- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

HR Audit, Crisis, Payroll and People Management - CPD Certified

4.7(26)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** HR Audit, Crisis, Payroll and People Management Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Did you know 53% of employees feel disengaged at work in the UK, costing businesses billions of pounds annually? Effective HR practices are crucial for employee satisfaction, productivity, and ultimately, your bottom line. But are you equipped to handle the complexities of the modern HR landscape? This HR Audit, Crisis, Payroll and People Management bundle equips you with the knowledge and skills to excel in HR management, crisis communication, and people development. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our HR Audit, Crisis, Payroll and People Management bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in HR Audit, Crisis, Payroll and People Management Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this HR Audit, Crisis, Payroll and People Management Career Bundle: Course 01: Advanced Diploma in HR (Human Resources) at QLS Level 7 Course 02: Employment Law Course 03: Human Resources (HR) Audit Course 04: Payroll Management Course Course 05: Office Administration Course 06: HR - Crisis Communication Course 07: Virtual Interviewing for HR Course 08: Recruitment Officer Diploma Course 09: HR Advisor and Recruitment Training Diploma Course 10: Motivation Skills Course 11: Virtual Training Masterclass Course 12: Dialectical Behaviour Therapy Course 13: HR Practice Essentials Level 4 Course 14: Delegation Skills Course 15: Dealing With Difficult People Training Course Course 16: Performance-Centered Asset Management Course 17: Interpersonal Skills in Management Course 18: Positive Psychology Masterclass Course 19: Personal and Networking Skills Course 20: Motivational Interviewing Course 21: People Management Skills Level 3 Course 22: HR and Recruitment Consultant Training Course 23: Contract Management Course Course 24: Office Skills and Administration Management Diploma Course 25: Workplace Stress Management Course 26: Effective Listening Skills for Leaders Course 27: HR Assistant Skills Certification Course 28: Team Management Course 29: HR and Marketing Level 4 Course 30: Payroll Management and Systems Diploma With HR Audit, Crisis, Payroll and People Management, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. Learning Outcomes of HR Audit, Crisis, Payroll and People Management Comprehend UK employment law and its implications for HR practices. Conduct comprehensive HR audits to identify and address weaknesses. Master payroll management, ensuring accuracy and compliance. Develop effective virtual interviewing skills to attract top talent. Become an expert in crisis communication, mitigating risks and building trust. Sharpen your motivational skills to inspire and engage employees. Enrol in HR Audit, Crisis, Payroll and People Management today and take the first step towards achieving your goals and dreams. Why buy this Bundle? Free CPD Accredited Certificate upon completion of HR Audit, Crisis, Payroll and People Management Get a free student ID card with HR Audit, Crisis, Payroll and People Management Lifetime access to the HR Audit, Crisis, Payroll and People Management course materials Get instant access to this HR Audit, Crisis, Payroll and People Management course Learn HR Audit, Crisis, Payroll and People Management from anywhere in the world 24/7 tutor support with the HR Audit, Crisis, Payroll and People Management course. Start your learning journey straightaway with our HR Audit, Crisis, Payroll and People Management Training! HR Audit, Crisis, Payroll and People Management premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of HR Audit, Crisis, Payroll and People Management is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the HR Audit, Crisis, Payroll and People Management course. After passing the HR Audit, Crisis, Payroll and People Management exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This HR Audit, Crisis, Payroll and People Management course is ideal for: Students seeking mastery in HR Audit, Crisis, Payroll and People Management Professionals seeking to enhance HR Audit, Crisis, Payroll and People Management skills Individuals looking for a HR Audit, Crisis, Payroll