantially after completion. The digital era allows for seamless learning, so why not embrace it? Opt for the traffic marshall course online and enjoy the flexibility and convenience of learning at your own pace. With such a comprehensive course structure, stepping into the world of traffic marshalling will be a breeze, opening doors to many opportunities. Learning Outcomes: Understand the foundational concepts and responsibilities of a Traffic Marshal. Develop expertise in traffic management strategies and techniques. Gain knowledge on setting up and overseeing temporary traffic controls. Acquire the capability to carry out detailed traffic risk assessments. Master the techniques of vehicle signalling and ensure safety during vehicle reversals. Why buy this Traffic Marshal course? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Traffic Marshal there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Traffic Marshal course for? Individuals aspiring to kickstart a career in traffic management and marshalling. Those looking to expand their job opportunities within the UK's traffic and transport sector. Job seekers aiming for traffic marshall positions in metropolitan areas like London. Professionals from other fields desiring a career change into a dynamic and essential profession. City planners or urban developers aiming to understand traffic flow and control better. Prerequisites This Traffic Marshal does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Traffic Marshal was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Traffic Management Coordinator: Average Salary: £25,000 - £30,000 Annually Traffic Control Officer: Average Salary: £27,000 - £33,000 Annually Road Safety Auditor: Average Salary: £30,000 - £36,000 Annually Traffic Engineer: Average Salary: £35,000 - £42,000 Annually Transport Planner: Average Salary: £38,000 - £45,000 Annually Senior Traffic Marshal: Average Salary: £40,000 - £47,000 Annually Course Curriculum Module 01: Introduction to Traffic Marshalling Introduction to Traffic Marshalling 00:14:00 Module 02: Traffic Management Traffic Management 00:21:00 Module 03: Temporary Traffic Control Temporary Traffic Control 00:30:00 Module 04: Traffic Risk Assessment Traffic Risk Assessment 00:26:00 Module 05: Vehicle Signaling Vehicle Signaling 00:17:00 Module 06: Reversing Vehicles Reversing Vehicles 00:22:00 Module 07: Health and Safety Health and Safety 00:26:00 Assignment Assignment - Traffic Marshal 00:00:00

Certified Diploma in Financial Management

By iStudy UK

Manage your Finance for better living Companies of every size need a solid financial plan in order to remain profitable. Financial managers are often employed in the banking and finance, healthcare and insurance industries, as well as by private companies and government agencies. This course will help you with everything you need to become a capable financial manager. Financial Management means planning, organizing, directing and controlling the financial activities such as procurement and utilization of funds of the enterprise. It means applying general management principles to financial resources of the enterprise. The financial management is generally concerned with procurement, allocation and control of financial resources of a concern. A finance manager has to make estimation with regards to capital requirements of the company. This will depend upon expected costs and profits and future programmes and policies of a concern. Get your career started in financial management with this popular course and pursue your dream in a well reputed company that are always on the lookout for financial managers. Course Highlights Certified Diploma in Financial Management is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Certified Diploma in Financial Management into 15 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 14 hours, 40 minutes and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Certified Diploma in Financial Management Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Certified Diploma in Financial Management is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Certified Diploma in Financial Management is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Module 1: Developing Financial IQ Introduction To Financial IQ FREE 01:00:00 Essential Ways To Build Wealth FREE 01:00:00 When's The Right Time To Invest? 01:00:00 The Methods Of Financial Mess 01:00:00 Module 2: Finance and Budgeting Financing Basics 01:00:00 Record Your Income 01:00:00 Make a List of Expenses First and Put Them in Categories 01:00:00 Countdown & Adjust 01:00:00 Review Regularly 01:00:00 Module 3: Debt Management Where to Start When You Have to Start Over 00:30:00 Concept of Credit 01:00:00 Way To Become Debt-free - The Step-By-Step Plan 01:00:00 The Credit Counseling and Debt Settlement options 01:00:00 The Psychology of Money - Changing your mindset 01:00:00 Budegets 00:30:00 Mock Exam Mock Exam- Certified Diploma in Financial Management 00:20:00 Final Exam Final Exam- Certified Diploma in Financial Management 00:20:00

The Managing Budget: Financial Statements and Money Management course provides comprehensive knowledge of budgeting fundamentals, financial statements, and budget monitoring. Participants will learn to create, manage, and analyze budgets, gaining valuable insights into financial decision-making processes and investment opportunities. Learning Outcomes: Understand the fundamentals of finance and budgeting principles. Identify the components and structure of financial statements. Master the budgeting process, including budget creation and approval. Acquire budgeting tips and tricks for efficient money management. Learn techniques for monitoring and managing budgets effectively. Develop the skills to crunch numbers and analyze financial data. Compare and evaluate investment opportunities for decision-making. Gain knowledge of ISO 9001:2008 quality management standards. Why buy this Managing Budget: Financial Statements and Money Management? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Managing Budget: Financial Statements and Money Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Aspiring finance professionals looking to enhance their budgeting skills. Managers and team leaders involved in financial decision-making. Small business owners seeking to improve their money management abilities. Professionals in non-financial roles aiming to understand budgeting and financial statements. Prerequisites This Managing Budget: Financial Statements and Money Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Managing Budget: Financial Statements and Money Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Financial Analyst: Analyze financial data and provide insights to support decision-making. Budget Analyst: Create, manage, and review budgets for organizations. Financial Manager: Oversee financial operations and develop long-term financial strategies. Business Consultant: Advise clients on financial management, budgeting, and investment. Entrepreneur: Apply budgeting skills to manage financial resources and optimize profitability. Course Curriculum Budgets and Financial Reports Module One - Getting Started 00:15:00 Module Two - Glossary 00:30:00 Module Three - Understanding Financial Statements 00:30:00 Module Four - Analyzing Financial Statements (I) 01:00:00 Module Five - Analyzing Financial Statements (II) 00:30:00 Module Six - Understanding Budgets 00:30:00 Module Seven - Budgeting Made Easy 00:30:00 Module Eight - Advanced Forecasting Techniques 00:30:00 Module Nine - Managing the Budget 00:30:00 Module Ten - Making Smart Purchasing Decisions 01:00:00 Module Eleven - A Glimpse into the Legal World 01:00:00 Module Twelve - Wrapping Up 00:15:00 Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Recommended Reading Recommended Reading : Finance and Budgeting Diploma 00:00:00 Assignment Assignment - Managing Budget: Financial Statements and Money Management 00:00:00

Search By Location

- Directing Courses in London

- Directing Courses in Birmingham

- Directing Courses in Glasgow

- Directing Courses in Liverpool

- Directing Courses in Bristol

- Directing Courses in Manchester

- Directing Courses in Sheffield

- Directing Courses in Leeds

- Directing Courses in Edinburgh

- Directing Courses in Leicester

- Directing Courses in Coventry

- Directing Courses in Bradford

- Directing Courses in Cardiff

- Directing Courses in Belfast

- Directing Courses in Nottingham