and People Management-related career. Anyone passionate about HR Audit, Crisis, Payroll and People Management Requirements This HR Audit, Crisis, Payroll and People Management doesn't require prior experience and is suitable for diverse learners. Career path This HR Audit, Crisis, Payroll and People Management bundle will allow you to kickstart or take your career in the related sector to the next stage. HR Specialist HR Manager Recruitment Consultant People Development Manager HR Business Partner HR Director Certificates Advanced Diploma in HR (Human Resources) at QLS Level 7 Hard copy certificate - Included CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Sage 50 Accounts Now Proper bookkeeping is a must for every organisation. But keeping track of all the transactions, employee payroll and creating reports is a very hard job. That is why we created this Sage 50 course. Acquire the skills and knowledge to operate Sage 50 cloud Accounts, one of the most popular accounting tools available today. Over 3 million people use it worldwide. It is great for small businesses. This Sage 50 course is a step by step guide on how to use and master Sage 50 cloud Accounts. The Sage 50 Accounts course covers everything from beginner level to advanced level. You will learn everything from setting up/creating a new company to how to create year-end reports. This course is the only guide you need to master Sage 50 cloud Accounts. So, Enrol Sage 50 Now! What other courses are included with this Diploma in Sage 50 Accounts? Course 01: Sage 50 Training Course 02: Payroll Management Course Course 03: Accounting and Bookkeeping Level 2 Course 04: Corporate Finance: Working Capital Management Course 05: Level 3 Xero Training Course 06: Data Analysis in Excel Level 3 Course Course 07: Office Skills Course 08: Level 2 Financial Planning and Management Course Course 09: Applied Business Analysis Diploma Course 10: Time Management Course 11: Fraud Management & Anti Money Laundering Awareness Complete Diploma Course 12: New Functions in Microsoft Excel 2021 Curriculum: Course 01: Sage 50 Training Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures -------------- 11 more courses------------- How will I get my Certificate? After successfully completing the Sage 50 course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 12= £120) Hard Copy Certificate: Free (For The Title Course) CPD 125 CPD hours / points Accredited by CPD Quality Standards Who is this course for? There is no experience or previous qualifications required for enrolment on this Sage 50 course. It is available to all students, of all academic backgrounds. Requirements Our Sage 50 Accounts is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path This Sage 50 Accounts will help you stand out from the competition and will help you in procuring jobs like: Bookkeeper Accounts Executive Auditor Staff Accountant Tax Accountant Certificates Certificate of completion Digital certificate - Included

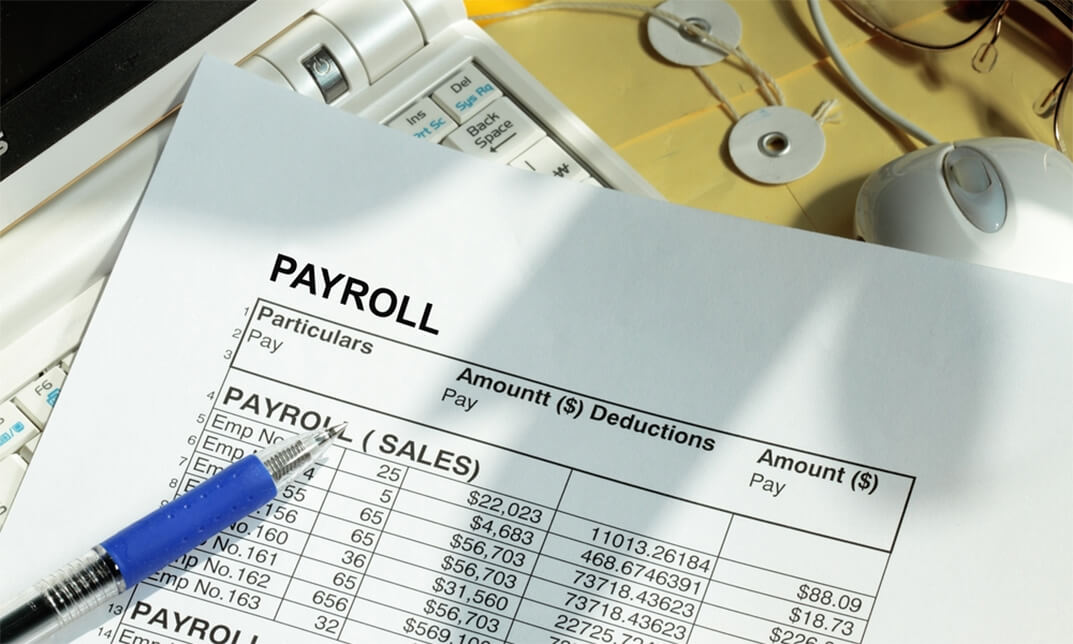

Description: In the current day and age, you must stand out and intrigue recruitment managers, such that your enhanced skills inspires them to show curiosity in your personality. What better way to improve your skill set and put yourself in the shoes of an HR manager than with this CPD certified HR and Payroll Management course. This simple and easy course is divided into two sections each focusing on human resources management and payroll management respectively. First, you learn about human resources management as you explore its development in the modern day. Following that, you will read about subjects such as recruitment, interview, retention, health & safety, disciplining employees and terminating them. In the next section, payroll management is discussed by learning basic terminologies, accounting methods, understanding balance sheets, other financial statements and so much more. This is a great tool if used correctly as you can easily gain more knowledge about the recruitment process and utilize it to your advantage. So, take this course now for the double feature of improving your payroll management skills as well. Who is the course for? People who want to work in human resources People looking to be successful in interviews by learning how interviewers think Professionals wanting to improve their skills in Payroll management Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: HR and Payroll Management is a useful qualification to possess and would be beneficial for any professions or career from any industry you are in such as: Payroll Administer HR Manager Recruitment Consultant Office Manger Human Resource Management Module One - Getting Started 00:30:00 Module Two - Human Resources Today 01:00:00 Module Three - Recruiting and Interviewing 01:00:00 Module Four - Retention and Orientation 01:00:00 Module Five - Following Up With New Employees 01:00:00 Module Six - Workplace Health & Safety 01:00:00 Module Seven - Workplace Bullying, Harassment, and Violence 01:00:00 Module Eight - Workplace Wellness 01:00:00 Module Nine - Providing Feedback to Employees 01:00:00 Module Ten - Disciplining Employees 01:00:00 Module Eleven - Terminating Employees 01:00:00 Module Twelve - Wrapping Up 00:30:00 Activities - Advanced Diploma in Human Resource Management 00:00:00 Bookkeeping & Payroll Basics Module One - Introduction 00:30:00 Module Two - Basic Terminology 01:00:00 Module Three - Basic Terminology (II) 01:00:00 Module Four - Accounting Methods 01:00:00 Module Five - Keeping Track of Your Business 01:00:00 Module Six - Understanding the Balance Sheet 01:00:00 Module Seven - Other Financial Statements 01:00:00 Module Eight - Payroll Accounting Terminology 01:00:00 Module Nine - End of Period Procedures 01:00:00 Module Ten - Financial Planning, Budgeting and Control 01:00:00 Module Eleven - Auditing 01:00:00 Module Twelve - Wrapping Up 00:30:00 Managing Payroll What Is Payroll? 00:30:00 Principles Of Payroll Systems 01:00:00 Confidentiality And Security Of Information 00:30:00 Effective Payroll Processing 01:00:00 Increasing Payroll Efficiency 01:00:00 Risk Management in Payroll 00:30:00 Time Management 00:30:00 Personnel Filing 00:30:00 When Workers Leave Employment 01:00:00 Hiring Employees 00:30:00 Paye and Payroll for Employers 01:00:00 Tell HMRC about a New Employee 01:00:00 Net And Gross Pay 00:30:00 Statutory Sick Pay 00:30:00 Minimum Wage for Different types of Work 01:00:00 Recommended Reading Recommended Reading: HR and Payroll Management 00:00:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- HR and Payroll Management 00:30:00 Final Exam Final Exam- HR and Payroll Management 00:30:00

Register on the Sage 50 Payroll Beginner today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Sage 50 Payroll Beginner is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Sage 50 Payroll Beginner Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Sage 50 Payroll Beginner, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 1: Payroll Basics Module 1: Payroll Basics 00:10:00 Module 2: Company Settings Module 2: Company Settings 00:08:00 Module 3: Legislation Settings Module 3: Legislation Settings 00:07:00 Module 4: Pension Scheme Basics Module 4: Pension Scheme Basics 00:06:00 Module 5: Pay Elements Module 5: Pay Elements 00:14:00 Module 6: The Processing Date Module 6: The Processing Date 00:07:00 Module 7: Adding Existing Employees Module 7: Adding Existing Employees 00:08:00 Module 8: Adding New Employees Module 8: Adding New Employees 00:12:00 Module 9: Payroll Processing Basics Module 9: Payroll Processing Basics 00:11:00 Module 10: Entering Payments Module 10: Entering Payments 00:12:00 Module 11: Pre-Update Reports Module 11: Pre-Update Reports 00:09:00 Module 12: Updating Records Module 12: Updating Records 00:09:00 Module 13: E-Submissions Basics Module 13: e-Submissions Basics 00:09:00 Module 14: Process Payroll (November) Module 14: Process Payroll (November) 00:16:00 Module 15: Employee Records And Reports Module 15: Employee Records and Reports 00:13:00 Module 16: Editing Employee Records Module 16: Editing Employee Records 00:07:00 Module 17: Process Payroll (December) Module 17: Process Payroll (December) 00:12:00 Module 18: Resetting Payments Module 18: Resetting Payments 00:05:00 Module 19: Quick SSP Module 19: Quick SSP 00:10:00 Module 20: An Employee Leaves Module 20: An Employee Leaves 00:13:00 Module 21: Final Payroll Run Module 21: Final Payroll Run 00:07:00 Module 22: Reports And Historical Data Module 22: Reports and Historical Data 00:08:00 Module 23: Year-End Procedures Module 23: Year-End Procedures 00:09:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Description: Payroll is the process by which employers pay an employee for the work they have completed. Any business with employees should have a payroll process established; payroll is often the largest expense for a business. If you want to learn how to perform payroll, gross pay, RTI and more, then this will be the perfect choice for you. This Payroll Management and Systems Diploma is all about payroll management, how to calculate the payroll and general overall understanding about what payroll is and the legal requirements in place, the forms, the deadlines, the process and procedures. The course will develop your skills in how to effectively perform a payroll run, understand statutory deductions, PAYE and real time income. Whether you currently work in finance, or wanting to work in finance, run your own business or simply want to gain a new skills then you should join us today! Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Payroll Management and Systems Diploma is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Payroll Management and Systems Diploma is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Introduction Introduction to the Course and Instructor FREE 00:10:00 An Overview of Payroll 00:17:00 The UK Payroll System Running the payroll - Part 1 00:14:00 Running the payroll - Part 2 00:18:00 Manual payroll 00:13:00 Benefits in kind 00:09:00 Computerised systems 00:11:00 Total Photo scenario explained 00:01:00 Brightpay Brightpay conclude 00:03:00 Find software per HMRC Brightpay 00:03:00 Add a new employee 00:14:00 Add 2 more employees 00:10:00 Payroll settings 00:04:00 Monthly schedule - Lana 00:14:00 Monthly schedule - James 00:08:00 Directors NI 00:02:00 Reports 00:02:00 Paying HMRC 00:05:00 Paying Pensions 00:04:00 RTI Submission 00:02:00 Coding Notices 00:01:00 Journal entries 00:07:00 102 Schedule 00:03:00 AEO 00:06:00 Payroll run for Jan & Feb 2018 00:13:00 Leavers - p45 00:03:00 End of Year p60 00:02:00 Installing Brightpay 00:13:00 Paye, Tax, NI PAYE TAX 00:13:00 NI 00:11:00 Pensions 00:06:00 Online calculators 00:07:00 Payslips 00:03:00 Conclusion and Next Steps Conclusion and Next Steps 00:07:00 Assessment Assignment - Payroll Management and Systems Diploma 00:00:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

Give a compliment to your career and take it to the next level. This Bookkeeping and Payroll Administration Diploma bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Bookkeeping and Payroll Administration Diploma bundle will help you stay ahead of the pack. Throughout the Bookkeeping and Payroll Administration Diploma programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Bookkeeping and Payroll Administration Diploma course, you will get 10 premium courses, an original hardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Bookkeeping and Payroll Administration Diploma Bundle Consists of the following Premium courses: Course 01: Payroll Management Course Course 02: Level 3 Tax Accounting Course 03: Certificate in Anti Money Laundering (AML) Course 04: HR Management Level 3 Course 05: Level 3 Xero Training Course 06: Pension UK Course 07: Document Control Course 08: GDPR Data Protection Level 5 Course 09: Office Skills Course 10: Advanced Diploma in MS Excel Enrol now in Bookkeeping and Payroll Administration Diploma to advance your career, and use the premium study materials from Apex Learning. The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Bookkeeping and Payroll Administration Diploma expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Curriculum of Bookkeeping and Payroll Administration Diploma Bookkeeping Skills Introduction to the course Introduction to Bookkeeping Bookkeeping systems Basics of Bookkeeping The functionality of bookkeeping On a personal note Accounting Skills Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Bookkeeping and Payroll Administration Diploma bundle. Requirements This Bookkeeping and Payroll Administration Diploma course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Payroll Management Course) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

HR and Payroll Management Course

By Training Tale

HR and Payroll Management Training Suppose you want to start a career as an HR and payroll manager or improve your knowledge and skills in HR and Payroll Management Course but do not know where to begin. In that case, this HR and Payroll Management Course will provide you with the necessary skills and expertise to take your professionalism to the next level in HR and Payroll Management sector. This thorough HR and Payroll Management Course will provide you with all of the required skills and important insight into Course to help you advance your career and opportunities in this HR and Payroll Management field. When working as an HR and payroll manager, there are always new skills to master and new knowledge to acquire in this field. This HR and Payroll Management Course will fully prepare you to embrace all of the key skills and information in this sector. After completing this comprehensive, combined HR and Payroll Management Training Course, you will have a thorough understanding of Payroll Management and great practical abilities in Human Resource Management, allowing you to excel as a successful HR and payroll manager in a competitive industry. Enrol in our HR and Payroll Management Course right now and start learning! Special Offers of this HR and Payroll Management Training Course This HR and Payroll Management Training Course includes a FREE PDF Certificate. Lifetime access to this HR and Payroll Management Training Course Instant access to this HR and Payroll Management Training Course Get FREE Tutor Support from Monday to Friday in this HR and Payroll Management Training Course ***Other courses are included with this HR and Payroll Management Training Bundle Course Course 01: HR and Payroll Management Course Course 02: Level 3 Business Administration Course 03: Level 7 Business Management Course [ Note: Free PDF certificate as soon as completing the HR and Payroll Management Course] HR and Payroll Management Training Industry Experts designed this HR and Payroll Management course in 15 detailed modules. Course Curriculum of HR and Payroll Management Course Assessment Method of HR and Payroll Management After completing each module of the HR and Payroll Management: HR and Payroll Management Course (Level 5 Diploma), you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of HR and Payroll Management After completing the MCQ/Assignment assessment for this HR and Payroll Management: HR and Payroll Management Course, you will be entitled to a Certificate of Completion from Training Tale. Who is this course for? HR and Payroll Management Training HR and Payroll Management course is ideal for anyone. Requirements HR and Payroll Management Training Students who intend to enrol in this HR and Payroll Management Training course must meet the following requirements: HR and Payroll Management: Good command of the English language HR and Payroll Management: Must be vivacious and self-driven. HR and Payroll Management: Basic computer knowledge HR and Payroll Management: A minimum of 16 years of age is required. Career path HR and Payroll Management This HR and Payroll Management course will help you to get a job in relevant field. Certificates Certificate of completion Digital certificate - Included

Follow your dreams by enrolling on the HR, Bookkeeping and Payroll Management course today and develop the experience, skills and knowledge you need to enhance your professional development. HR, Bookkeeping and Payroll Management will help you arm yourself with the qualities you need to work towards your dream job. Study the HR, Bookkeeping and Payroll Management training course online with Janets through our online learning platform and take the first steps towards a successful long-term career. The HR, Bookkeeping and Payroll Management course will allow you to enhance your CV, impress potential employers, and stand out from the crowd. This HR, Bookkeeping and Payroll Management course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Study the HR, Bookkeeping and Payroll Management course through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the HR, Bookkeeping and Payroll Management course, to ensure you are supported every step of the way. Get a digital certificate as proof of your HR, Bookkeeping and Payroll Management course completion. Janets is one of the top online training course providers in the UK, and we want to make education accessible to everyone! Learn the essential skills you need to succeed and build a better future for yourself with the HR, Bookkeeping and Payroll Management course. The HR, Bookkeeping and Payroll Management course is designed by industry experts and is tailored to help you learn new skills with ease. The HR, Bookkeeping and Payroll Management is incredibly great value and allows you to study at your own pace. With full course access for one year, you can complete the HR, Bookkeeping and Payroll Management when it suits you. Access the HR, Bookkeeping and Payroll Management course modules from any internet-enabled device, including computers, tablets, and smartphones. The HR, Bookkeeping and Payroll Management course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the HR, Bookkeeping and Payroll Management now and start learning instantly! What You Get Out Of Studying HR, Bookkeeping and Payroll Management With Janets: Receive a digital Certificate upon successful completion of the HR, Bookkeeping and Payroll Management course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Description The HR, Bookkeeping and Payroll Management training course is delivered through Janets' online learning platform. Access the HR, Bookkeeping and Payroll Management content from any internet-enabled device whenever or wherever you want to. The HR, Bookkeeping and Payroll Management course has no formal teaching deadlines, meaning you are free to complete the course at your own pace. Method of Assessment To successfully complete the HR, Bookkeeping and Payroll Management course, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the HR, Bookkeeping and Payroll Management course. After successfully passing the HR, Bookkeeping and Payroll Management course exam, you will be able to apply for a CPD-accredited certificate as proof of your HR, Bookkeeping and Payroll Management qualification. Certification All students who successfully complete the HR, Bookkeeping and Payroll Management course can instantly download their digital certificate. You can also purchase a hard copy of the HR, Bookkeeping and Payroll Management course certificate, which will be delivered by post for £9.99. Who Is This Course For: The HR, Bookkeeping and Payroll Management is ideal for those who already work in this sector or are an aspiring professional. This HR, Bookkeeping and Payroll Management course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The HR, Bookkeeping and Payroll Management is open to all students and has no formal entry requirements. To study the HR, Bookkeeping and Payroll Management course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Career Path: The HR, Bookkeeping and Payroll Management is ideal for anyone who wants to pursue their dream career in a relevant industry. Learn the skills you need to boost your CV and go after the job you want. Complete the HR, Bookkeeping and Payroll Management and gain an industry-recognised qualification that will help you excel in finding your ideal job. Course Content Human Resource Management Introduction to Human Resources 00:20:00 Employee Recruitment and Selection Procedure 00:35:00 Employee Training and Development Process 00:24:00 Performance Appraisal Management 00:22:00 Employee Relations 00:15:00 Motivation and Counselling 00:19:00 Ensuring Health and Safety at the Workplace 00:16:00 Employee Termination 00:15:00 Employer Records and Statistics 00:11:00 Essential UK Employment Law 00:27:00 Bookkeeping & Payroll Basics Module 1: Payroll Basics 00:10:00 Module 2: Company Settings 00:08:00 Module 3: Legislation Settings 00:07:00 Module 4: Pension Scheme Basics 00:06:00 Module 5: Pay Elements 00:14:00 Module 6: The Processing Date 00:07:00 Module 7: Adding Existing Employees 00:08:00 Module 8: Adding New Employees 00:12:00 Module 9: Payroll Processing Basics 00:11:00 Module 10: Entering Payments 00:12:00 Module 11: Pre-Update Reports 00:09:00 Module 12: Updating Records 00:09:00 Module 13: e-Submissions Basics 00:09:00 Module 14: Process Payroll (November) 00:11:00 Module 15: Employee Records and Reports 00:13:00 Module 16: Editing Employee Records 00:07:00 Module 17: Process Payroll (December) 00:12:00 Module 18: Resetting Payments 00:05:00 Module 19: Quick SSP 00:10:00 Module 20: An Employee Leaves 00:13:00 Module 21: Final Payroll Run 00:07:00 Module 22: Reports and Historical Data 00:08:00 Module 23: Year-End Procedures 00:09:00 Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria 00:11:00 Module 2: Global Changes 00:07:00 Module 3: Timesheets 00:12:00 Module 4: Departments and Analysis 00:11:00 Module 5: Holiday Schemes 00:10:00 Module 6: Recording Holidays 00:12:00 Module 7: Absence Reasons 00:13:00 Module 8: Statutory Sick Pay 00:16:00 Module 9: Statutory Maternity Pay 00:17:00 Module 10: Student Loans 00:09:00 Module 11: Company Cars 00:13:00 Module 12: Workplace Pensions 00:21:00 Module 13: Holiday Funds 00:13:00 Module 14: Process Payroll (November) 00:16:00 Module 15: Passwords and Access Rights 00:08:00 Module 16: Options and Links 00:10:00 Module 17: Linking Payroll to Accounts 00:08:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Payroll Training: Sage 50, Accounting

By Compliance Central

Did you know that Payroll training course are now among the top skills in demand worldwide? Payroll Course is for those who want to advance in this platform. Throughout this course, you will learn the essential skills and gain the knowledge needed to become a well versed in Payroll. Our course starts with the basics of Payroll and gradually progresses towards advanced topics. Therefore, each lesson of this course is intuitive and easy to understand. Learning Outcomes: Upon successful completion of this highly appreciated Payroll course, you'll be a skilled professional, besides- Basic Payroll systems and processes in the UK Process the new starter and lever Tax Coding Notice and understand what the different tax codes mean Process monthly payroll Understand how pensions are applied Process deductions such as taxes, student loan repayments Attachment of earnings process like payment of court fines Know the payroll journal and relevant accounts to debit and credit Pay the relevant authorities and agencies Year-end processing Key Highlights: CPD Accredited Course Unlimited Retake Exam & Tutor Support Easy Accessibility to the Course Materials 100% Learning Satisfaction Guarantee Lifetime Access & 24/7 Support Self-paced course modules Curriculum Breakdown: Module 01: Payroll System in the UK Module 02: Basics Instruction Module 03: Company Settings Module 04: Legislation Settings Module 05: Pension Scheme Basics Module 06: Pay Elements Module 07: The Processing Date Module 08: Adding Existing Employees Module 09: Adding New Employees Module 10: Payroll Processing Basics Module 11: Entering Payments Module 12: Pre-Update Reports Module 13: Updating Records Module 14: e-Submissions Basics Module 15: Process Payroll (November) Module 16: Employee Records and Reports Module 17: Editing Employee Records Module 18: Process Payroll (December) Module 19: Resetting Payments Module 20: Quick SSP Module 21: An Employee Leaves Module 22: Final Payroll Run Module 23: Reports and Historical Data Module 24: Year-End Procedures Curriculum: CPD Accredited (CPD QS) Certificate Both PDF & Hardcopy certificates are available CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this course. Particularly, this course is ideal for: Accountant Department Officer General Advisor Specialist HR and Officer Requirements To enrol in this Course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to the course, such as- Payroll Accountant Administrator Advisor Payroll Analyst Manager Payroll Coordinator Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Xero Accounting, Payroll with Accounting and Finance QLS Endorsed Diploma

By Compliance Central

In the realm of accounting and finance, proficiency in Xero Accounting & Payroll systems has become increasingly indispensable. This comprehensive diploma bundle offers a gateway to expertise in these critical areas, catering to the growing demand for skilled professionals in the field. Statistics reveal a rising trend in the adoption of Xero Accounting and Payroll systems, with businesses recognizing the efficiency and effectiveness they bring to financial management. With this bundle, individuals can seize the opportunity to enhance their knowledge and skills, positioning themselves as valuable assets in today's competitive job market. The Xero Accounting & Payroll diploma bundle comprises a carefully curated selection of QLS endorsed and CPD QS accredited courses, covering essential aspects of accounting, finance, and payroll management. From foundational principles to advanced techniques, each course is designed to equip learners with the necessary tools to navigate complex financial landscapes confidently. With a focus on theoretical understanding and practical application, this bundle offers a holistic learning experience that empowers individuals to excel in diverse roles within the accounting and finance sectors. QLS Endorsed Courses: Course 01: Diploma in Accounting and Finance at QLS Level 4 Course 02: Diploma in Payroll (UK Payroll System, Payee, Tax, NI, Pension) at QLS Level 5 Course 03: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 CPD QS Accredited Courses: Course 04: Introduction to Accounting Course 05: Management Accounting - Costing & Budgeting Course 06: Business Accounting Training Course 07: Banking and Finance Accounting Statements Financial Analysis Course 08: Tax Accounting Diploma Course 09: Sage 50 Accounts Course 10: Payroll Management Course Course 11: Theory of Constraints, Throughput Accounting and Lean Accounting Take your career to the next level with our bundle that includes technical courses and five guided courses focused on personal development and career growth. Course 12: Career Development Plan Fundamentals Course 13: CV Writing and Job Searching Course 14: Networking Skills for Personal Success Course 15: Ace Your Presentations: Public Speaking Masterclass Course 16: Decision Making and Critical Thinking Seize this opportunity to elevate your career with our comprehensive bundle, endorsed by the prestigious QLS and accredited by CPD. With industry-specific knowledge and essential career skills, you'll be well-equipped to make your mark in Xero Accounting and Payroll with the Accounting and Finance industries. Learning Outcomes: Develop a thorough understanding of Xero Accounting software and its applications in financial management. Master the intricacies of payroll processing, including UK payroll systems, taxation, and pension schemes. Acquire advanced skills in bookkeeping and financial record-keeping using Xero Accounting. Gain proficiency in management accounting techniques such as costing and budgeting. Explore theoretical frameworks in accounting, including the Theory of Constraints and Lean Accounting principles. Enhance analytical capabilities for financial statement analysis and decision-making in banking and finance contexts. The Xero Accounting & Payroll diploma bundle offers a comprehensive curriculum that covers a wide range of topics essential for professionals in the accounting and finance fields. From foundational courses introducing basic accounting principles to advanced modules focusing on Xero Accounting software and payroll management, learners gain a well-rounded understanding of key concepts. Through theoretical exploration and practical exercises, individuals develop the skills and knowledge necessary to navigate real-world financial scenarios with confidence and competence. This bundle is designed for individuals seeking to enhance their expertise in accounting, finance, and payroll management. Whether you're a seasoned professional looking to expand your skill set or a newcomer eager to enter the field, this bundle provides valuable insights and practical knowledge to support your career aspirations. With its comprehensive curriculum and flexible learning options, it's suitable for anyone passionate about pursuing a rewarding career in accounting and finance. Disclaimer This course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 160 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Accounting professionals aiming to enhance their skills in Xero Accounting and payroll management. Finance professionals seeking to broaden their knowledge in financial analysis and management accounting. Individuals interested in pursuing careers in banking and finance sectors. Business owners and entrepreneurs looking to manage their finances more effectively. Students and recent graduates aspiring to enter the accounting and finance industry. Anyone seeking to advance their career prospects in accounting, finance, or payroll management. Requirements You are warmly invited to register for this bundle. Please be aware that there are no formal entry requirements or qualifications necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path Xero Accountant Payroll Manager Financial Analyst Management Accountant Tax Accountant Finance Manager Banking Specialist Certificates 13 CPD Quality Standard Certificates Digital certificate - Included 3 QLS Endorsed Certificates Hard copy certificate - Included